American-French beauty house Coty has highlighted ‘outstanding growth’ in travel retail sales across Europe, the Americas and Asia Pacific in its fiscal year 2024 first-quarter results for the period ended 30 September.

Its revenues in the channel grew over +20% year-on-year, propelled by the continued recovery of international travel and the company’s expansion across the various fragrance & cosmetics categories.

The beauty conglomerate marked a strong start to the fiscal year with 18% like-for-like groupwide sales growth, well ahead of expectations and recently raised guidance of +10 to 12% for the first half of FY24.

Coty Chief Executive Officer Sue Y. Nabi shed light on the performance during a post-results earnings call on 8 November. “Regarding the performance in Asia Pacific, travel retail has indeed been a very strong part. This company was mainly an entry prestige fragrance seller two or three years ago, and we’ve decided that we are going to play on the full scope of what the fragrance market is about,” she said.

“Entry prestige fragrances, where the company has already been very strong, is continuing to grow very fast. One of our fastest-growing brands in this channel is Calvin Klein, which is doing very well. We’ve added on top of this premium brands such as Burberry Goddess, Chloé and others, and we have also added niche offerings on top.

“Next to the full line-up of brands occupying different price tiers in the fragrance market, we also have three makeup brands: Kylie Cosmetics, Gucci and Burberry. These are doing very well and this is the second leg of the growth engine we have added to the travel retail channel.

“And last but not least, it’s also about skincare. And there we have Lancaster doing very well in this area. The brand is witnessing double-digit growth, for example in Hainan. We are also starting, mainly in domestic markets, in Southeast Asia with Philosophy skincare. That is a brand that is present in a Sephora environment, which we believe has a role to play in the skincare market.

“We did fiscal year 2023 at +30% in travel retail. We are continuing to grow at +20% in this channel. And this is despite the fact that we are still far under the level of travellers in Europe, especially Chinese travellers.

“We believe that only 30% of the levels of Chinese travellers pre-pandemic are back outside China. So, there is still some room [for strong growth].”

Ahead of expectations

Coty’s prestige revenues grew at a strong rate in the first quarter, accelerating by +23% growth as reported and 22% like-for-like. The prestige fragrance category is continuing to grow at over +10%.

Coty’s prestige fragrance sales grew approximately +25% like-for-like, driven by momentum in its core fragrance lines, recent innovations and improved service levels.

As reported, a key factor was the recently launched Burberry Goddess Eau de Parfum, which became the top female fragrance launch in key markets, while simultaneously elevating the sales of other Burberry fragrance icons including Hero and Her.

The strengthening of Coty’s fragrance icons was evidenced by three franchises – Burberry Goddess, Gucci Flora, and Burberry Her. Coty is also continuing to advance its skincare strategy, with key brands Philosophy and Lancaster growing revenues at a double-digit percentage pace like-for-like in both Q1 and the last six months.

Beauty retail and the Chinese consumer

Nabi commented on the recovering beauty market in China, especially Hainan. “It’s interesting to see how the market is evolving quite fast, specifically in the fragrance category. The Chinese consumer is getting very interested in this category and this is accelerating at an incredible pace.

“We launched Burberry Goddess in this country a little bit after the rest of the countries, and the reception has been outstanding. The line is already the number six line at Sephora, which is a ranking that we never achieved in this country with any of our fragrances.

“The fragrance category is growing by +6%, and Coty in the country (based on Beauty Research latest results) is growing over two times faster than this level of the market. Burberry Goddess is just starting in this country, and we believe it’s going to be a game changer.

“The other element we are seeing is the premiumisation of the market and the bigger part of niche fragrances. These fragrances represent almost a quarter of the market today in China. This is two and a half times bigger than what you see in the rest of the world.

“We are eager to develop expertise inside the company to understand how to create winning niche brands, but also to understand the world of retail when you are operating a freestanding store.

“The other market that’s doing well in China today is makeup. It is growing by +10% and there we are growing faster than the makeup market thanks to Gucci and Burberry makeup. Last but not least, the skincare market, which is the immense majority of the sales, has been slightly negative in the most recent period.

“We are also adding innovations that are about to land in the market in January.”

Balanced growth across prestige and consumer beauty

Coty’s consumer beauty first-quarter revenues grew by +10% as reported and like-for-like, growing in line with the global mass beauty market, where demand remains resilient. The company noted strength in its colour cosmetics, mass fragrances, skin and bodycare sales.

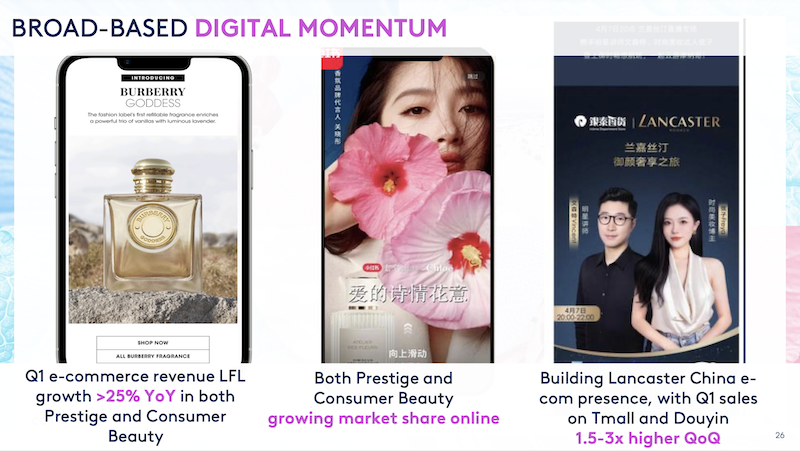

The consumer beauty business saw particular momentum in ecommerce, with over 25% like-for-like sales growth, delivering shared gains in the channel. As part of the company’s strategy to accelerate its influencer and social media strategy, Coty reached key milestones in its core UK market, with two of its cosmetics brands – Rimmel and Max Factor – ranking within the top ten brands in terms of earned media value and visibility, impact and trust.

Geographically, all regions generated double-digit percentage revenue growth. Europe, the Middle East and Africa (EMEA) sales expanded +20% as reported and +18% like-for-like in Q1, driven by double-digit percentage growth across most markets and travel retail.

Americas sales rose +17% as reported and like-for-like, also driven by strong momentum in all markets and travel retail. Asia Pacific sales grew +16% as reported and +19% like-for-like in Q1, with strength in the Asian markets and travel retail.

In China, sellout growth in Coty’s prestige business was well ahead of the market, growing by double digits percentage in Mainland China generally and by a triple-digit percentage in Hainan, specifically.

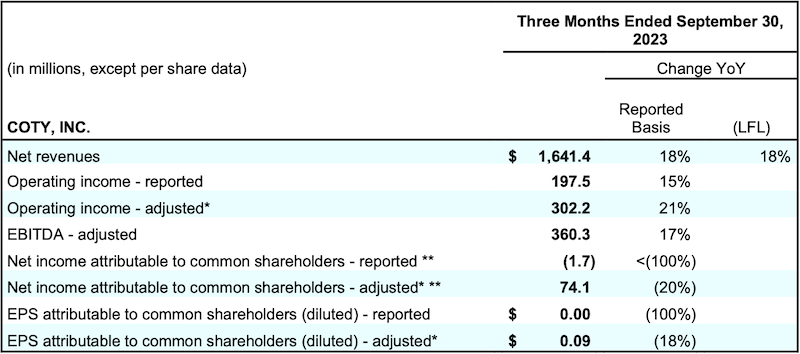

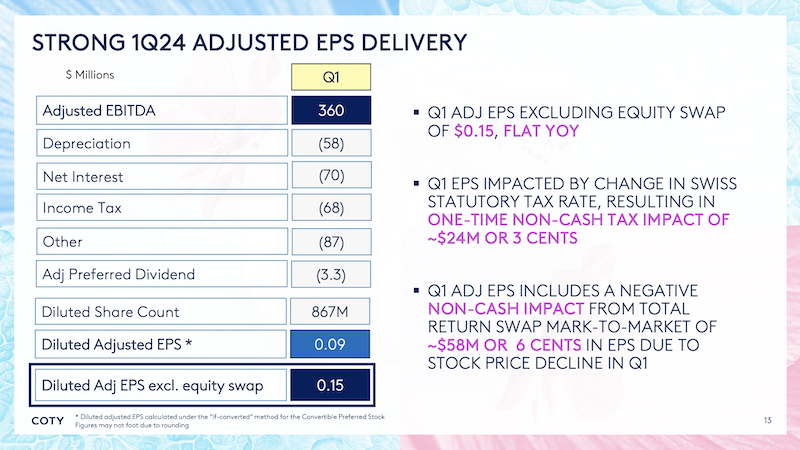

The strong Q1 sales momentum translated into significant profit expansion. Coty reported operating income of US$197.5 million, up +15% year-on-year. Adjusted operating income grew +21% year-on-year to US$302.2 million and adjusted EBITDA increased +17% to US$360.3 million.

The company also continued to progress on its ESG agenda with three of its global manufacturing plants now carbon neutral.

Nabi said, “We are proud of our great Q1 results, with sales growth once again amongst the best in our peer set and ahead of the beauty market. Coty continues to deliver on our balanced growth agenda, with strong like-for-like growth across both divisions and all regions, with growth contribution from volumes and premiumised mix, complemented by targeted pricing, and from our key categories including fragrances, cosmetics and skincare.

“While the external environment remains complex and consumers are being considered in their spending, the beauty category remains advantaged, at the nexus of affordable luxury, selfcare, and confidence boosting.

“We remain well positioned to benefit from this strong beauty performance, while capitalising on the multiple white space opportunities in our portfolio, including female fragrances, ultra-premium fragrances, skincare, China and travel retail. These opportunities and our strong Q1 delivery enable us to raise our FY24 guidance for the second time this fiscal year.

“The exceptional performance of our recent fragrance launches, and in particular Burberry Goddess, reaffirms Coty’s position as a leading fragrance expert with end-to-end capabilities: from developing a winning scent which resonates with consumers across all regions to activating distinctive marketing campaigns, and launching disruptive in-store and online activations.

“Even as we invest to fuel our near- and medium-term growth ambitions, we continue to deliver robust profit growth, cash generation and deleveraging. On the eve of our 120th anniversary, Coty returned to its Parisian roots, providing US and European investors he perfect opportunity to join our accelerating growth trajectory and success.” ✈

All graphics and charts courtesy of Coty

On the record with Sue Y. Nabi*On the latest beauty trends: The skincare market, and the beauty market, is going in the direction of medicated beauty. This is something that we see very strongly and that’s the reason we have decided to reposition some of our brands quite strongly in these areas. On digitalisation: In consumer beauty we are accelerating our ability to create locally in different countries, because you need to fit in the culture, language and local trends. We are creating studios in the US, UK and elsewhere. We’ve created about 15 studios which are TikTok or YouTube, through which we create or co-create with influencer content. Until recently we were working with a dozen influencers behind key launches of consumer beauty makeup brands, but recently we moved to hundreds and saw results immediately. Now the objective is to multiply this number by three to get above the threshold of the 1,000 influencers reached by our brands. This is what’s happening in terms of centres of excellence, first built globally in Paris, and now going into different countries: New York, London, Shanghai and so on. On the impact of the Middle East crisis: The Middle East business is a mid-single-digit business at Coty. So far we are not seeing any negative impact on our business. On a personal level, I’m very saddened by the violence, and we continue to hope for peace and an end to the suffering. On consumer beauty recovery: In every country, people are craving fragrances from the lowest price possible to the highest price possible. It is important to diversify sources of growth ideally in categories that are highly relative to the gross margins of the consumer beauty division. If I take the example of CoverGirl, we have solidified the foundation of the brand towards millennials, Gen X and boomers. This is something that is not seen in other indie brands. We are going to build on top of this a digital influencer and advocacy-driven business. *Speaking on the 8 November earnings call |