CHINA. Offline business continued to recover in the first quarter for China Tourism Group Duty Free Corporation (China Tourism Group), parent company of the world’s number one travel retailer China Duty Free Group (CDFG) but overall revenues were down.

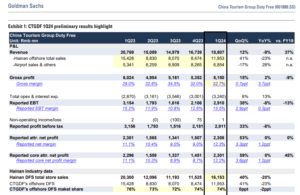

Declaring its preliminary Q1 results for the period ended 31 March 2024, CTG posted a -9.45% decrease year-on-year in operating income to RMB18.807 billion (US$2.6 billion). Operating profit fell -7.72% (see table below) while net profit grew +0.33% to RMB2.308 billion (US$319.2 million).

Chairman of the Board Wang Xuan said: “During the reporting period, the gross profit margin of the company’s principal business [China Duty Free Group -Ed] was 32.70%, representing an increase of 3.95 percentage points as compared with the corresponding period of last year and a steady improvement in the profitability of the company.”

He added: “During the reporting period, as the inbound and outbound duty-free business further recovered, the proportion of offline business of the company continuously rebounded, and the product sales structure was constantly optimised.”

The year-on-year turnover comparison is made with a period that pre-dated the local crackdown on daigou trading from April 2023.

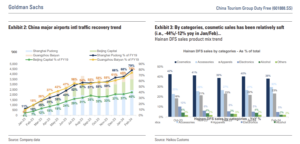

Commenting on that point in a note issued this morning, Goldman Sachs Investment Research said that sales of cosmetics – historically the driver of the Hainan offshore duty-free business – have been relatively soft in Q1 (down -44% and -12% year-on-year respectively in January and February), partly due to stiff online pricing competition.

CDFG has been introducing more accessories and fashion to its mix, the categories accounting for 30% and 23%, respectively of total Hainan duty-free sales in February vs 25% and 21% last March, Goldman Sachs noted.

As mentioned during an earnings call after China Tourism Group’s recent full-year earnings announcement, CDFG is set to introduce more high-end luxury brands, alcohol and food & beverage outlets at cdf Sanya International Duty Free Shopping Complex’s Block A & B to complement the new beauty-driven Block C.

Goldman Sachs noted that EBT margin ticked up by ~3pts quarter-on-quarter to 15.5% on rental cost savings emanating from CDFG’s advantageously re-negotiated rental contracts with Shanghai and Beijing airports – revenue share revised down to 18-36% or below 30% on a blended basis (Goldman Sachs estimate) vs. 42.5% previously.

The report concluded: “We continue to expect Hainan’s duty-free sales growth rate to look more favourable on a year-on-year basis as the impact of daigou crackdown will lapse in 2Q-3Q24. Maintain Buy.”

The firm bases that rating on two potential sources of earnings upside in relation to the airports; firstly the lower revenue share paid to key airport landlords and secondly the anticipated approval of Korean-style pre-departure shops this year. ✈