American-French beauty conglomerate Coty has posted strong third-quarter results for the period ended 31 March 2023, buoyed by the strong momentum of travel retail.

Travel retail revenues increased +30% year-on-year during the period. The channel now represents 8% of Coty sales (see details below).

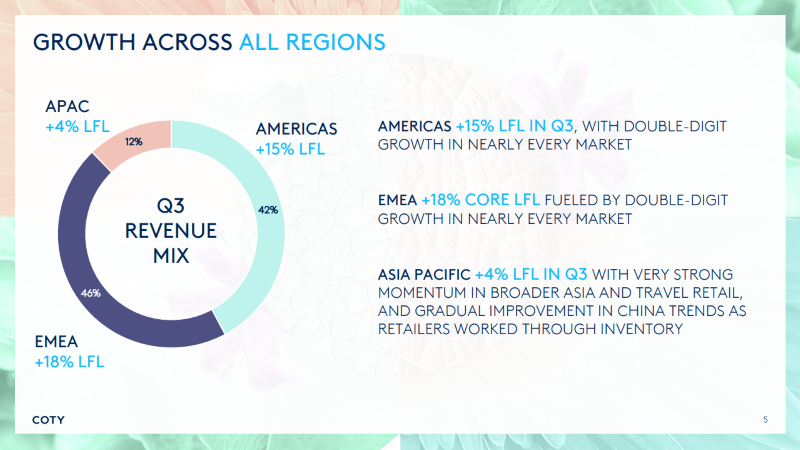

Coty Chief Executive Officer Sue Y. Nabi said during a post-results earnings call, “We saw double-digit growth in nearly every market, with particularly strong momentum in regional travel retail.

“Asia Pacific revenue grew +4% like-for-like in Q3 with strong momentum in broader Asia and travel retail and negative but steadily improving trends in China as retailers worked through inventory. Importantly, April sales in China, including Hainan, increased both versus last year and versus two years ago, speaking to the strong signs of recovery in the market.”

“We are continuing to see incredible momentum in our travel retail sales,” Nabi remarked. “Both in Q3 and year-to-date, our travel retail sales grew over 30%. As a result, our travel retail sales are approximately 8% of our overall business.

“This is consistent with our travel retail penetration in 2019 even though international travel is still close to -20% below pre-COVID levels.

“Here we’ve continued to gain share in the mid-to-high-growth and highly profitable travel retail channel, particularly in EMEA and in the Americas, fuelled by distribution expansion, travel retail-exclusivities, successful innovations and, of course, our growing multi-category presence.

“And with no signs of slowing in global consumer’ appetite for travel and coupled with the return of Chinese travellers in the coming quarters, we remain highly optimistic about the growth potential of this channel for the beauty industry as a whole and Coty in particular.”

Later Nabi added: “We remain confident in beauty as a structurally attractive category and the longevity of the fragrance index. And in this attractive market, Coty is poised to further outperform given the significant white space opportunities ahead of us within skincare and in China and travel retail.

“In short, we are excited by the path ahead as we continue on our journey to transform our company into a true beauty powerhouse.’

High hopes for Hainan

While noting the inventory issues in Hainan that so dominated The Estée Lauder Companies’ results, Nabi painted an optimistic picture of the key Hainan offshore duty free business.

“Since the lifting of COVID restrictions at the end of calendar 2022, we have seen a steady return of consumer traffic to stores and resumption of flights to Hainan,” she said.

“While inventory work-down at some of our China retailers and distributors weighed on our Q3 sales in China, it’s important to highlight that in April our sales in China, including Hainan, have increased versus both last year and versus two years ago. This reinforces our confidence in the strong multi-year potential of China for our business as we expand our presence in this critical market.”

Nabi singled out the strong performance of Chloé’s Atelier des Fleurs fragrance, which reached the #4 position fragrance brand in China travel retail in calendar 2022;

The company noted strong travel demand and increased consumption drove ongoing momentum and growth across all markets.

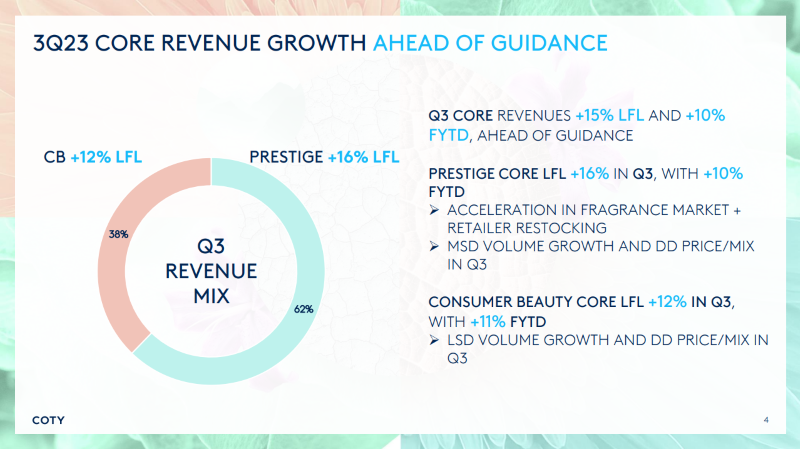

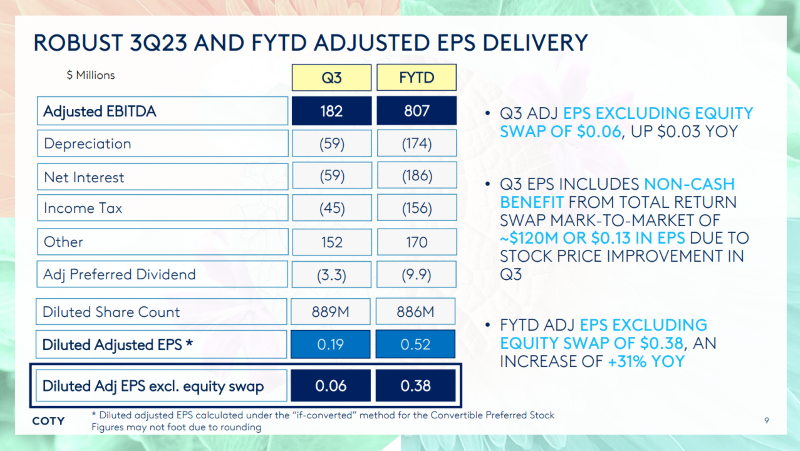

The group showed steady progress across its strategic growth pillars, delivering performance well ahead of expectations. It noted that growth was fueled by accelerating demand for prestige fragrances, retailer restocking and a range of company initiatives.

Third-quarter sales rose +9% as reported, with sales increasing by +15% on a like-for-like basis. This included a 3% negative impact from exiting the Russia business.

Fiscal year-to-date sales increased +2% as reported, while like-for-like sales increased +10%, exceeding the company’s initial FY23 guidance of +6-8% like-for-like growth, adjusting for the impact of the Russia exit.

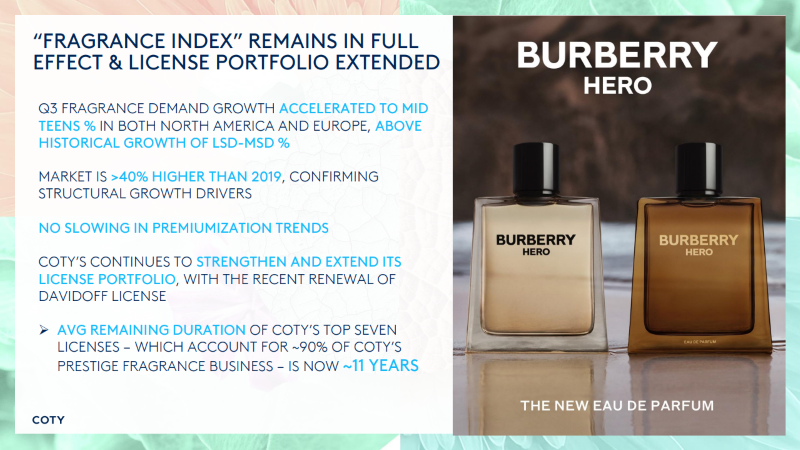

Coty’s Prestige business in Q3 was up by +10% as reported, and +16% like-for-like. The company noted Q3’s market was +40% higher than pre-pandemic 2019 levels – boosted by the growing demand for high-end fragrances, which increased to the mid-teens from the already high single-digit growth from the previous quarter.

Prestige revenue was also strengthened by an improvement in prestige service levels, allowing retailers to restock after industry-wide component shortages during the previous quarter.

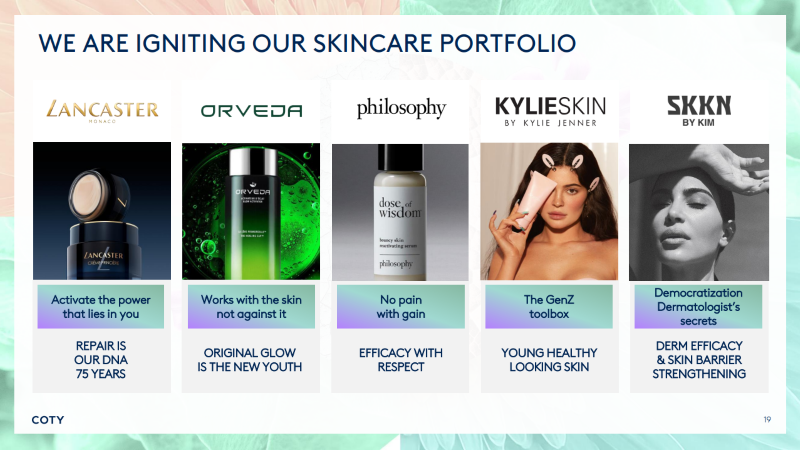

Coty also noted its strategic investments in the skincare category, including the launch of the breakthrough Lancaster Ligne Princière skincare line in China and travel retail. This laid the foundation for targeted multi-year skincare revenue acceleration.

The group’s Consumer Beauty core business also posted solid growth in the third quarter, up by +6% as reported, and +12% like-for-like, outperforming the global mass beauty market. Its strong performance was driven by key beauty brands including CoverGirl, Max Factor, Rimmel and Monange.

Across all geographic zones, revenues also increased on a constant currency basis. EMEA sales climbed by +7% as reported and grew 18% like-for-like in Q3. Sales in the Americas also jumped by +13% as reported and 15% like-for-like, boosted by strong momentum in North America, Brazil and Latin America.

Asia Pacific sales were stable as reported but grew +4% like-for-like in the third quarter, with strength in broader Asia and travel retail, and a gradual recovery in China.

Coty CEO Sue Y. Nabi said: “We are once again proud to report strong operational and financial performance, with today’s Q3 results marking the 11th consecutive quarter of results in-line to ahead of expectations. We are delivering on our balanced growth agenda, with strong LFL growth across both divisions and all regions, with growth contribution from volume, price and mix, and from our key categories including fragrances, cosmetics, and body care.

“In a complex global environment, beauty remains an advantaged category with consumers, at the sweet spot of affordable luxury, self-care, and confidence-boosting. This dynamic reinforces our confidence in global beauty consumption outperforming in a variety of macroeconomic scenarios, with Coty well placed to succeed, supported by our positions as a leader in fragrances and cosmetics, and significant untapped potential in skincare, China and travel retail.

“In Prestige, demand for prestige fragrances accelerated in the quarter across developed markets, once again confirming the structural changes in global consumption as more consumers enter the category, use fragrances more frequently, and opt for longer-lasting and more premium products.

“Against this backdrop, we continue to grow the fragrance category and premiumise our business through our portfolio of icons and leading launches, such as Burberry Hero and Her, Gucci Flora Gorgeous Jasmine and Gorgeous Gardenia, Boss Bottled Parfum and Chloé Atelier des Fleurs. This momentum is underpinned by the growing agility of our supply chain, as we’ve increased supply and expanded our dual-sourcing initiatives in the midst of continued constraints in fragrance components.

“In Consumer Beauty, our brands are delivering strong and consistent growth across developed and developing markets. Our launches are resonating with consumers, whether it’s CoverGirl’s Clean Fresh Yummy Gloss which has become the #1 Lip launch this spring in the US mass market or Sally Hansen’s successful entry into the booming artificial nail category with its Perfect Manicure collection. Our Consumer Beauty business remains a key part of our strategy, consistently offering consumers value through high-quality and desirable beauty products at an affordable price.

“The momentum in our established prestige fragrance and consumer beauty businesses, coupled with strong savings generation in the quarter of close to US$60 million, are fuelling the next key pillar in our strategy: our skincare business. While we are in the very initial stages of igniting our focus skincare brands, I am encouraged by the positive initial signals we are tracking, whether it is leading social buzz and product reviews for Lancaster Ligne Princière, or step-changes in philosophy’s sales fuelled by its new brand equity and newly launched serum, Dose of Wisdom.

She concluded: “Finally, we are making tangible progress on our sustainability agenda, as our industry-first partnership with Lanzatech to produce fragrance-quality ethanol from upcycled carbon has reached a new milestone with the recent launch of Gucci Alchemist’s Garden, Where My Heart Beats, the first globally distributed fragrance using 100% carbon-captured ethanol.

“Nine months into FY23, we are continuing to deliver sales growth amongst the best in our peer set, strong profit growth and operating margin expansion, and solid free cash flow as we progress towards our leverage target towards 3x exiting CY23. I am excited by the many initiatives planned for the coming quarters and years, as we continue on our journey to transform Coty into a true beauty powerhouse.” ✈