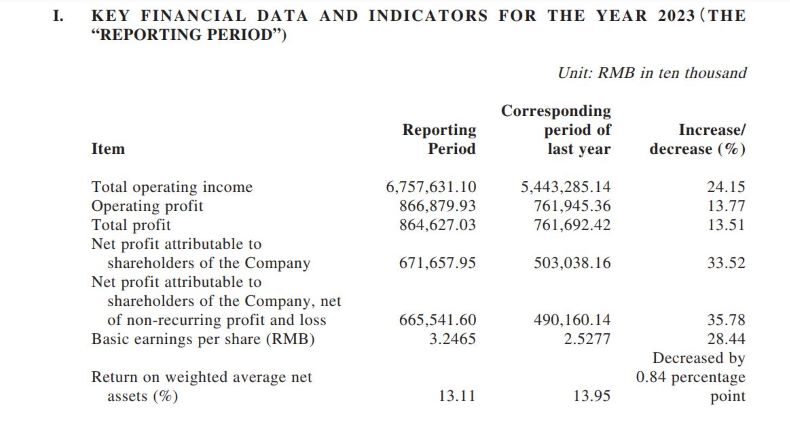

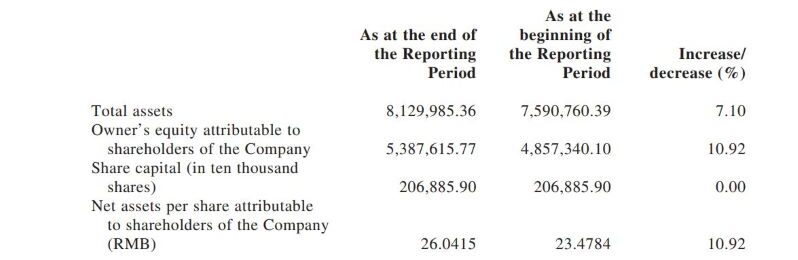

CHINA. China Tourism Group Duty Free Corporation (CTG), the parent company of the world’s number one travel retailer China Duty Free Group, posted a +33.52% year-on-year increase in net profits for 2023 to CNY6.71 billion (US$944.8 million).

Preliminary results revealed yesterday for the full year show total operating income up +24.15% year-on-year to CNY67.576 billion (US$9.5 billion), while realised operating profit jumped by +13.77% to CNY8.668 billion (US$1.2 billion).

Operating income in Q4 rose +11.09% year-on-year to CNY16.739 billion (US$2.4 billion) while net profit increased +275.62% to CNY1.510 billion (US$212.6 million).

CTG said: “During the reporting period, the company’s business development was steadily improved with the profitability continuously optimised and the gross profit margin of the principal business steadily increased. In 2023, the gross profit margin of the company’s principal business was 31.44%, representing a year-on-year increase of 3.42 percentage points.”

In a note, Goldman Sachs Equity Research said it estimated CTG’s key Hainan operations (excluding duty paid, worth some CNY) to have reached CNY11.5 billion (US$1.6 billion) in Q4, up +3% quarter-on-quarter but lagging behind typical 4Q seasonality.

The firm commented: “Given Hainan’s tropical weather during the winter, 4Q was usually the strongest season with duty free sales tracking +10-20% above 3Q run-rate. We attribute the softer momentum (+3% qoq) of last year to the general weakness in China’s consumption sentiment, in absence of daigou contribution since its crackdown in March-April.”

The note said Hainan’s daily duty free store sales of CNY120-130 million (US$16.9-18.3 million) in Q2 2023 represented a -35-41% decline vs. FY21 level.

Goldman Sachs estimated CTG’s Q4 airport duty free sales had grown by a high-teen percentage quarter-on-quarter driven by a gradual recovery in per-passenger spending to 50-70% of pre-COVID levels (e.g. CNY250 at Shanghai Airport,CNY110-150 in Beijing). Following the recent improvement of the retailer’s concession terms at Shanghai Pudong International, Shanghai Hongqiao International and Beijing Capital International airports, the firm believes CTG’s airport duty free business could return to profitability this year.

Goldman Sachs maintained a ‘Buy’ rating on CTG stock.

CTG said it had focused on its established development strategy and business objectives in 2023 while promoting reforms, innovation and management enhancement. The company had strengthened reforms in key areas such as marketing, sales and supply chain, while continuing to focus on duty free business as its principal business.

CTG noted how it had optimised its domestic and overseas businesses, “through which operational benefits, operational efficiency and management quality were simultaneously enhanced, and the company’s core competitiveness continued to be strengthened.” ✈