INTERNATIONAL. DFS Group experienced mixed fortunes in 2019, hit hard by the social unrest in Hong Kong while its T Fondaco dei Tedeschi by DFS store in Venice performed “very well”.

Key LVMH take-outs Highlights from 2019, according to LVMH, include:

|

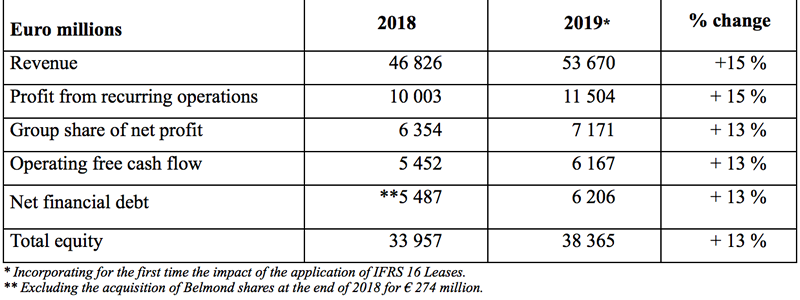

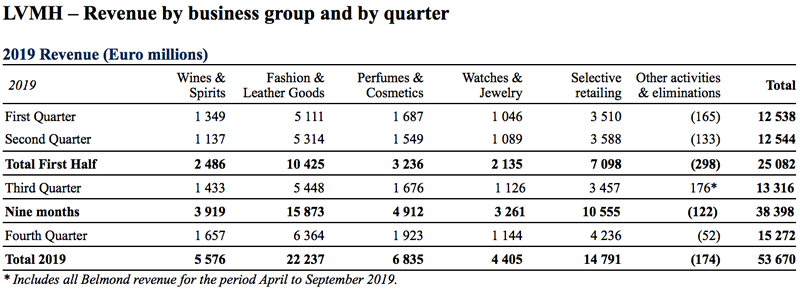

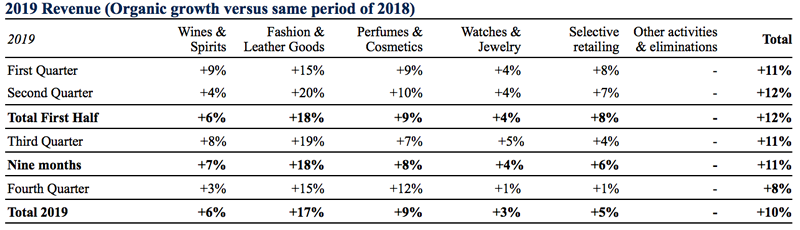

That’s according to parent company LVMH Moët Hennessy Louis Vuitton, the world’s leading luxury products group, which today posted a +15% rise in recorded revenue to €53.7 billion (US$59.1 billion) for the year. Organic revenue growth was +10%.

Groupwide, Europe and the US experienced good growth over the year, as did Asia, despite a difficult environment in Hong Kong in the second half.

The Selective Retailing business group (which includes DFS Group and Starboard Cruise Services alongside Sephora and Le Bon Marché) achieved organic revenue growth of +5%. Profit from recurring operations for this part of the business was up +1%.

LVMH noted that preparations are underway for the imminent opening of DFS Group’s new location at La Samaritaine in Paris this April.

LVMH revenue growth in the fourth quarter reached +12% compared to the same period in 2018. Organic revenue growth was +8% for the quarter. Restated for the non-recurring effects of a VAT increase in Japan and the stock movements of distributors of Cognac in the US, the Group’s organic growth was at a similar level in the third and fourth quarters.

Profit from recurring operations amounted to €11.5 billion (US$12.7 billion) in 2019, up +15% compared to an already high level in 2018. Operating margin reached 21.4%. Group share of net profit amounted to €7.2 billion (US$7.9 billion), up +13%.

DFS faces first-half 2020 headwinds In a note, Morgan Stanley Research analyst Edouard Aubin points out that Selective Retailing’s 4Q sales rose just +1% year-on-year (220 bps below market expectations), while operating profit contracted by -15%. “We believe that the shortfall came mostly from duty free chain DFS (about a third of the division’s sales), which was very negatively impacted by its exposure to Hong Kong,” he wrote. Morgan Stanley estimates that DFS generates over 30% of its sales in Hong Kong and that its sales were down over -40% year-on-year in 4Q (“rents are mostly fixed there so operating deleverage was material”, notes Aubin). “Going forward, the performance of DFS should continue to drag that of the division in 1H20 and, as of June 2020, DFS will be negatively impacted by the termination of the historical Singapore airport concession (~€400m in annual sales but relatively minimal profit contribution), as well as the start-up costs associated with the opening of La Samaritaine in Paris,” the note concluded. |

LVMH Chairman and Chief Executive Officer Bernard Arnault said: “LVMH had another record year, both in terms of revenue and results. The desirability of our brands, the creativity and quality of our products, the unique experience offered to our customers, and the talent and the commitment of our teams are the Group’s strengths and have, once again, made the difference.

“In addition to the many successes of our Maisons, highlights of the year include the arrival of the exceptional hotel group Belmond, the partnership with Stella McCartney and the agreement with prestigious jewellery Maison, Tiffany & Co.

“LVMH is driven by a permanent commitment to perfection and quality, and by a long-term vision combined with a sense of responsibility in all our corporate actions, notably in its commitment for the preservation of the environment, sustainability and inclusion. In a buoyant environment that remains uncertain in 2020, we continue to be vigilant and focused on our objectives for progress. We can count on the strength of our brands and the agility of our teams to reinforce, once again in 2020, our leadership in the universe of high-quality products.”

PERFORMANCE BY DIVISION

Wines & Spirits – “Excellent global momentum”

The Wines & Spirits business group achieved organic revenue growth of +6%. Profit from recurring operations also increased by +6%. The business group continued to pursue its value strategy based on a strong innovation policy, while accentuating its environmental and societal commitment.

The different regions contributed in a balanced way to its growth. Champagne was driven by the faster growth of prestige cuvées and by its price increase policy. Hennessy Cognac, which recorded good growth, became the world’s leading premium spirits brand. The American market saw a normalisation in stock levels among distributors at the end of the year, while China continued its rapid progress linked notably to the timing of Chinese New Year. The acquisitions in 2019 of Château du Galoupet and Château d’Esclans mark LVMH’s entry into the “promising” market of high-quality rosé wines.

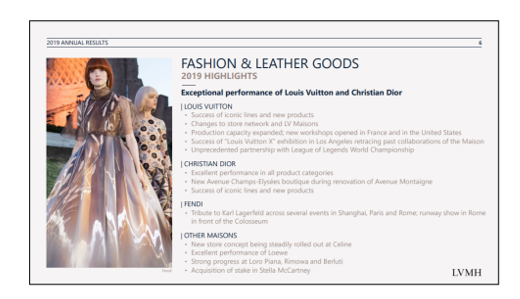

Fashion & Leather Goods: “remarkable” performances by Louis Vuitton and Christian Dior

The Fashion & Leather Goods business group achieved organic revenue growth of +17% in 2019. Profit from recurring operations was up +24%.

Louis Vuitton continued to deliver an “exceptional” performance, to which all businesses and all clientele contributed. Iconic lines and new creations contributed in a balanced way to revenue growth.

The Louis Vuitton X exhibition in Los Angeles successfully showed the Maison’s many artistic collaborations, and an unprecedented partnership in e-sport was signed with the League of Legends World Championship.

The qualitative transformation of the distribution network continued. notably with the inauguration of the Louis Vuitton Maison in Seoul, for which Frank Gehry designed an acclaimed glass structure.

Christian Dior has had a “remarkable year”, LVMH said. Confirmation of the Maison’s unique influence was its exhibition at the Victoria and Albert Museum in London which had record attendance of nearly 600,000 visitors. A new boutique on the Champs Elysées in Paris took over from the historic address of 30 Avenue Montaigne while it is being renovated. Fendi’s highlight for 2019 was its final tribute to Karl Lagerfeld, after a collaboration of 54 years.

Celine gradually rolled out its boutique concept and launched its first high-end perfumery collection. Loewe delivered strong growth under the impetus of its designer JW Anderson. Loro Piana, Rimowa and Berluti experienced good progress.

Perfumes and Cosmetics: “Excellent growth of flagship brands and rapid progress in Asia”

The Perfumes and Cosmetics business group achieved organic revenue growth of +9%, driven by the “remarkable momentum” of its major brands, notably Dior, Guerlain and Givenchy.

Profit from recurring operations was up +1% after taking into account an exceptional depreciation of the product lines of certain young American brands. Skincare grew, underpinned notably by the demand in Asia. Christian Dior continued to grow much faster than the market. In addition to the strength of its iconic perfumes J’adore, Miss Dior and Sauvage, makeup and skincare contributed significantly to the excellent performance of the Maison.

Guerlain’s growth accelerated and the brand enjoyed particularly good momentum with the success of Abeille Royale in skincare and Rouge G in makeup. Parfums Givenchy achieved another year of strong growth thanks to its makeup and its L’Interdit perfume. Fresh, Fenty Beauty by Rihanna and Acqua di Parma grew rapidly.

Watches and Jewelry: “Strong growth at Bvlgari and continued repositioning of TAG Heuer”

The Watches and Jewelry business group recorded organic revenue growth of +3%. Profit from recurring operations rose +5%.

The agreement with Tiffany & Co was a strategic highlight of the year. Bvlgari continued to perform very well and to strongly increase its market share. High jewelry lines Serpenti, B.Zero 1 and Diva’s Dream were enriched with many new products and the Fiorever collection, launched at the end of 2018, combining flowers and diamonds, contributed significantly to growth.

In watchmaking, the Serpenti Seduttori watch was exceptionally well received, LVMH said. Chaumet’s growth was driven by the success of its iconic collections. In early 2020, the Maison will inaugurate its completed renovated site on Place Vendôme. As distribution evolves rapidly within the watchmaking sector, TAG Heuer continued to work with its partners to provide an increasingly selective and efficient distribution network, while pursuing its creative resurgence.

Hublot recorded strong growth, driven by the Classic Fusion, Big Bang and Spirit of Big Bang lines. The first LVMH Watch exhibition at the Bvlgari Hotel in Dubai was a great success, the group said.

Selective Retailing: “Strong growth at Sephora and good resilience at DFS”

The Selective Retailing business group (which includes DFS Group and Starboard Cruise Services alongside Sephora and Le Bon Marché achieved organic revenue growth of +5%. Profit from recurring operations was up +1%. Sephora is experiencing strong growth, LVMH noted, and continues to gain market share. Growth was particularly strong in Asia and the Middle East. Online sales grew rapidly throughout the world. Its distribution network continued to grow with more than 100 new stores and the renovation of the flagship stores of Dubai Mall, Times Square in New York and La Défense in Paris.

Le Bon Marché continued to cultivate exclusivity in its offer and in 2019 it opened its “private apartments” for a personalised shopping service. The 24S digital platform progressed well, with an increasingly international clientele.

In the second half of 2019, DFS faced a slowdown in tourism in Hong Kong, an important market. In Europe, the Galleria in Venice continued to perform very well, and preparations are underway for the imminent opening of its new location at La Samaritaine in Paris.

Outlook: “Cautiously confident” for 2020

In an uncertain geopolitical context, LVMH said that it is well-equipped to continue its growth momentum across all business groups in 2020. The Group will pursue its strategy focused on developing its brands by continuing to build on strong innovation and investments as well as a constant quest for quality in their products and their distribution.

“Driven by the agility of its teams, their entrepreneurial spirit, the balance between its different businesses and geographic diversity, LVMH enters 2020 with cautious confidence and once again, sets an objective of reinforcing its global leadership position in luxury goods,” the group concluded.

Dividend up by 13%

At the Annual General Meeting on 16 April, LVMH will propose a dividend of €6.80 per share, an increase of 13%. An interim dividend of €2.20 per share was paid on 10 December last year. The balance of €4.60 will be paid on 23 April.