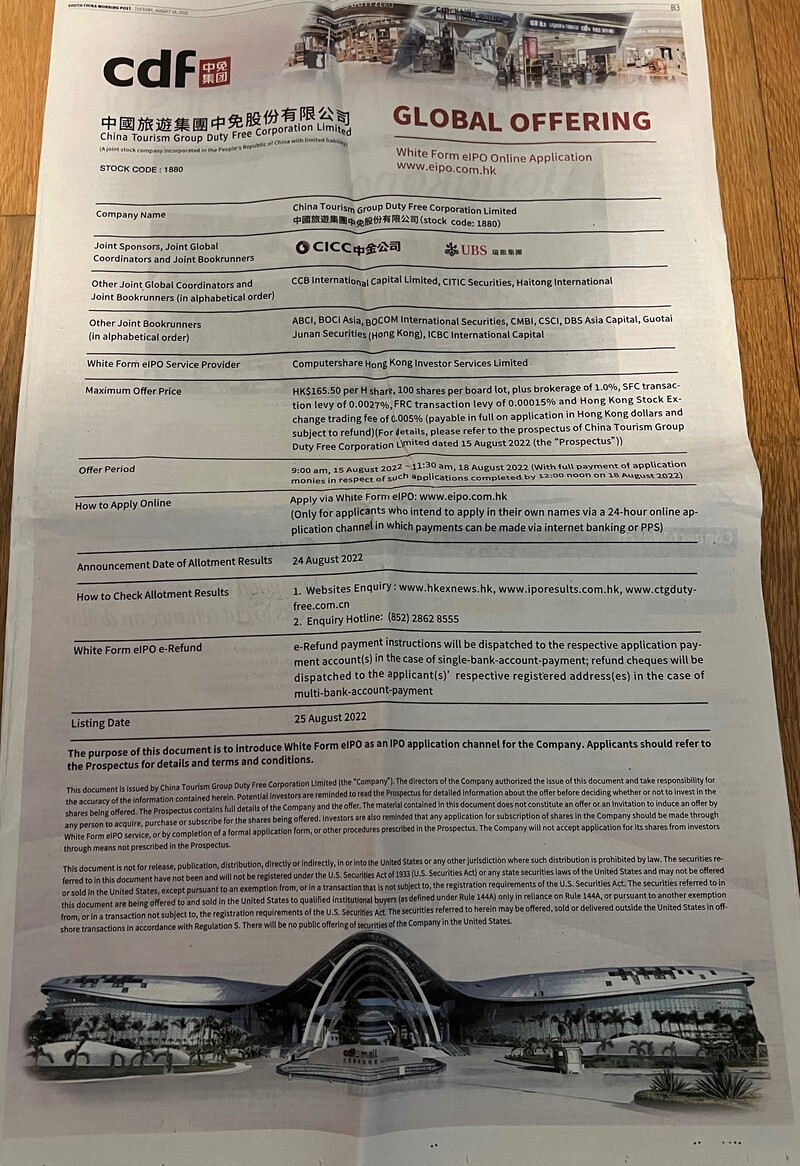

HONG KONG, CHINA. China Tourism Group Duty Free Corporation Limited, parent of China Duty Free Group (CDFG), today unveiled full details of its Global Offering and listing of H Shares on The Stock Exchange of Hong Kong.

China Tourism Group Duty Free Corp (CTG Duty Free) was established in 1984. In 2020 CDFG became the world’s number one travel retailer by sales, according to The Moodie Davitt Report annual Top Travel Retailers benchmark ranking.

CTG Duty Free said that it held a 24.6% market share of global travel retail sale in 2021, citing a recent Frost & Sullivan report. “The company has developed China’s travel retail business with duty free as its core strength and seeks to increase its global presence,” the group said.

Here are the key details of the offering:

- CTG Duty Free plans to offer an aggregate of 102,761,900 H Shares (subject to the Over-allotment Option) under the Global Offering, of which 97,623,700 H Shares (subject to adjustment and the Over-allotment Option) will be offered by way of International Offering, and 5,138,200 H Shares (subject to adjustment) will be offered in the Hong Kong Public Offering. The Offer Price will not be more than HK$165.50 per H Share and is currently expected to be not less than HK$143.50 per H Share.

- The Hong Kong Public Offering commenced on Monday, 15 August and is expected to close at 12:00 noon (at 11:30 a.m. for completing electronic applications under the White Form eIPO service) on Thursday, 18 August. Dealings in the H Shares on the Main Board of the Hong Kong Stock Exchange are expected to commence on Thursday, 25 August 2022. The H Shares will be traded in board lots of 100 H Shares each.

- Assuming that the Offer Price is HK$154.50 per Share (being the mid-point of the Offer Price range of between HK$143.50 and HK$165.50 per H Share), the Company estimates that it will receive net proceeds of approximately HK$15,538.0 million [circa US$1.99 billion at today’s exchange rate -Ed] from the Global Offering after deducting the underwriting commissions and the other expenses payable. The Company intends to use the net proceeds from the Global Offering as follows:

➢ Approximately 48.8%, or HK$7,579.2 million will be used to reinforce its domestic channels, among which, (i) approximately 3.0%, or HK$465.8 million, will be used to invest in the duty free stores in key airports; (ii) approximately 0.7%, or HK$116.5 million, will be used to invest in other port duty free stores; (iii) approximately 3.7%, or HK$582.3 million, will be used to invest in duty paid travel retail projects; and (iv) approximately 41.3%, or HK$6,414.6 million, will be used to invest in offshore stores and downtown duty free stores;

➢ Approximately 22.5%, or HK$3,493.7 million will be used for expanding overseas channels, among which, (i) approximately 8.2%, or HK$1,281.0 million, will be used to open downtown stores overseas; (ii) approximately 4.5%, or HK$698.7 million will be used to expand its port stores overseas; (iii) approximately 2.2%, or HK$349.4 million, will be used to expand its stores on more cruise ships; and (iv) approximately 7.5%, or HK$1,164.6 million [US$148.6 million at current exchange rates -Ed]will be used to selectively pursue acquisitions of travel retail operators overseas;

➢ approximately 13.5%, or HK$2,096.2 million, will be used to improve supply chain efficiency, among which, (i) approximately 6.7%, or HK$1,048.1 million, will be used to invest in developing its logistics centres; (ii) approximately 1.5%, or HK$232.9 million, will be used to upgrade its existing supply chain; and (iii) approximately 5.2%, or HK$815.2 million, will be used to consolidate its upstream procurement systems;

➢ approximately 1.5%, or HK$232.9 million, will be used to upgrade the information technology system;

➢ approximately 3.7%, or HK$582.3 million, will be used for marketing and further improve its customer loyalty program, among which, (i) approximately 2.2%, or HK$349.4 million, will be used for marketing, and (ii)approximately 1.5%, or HK$232.9 million will be used for developing its membership system by attracting new customers to join the its customer loyalty program and to improve the membership benefits for its existing members;

and ➢ approximately 10.0%, or HK$1,553.8 million will be used for working capital and other general corporate purposes.

CTG Duty-Free confirmed earlier reports that it has secured nine cornerstone investors:

- China State-Owned Enterprise Mixed Ownership Reform Fund Co., Ltd

- AmorePacific Group

- COSCO Shipping (Hong Kong) Co., Limited

- Rongshi International Holding Company Limited

- Shanghai Airport Investment Corporation Limited

- Luzhou Laojiao Co., Ltd.

- China Structural Reform Fund Corporation Limited

- Hainan Free Trade Port Construction Investment Fund Co., Ltd

- The Oaktree Funds

China International Capital Corporation Hong Kong Securities Limited and UBS Securities Hong Kong Limited are the Joint Sponsors. China International Capital Corporation Hong Kong Securities Limited and UBS AG Hong Kong Branch are the Joint Global Coordinators and Joint Bookrunners.

CCB International Capital Limited, CLSA Limited and Haitong International Securities Company Limited are other Joint Global Coordinators and Joint Bookrunners.

ABCI Capital Limited, BOCI Asia Limited, BOCOM International Securities Limited, CMB International Capital Limited, China Securities (International) Corporate Finance Company Limited, DBS Asia Capital Limited, Guotai Junan Securities (Hong Kong) Limited and ICBC International Capital Limited are the other Joint Bookrunners.

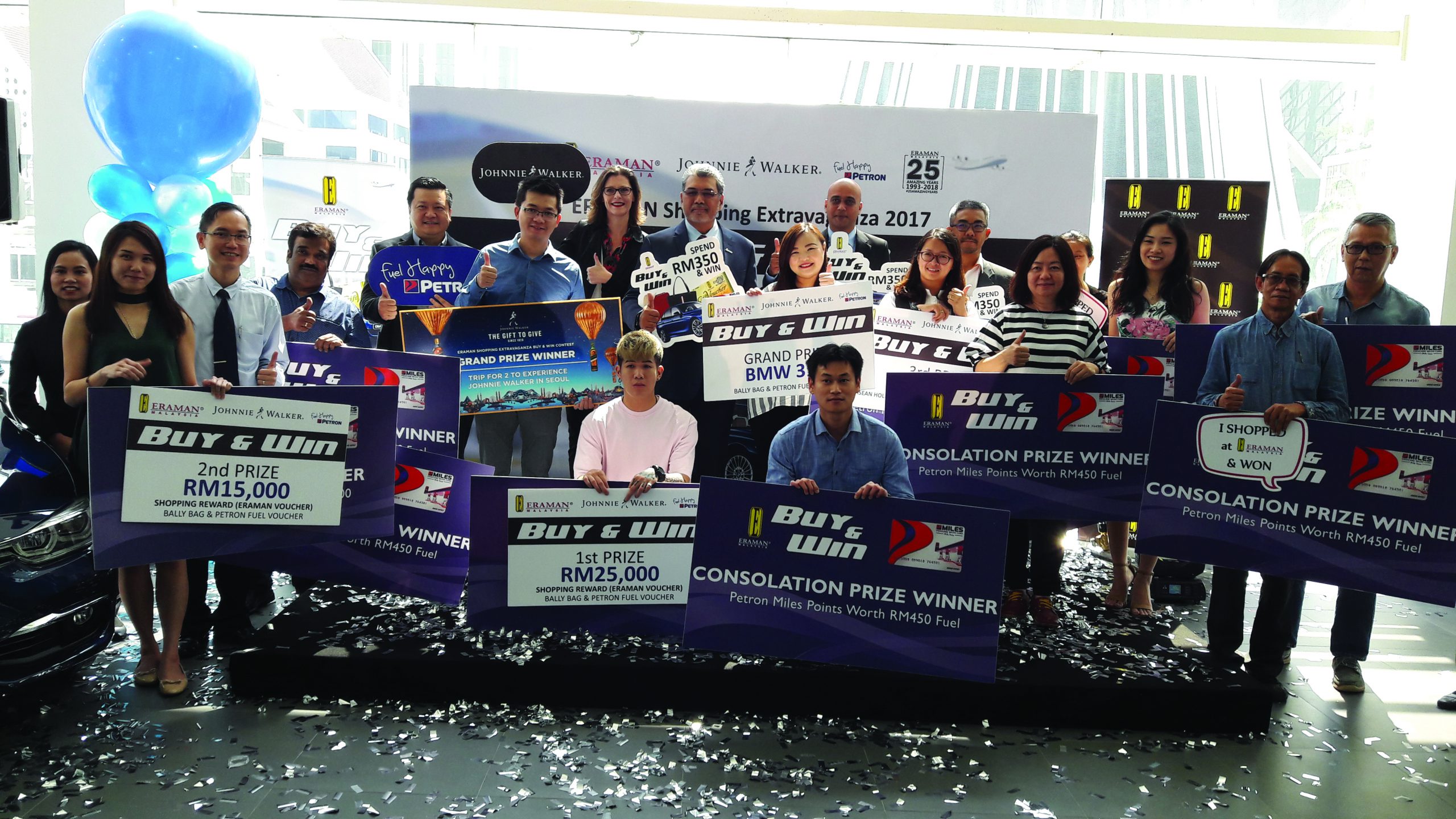

In June The Moodie Davitt Report launched a new quarterly eZine called The Moodie Davitt China Travel Retail Report. The cover story is dedicated to China Tourism Group and CDFG. Click on the image to read the bi-lingual title. The next edition will be published in October. Please email Kristyn@MoodieDavittReport.com for a free first year subscription.