INTERNATIONAL. Positive vibes for the accelerating and sustained recovery of the Chinese outbound travel market were the order of the day at two Tax Free World Association (TFWA) webinars last week.

Moderating the sessions, TFWA Managing Director John Rimmer, TFWA Conference Manager Michele Miranda and TFWA Chief Representative in China Hannah Gao were joined on Wednesday 1 March by China Duty Free Group (CDFG) Assistant General Manager Michelle Sun, Dragon Trail Director of Marketing & Communications Sienna Parulis-Cook and Global Duty Free (GDF) Vice President Jason Cao.

On 2 March delegates heard from Jing Daily fashion expert Lisa Nan, Jessica’s Secret CEO Mirko Wang and Zhuhai Duty Free Chief Deputy Director Procurement Operations Center Daniel Chow.

Chinese Lunar New Year drives strong recovery

Opening the first session, CDFG’s Michelle Sun noted that China’s travel market had seen a rapid recovery since the end of 2022. This followed China’s move to update its pandemic policies and stabilise the economy.

She said: “We can see a very strong recovery for domestic tourism from the Lunar New Year period.” Domestic travellers reached 308 million, recovering to 88.6% of 2019 levels. Tourism revenue recovery stood at 73.1% of the 2019 level, reaching RMB375.8 billion (US$54.4 billion).

“The Chinese domestic tourism market is expected to be stable and high throughout the whole year,” Sun added. The number of domestic tourists through 2023 is expected to reach around 4.55 billion, up by +80% year-on-year, with recovery to 76% of the 2019 level.

Over Lunar New Year, sales revenue from consumption-related industries in China rose +12.2% compared to 2022 and +12.4% compared to 2019.

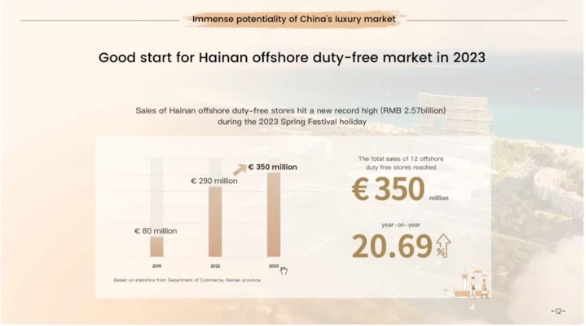

Hainan offshore duty free sales reached a new high during the 2023 Lunar New Year period, hitting RMB 2.57 billion (US$372 million) an increase of +20.69% year-on-year. Hainan as a destination received more than 16 million visitors during the Lunar New Year period, an increase of +11% year-on-year.

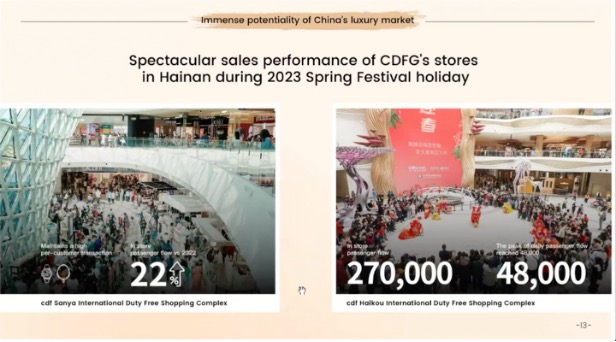

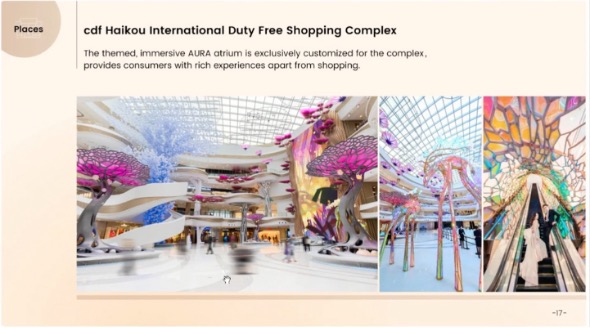

“For CDFG’s stores, we also saw a very positive result during Chinese New Year” added Sun. In-store passenger flow at Sanya International Duty Free Shopping Complex climbed +22% compared to 2022 in this period. At the cdf Haikou International Duty Free Shopping Complex, which opened last October, passenger flow peaked at 48,000 per day over Lunar New Year.

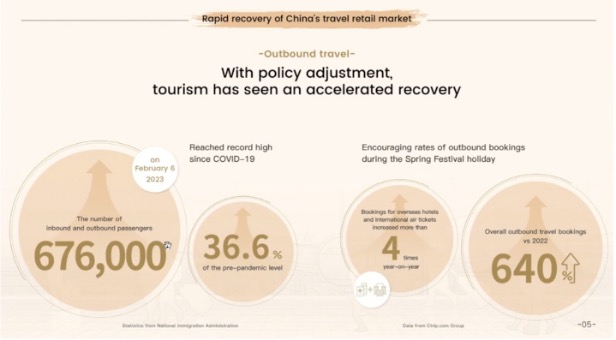

China is also seeing a strong outbound travel recovery, which is expected to continue through 2023.

“With the policy adjustment, we see a strong recovery on outbound travel,” Sun continued. “On 6 February, the day travel resumed between Hong Kong and Mainland China, the number of inbound and outbound passengers reached 676,000, a record high since the outbreak of Covid-19”.

The top three destinations for the May holidays from the Mainland are expected to be Bangkok, Hong Kong and Macau.

Sun also highlighted the potential of China’s luxury market. The Chinese consumer is expected to contribute 38-40% of global personal luxury consumption by 2030, from around 25% pre-pandemic.

She pointed out that although consumers can now travel internationally and buy luxury goods overseas, China’s domestic market remains attractive due to structural changes in the market over the last three years.

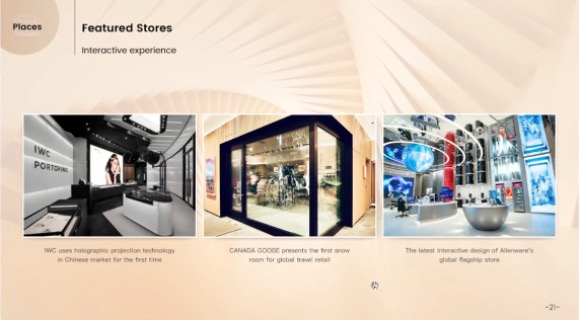

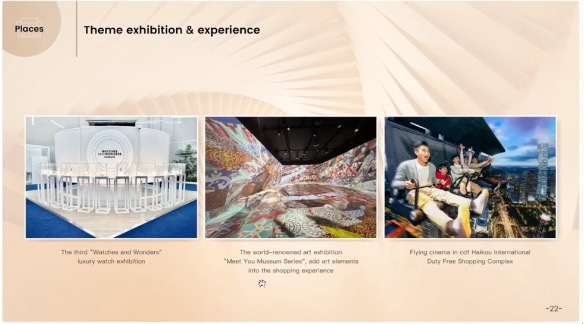

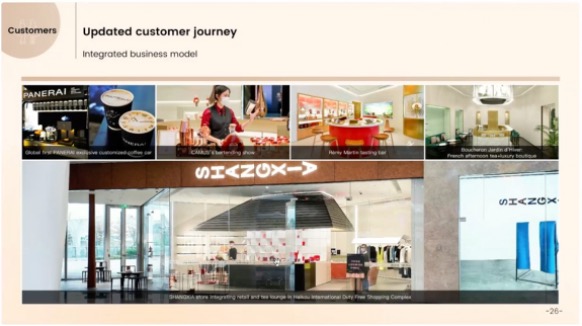

One of these relates to upgraded retail formats, with upgrades to architectural designs and engineering quality, and shopping experiences that integrate entertainment, leisure, art and food & beverage. Brands have upgraded their store concept designs to provide a richer experience, with many at cdf Haikou International Duty Free Shopping Complex offering a prime showcase.

{Click here for a special edition of The Moodie Davitt Spotlight Series eZine dedicated to the spectacular cdf Haikou International Duty Free Shopping Complex, produced in association with Hainan Hinews Media Co, out strategic partner in Hainan province.}

CDFG is currently building an extension to its Sanya International Duty Free Shopping Complex (Block C) to create the largest stand-alone beauty complex in the world.

Brands are working closely with CDFG to create exclusive designs and differentiated stores, incorporating interactive experiences – examples include the ‘Snow Room’ by Canada Goose.

CDFG has also expanded its stores to incorporate exhibitions relating to retail, art and entertainment.

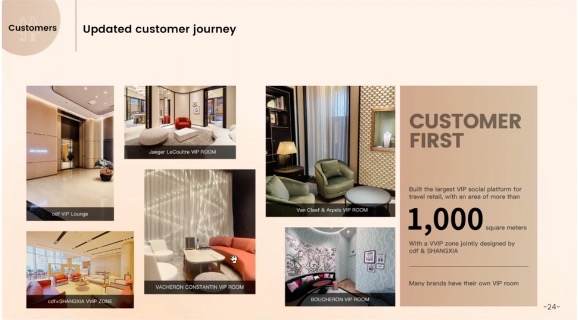

Another focus for CDFG, explained Sun, is on customer-centricity. Examples include the expansion of VIP lounges to provide an upgraded customer journey for VIPs and more engagement by the retailer with members.

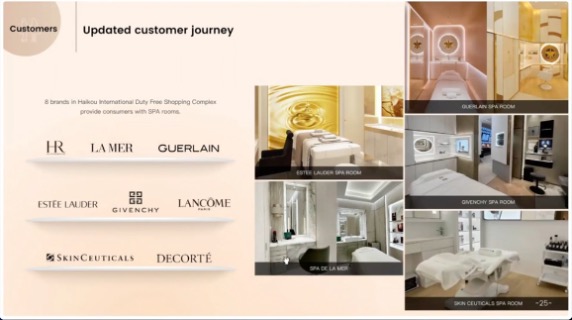

Beauty brands are working closely with CDFG to provide a fuller experience of their brands and their products in-store, offering personalised spa treatments, for example.

On top of the retail offer, some drinks brands are providing tasting opportunities and exclusive customised beverages, all to enhance the retail experience for CDFG customers.

CDFG has further enhanced the shopping experience through a convenient, high-tech, interactive directory system helping shoppers to locate stores, navigate the malls, find activities, join membership schemes and source tourism information. A ‘scan and go’ service has been launched in stores to relieve queue pressures during busy times. A One on One VIP Service “allows customers to have a more efficient and pleasant shopping experience,” added Sun.

Products assortment is a further area of focus. Many brands now introduce their new ranges in their Chinese stores first, a drive being replicated in the travel retail market. CDFG has received “great support from brands” Sun said, with many launching exclusive items for the travel retail market with CDFG across all categories.

Sun confirmed that CDFG is seeing a notable increase in the choice of Chinese brands from younger customers, which is being reflected in an enhanced offer from national labels.

Sun said: “We can see that the experiences and expectations from Chinese consumers have been greatly updated and changed over the past three years. We have realised that there are a lot of tasks and work to be done after the reopening.”

CDFG have five key areas of focus as it seeks to provide the “best service to Chinese tourists wherever they are travelling”, she noted.

- Bidding for large hub airports, domestic and abroad.

- Expanding its overseas business.

- Building downtown duty free stores across China.

- Improving online and offline retailing business.

- Strengthening capital operations.

Opening up

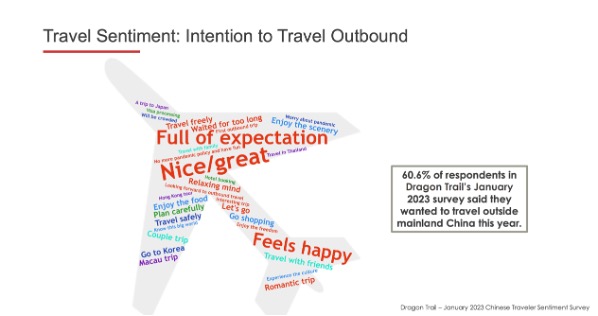

Director of Marketing & Communications at Dragon Trail Sienna Parulis-Cook provided an update to delegates on the recent Covid-19 policy changes for Chinese travellers, including the reissuing of short-term visas to South Korea as of mid-February. Most recently China has dropped the requirement for inbound travellers from certain countries to complete a PCR test within 48 hours of departure. Instead, an antigen test is required (including a self-test) making it easier for Chinese travellers to return to China.

According to data from Dragon Trail’s latest sentiment survey, Parulis-Cook said that “the appetite for future outbound travel is very high”. More than 60% of respondents stated that they want to travel outside Mainland China this year, with major motivations to relax, experience scenery, culture, food and shopping overseas. She added: “We expect to see the biggest uptake in travel during the second half of 2023.”

Preferred destinations for Mainland Chinese travellers in 2023 remain broadly in line with pre-Covid trends. Hong Kong is set to be the leading destination accounting (20.7% of those planning to travel) with Thailand leading the way as the top international destination.

Preferred destinations for Mainland Chinese travellers in 2023 remain broadly in line with pre-Covid trends. Hong Kong is set to be the leading destination accounting (20.7% of those planning to travel) with Thailand leading the way as the top international destination.

The GDF Plaza view

Jason Cao, newly appointed Vice President of Global Consumer Boutique (Hainan) Trading Co, operator of Haikou-based travel retailer GDF Plaza, said that “sales figures are very exciting” with RMB9 billion (US$1.29 billion) in offshore duty free sales achieved in Hainan over the Lunar New Year period.

Despite Covid-19-related controls, 4.2 million customers purchased in the offshore duty free channel in Hainan in 2022 (3.7 million in 2019), he noted. Cao said that Hainan will continue to grow post-pandemic due to continued investment and development over the past three years.

Zhuhai Duty Free’s Daniel Chow (speaking at the TFWA webinar on Thursday) also discussed the company’s many ambitious projects, including developments in Sanya and Hengqin, to harness the rapid recovery in Chinese tourism.

Chow updated delegates on the company’s latest strategic developments.

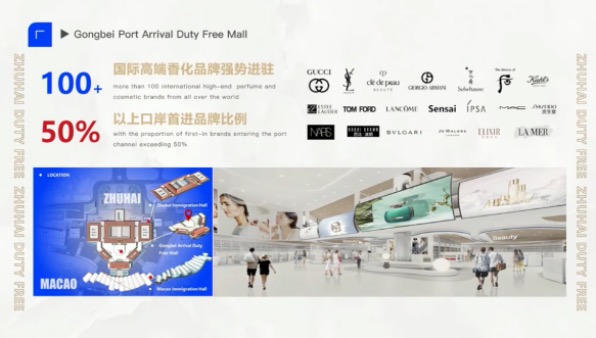

One of the most important projects is Gongbei Port Arrival Duty Free Mall, which is the largest duty free shop at a land port in China measured by floor space. In peak season, daily passenger flow can reach 500,000 through the port.

Chow said: “We are happy to share with you that the Gongbei Port Arrival Duty Free Mall will officially debut in the first half of this year creating a new benchmark in the Greater Bay Area.”

Passenger flow between Zhuhai and Macau showed rapid growth in January, surpassing 10 million, and is expected to recover to pre-pandemic levels later this year.

Zhuhai Duty Free has also launched a WeChat pre-order platform, helping the company to grow sales in January and February 2023 by +76% and +112% year-on-year respectively. The perfumes & cosmetics category posted +249% growth in January and +246% in February alone.

The construction of Hengqin Guangdong-Macao in-depth Cooperation Zone will be another important project for Zhuhai Duty Free. On January 9, the regulations for the development were passed by authorities.

Zhuhai Duty Free signed a strategic cooperation agreement in May 2022 with Hong Kong Lai Sun Group to create a new commercial complex, Novatown. It is located in a key commercial area in Hengqin, adjacent to Macau, and a key centre for business tourists. Phase two of the project will see a comprehensive shopping experience centre for high-quality consumer goods integrating online and offline shopping.

Chow also addressed ambitions for the Zhuhai Duty Free brand in Hainan, saying, “Our aim is to enter Hainan and embrace the future”. With offshore duty free sales in Hainan expected to exceed RMB80 billion (US$11.6 billion) in 2023, the opportunity is exciting, he added.

Chow also addressed ambitions for the Zhuhai Duty Free brand in Hainan, saying, “Our aim is to enter Hainan and embrace the future”. With offshore duty free sales in Hainan expected to exceed RMB80 billion (US$11.6 billion) in 2023, the opportunity is exciting, he added.

Zhuhai Duty Free’s store will be located in the Sanya Helian Central Business District Project, in the core area of Sanya Phoenix Coast.

China’s luxury market

Jing Daily journalist Lisa Nan updated delegates on the current state of the Chinese luxury market. “By 2025, China’s luxury market will reach US$119 billion in sales,” she said. China is expected to have the largest share of the global luxury market by then, noted Nan.

Within the global luxury market, Nan highlighted two key segments, high net worth individuals (HNWIs) and Gen Z consumers. HNWIs are identified as having a net worth of over US$1.4 million a year and account for 0.3% of China’s population but represent 42% of luxury sales in China. “It’s very impressive that a minimal number of people are driving nearly half of the sales,” she said. By category, HNWIs are most interested in investing in couture, watches and jewellery.

Gen Zs account for 46% of total luxury sales in China and are driven by “self-reward and individualism, interested in avant-garde designs and extreme novelty that expresses their own personality”.

Pop-up activations are one key tool in attracting Gen Z shoppers, added Nan. “Brands must prioritise experience and storytelling, and pop-ups are becoming an attraction in themselves.”

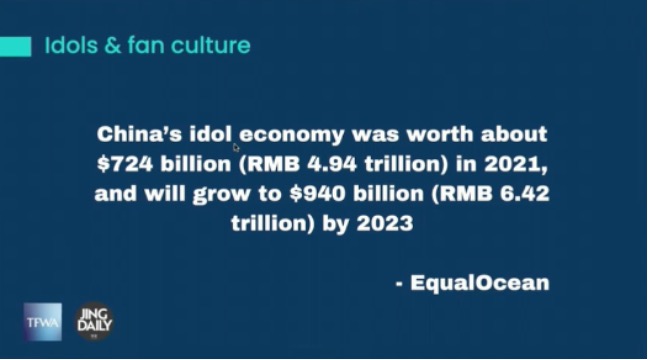

On idols and fan culture in China, she added, “A key to a high ROI is to invite celebrities or KOLs; their appearance can boost sales by to five to 15 times especially when combined with limited editions.”

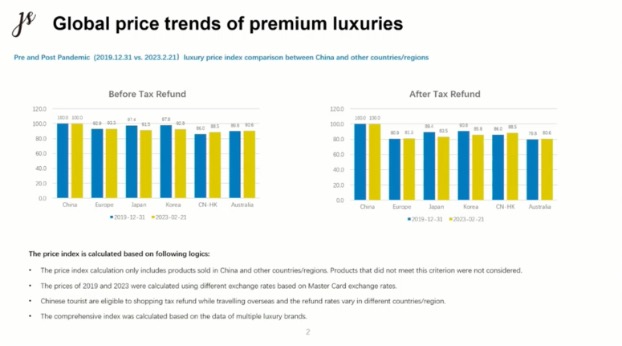

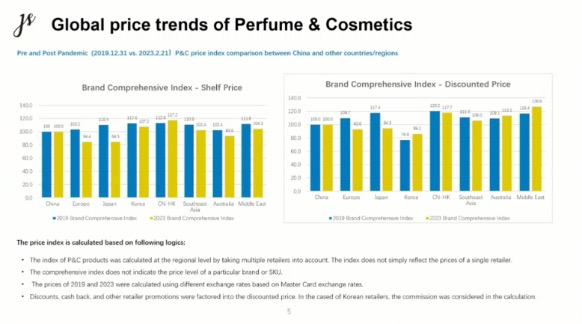

Mirko Wang, CEO of Chinese price comparison app Jessica’s Secret, provided the latest data on price changes in the travel retail market. “Price is one of the most important factors influencing consumers,” he noted, adding that beauty sales had been heavily impacted by recent price changes.

Prices of luxury goods within China have not fluctuated much through the pandemic, he said, but there remains a big price gap compared to other regions, led by Europe.

He said: “During the past three years of the pandemic, P&C was the most impacted segment, not only in the duty free industry but also the duty paid market. For example consumer behaviour in buying makeup has changed for reasons such as wearing masks and staying home a lot.” Many duty free retailers cleared old inventory through re-sale channels, explained Wang. ✈