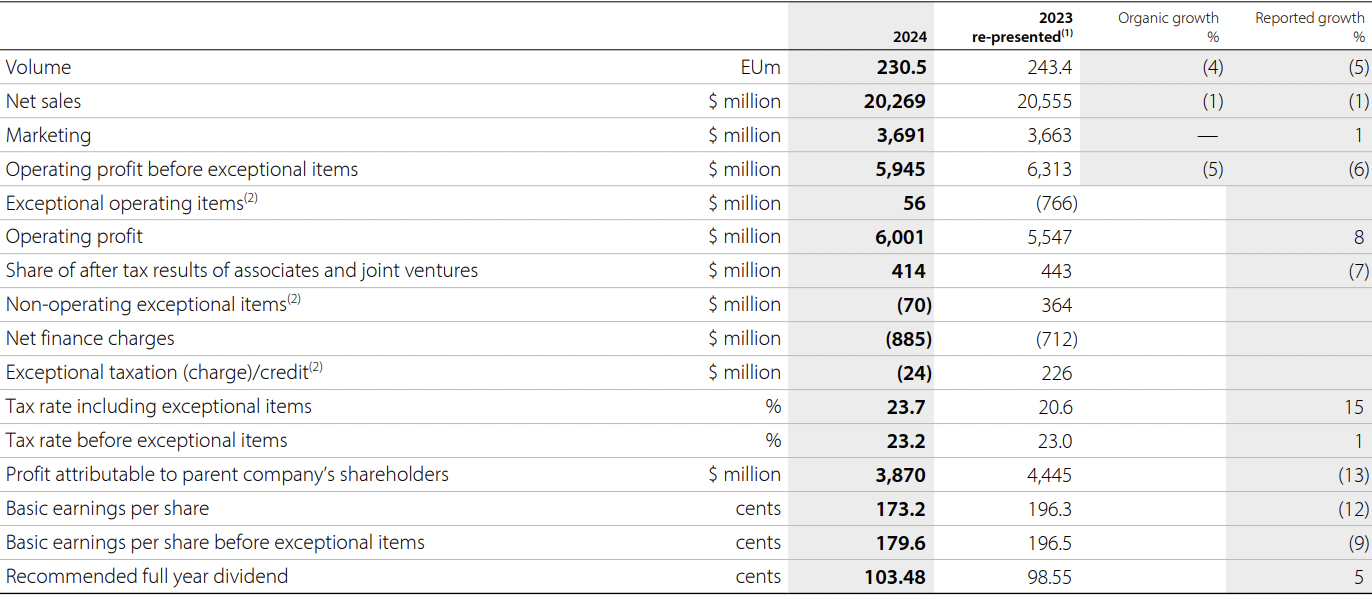

Leading spirits group Diageo has reported a -1.4% decline in net sales to US$20.3 billion for the year ended 30 June. The fall was linked to an unfavourable foreign exchange impact, organic net sales decline (-0.6%) and a negative impact from acquisitions and disposals.

Travel Retail Asia and Middle East net sales grew by an encouraging +10% year-on-year (see below).

Diageo volumes worldwide fell by -3.5%, primarily driven by a -21.1% decline in the Latin America and Caribbean (LAC) region.

Organic operating profit declined by -4.8%, most of which was attributable to LAC, with net profit (attributable to shareholders) down by -13% to US$3,870 million.

Chief Executive Debra Crew said: “While fiscal 24 was a challenging year for both our industry and Diageo with continued macroeconomic and geopolitical volatility, we focused on taking the actions needed to ensure Diageo is well-positioned for growth as the consumer environment improves.

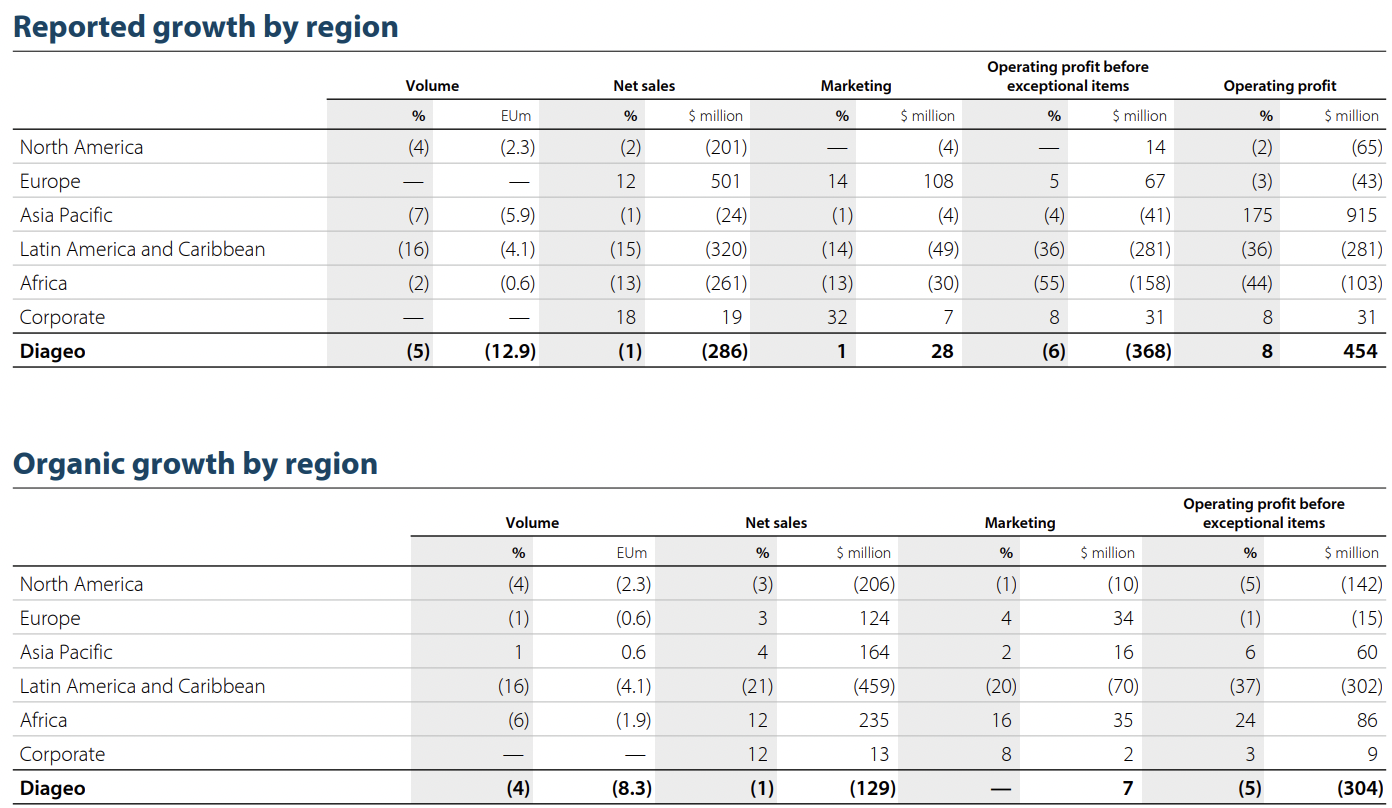

“Fiscal 24 was impacted by materially weaker performance in LAC. Excluding LAC, organic net sales grew +1.8%, driven by resilient growth in our Africa, Asia Pacific and Europe regions. This offset the decline in North America, which was attributable to a cautious consumer environment and the impact of lapping inventory replenishment in the prior year.

“In fiscal 24 we made good progress against our strategic priorities. We ended fiscal 24 gaining or holding share in measured markets totalling over 75% of our net sales value, including in the US.

“We have taken actions to manage the inventory issues in LAC; we have strengthened our consumer insights and redeployed resources towards the best growth opportunities; we have stepped up our route-to-market across several markets, including our most significant transformation in at least a decade in our US Spirits organisation; we have delivered record productivity savings of nearly US$700 million; and we have generated US$2.6 billion in free cash flow while increasing strategic investments. We are confident that when the consumer environment improves, the actions we are taking will return us to growth.”

By region, Travel Retail Asia and Middle East net sales grew +10%, as noted, primarily driven by Johnnie Walker Blue Label Xordinaire and Don Julio 1942. Tequila delivered strong share growth, said Diageo, supported by focused execution with increased portfolio and brand distribution across the channel.

Spirits net sales in Asia Pacific grew +6%, driven by strong performance in Greater China and India. Tequila delivered double-digit sales growth off a low base, with particularly strong growth in Travel Retail and India.

North America reported net sales declined -2%, with lower sales in US spirits and Canada the key factors.

In Europe, reported net sales grew +12%, primarily driven by a hyperinflation adjustment related to Türkiye and organic growth.

Asia Pacific reported net sales declined -1%, driven by the negative impact of foreign exchange and the disposal of Windsor, which was partially offset by organic sales growth.

Latin America reported net sales declined -15%, reflecting weaker organic performance, partially offset by a favourable impact from foreign exchange.

Africa reported net sales declined -13%, reflecting an unfavourable impact from foreign exchange, mainly due to a weakening Nigerian currency, partially offset by organic growth. ✈