INTERNATIONAL. The latest Duty Free World Council (DFWC) KPI Monitor for Q1 2025 shows international passenger traffic has finally surpassed pre-pandemic 2019 benchmarks across all world regions, including Asia Pacific.

The Q1 research, produced for DFWC by Swiss consumer insights agency m1nd-set, also claims to reveal a series of shifts in shopper behaviour (*see The Moodie View below for our comment in which we question the basis of such aggregated findings).

Air passenger traffic results

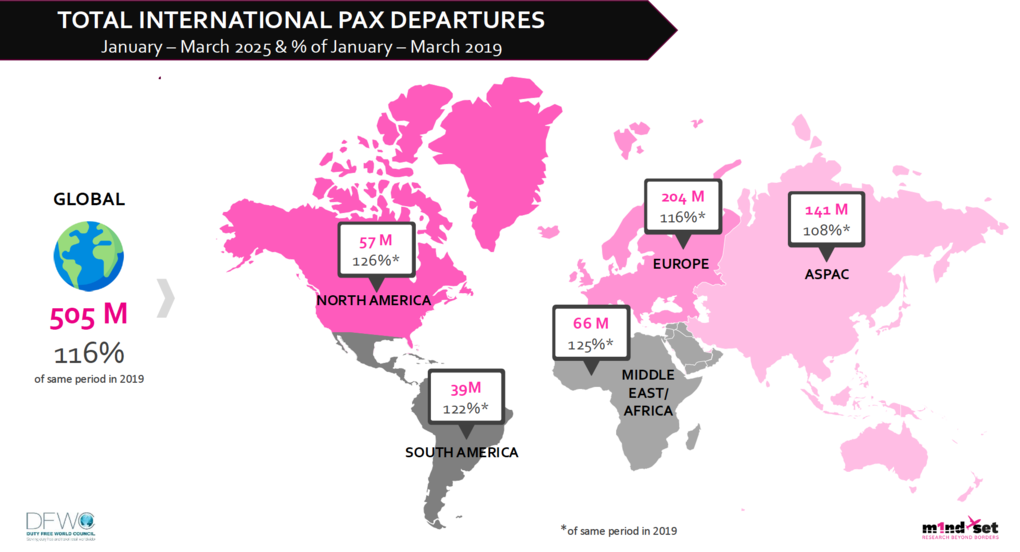

The DFWC KPI Monitor demonstrates robust passenger traffic growth against the pre-pandemic era across all world regions. According to the research, international passenger departures surged to 505 million in Q1, standing at 116% of Q1 2019 levels.

Q1 saw over 200 million international departures in Europe, also at 116% of 2019 numbers, and traffic in Asia Pacific at more than 140 million, 108% compared to pre-COVID.

The largest percentage increases can be seen in the Americas with traffic at 126% and 122% of Q1 2019 levels in North and Latin America respectively. In the Middle East, traffic reached 125% of pre-COVID volumes.

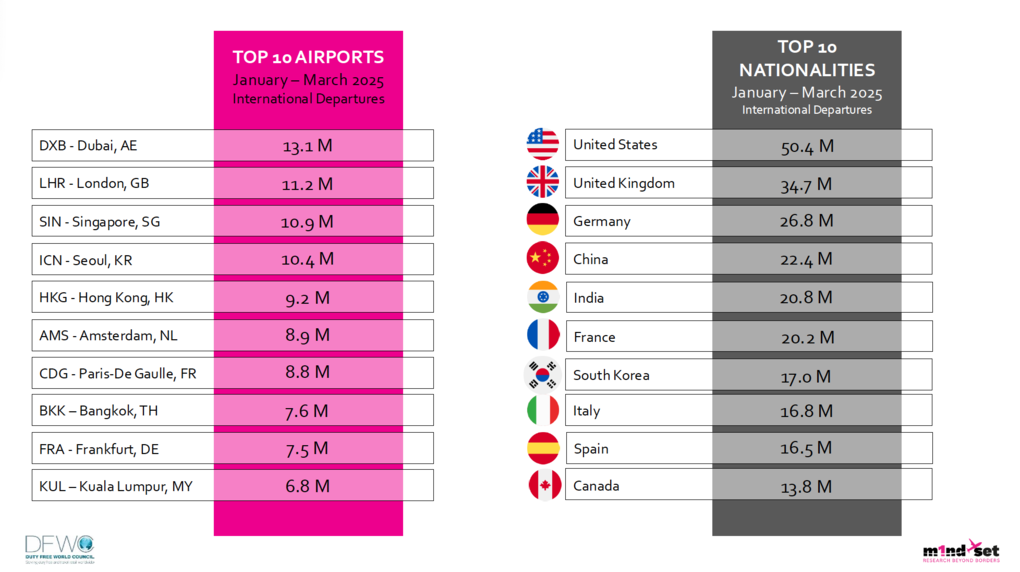

The world’s busiest airports for international departures in Q1 2025 were Dubai International (13.1 million passengers), London Heathrow (11.2 million) and Singapore Changi (10.9 million).

Incheon International follows with 10.4 million passengers while Hong Kong International rounds out the top five airports, serving 9.2 million passengers.

The top nationalities contributing to international departures in Q1 were from the US (50.4 million), the UK (34.7 million) and Germany (26.8 million). China and India completed the top five with 22.4 million and 20.8 million passengers, respectively.

“The resurgence of international mobility is a welcome milestone not just for airports and airlines, but also for the entire travel ecosystem – retailers, brands and beyond,” commented DFWC President Sarah Branquinho. “But along with the numbers comes a message: travellers are back, but they’re not shopping the same way. Experience is as important as price, and expectations are higher than ever.”

Duty-free shopping insights

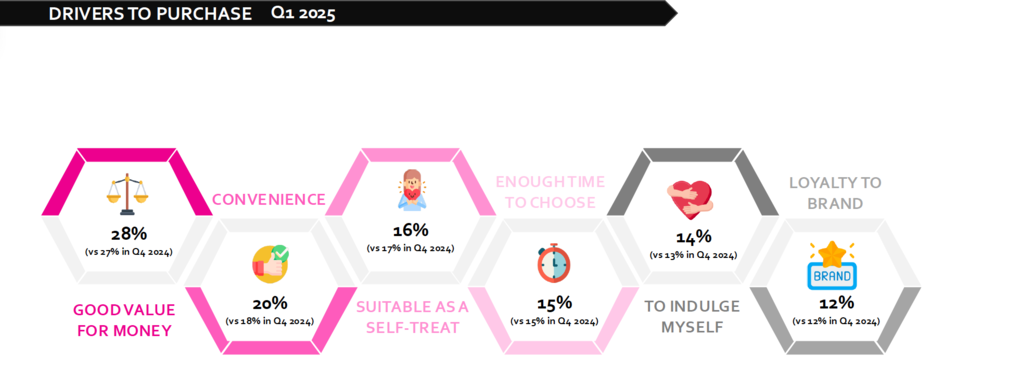

The Q1 DFWC KPI Monitor claims to identify a notable shift in the factors motivating travellers to make purchases in duty-free shops. While ‘Good value for money’ remains important (28%), its influence has slightly decreased compared to Q4 2024.

Notably, ‘Convenience’ remains a strong driver, increasing to 20% in Q1 2025, up from 18% in Q4 2024, indicating, m1nd-set claims, that ease and efficiency are becoming increasingly important to shoppers.

Other key purchase drivers include ‘Suitable as a self-treat’ (16%), ‘Enough time to choose’ (15%), ‘To indulge myself’ (14%) and ‘Loyalty to brand’ (12%).

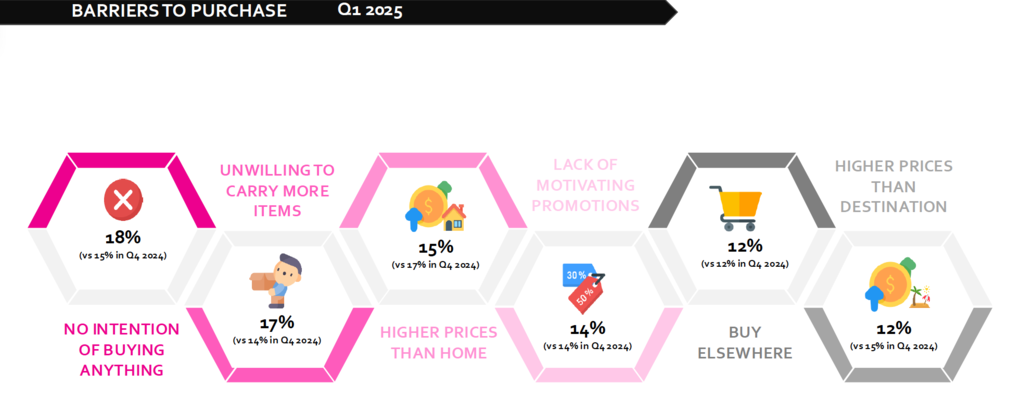

Barriers to purchase remain, with apathy and unwillingness on the increase, according to the research. The most-cited reasons for not buying include ‘No intention to buy anything’ (18%) and ‘Unwilling to carry more items’ (17%).

Price perception is improving compared to previous quarters. Price perception compared to the traveller’s home market ranks third as a barrier to purchase at 15%, down from 17% in the previous quarter. Price perception compared to the traveller’s destination as a barrier was down from 15% in Q4 2024 to 12%.

The KPI Monitor underlines the need for more effective, value-driven promotions tailored to the specific needs and preferences of travellers. The ‘Lack of motivating promotions’ (14%), and ‘Buying elsewhere’ (12%) are other commonly cited reasons for not purchasing.

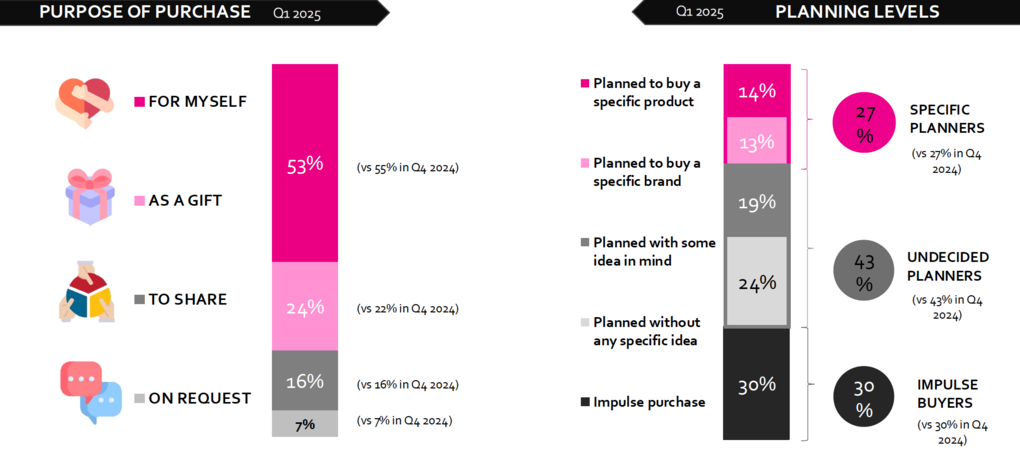

The Q1 research also claims to provide insights into how travellers plan duty-free shopping, revealing no change in their planned vs. impulse behaviour from the previous quarter.

Some 27% of shoppers are ‘Specific Planners’ who know exactly what they want to buy; 43% are ‘Undecided Planners’ who have some ideas but remain open to suggestions from the sales staff’; and 30% are ‘Impulse Buyers’ who make unplanned purchases on the spur of the moment, encouraged by in-store merchandising, promotions or the sales staff.

M1nd-set Owner & CEO Peter Mohn said: “There is a clear need to inspire purchases early in the journey via airline websites or booking platforms and, at the same time, to stimulate spontaneous conversion in-store through standout displays and activations.

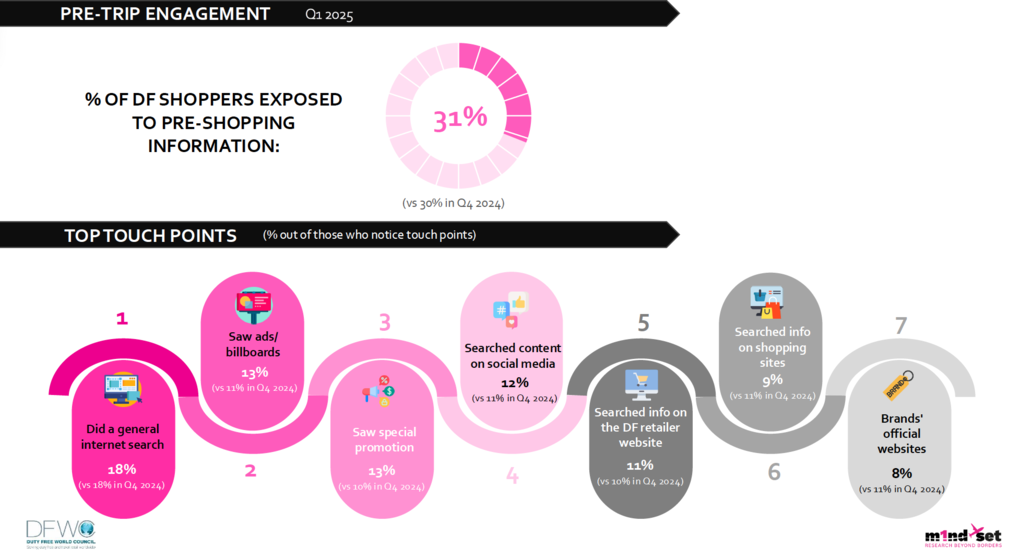

“Interestingly, only 18% of travellers conducted general online searches for duty-free offers before their trip, and just 11% visited retailer websites.

“Social media had an influence on 12% of shoppers, and a similar percentage (13%) noticed either a special promotion before travel or an advert or billboard.”

He continued: “Brand websites and other shopping-related websites are the least common sources for information with only 8% and 9% of shoppers seeking information on the duty-free shopping offer in these environments.

“This underlines the untapped potential of pre-travel digital engagement and the importance of building stronger omnichannel ecosystems to capture travellers’ attention before they reach the airport.”

The survey claims that “among the most positive findings” is the crucial role of sales staff in influencing shopper behaviour. It cites the fact that nearly half of shoppers (47%) engaged with staff during their last duty-free visit, up from 45% during the previous quarter, and 72% felt positively influenced by the interaction*.

Branquinho concluded: “As differentiation through product alone becomes harder, the ability of staff to engage travellers personally, culturally and emotionally is what will drive sales and brand loyalty. Investments in training, immersive product storytelling and service empathy are not just desirable, they’re essential.” ✈

Comment: The impressively articulated international passenger numbers component of this report makes encouraging reading. But as always in travel retail it is not only a numbers game but also a behavioural one.

Comment: The impressively articulated international passenger numbers component of this report makes encouraging reading. But as always in travel retail it is not only a numbers game but also a behavioural one.

In that context, the consumer behaviour component of this report would be much enhanced by including more information on the survey methodology. How many passengers were surveyed? Where? Which nationalities? What demographic profiles?

The ‘pre-travel digital engagement’ referred to in the findings is most certainly not ‘untapped’ by, for example, many beauty brands and travel retailers in Asia. Nor is that digital engagement confined to ‘brand websites and other shopping-related websites’.

How and on which platforms Chinese or Korean travelling consumers use social media, for example, is a very different proposition from, say, Swiss or British travellers.

Take a look at the brilliantly innovative social media pre-enagement across multiple platforms by Lotte Duty Free, The Shilla Duty Free, Shinsegae Duty Free and Hyundai Duty Free in South Korea, DFS Group in Macau and Hong Kong, China Duty Free Group and its peers in Hainan and elsewhere in China and you will see a very different picture.

Are these retailers’ audiences being included in the global aggregation?

The staff engagement number also warrants close scrutiny. Sarah Branquinho is right on the money in affirming the vital need for staff to engage travellers personally, culturally and emotionally. In that context, if 47% of shoppers engaged with staff during their last duty-free visit and only 72% felt positively influenced by the interaction, that implies 28% were either negatively impacted or not impacted at all (despite going on to purchase). If accurate, that would be a damning rather than positive statistic indeed. ✈