INTERNATIONAL. The International Air Transport Association (IATA) has announced a revised outlook for airline industry performance in 2020 and 2021, with “deep industry losses” set to continue next year, even though performance is expected to improve. Passenger numbers are forecast to grow to 2.8 billion in 2021. That would be 1 billion more travellers than in 2020, but still 1.7 billion travellers short of 2019 performance.

The airlines association said:

- A net loss of US$118.5 billion is expected for 2020 (deeper than the US$84.3 billion forecast in June).

- A net loss of US$38.7 billion is expected in 2021 (deeper than the US$15.8 billion forecast in June).

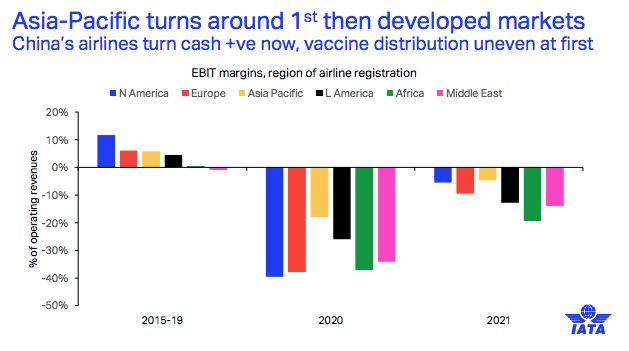

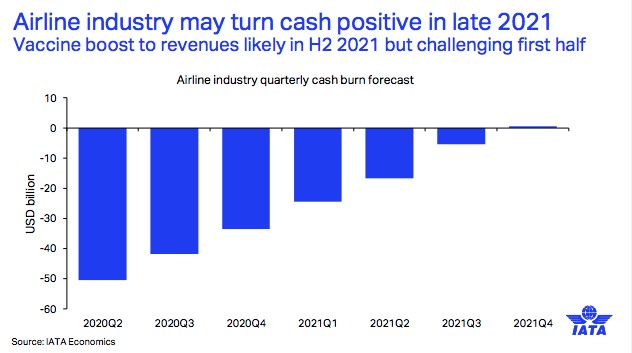

The second half of 2021 is expected to see improvements after a difficult first half, said IATA. Increased demand should see the industry turn cash-positive in the fourth quarter of 2021, which is earlier than previously forecast.

IATA Director General and CEO Alexandre de Juniac said: “This crisis is devastating and unrelenting. Airlines have cut costs by 45.8%, but revenues are down 60.9%. The result is that airlines will lose US$66 for every passenger carried this year for a total net loss of US$118.5 billion.

“This loss will be reduced sharply by US$80 billion in 2021. But the prospect of losing US$38.7 billion next year is nothing to celebrate. We need to get borders safely re-opened without quarantine so that people will fly again. And with airlines expected to bleed cash at least until the fourth quarter of 2021 there is no time to lose.”

2020 performance

Passenger numbers for 2020 are expected to plummet to 1.8 billion (60.5% down on the 4.5 billion passengers in 2019). This is roughly the same number that the industry carried in 2003. This year, in the face of a half trillion-dollar revenue drop (from US$838 billion in 2019 to US$328 billion) airlines cut costs by US$365 billion to US$430 billion.

“The history books will record 2020 as the industry’s worst financial year, bar none. Airlines cut expenses by an average of a billion dollars a day over 2020 and will still rack-up unprecedented losses. Were it not for the US$173 billion in financial support by governments we would have seen bankruptcies on a massive scale,” said de Juniac.

2021 forecast

Airline financial performance is expected to see a significant turn for the better in 2021, even if historically deep losses prevail. The expected US$38.7 billion loss in 2021 will be second only to 2020 performance.

On the assumption that there is some opening of borders by mid-2021 (either through testing or growing availability of a vaccine), overall revenues are expected to grow to US$459 billion (still 45% below the US$838 billion achieved in 2019). In comparison, costs are only expected to rise by US$61 billion, delivering overall improved financial performance.

Challenges to Recovery

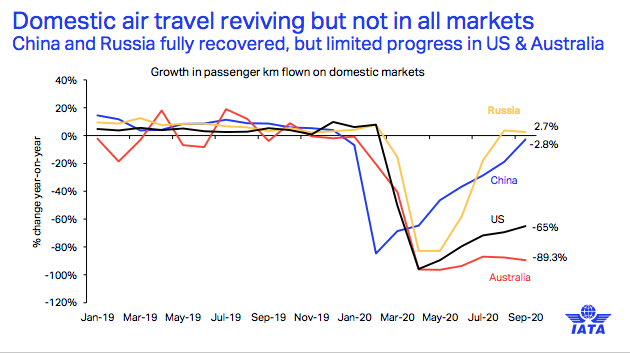

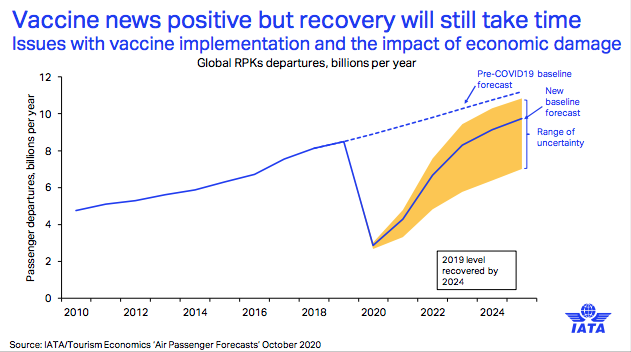

Passenger volumes are not expected to return to 2019 levels until 2024 at the earliest, with domestic markets recovering faster than international services. Several critical challenges need urgent attention, claimed IATA:

Debt Levels and Financial Support: Even after US$173 billion of government support of various kinds in 2020, the median airline has just 8.5 months of cash to survive, said IATA. This comes as the industry enters into the critical winter period, which is characterised by weak demand even in normal times. While cash burn has diminished from the peak of the crisis, airlines are still expected to burn an average of US$6.8 billion/month during the first half of 2021, before the industry turns cash positive in the fourth quarter of 2021.

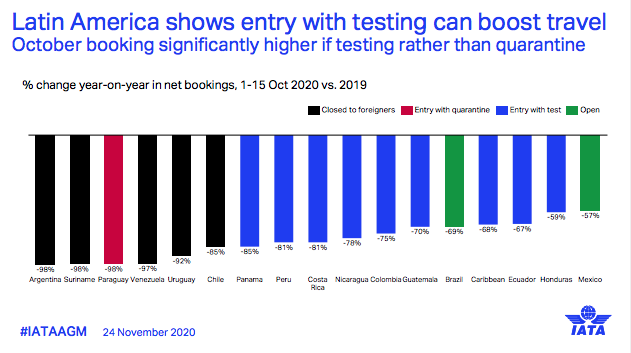

Closed Borders/Quarantine: The biggest factors impeding the industry’s recovery are travel restrictions and quarantine measure that effectively prevent a meaningful revival of travel, noted IATA.

“We have the ability to safely re-open travel with systematic testing. We cannot wait on the promise of a vaccine. We are preparing for efficient vaccine distribution. But testing is the immediate solution to meaningfully re-open air travel. With 46 million jobs at risk in the travel and tourism sector alone because of plummeting air travel, we must act fast with solutions that are at hand.

“We have fast, accurate and scalable testing that can safely do the job. The airlines are ready. The livelihoods of millions are in the hands of governments and public health authorities. Governments understood the criticality of a viable air transport sector when they invested billions to keep it afloat. Now they need to protect those investments by giving airlines the means to safely do business,” said de Juniac.

He concluded: “The numbers couldn’t get much worse. But there is a way forward. With the continued financial support of governments to keep airlines financially viable and the use of testing to enable travel without quarantine, we have a plan to overcome the worst immediately. And longer-term the progress on vaccines is encouraging.

“Most importantly, people have not lost their desire to travel. The market response to even small measures to lift quarantine is immediate and strong. Where barriers have been removed, travel rebounded. The thirst for the freedom to fly has not been overcome by the crisis. There is every reason for optimism when governments use testing to open borders. And we need to make that happen fast.”