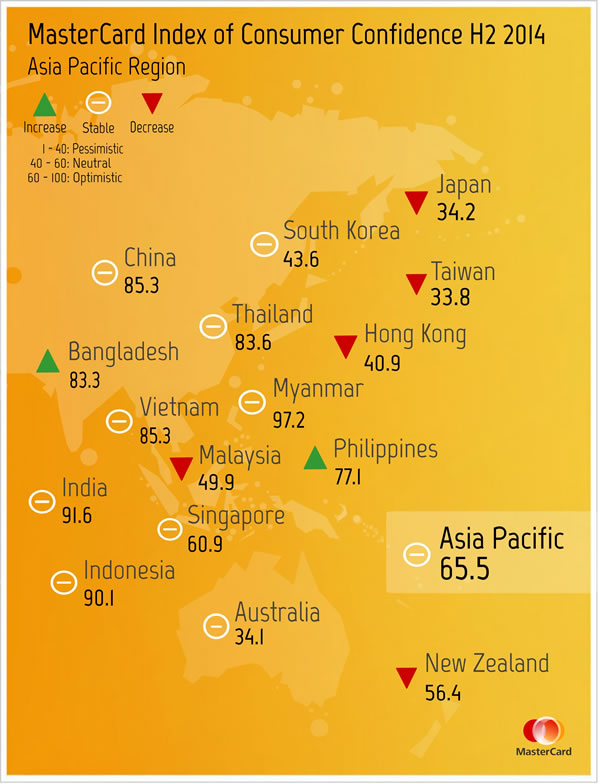

ASIA PACIFIC. Consumers in Asia Pacific’s emerging markets remain optimistic despite a slight decline in overall consumer confidence for the region, according to the MasterCard Index of Consumer Confidence, released today.

This decrease comes after the region recorded the highest consumer confidence score in more than a decade in the previous survey during the first half of 2014 (H1 2014).

Respondents were asked to give a six-month outlook on five economic factors: the economy, employment prospects, regular income prospects, the stock market and their quality of life. The Index is calculated with zero as the most pessimistic, 100 as most optimistic and 50 as neutral.

|

“The slight drop in Asia Pacific’s consumer confidence reflects an outlook of cautious optimism. Consumers across the region are holding their breath for signs of sustained economic growth and opportunity.“ |

Pierre Burret Head of Delivery, Quality & Resource Management for Europe, Asia Pacific, Middle East & Africa MasterCard Advisors |

Overall Asia Pacific markets showed optimism despite a decrease of -2.9 Index points to 65.5 Index points in the second half of 2014 (H2 2014). There were declines across all five key economic indicators for Asia Pacific.

Out of the 16 Asia Pacific markets surveyed, only the Philippines (up +7.7 points) and Bangladesh (up +16.9 points) recorded a greater than five Index point improvement in consumer confidence. Ten out of 16 Asia Pacific markets remained stable with either muted improvements or declines.

Bangladesh recorded the single largest improvement in Asia Pacific, moving from optimistic to very optimistic territory at 83.3 points, up +16.9 points. It is the only market that saw a double-digit rise in consumer sentiment.

Myanmar, India and Indonesia are the Asia Pacific region’s most optimistic markets, with 97.2, 91.6 and 90.1 points, respectively.

Within Southeast Asia, consumer confidence rose in the Philippines by +7.7 points, pushing into optimistic territory (77.1 points), while Malaysia saw a deterioration in consumer confidence, down -11.5 to 49.9 points in H2 2014, sliding below the 50-point neutral mark for the first time since the financial crisis low in H1 2009.

Vietnam (85.3 points) and Thailand (83.6 points) remain very optimistic and Singapore remains optimistic (60.9 points).

While consumer confidence in China (up +2.7 to 85.3 points in H2 2014) and South Korea (up +1.7 to 43.6 points) stayed stable with muted increases, their Northeast Asian counterparts posted the sharpest declines in consumer confidence, led by Taiwan (down -23.8 to 33.8 points), Japan (down -17.6 to 34.2 points) and Hong Kong (down -13.5 to 40.9 points). All three markets dropped below the 50-point neutral mark from the previous survey.

Additional declines were recorded in Australia (down -3.2 to 34.1 points in H2 2014) keeping it in pessimistic territory, while New Zealand inched closer to the 50-point neutral mark after falling -9.4 to 56.4 points. Australia’s score is the lowest since the financial crisis low in H1 2009.

MasterCard Advisors Head of Delivery, Quality & Resource Management for Europe, Asia Pacific, Middle East & Africa Pierre Burret commented: “The slight drop in Asia Pacific’s consumer confidence reflects an outlook of cautious optimism. Consumers across the region are holding their breath for signs of sustained economic growth and opportunity. Emerging markets Myanmar, India and Indonesia are the most optimistic because of either positive anticipation for a brighter future or excitement around their respective newly-minted governments.

“Conversely, the developed markets of Northeast Asia, namely Taiwan, Japan and Hong Kong were much less optimistic in their outlook. In these markets, the wanted signs of long-term growth and opportunity are blocked by Hong Kong’s recent political crisis and Japan’s weakening Yen,” he added.

The Index is based on a survey conducted between October 2014 and November 2014 on 8,235 respondents aged 18-64 in 16 countries across Asia Pacific.

|