MIDDLE EAST. The ending of a four-year blockade on Qatar by Saudi Arabia, the United Arab Emirates (UAE), Bahrain and Egypt in early January this year has had a significant effect on recent available air passenger seat capacity in the Middle East, according to new data shared by ForwardKeys.

The travel data analyst revealed that international capacity to Qatar from the Middle East for the first quarter of 2021 is only -34% down compared to the year-ago period, boosted by the newly-reconnected countries. ForwardKeys noted that this greatly contrasts with the big reductions in capacity that are being seen in other world regions.

According to ForwardKeys’ data, approximately 41% of the planned capacity for this quarter is made up of routes between Qatar and Saudi Arabia, the UAE and Egypt that weren’t available for international travel across the Middle East last year.

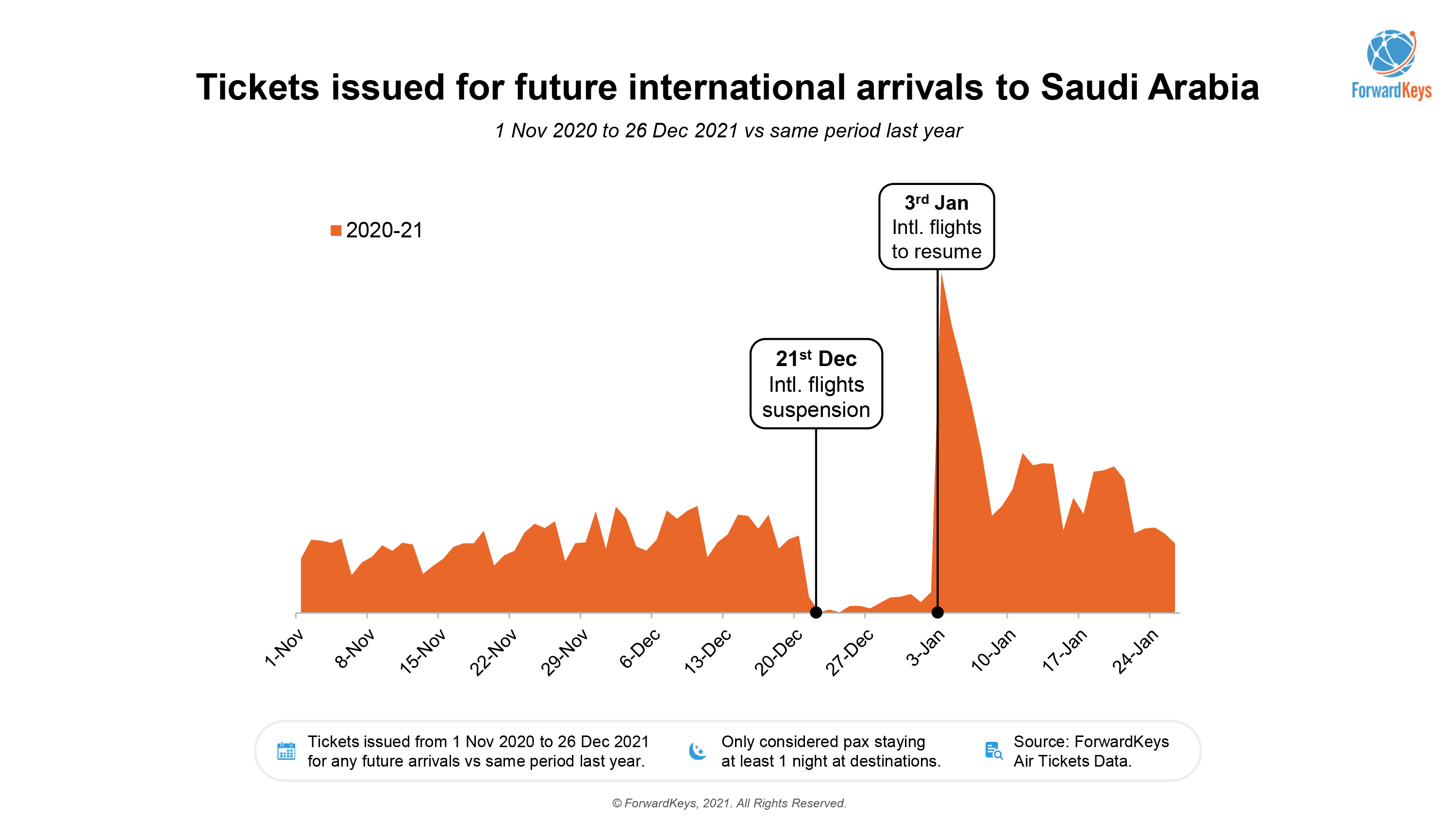

The analyst also revealed some encouraging recent air ticketing patterns from the Saudi Arabian market. On 21 December, Saudi Arabia suspended international flights to contain the spread of new COVID-19 strains and subsequently ticketing activity for future arrivals to the country dropped dramatically.

But on 3 January, it was announced that borders would reopen and international flights could resume, releasing pent-up demand, as air tickets purchased on that day achieved a year-on-year growth. Although demand has eased since then, ForwardKeys said it is still observing a higher number of tickets being issued than before the suspension.

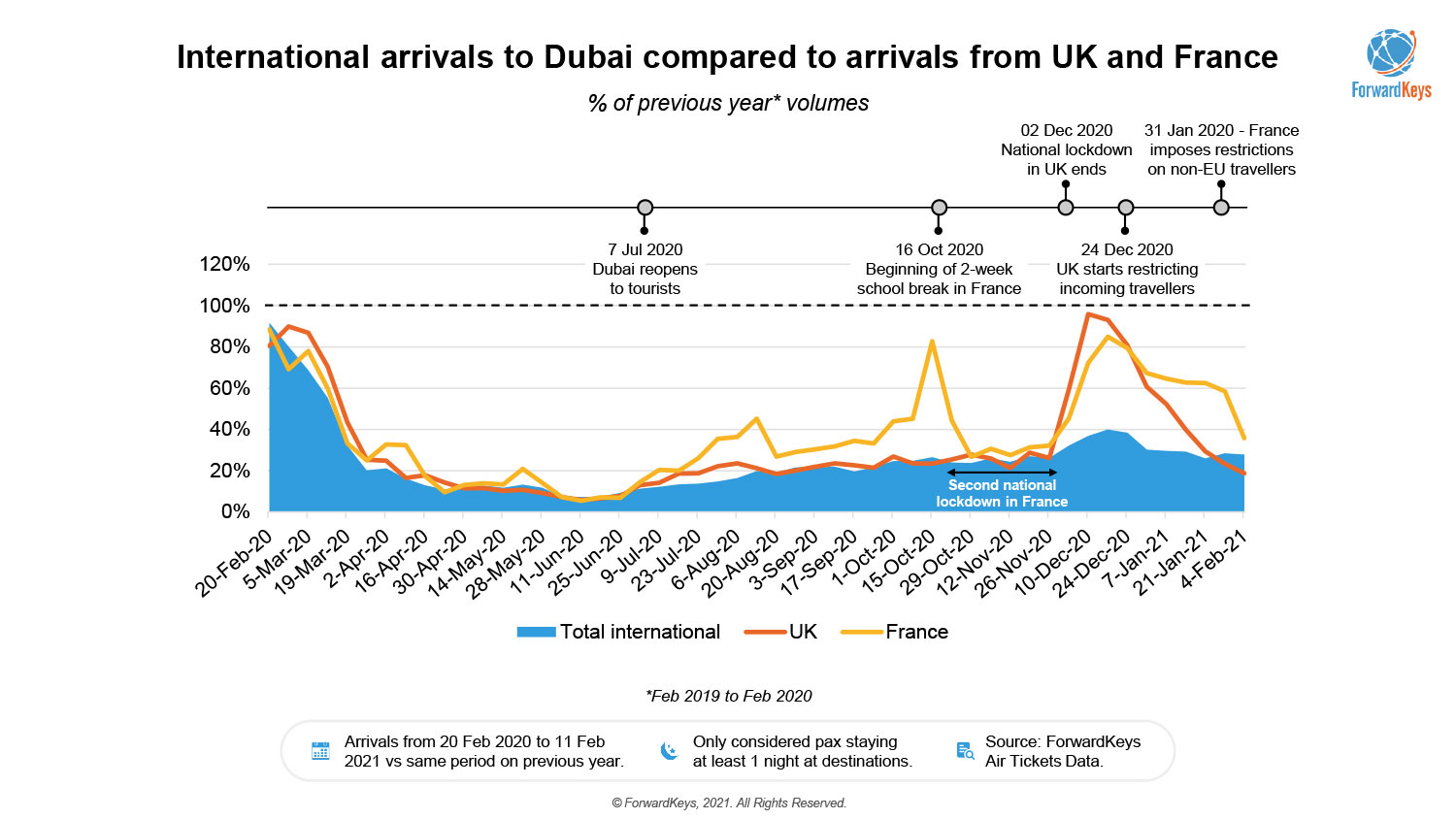

ForwardKeys also released air ticket data which tracks travellers’ movements to Dubai since it announced its reopening on 7 July last year. From the key international source markets, the analyst said that air tickets bought in France on 15 October climbed to 83% of 2019 levels. It also observed, however, that bookings from the country to Dubai dropped off once the former went into its second national lockdown, before picking up again over the Christmas period.

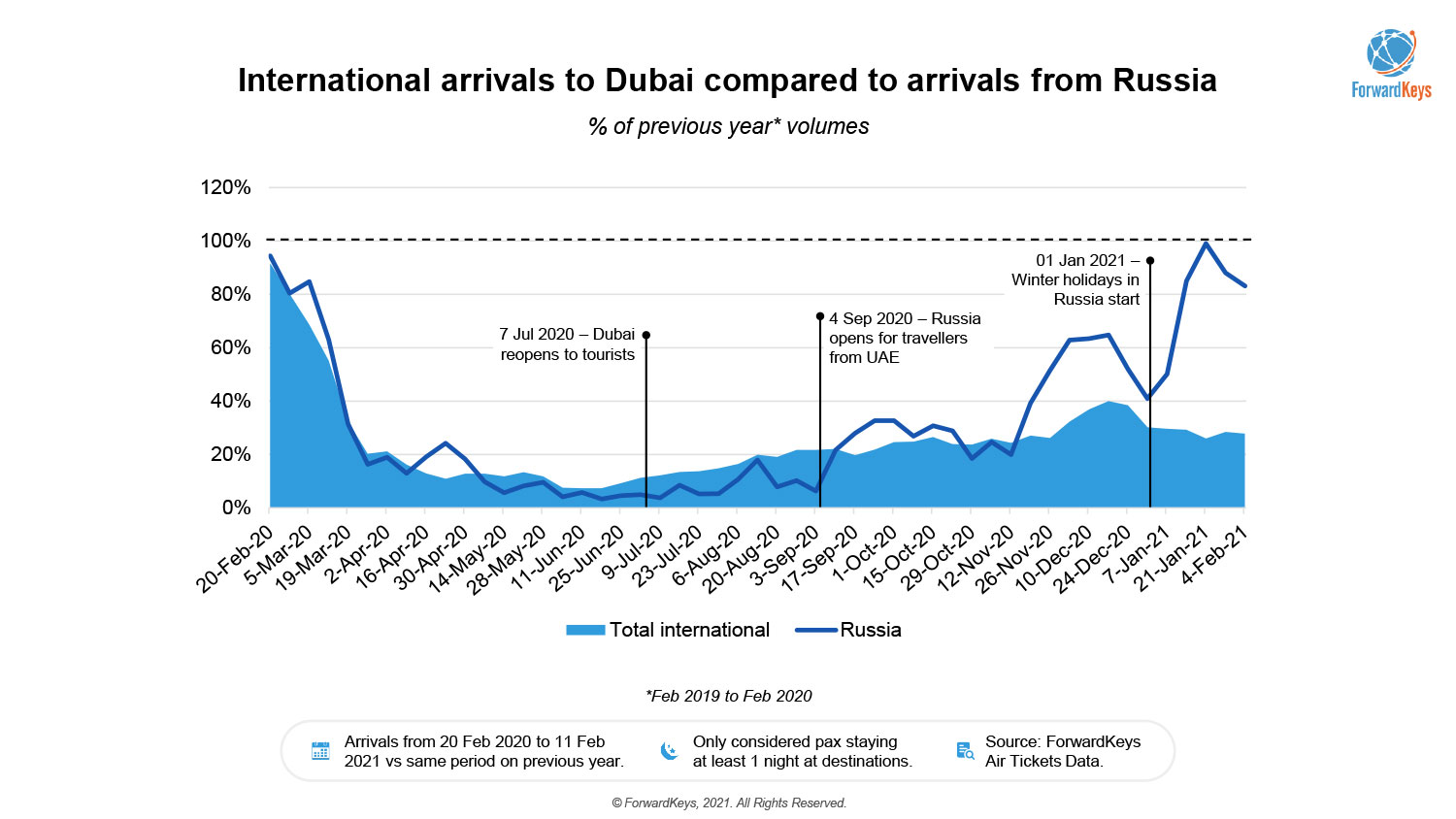

Another Dubai trend ForwardKeys picked out was that Russians’ average length of stay in the emirate was almost twice the average of 2019 (see our recent story on ForwardKeys’ analysis of the Russian market here).

The travel data analyst observed that the trend of staying longer in Dubai is partly the result of a “smart move” played by the city’s government, with its introduction of the Digital Nomad Visa on 14 October to attract longer staying travellers from more affluent markets.

Finally, ForwardKeys noted that the latest data confirms that air tickets issued from Europe and the Americas to Dubai have mainly been on an upward climb since 20 October. ForwardKeys Insights Specialist Ema Mandal said: “We have noticed constant week-on-week growth in long-term international tickets from late October when the [Digital Nomad Visa] programme was first announced.”

She added: “Remote workers can come to Dubai to live with their families with the visa valid for up to a year. Many origin markets, including Canada and UK, have been demonstrating year-on-year growth in November and December.”