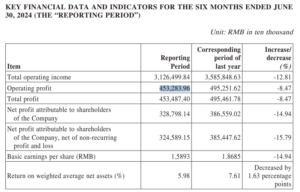

CHINA. China Tourism Group Duty Free Corporation (CTGDF), parent company of the world’s number one travel retailer by sales, China Duty Free Group (CDFG), posted a -12.81% year-on-year decrease in first-half sales for the period ended 30 June to CNY31.265 billion (US$4.3 billion).

Net profit declined -14.94% year-on-year to CNY3.288 billion (US$453.5 million).

However, the H1 year-on-year result was heavily affected by the unflattering comparison with the pre-daigou crackdown months of January-April 2023 (the curb on reselling came from May/June that year; see Goldman Sachs note below).

The gross profit margin of the principal business (CDFG) in the second quarter was 33.29%, up by an 0.82 percentage point year-on-year and a 0.59 percentage point quarter-on-quarter, underlining continued improvement in the key indicator, CTGDF.

Commenting on the performance, the group highlighted “the complex and severe external market environment”.

Against that challenging backdrop the company said it had focused closely on steady growth, promoting reform and striving for development.

CTGDF highlighted four particular measures it is adopting to drive business improvement.

Firstly, it plans to revive traditional businesses and improve profitability. During the reporting period, CDFG’s sales from its China-based international departures and arrivals duty-free stores had rise by more than 100% year-on-year, driven by the continuous recovery of international flights and passenger numbers. Profitability also continued to improve.

More flattering year-on-year comparitives ahead – Goldman SachsIn a post-results note, Goldman Sachs Research said: “Hainan’s DFS data was weak in April/May tracking at CNY72mn/64mn per day (-45%/-38% yoy) partly due to the poor weather in Southern China. “Although June data are not available yet (likely to be released later this week), we gather from industry participants that the trend remains soft. “Taking into account for duty-on sales, we estimate CTGDF’s revenue in Hainan fell -35% yoy or -53% sequentially to CNY5.8bn (vs. -20% yoy in 1Q24), against a broader China consumption slowdown seen across various industries (e.g. restaurants, spirits, luxury spending etc.) in recent months and perhaps some dilution from outbound travel to Japan, Korea etc. due to a favorable Japanese Yen. “Looking into 2H24(e), we believe the trend will look optically better as Hainan’s air traffic data is showing a gradual improvement to +2% yoy as of late vs. -4%/-1% in May/June heading into the summer seasons. “The base effect should become more favorable as the daigou crackdown started sometime in late 2Q23.” |

Revenue from duty-free stores at Beijing airports (Beijing Capital International and Daxing International) increased by more than +200% year-on-year.

Turnover from duty-free stores at Pudong International and Hongqiao International airports in Shanghai nearly doubled, and their net profits both increased significantly, CTGDF said.

Secondly, CTGDF pledged to enhance service quality and efficiency and consolidate the key Hainan offshore duty-free market. CDFG’s dominant position and related market share in that channel steadily increased.

In a note just before the results, Goldman Sachs Research said it expects Hainan’s duty-free sales trend to look better on a year-on-year basis in the next few months as the impact of the daigou crackdown will lapse from May-June onwards.

CDFG had strived to establish benchmarks in terms of service, management and value creation, in order to promote the comprehensive and systematic improvement of operation and service standards.

Thirdly, CTGDF said it continues to promote overseas development and expand domestic channels. The company implemented the national strategy of ‘One Belt, One Road’ to promote the opening of a duty-free operation onboard the Adora Magic City cruise line and the Qeelin boutique at Singapore Changi Airport.

CDFG also won an open tender to operate an MCM boutique at Singapore Changi Airport and a Qeelin boutique at Hong Kong International Airport.

At home, CDFG won the operational rights for departure duty-free stores at Guangzhou Baiyun International Airport Terminal 1 and Kunming Changshui International Airport.

The fourth priority is to continue enhancing the group’s ESG programme, partly in collaboration with business partners.

During the Reporting Period, the Company was included in several key ESG indices and achieved a leap in several ESG ratings at home and abroad, CTGDF said. ✈