The US$600 million acquisition of a 51% stake in Kylie Cosmetics marks a major statement of faith by Coty in a brand that was only launched in November 2015.

The global beauty house – whose luxury brands include Boss, Burberry, Calvin Klein, Chloe, Gucci, and Marc Jacobs among others – will begin the hard work of recouping its investment after the acquisition closes, expected to be in the third quarter of fiscal year 2020 (ending March).

Kylie Cosmetics is a young brand – in every sense. Launched four years ago by celebrity star of Keeping Up With Kardashians, Kylie Jenner, its target is very much a younger generation of consumers. That’s no surprise when 75% of Jenner’s 270 million followers (across her personal and brand channels, and across social media platforms) are aged between 18 and 34.

Coty has confirmed that it will be looking to globalise the brand quickly – and travel retail may well have a key role in this. Coty Chairman Peter Harf said: “This new partnership between Kylie and Coty is an exciting step. Kylie is a modern-day icon, with an incredible sense of the beauty consumer, and we believe in the high potential of building a global beauty brand together.”

There are some concerns that the price paid by Coty is a very high multiple of sales “for a brand that may well be a fad” as Deutsche Bank Equity Research Analyst Faiza Alwy put it yesterday.

However, Coty Chief Financial Officer Pierre-André Terisse pointed out: “By combining our global network in many functions and in many different countries, with the power of a brand which has been able to expand at such a quick pace in the US, without the network we have, there’s an obvious case for value creation.”

Kylie Cosmetics generated revenue of approximately US$177 million over the past 12 months “representing over +40% growth relative to calendar year 2018” according to Terisse. “Clearly it is a brand with strong momentum,” he noted.

A three-axis brand is on its way… probably

While Kylie Cosmetics began as a direct-to-consumer ecommerce brand initially focused on makeup, its partnership with beauty retailer Ulta (started in November 2018) has moved sales to a roughly even split between direct-to-consumer and retail. The skincare line Kylie Skin launched in May 2019 and is on track to reach US$25 million sales in calendar year 2019.

“So we are talking of cosmetics, we are talking of skincare, and we are probably going to talk about fragrance as well,” said Terisse, suggesting that Coty will make the brand a full three-axis brand before long, possibly under the all-encompassing name: Kylie Beauty.

“Strong interest” from international retailers

Coty is upbeat on global prospects for its new acquisition, as is Jenner herself. She said: “This partnership will allow me and my team to stay focused on the creation and development of each product while building the brand into an international beauty powerhouse.”

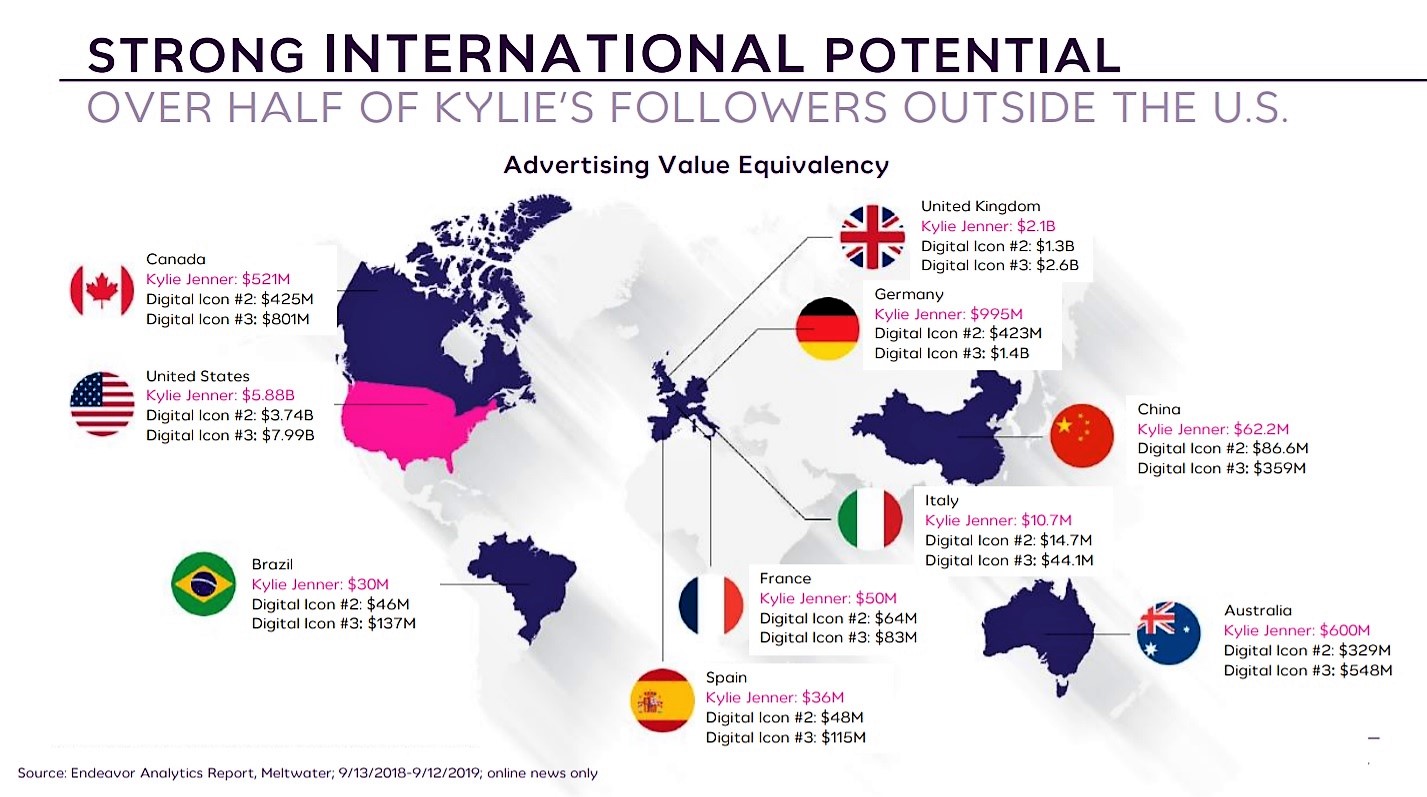

While the vast bulk of Kylie Cosmetics sales are in the US (Coty did not divulge the exact share) the beauty group wants to change that. Terisse said: “There are clear international expansion opportunities. Underpinning this potential is the fact that over half of Kylie Jenner (online) followers are outside the US and she clearly has resonance in countries such as the UK, Germany and Canada. Several international retailers have already expressed strong interest.”

For non-US travel retailers there is also a chance to capitalise on Jenner’s online fan-base. Based on the Advertising Value Equivalency of Kylie Jenner’s online activity, markets valued at more than US$500 million are: the UK (US$2.1 billion), Germany (US$995 million), Australia (US$600 million) and Canada (US$521 million). The next biggest markets are China, France, Spain, Brazil and Italy.

“Given our global R&D, manufacturing and distribution footprint, we are very well positioned to further build out the brand,” said Terisse.