We start each day’s update with this message from DFS Group when the retailer reopened its stores in Macau on 20 February after a 13-day closure.

Published in Chinese, it translates as:

No winter can’t be passed

No spring will not come

For our updates from 28 April onwards please click here

27 April

International

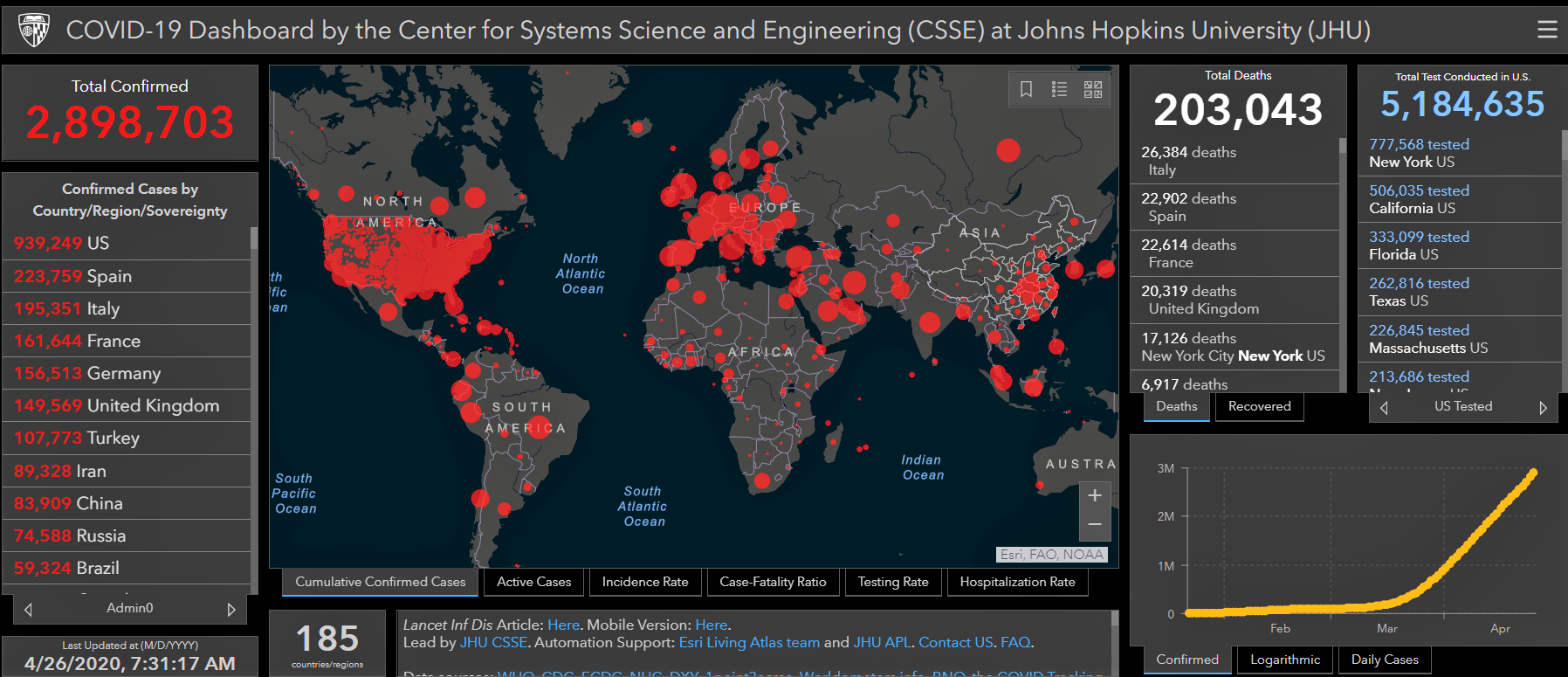

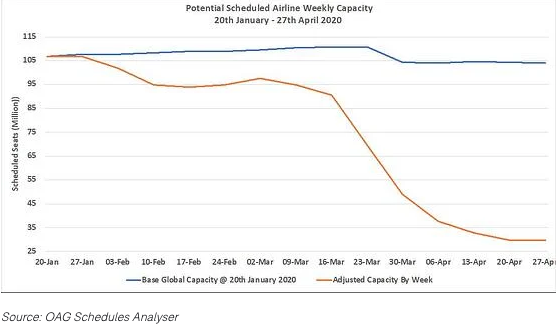

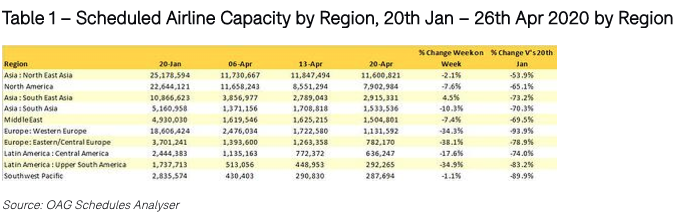

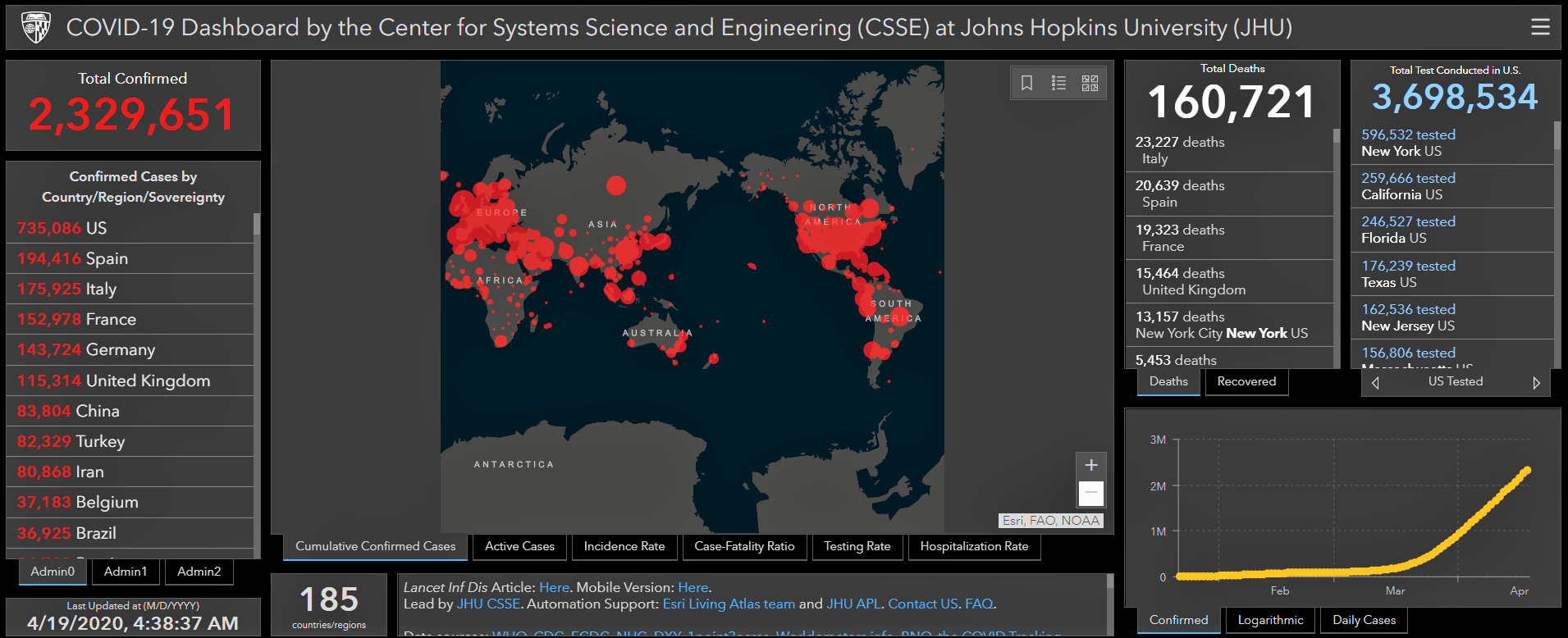

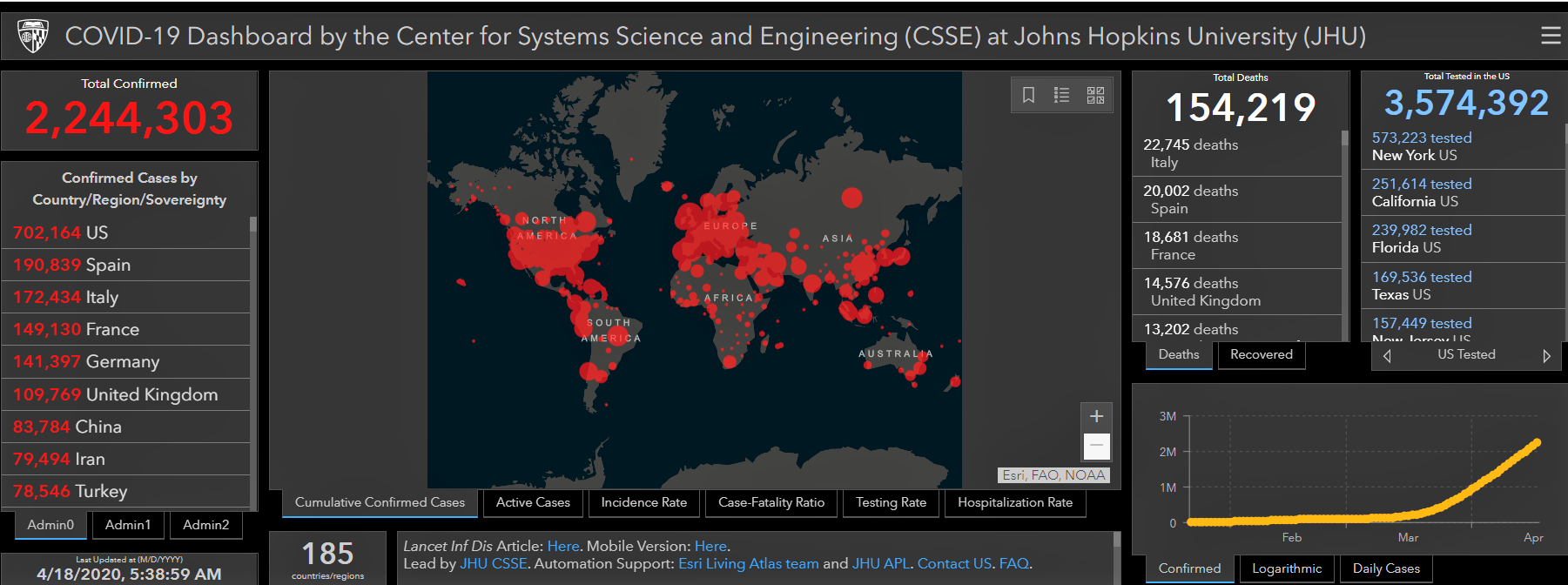

Global scheduled airline capacity this week is up by +2% this week compared to last, signalling the first rise in almost ten weeks, according to flight analyst OAG. This week’s data include early May, which is a holiday in some markets (including China). Global seat capacity remains below 30 million (29.2 million), from over 105 million in mid-January.

From 1 May Wizzair will resume operations from some of its European bases, while Turkish Airlines will restart some domestic flights. In Asia most of the added capacity comes from Chinese carriers planning ahead for the Labour Day holiday, said OAG.

For more, click here.

France/Netherlands

In an important development for European aviation, Air France-KLM, one of the region’s major airline groups, has secured €7 billion in funding from the French government, with more to come from the Dutch state. The move, if approved by the EU Commission, will providing the airline group with the liquidity it needs to survive the COVID-19 crisis.

On 9 April the group said that the crisis would weigh heavily on EBITDA, and predicted that in the absence of additional funding, a cash injection would be necessary by the third quarter of 2020. The Air France-KLM Group, engaged in talks with the French and Dutch governments about aid measures to enable it to maintain solvency.

This support mechanism comprises:

- A French state-backed loan of €4 billion granted by a syndicate of six banks to Air France-KLM and Air France. The French state is guaranteeing this loan up to 90%, and it has a maturity of 12 months, with two consecutive one-year extension options exercisable by Air France-KLM;

- A direct shareholder’s loan of €3 billion from the French state to Air France-KLM with a maturity of four years, with two consecutive one-year extension options exercisable by Air France-KLM.

The Dutch state has also stated its intention to support the KLM Group. Discussions to finalise a plan for additional aid continue.

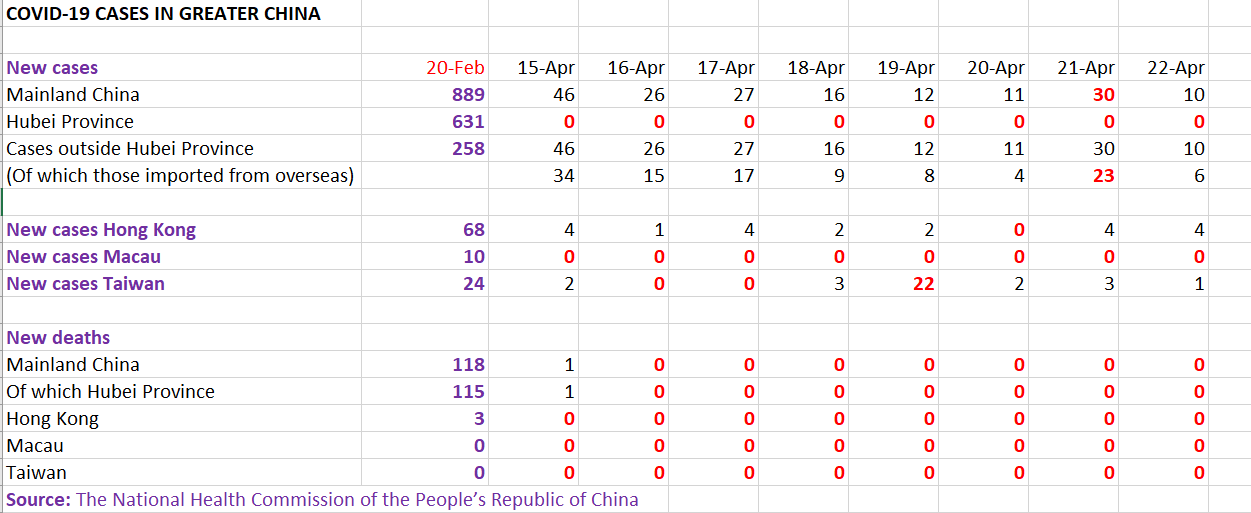

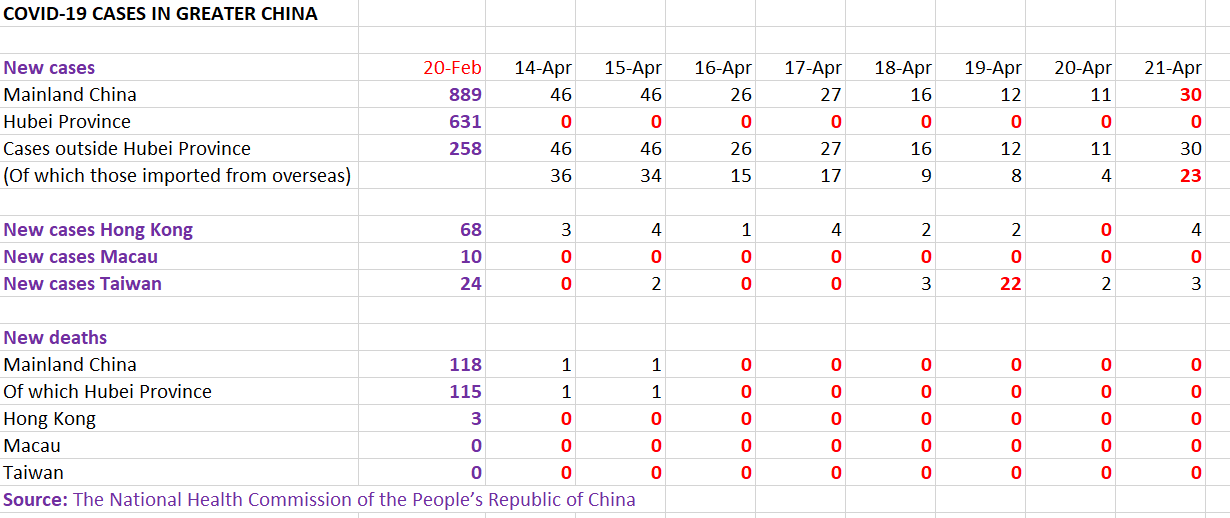

Greater China

COMMENTARY

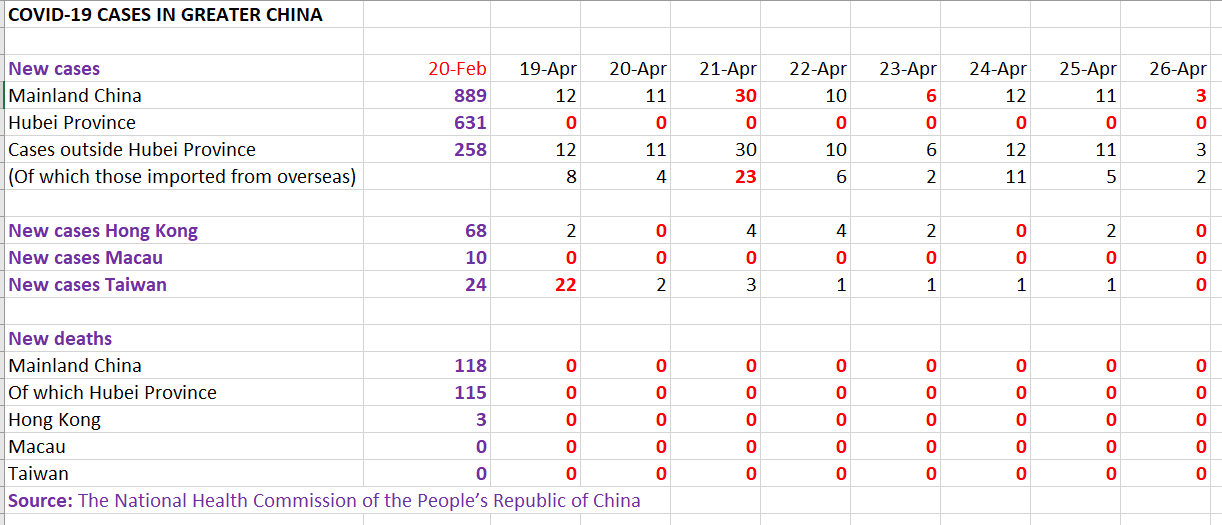

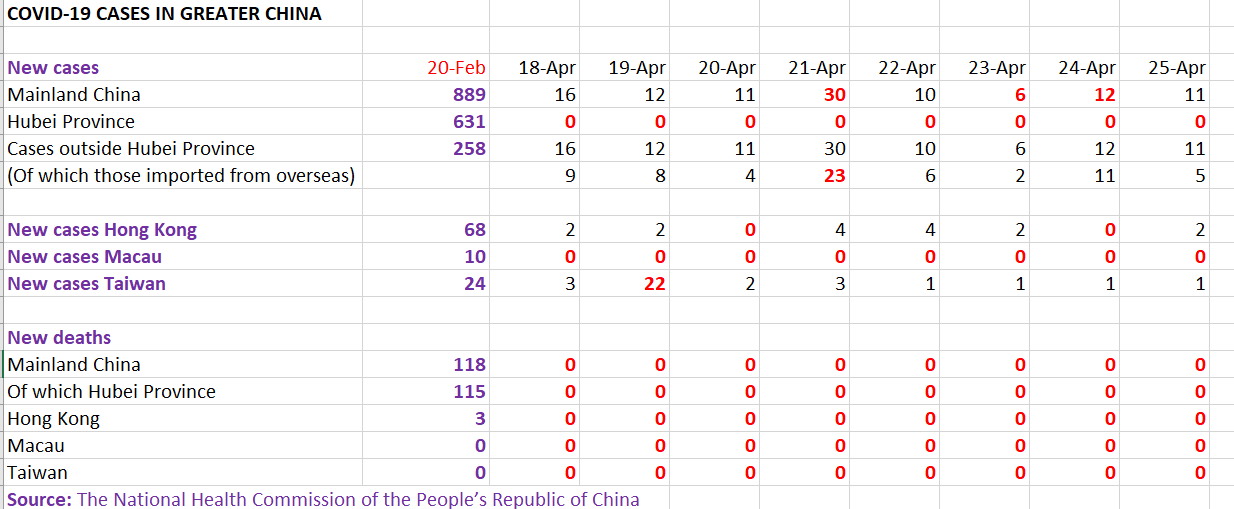

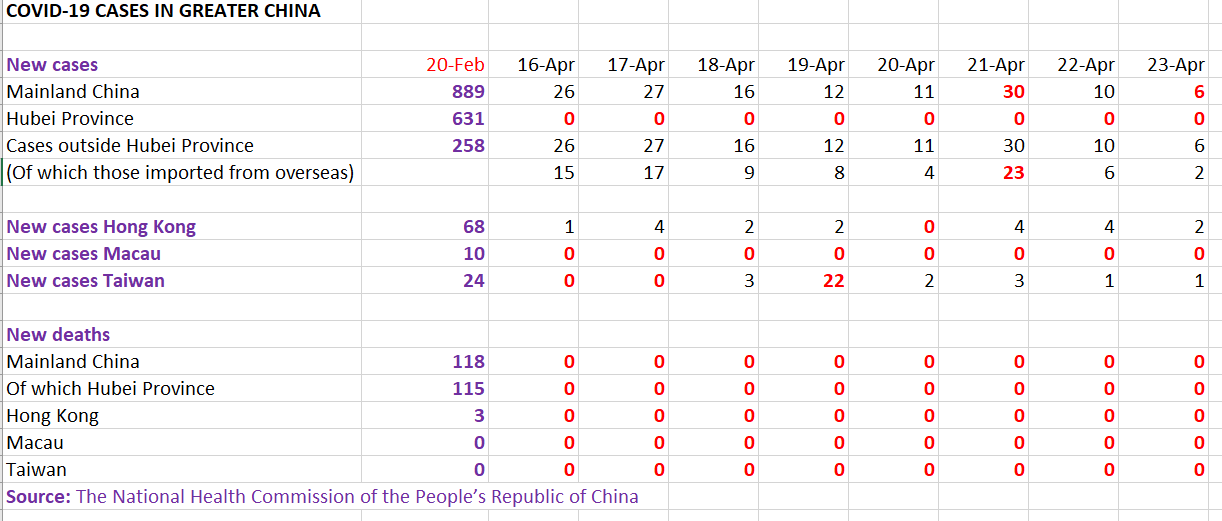

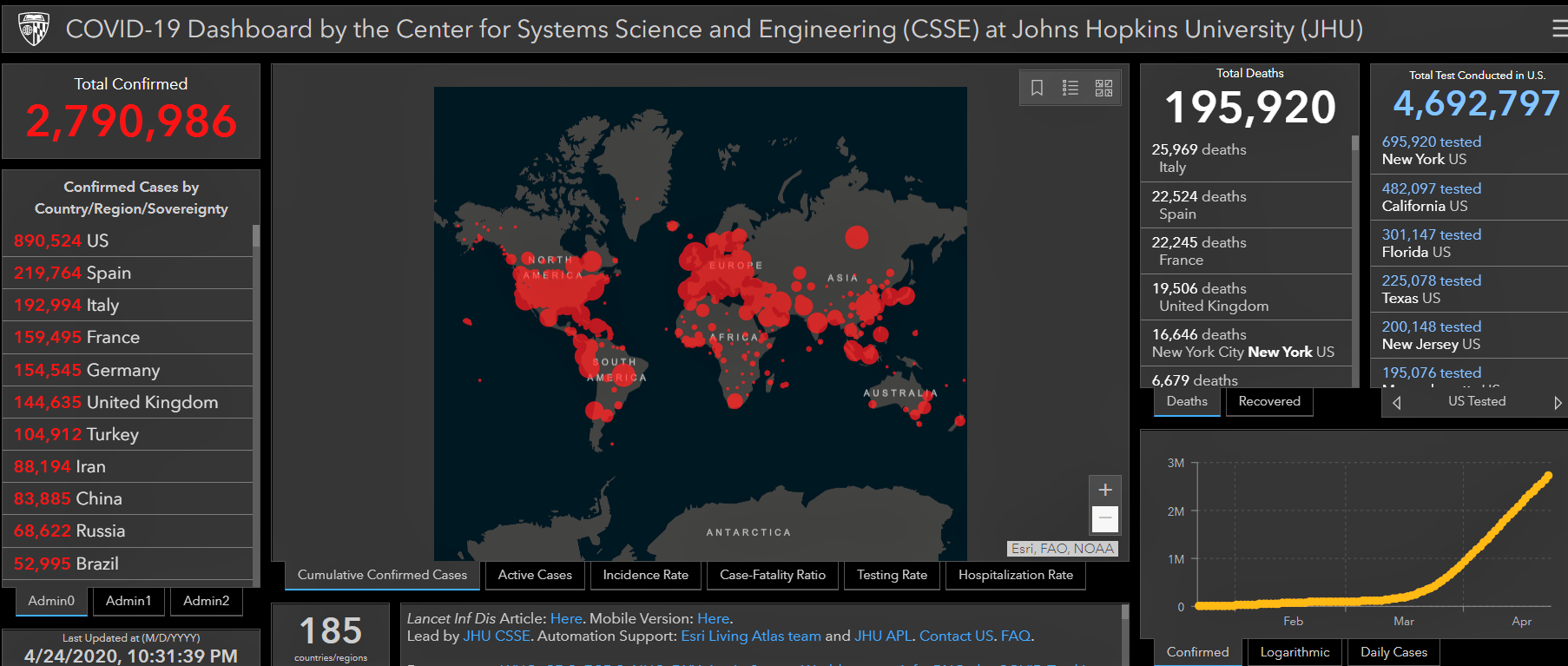

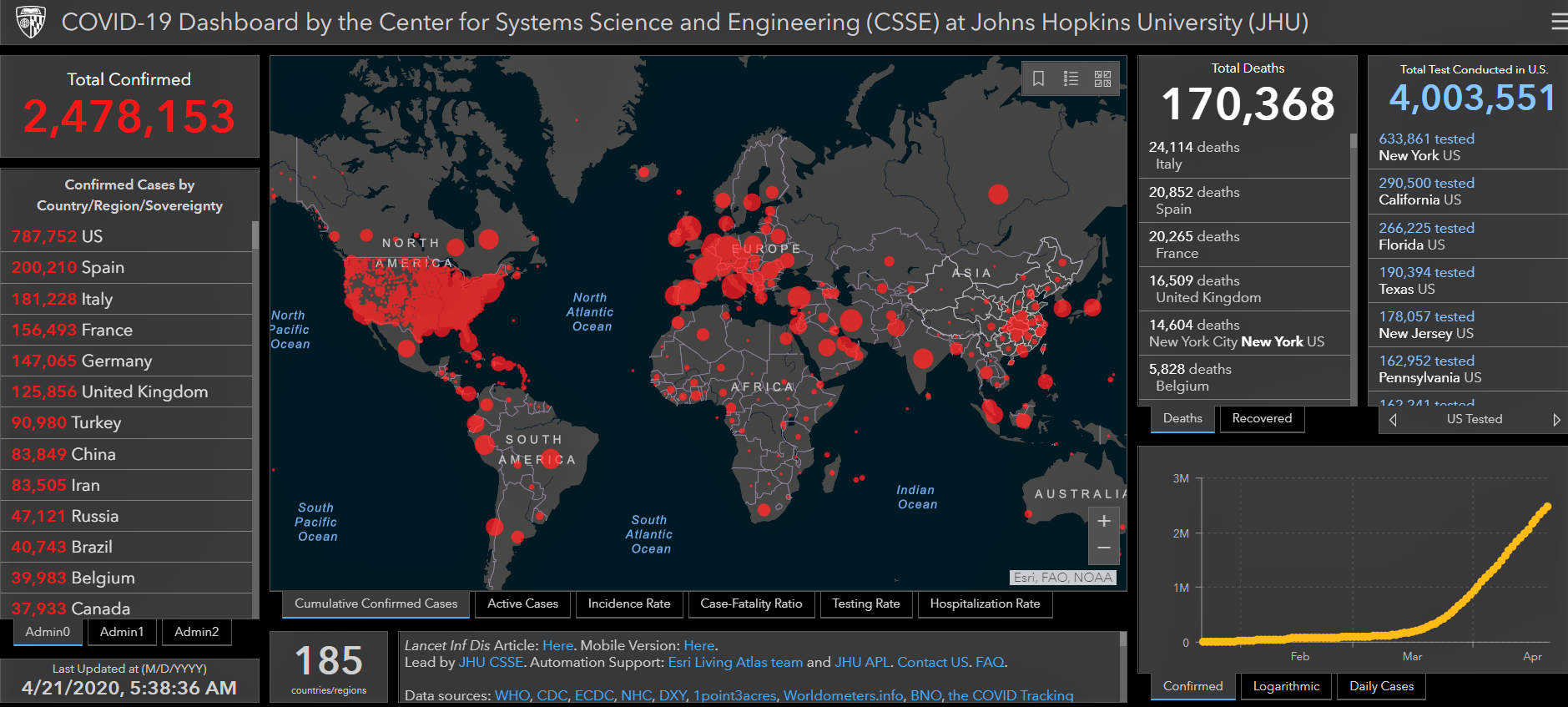

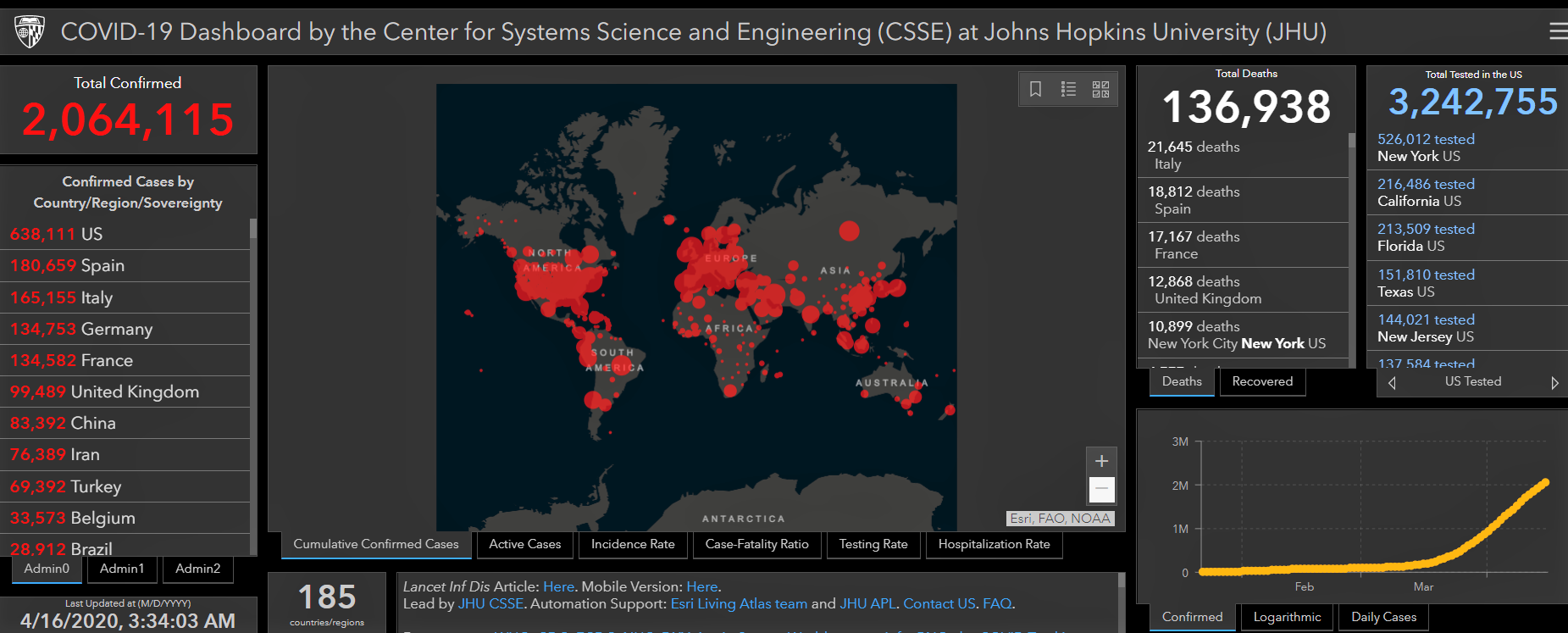

These are numbers above that should give us all cause for optimism – and reflection, writes Martin Moodie. No new cases in Hong Kong, Taiwan or Macau, and no deaths. No new cases nor deaths in Hubei province, whose capital Wuhan was the original epicentre of the COVID-19 outbreak. Just three cases across Mainland China, two of them imported. Now compare those figures with those of 20 February, less than ten weeks ago, which we have shown as a comparative baseline.

The statistics are important both in a global context – showing what can be done with a combination of strict government policy, strong leadership and civic responsibility – and in a travel retail one. China, or more specifically Chinese travel, is the key to any sector recovery. But for the Chinese to travel (and shop) in any significant numbers, China must first be considered ‘safe’, as must any destination favoured by Chinese consumers.

That is why Hainan, home to China’s hugely successful offshore duty free industry (and the acclaimed CDF Mall in Haitang Bay, the biggest travel retail door in the world for many beauty brands) is the first beneficiary. The island province has recorded just 168 cases, with 162 of the patients having recovered and just six deaths. On 24 March, several Chinese state media declared the island clear of COVID-19.

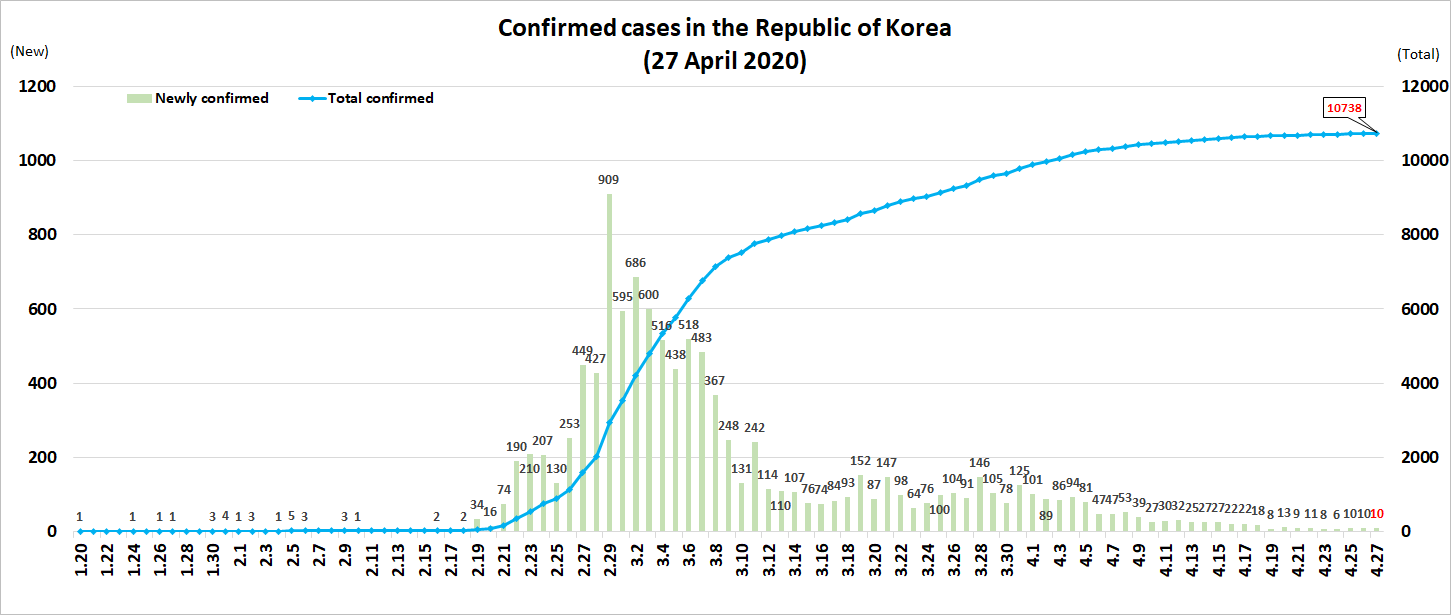

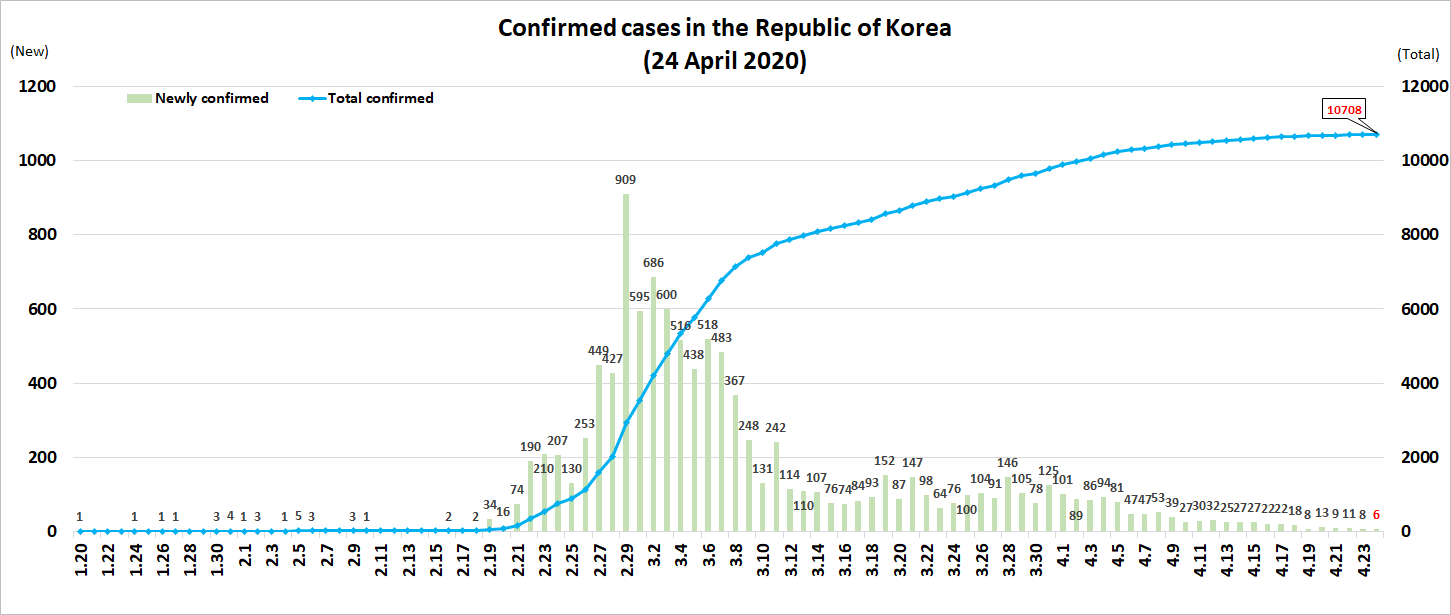

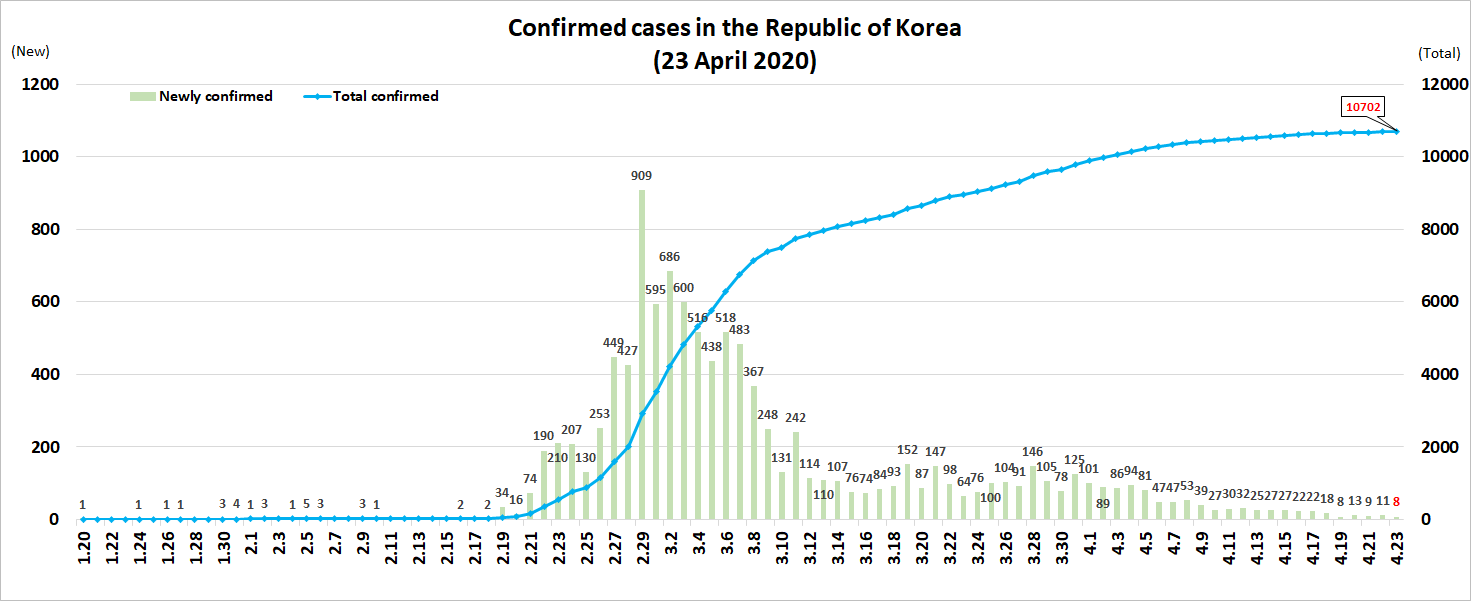

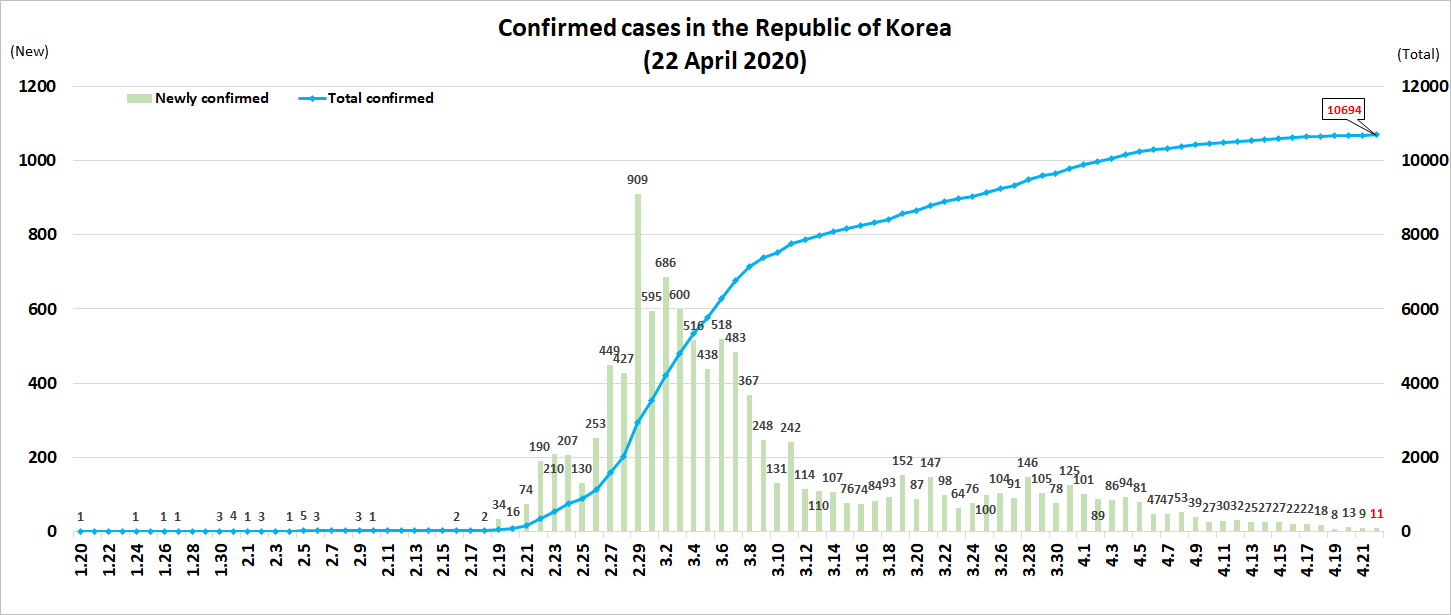

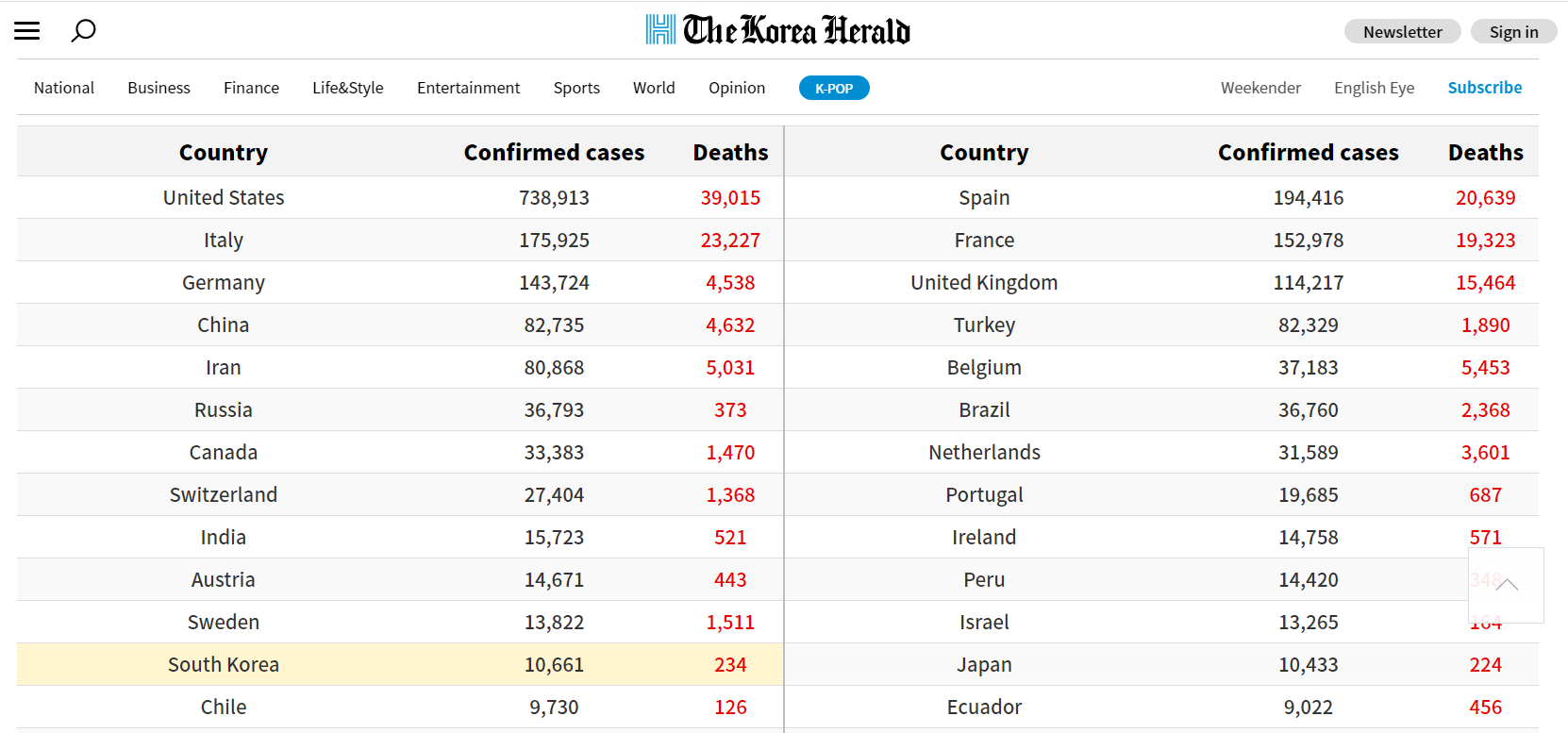

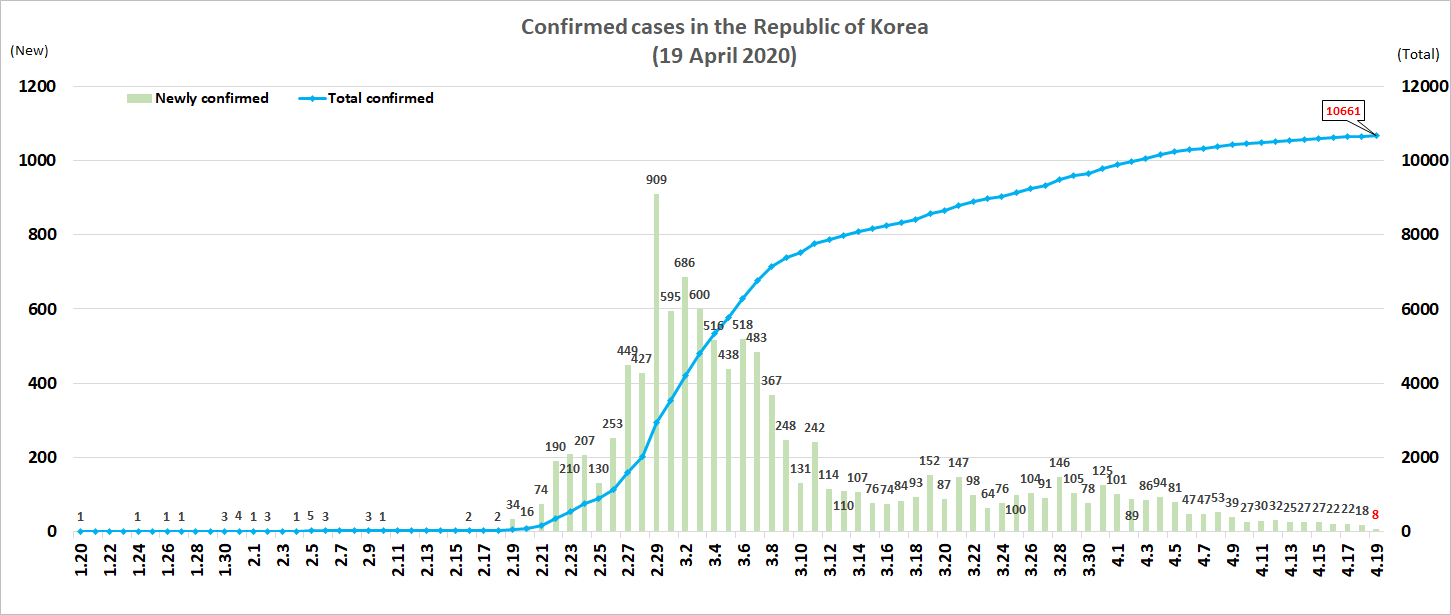

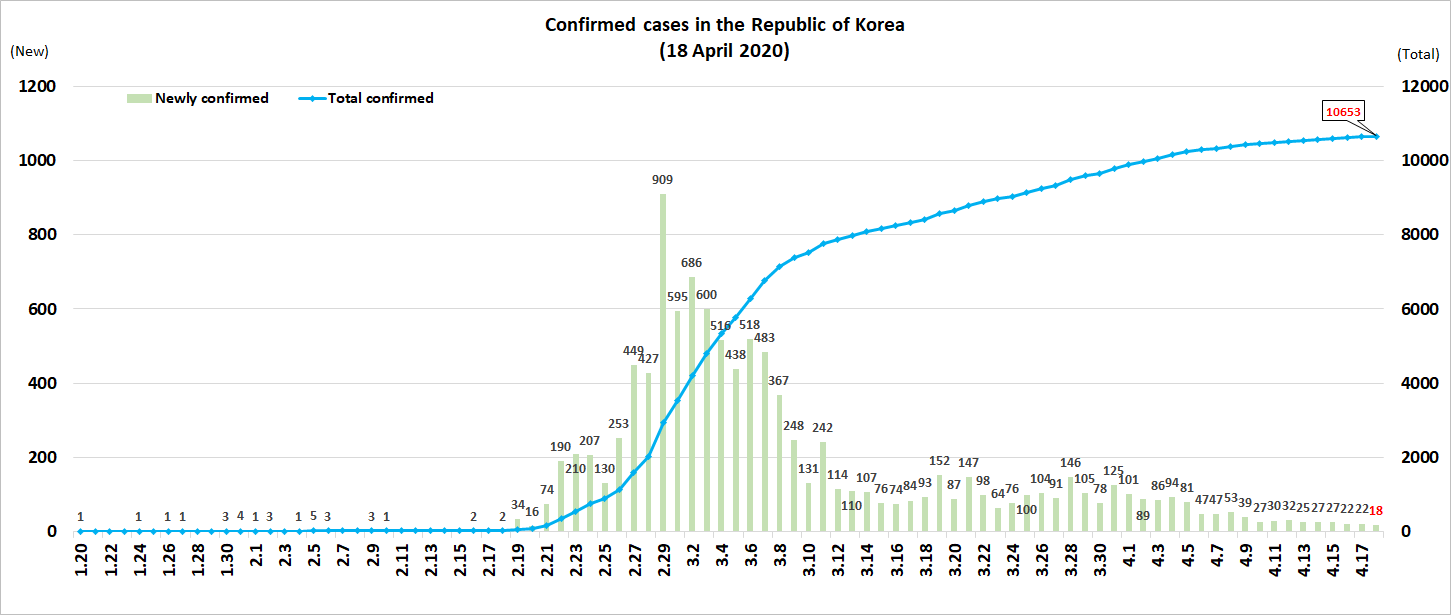

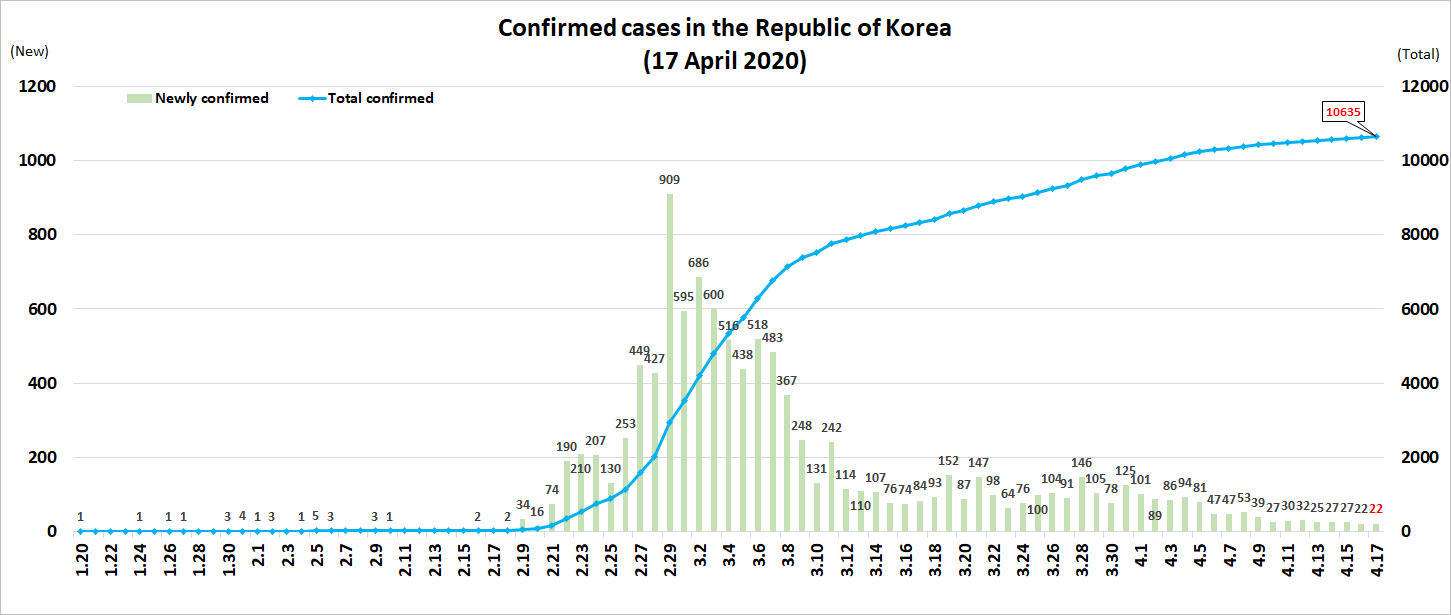

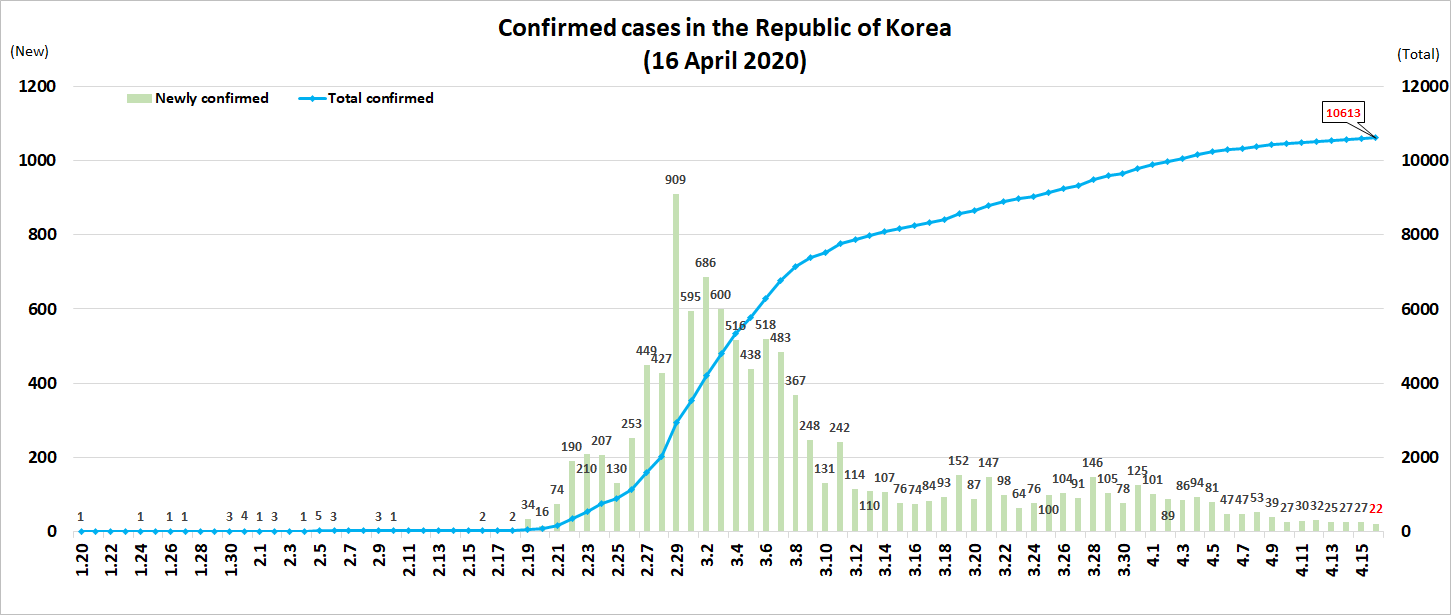

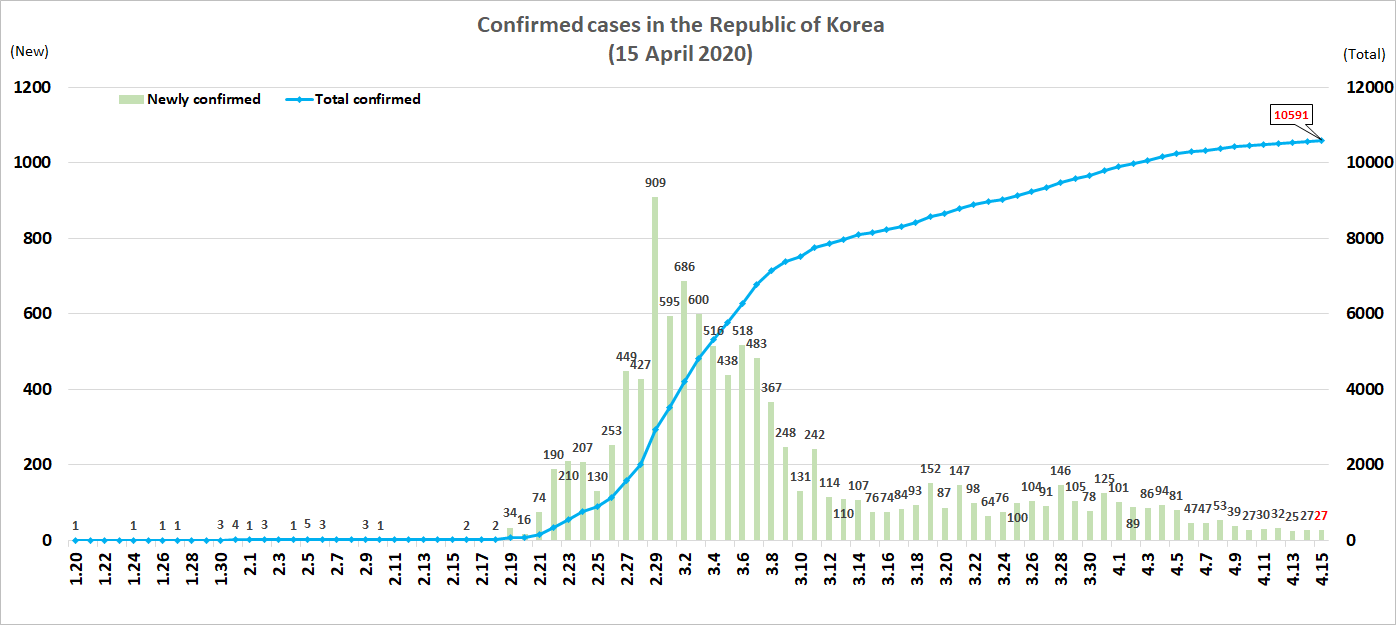

After Hainan? It’s increasingly clear. Look to the impressive results from South Korea, where just 64 new cases have been recorded over the past seven days, an average of just over nine a day. The Republic was once the world’s second hardest-hit country and many feared the worst. But thanks to an outstanding medical system; strict government measures on infection tracking and social distancing; and – critically – great discipline by the people, the outbreak has been largely confined. Imported cases (five of yesterday’s ten new cases were identified by airport screening) are now the greatest concern.

But Seoul, the key destination for China’s daigou shoppers, has experienced just 629 cases (none yesterday) of the country’s total 10, 738, and only two deaths.

These are still early days, and a serious second wave remains possible in both South Korea and China, but given continued strict control in both countries – a certainty – then there is real grounds for optimism of a kick-start to the travel retail channel in the summer. South Korea is a known quantity to the Chinese. It is geographically adjacent; ‘China friendly’ (given the worrying Sinophobia that has emerged in many western countries during the crisis, this is likely to be an important consideration in the travel choice of many countries); and, not least, offers highly attractive duty free pricing.

South Korea

International

26 April

South Korea

International

Greater China

25 April

Greater China

A landmark story from Chinese state media Global Times, which has reported so openly, transparently (and, where necessary, critically) on the COVID-19 outbreak in China.

The title reports that the number of COVID-19 patients in critical condition fell to zero in Wuhan, capital of Central China’s Hubei Province – the original epicentre of the outbreak – after the last infected patient in the city completed treatment on Friday.

The milestone was announced at a press conference in the city on Friday by Mi Feng, a spokesperson for the National Health Commission of the People’s Republic of China.

Mi confirmed that as of 24 April, no new confirmed or suspicious cases had been recorded in Hubei province over the past 20 days.

South Korea

International

24 April

UK

London Gatwick Airport has said it expects post-COVID-19 passenger numbers to return to recent levels within 36 to 48 months. It outlined its updated action plan as it released its latest results.

Full story here.

France

Groupe ADP is forecasting a fall of -55-65% in passenger traffic year-on-year across its network from April to December, and a revenue hit of €2 billion to €2.5 billion in the same period.

The company updated the market on its latest assumptions as it revealed Q1 revenues to the end of March (see below). The figures above include traffic at the two major Paris airports, TAV Airports and Airport International Group (in Jordan).

As reported, at Paris Charles de Gaulle, since 30 March only terminals A, C, 2E Hall K and 2F are open for commercial flights. At Paris Orly, commercial traffic is temporarily suspended since 1 April. Only three airports operated by TAV Airports remain open to commercial flights, although only partially (Ankara, Antalya and Izmir). The other airports of the group, except Liège airport, are either closed or subject to restrictions.

For more on this story and on Q1 revenues at ADP, click here.

Japan

Chubu Centrair International Airport duty free sales fell by -11% year-on-year in the six months to 31 March, mainly as a result of the severe impact of COVID-19 on traffic and spend in the final two months.

Full story here.

South Korea

23 April

Switzerland

Dufry Group is planning for a “worst-case scenario” of a -70% fall in sales year-on-year in 2020, in which case it anticipates a return to 2019 business levels by 2022.

Speaking on an investors call after revealing Dufry’s latest measures to boost liquidity and cut costs, reported earlier (see below), CEO Julián Díaz said the retailer was also planning for other potential scenarios, depending on the speed of recovery. In the event of a -50% fall in sales, business could recover by mid to late 2021, and a -40% fall in sales could result in a return to 2019 levels as soon as early 2021.

Commenting on how Dufry is renegotiating Minimum Annual Guarantee-based contracts with airports, Díaz said that about 25% of its concessions were exposed to MAG.

“Most of our contracts have a variable element, where we pay a percentage of sales,” he said. “Our strategy is to pay the variable [rent] where we have no visibility about the recovery, and that is what we are offering to airports.”

For more on this story, click here.

USA

The New York Post has reported that John F. Kennedy International Airport has the highest number of employees of any airport in the US which have tested positive for coronavirus. Data released by the Transportation Security Administration (TSA) shows that 95 TSA employees – including 88 screening officers – have COVID-19.

Meanwhile, at Newark Liberty International Airport in New Jersey, 48 employees have coronavirus, according to the TSA figures. LaGuardia Airport in Queens, New York, has reported third-highest number of infected employees – 28 tested positive for the virus.

New York and New Jersey have been the hardest hit states by the coronavirus pandemic in the US.

In total, TSA reported that 459 federal employees have tested positive for COVID-19. Of those, 110 have recovered and four have died.

Switzerland

Industry leader Dufry shows its steel in the face of a mounting COVID-19 crisis that has seen sales plummet by -90% in April. Its latest measures offer a strong capital structure and liquidity position to sustain a prolonged period of sales declines, as it reveals that business has fallen by -90% in early April.

CEO Julián Díaz said: “The initiatives are designed to help Dufry to weather the COVID-19 pandemic and current economic downturn even under a severe scenario, while also providing the company with enough flexibility to react to business opportunities arising in the context of the current situation. The company’s set-up allows us to react fast and adapt to business requirements as needed, also in view of the travel recovery phase.”

Full details in our comprehensive story here.

Greater China

South Korea

22 April

USA

Following the implementation of a public health order in response to COVID-19, San Francisco International Airport has announced that all airport users are to wear face coverings with immediate effect. The order – which extends to employees, tenants and contractors – also includes a social distancing requirement of at least six feet of separation between airport users.

Visitors to the airport – which remains open for essential travel – will find signage with instructions on face coverings, which must fully cover the nose and mouth and fit securely. The airport advised that coverings can be a manufactured or homemade mask such as a bandana, scarf, towel, or other piece of cloth or fabric which covers the nose and mouth. However, the airport urged the public to refrain from buying hospital-grade (N95) masks so there is a greater supply for health care workers and first responders.

The airport is also emphasising the importance of frequent hand washing and regular sanitising of common spaces and touch points.

International

Once air travel restarts in the aftermath of the crisis, a key question is how long it will take to rebuild consumer trust in the health and safety of airline and airport environments.

“Passenger confidence will suffer a double whammy even after the pandemic is contained – hit by personal economic concerns in the face of a looming recession on top of lingering concerns about the safety of travel. Governments and industry must be quick and coordinated with confidence-boosting measures,” said IATA Director General and CEO Alexandre de Juniac, whose organisation represents airlines worldwide.

An IATA-commissioned survey of recent travellers has found that:

- 60% anticipate a return to travel within one to two months of containment of the COVID-19 pandemic but 40% indicate that they could wait six months or more;

- 69% indicated that they could delay a return to travel until their personal financial situation stabilises.

- For the full story, click here.

Australia

Sydney Airport passenger traffic slumped by -96.1% year-on-year in the first 16 days of April, with domestic traffic down by -97.4%, underlining the collapse in air travel among leading airports in the region and worldwide.

In March, Sydney Airport handled 2 million passengers, down by -45.1% on the corresponding period last year. International traffic was 700,000, down -47.9%, and domestic traffic was 1.3 million, down -43.4% year-on-year.

For more on this story, and on continuing rent negotiations with tenants, click here.

Greater China

South Korea

International

21 April

Germany

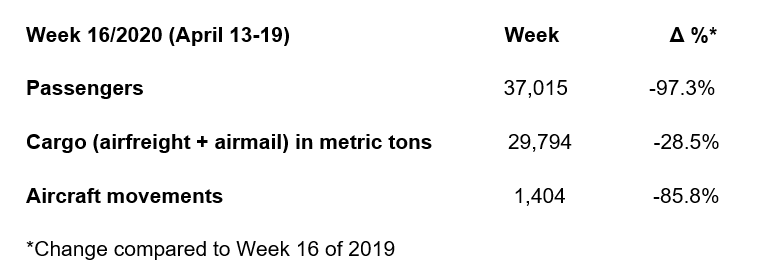

The numbers tell their own devastating story at one of the world’s great airports.

The Frankfurt Airport press release is justifiably short, sharp and sad: Passenger numbers remain very low – Repatriation of passengers largely completed – High demand for freight capacities – Some airlines use passenger airplanes as freighter only aircraft – Continued reduction of cargo throughput, due to lack of belly freight (shipped on passenger aircraft)

Singapore

The government this afternoon extended the country’s semi-lockdown called the ‘Circuit Breaker’ for another four weeks beyond 4 May up to 1 June. The move has been prompted by a wave of infections among migrant workers living in cramped conditions.

Speaking in his fourth national address on the situation today, Prime Minister Lee Hsien Loong also said that existing restrictions will be tightened until 4 May. This means that more workplaces will be closed to further reduce the number of workers keeping essential services going, the Straits Times reported. Some hot spots, including popular wet markets, remain a problem, as large groups of people continue to congregate there, Lee said.

While he noted that the circuit breaker measures have been working, the Prime Minister warned that Singapore cannot be complacent. He said the number of unlinked cases has not come down, which suggests a “hidden reservoir” of cases in the community.

Germany

“Whether there will be a return to normality, we cannot say today. 2020 will be characterised by high financial losses.” So says leading travel retailer and distributor Gebr Heinemann of the impact that COVID-19 is having on its business, in a statement outlining its response to date.

The Hamburg-based family company has taken steps to address its fixed cost base by introducing shorter working hours while postponing capital projects and negotiating terms with airport partners.

Crucially, it continues to take a long-term view, saying, “As a family business, we think in generations, not quarters.”

For the full story, click here.

Australia

Virgin Australia has entered voluntary administration and is seeking a buyer or investors to help it survive the COVID-19 crisis. Australia’s second largest airline (after Qantas) has sought financial assistance from State and Federal governments, but so far without success.

CEO Paul Scurrah said: “Australia needs a second airline and we are determined to keep flying.”

Yesterday, Virgin Group Founder Richard Branson said: “Over the five decades I have been in business, this is the most challenging time we have ever faced.”

He said that Virgin Atlantic would require government assistance in the form of a commercial loan to survive, but this has yet to be agreed.

Branson said he would use his private island in the Caribbean as collateral to raise money to save other group interests. “As with other Virgin assets, our team will raise as much money against the island as possible to save as many jobs as possible around the group,” he said.

For more on this story, click here.

China

Just 11 new confirmed COVID-19 cases were revealed across Mainland China yesterday, with four imported cases, according to the National Health Commission of the People’s Republic of China. Additionally, 37 new asymptomatic COVID-19 patients were identified.

In other important news from China, courtesy of the excellent state media Global Times, which has offered a consistent reflection of official and popular sentiment throughout the crisis (important highlights in blue italics).

- A Chinese research team has released the first animal experiment data on a COVID-19 vaccine, which shows the vaccine is effective and safe on rats and non-human primates.

- Since late March, a total of 49 people in Beijing have breached home-isolation rules and have been “sternly” dealt with, according to a local official.

- Following mounting numbers of imported COVID-19 cases, Suifenhe, a border town between China and Russia, will allow its residents to book nucleic acid tests with a daily limit of 200 people. 8 new imported cases were reported on Sunday.

- The number of imported COVID-19 cases is on the decline in China. However, the risk of imported cases from land borders has gradually increased, causing the emergence of more local cases linked to such imported ones. This in turn has led to cluster outbreaks, according to a National Health Commission spokesman.

- In landmark news, 74 members of the disease control team dispatched by the National Health Commission to support Wuhan returned to Beijing on Monday. This is the last aid team to retrieve from Wuhan.

South Korea

International

20 April

Taipei

Estonia

“The changed shopping habits of customers and steep growth in the figures of shopping via the Internet have presented us with the opportunity to open the Tallink Ekspress as a webshop.” So said Tallink Grupp Head of Onshore Retail Katre Kõvask as the cruise & ferry company makes food & beverage and its core retail offer available through a new online service, launched today.

International

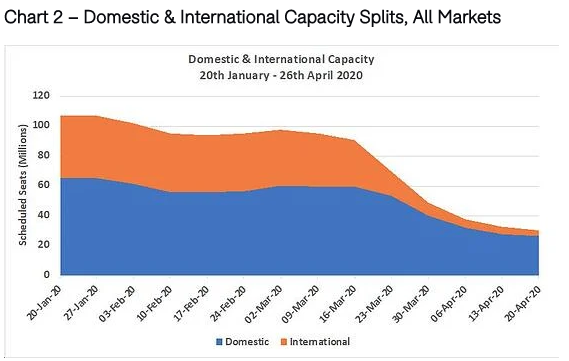

Global airline capacity has been cut by nearly three-quarters since January, with fewer than 30 million seats per week now available worldwide, according to flight schedules analyst OAG. The company today reported on airline seat availability this week, comparing it to last week and the week of 20 January. In the past seven days, capacity has fallen by -7%, a lower reduction than in previous weeks, signalling that the bottom of the market may be close.

From over 105 million seats in January, the figure for the week ahead is 29.8 million, with possible further cuts from major airlines to come next week, noted OAG. These include planned cuts from the domestic market in Japan (Japan Airlines and ANA) where capacity had been running at around 65% compared to January. This will drop sharply amid the state of emergency declared by government.

The domestic/international split has also changed sharply through the crisis. Some 90% of all seats scheduled this week are on domestic flights, compared to 60% before COVID-19. Reinforcing its previous comments on the shape of the recovery, OAG said that both capacity and demand would likely return more quickly in domestic markets and take longer on international routes.

Singapore

Singapore Changi Airport passenger numbers fell -70.7% year-on-year in March, to 1.65 million. In the final week of March, volumes plummeted by -98% compared to a year earlier.

For April, scheduled flights are down around -96% on the volumes originally planned for the month.

For the full story, click here.

China

A fascinating article in Chinese state-controlled media Global Times – which has reported so quickly and accurately throughout the crisis – reports how the authorities in Wuhan are kick starting the local economy after weeks of lockdown.

Here are some excerpts (for the full, fascinating article click here).

For more than two months, residents in Wuhan, Central China’s Hubei Province, were required to stay home to stop the spread of the coronavirus. Now, officials in the city are literally paying residents tens of millions of dollars to go out and spend money, in an attempt to pull up the local economy.

The Wuhan government’s move of disbursing 500 million yuan (US$71 million) worth of ‘consumption coupons’ marks a milestone in the city’s path to recovery from the dark shadows of the COVID-19 epidemic. Scenes of local residents rushing to restaurants, shopping malls and tourist spots offer the clearest signals of a city gradually returning to normality and a local economy getting back on its feet.

The strategy to disburse coupons could be the most direct and effective way of reigniting the most powerful engine for economic growth in not just Wuhan but also the entire country: consumption, analysts said. However, the size and scale of consumption stimulation still need to be significantly increased to better cope with the massive economic losses the epidemic has inflicted, they added.

Consumption makes up around 46 percent of Wuhan’s roughly 1.6 trillion yuan economy, in line with the national economic growth structure. In 2019, consumption contributed to 57.8 percent of China’s GDP growth, official data showed. However, consumption has also been hit hard by the coronavirus, with total retail sales dropping by 19 percent in the first quarter, making such stimulus a most crucial part of China’s economic recovery.

South Korea

China

The National Health Commission of the People’s Republic of China reported just 12 new confirmed COVID-19 cases yesterday, 8 of them imported. More details to follow.

International

19 April

South Korea & International

International

China

![]() The National Health Commission of the People’s Republic of China said that there were just 16 new confirmed COVID-19 cases in Mainland China yesterday, 9 of them imported. [Source: Global Times].

The National Health Commission of the People’s Republic of China said that there were just 16 new confirmed COVID-19 cases in Mainland China yesterday, 9 of them imported. [Source: Global Times].

South Korea

18 April

UAE

Greater China

South Korea

International

17 April

Greater China

The Moodie Davitt Report content partner Jing Daily spread the message of hope as it shared our story on Lagardère Travel Retail’s reopening of 88 stores and restaurants in Wuhan Tianhe International Airport, after a 76-day lockdown of the city and region.

As reported, the airport resumed domestic flights on 8 April. Lagardère Travel Retail said it expects sales at Wuhan Airport to gradually pick up in line with the increasing numbers of passengers.

The retailer has put in place strict hygiene and safety measures that include the use of protective equipment, personal hygiene protocols, temperature screening, regular disinfection of all facilities and social distancing measures.

Asia Pacific

In an encouraging move for the regional aviation market, AirAsia is to resume scheduled domestic flights in coming weeks. These will begin in its home market of Malaysia on 29 April, followed by Thailand (1 May), the Philippines (1 May), India (4 May) and Indonesia (7 May), subject to approval from the authorities.

South Korea

Amid the widespread business disruption caused by COVID-19, duty free retailers in Korea have asked the government for temporary approval to sell inventory to domestic department stores and other outlets.

Leading duty free retailers told The Moodie Davitt Report that negotiations with Korea Customs Service began on 7 April. Industry representatives have asked KCS to temporarily allow the sale of duty free goods (led by fashion, watches and other accessories) into domestic channels (sold duty paid) and to allow foreign nationals – including Chinese resellers – to mail their purchased goods directly from the store to overseas destinations.

If the industry’s proposals are accepted, it would mark the first time that government-approved duty free goods are sold through non-duty free channels in Korea. Current regulations stipulate that unsold duty free goods should either be incinerated or discarded.

Full story here.

Japan

Narita International Airport will close some of its terminal facilities from 20 April in response to the downturn in traffic caused by the COVID-19 outbreak. It also follows the declaration of a state of emergency by government on 7 April – initially in Tokyo, Osaka and other named prefectures but now extended nationwide.

Narita Terminal 1 satellites 1 and 4 will close from 20 April, as will the domestic flight pier. In T2, the satellite building will close, as will the concourse from the main building. Narita had already closed its second runway from 12 April.

As reported, almost all airside shops and boutiques are now closed with the exception of the main FaSoLa P&C and liquor & tobacco stores in T1, T2 and T3, plus the Tax Free Akihabara store in T2 (all run by NAA Retailing). In T2, the JAL-DFS duty free store that has remained open until now will close from 18 April to 6 May.

International

Airports Council International (ACI) World today published a policy brief for regulators, outlining the key measures required for the airports industry to recover from the COVID-19 pandemic.

Among the initiatives suggested is for governments to permit an increase in duty free allowances for travellers after the crisis passes. This, said ACI, “will result in increased sales for airport retailers, benefiting the airport ecosystem overall”.

For the full story, click here.

Greater China

South Korea

International

16 April

International

Leading luxury goods group LVMH Moët Hennessy Louis Vuitton recorded revenue of €10.6 billion for the first quarter of 2020, down -15% compared to the same period in 2019 and down -17% on an organic basis. The performance illustrates the sharp impact of the COVID-19 crisis on the luxury goods and travel retail industries.

In the Selective Retailing division, organic revenue was down -26% in Q1. LVMH said: “DFS experienced a significant decline in activity in most destinations as a result of the suspension of international travel.”

The company acknowledged the closures of manufacturing sites and stores in most countries in the first half will have an impact on annual revenue and results.

“This impact cannot be precisely evaluated at this stage without knowing the timetable for a return to normal business in the different areas where the group operates. We can only hope that the recovery happens gradually from May or June after a second quarter which will still be very affected by the crisis, in particular in Europe and the US.”

Click here for the full story.

UK

Low-cost carrier easyJet today said that it expects to report a first-half (to 31 March 2020) pre-tax loss of between £360 million and £380 million, including the impact of fuel hedging and foreign exchange (the latter two factors valued at £175-185 million).

The company grounded its entire fleet on 30 March as travel restrictions due to COVID-19 took effect. It said that the date on which it can restart commercial flights remains uncertain.

Speaking as the company revealed half-year results today, CEO Johan Lundgren said he expected the market to return slowly and that demand would be uncertain.

He also said that consumers would expect airlines and airports to introduce social distancing measures. Onboard easyJet aircraft this will include keeping middle seats empty for a period once travel resumes to help rebuild customer confidence.

Lundgren said: “That is something that we will do because I think that is something that the customers would like to see.”

In attempting to mitigate the impact of COVID-19, the airline said that “decisive cost actions, deferring the purchase of 24 new aircraft and the raising of significant new finance ensure that easyJet has sufficient liquidity to endure a lengthy fleet grounding”.

Qatar

Qatar Airways has secured an US$850 million aircraft financing deal with Standard Chartered Bank, covering seven Boeing 787-9 Dreamliner aircraft.

Commenting on the agreement, Qatar Airways Group Chief Executive, His Excellency Akbar Al Baker said, “I am grateful to Standard Chartered for their continued support to Qatar Airways. The bank has been a close partner of Qatar Airways for many years and have proven their support for the airline by closing this transaction during difficult times resulting from Covid-19.”

He added, “Qatar Airways’ focus remains on finding solutions to get as many people back to their homes to be with their families and loved ones during these difficult times and this is made possible by the support we have from so many people, including our close partners such as Standard Chartered.”

France

Passenger traffic at the two major Paris airports, Charles de Gaulle and Orly, fell by -98% year-on-year in the first two weeks in April, Groupe ADP has reported.

At Paris Charles de Gaulle, since 30 March only terminals A, C, 2E Hall K and 2F are open, while commercial traffic at Orly has been suspended since 1 April.

For more details, click here.

USA

The Greater Orlando Aviation Authority Board has taken the first in a series of steps to support its business partners during the COVID-19 crisis by deferring US$17 million in payments due in May.

The move comes against the backdrop of a dramatic fall in passenger traffic, which fell -90% in the period from 28 March to 8 April.

More on this story here.

China

46 new COVID-19 cases were reported in Mainland China yesterday (the same figure as the previous day), with just 34 imported cases (down 2). Details to follow soon.

South Korea

International

15 April

China (Hong Kong)

Hong Kong International Airport (HKIA) passenger traffic fell by -91% year-on-year in March as the COVID-19 crisis hit hard.

From 25 March, all transit and transfer services at HKIA have been suspended, and all non-Hong Kong residents coming from overseas countries and regions by plane are denied entry to Hong Kong.

These factors led to weak travel demand in March, and airlines have suspended more flights. Visitor traffic, which was affected the most, posted a -97% year-on-year decrease. Transfer/transit traffic and Hong Kong resident travel declined by -91% and -83%, respectively.

Over the first quarter of the year, HKIA handled 8.2 million passengers, down by -56.5%. On a 12-month rolling basis, passenger volume dropped -18.9% to 60.9 million.

Thailand

Having introduced a ban on international flights to Thailand from 7-18 April, the Civil Aviation Authority of Thailand has extended the measure until 30 April. The move was confirmed today in a statement by Airports of Thailand.

“This is to ensure continuity and effectiveness of precautionary measures against the COVID-19 outbreak,” said the Civil Aviation Authority.

As reported, operations at Phuket International Airport have been suspended until 30 April. That followed the local government’s announcement that it was temporarily closing all land and sea entry and exit points from 30 March until 30 April.

Switzerland

Zürich Airport turnover from retail and dining fell by -55.5% year-on-year in March to CHF20.5 million (US$21.3 million) due to the COVID-19 crisis. The turnover figure for the first quarter was down by -18.9% to 103.5 million (US$107.6 million).

The figures were driven by the sharp fall in passenger traffic, which was down by -63.2% in March and -23.4% in the quarter.

Click here for the full story.

Australia

“Opportunity in adversity” is how Brisbane Airport Corporation (BAC) describes the launch this week of BNE Marketplace, a new online airport retail home delivery service.

Developed with its retailers, it offers them the chance to shift stock that remains unsold while physical stores are closed or there is little passing trade during the COVID-19 crisis. BAC acted quickly too, going from concept to a full ecommerce site in just 16 days.

Full story here.

Germany/International

Frankfurt Airport is experiencing a near-total decline in passenger volumes. During Week 15 (April 6-12), traffic plummeted -96.8% year-on-year to 46,338 passengers. Aircraft movements shrank by -86.3% to 1,435 takeoffs and landings. The shocking numbers follow a -95.2% decline in passenger traffic the previous week.

International Group airports also report noticeable decline in traffic

In March 2020, for the first time, the COVID-19 pandemic impacted Fraport’s entire international portfolio – with passenger traffic dropping noticeably at all Group airports. The April numbers are certain to be much worse.

Each country implemented specific measures to counter the virus, Fraport said. Some countries introduced travel restrictions (for example, Brazil, Bulgaria, Russia, India and China), while other countries temporarily suspended flight operations (Ljubljana and Lima).

Slovenia’s Ljubljana Airport registered a -72.8% decline to 36,409 passengers. Combined traffic for Fraport’s two Brazilian airports in Fortaleza and Porto Alegre fell by -37.5% to 773,745 passengers. Lima Airport in Peru experienced a -47.8% fall to 962,507. Combined passenger figures for the 14 Greek regional airports shrank by -58.8% to 293,525 passengers. Bulgaria’s Twin Star airports in Burgas and Varna received 39,916 passengers, down -46.1% year-on-year.

At Antalya Airport in Turkey, passenger traffic declined -46.9% to 570,013. At St. Petersburg’s Pulkovo Airport in Russia, volumes fell -27.5% to 964,874. With about 1.3 million passengers in March 2020, Xi’an Airport in China recorded -66.1% fewer passengers compared to the same month last year.

South Korea

Greater China

International

For updates from pre-April 15 click here.