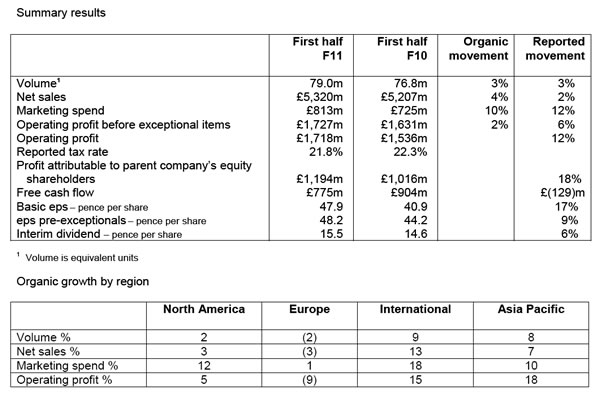

INTERNATIONAL. Diageo has reported a +2% increase in net sales to £5,320 million in the six months ended 31 December (organic net sales growth: +4%).

Reported operating profit for the period increased +12% to £1,718 million, while operating profit before exceptional operating items rose +6% to £1,727 million compared to the corresponding period in 2009. Organic operating profit grew +2%.

Profit before taxation increased by +16% to £1,612 million.

At the Global Travel and Middle East division, marketing investment increased as passenger numbers recovered, with Johnnie Walker leading continued net sales growth.

GTME delivered volume growth of +10% and net sales growth of +15%. The company said: “The increased level of marketing spend reflects the important role GTME plays as a brand and category building channel. Johnnie Walker drove performance with +22% net sales growth. The ‘Step Inside the Circuit’ campaign, a programme to encourage consumers into stores, the continuation of the ‘Walk with Giants’ marketing campaign, and the ongoing roll out of Johnnie Walker Double Black all contributed to the brand’s success. The largest non-Scotch brands, Baileys, Smirnoff, Tanqueray and Captain Morgan all grew volume and net sales, and innovation continued to play a significant role in driving growth.”

At group level, stronger volume growth and improved price/mix was delivered in North America, Diageo said. Continued momentum in International again led to double-digit top-line growth in the region and top-line growth improved in Asia Pacific.

Europe’s performance was weaker given the challenging economic conditions, the company added. At a group level, top-line growth delivered gross margin improvement. Investment to drive growth continued with organic marketing spend up +10% and increased overhead investment, particularly in Latin America.

“Momentum is building in our business,” commented Diageo CEO Paul Walsh. “Our top-line performance was stronger and price/mix improved. We have increased marketing spend significantly, up +10%, but in a very focused way. 35% of the increase was behind strategic brands in US spirits to build the brand equity as we move away from promotional support and over 60% of the increase was on our brands in the faster growing emerging markets.

“Despite the economic weakness in much of Europe, our first half performance gives me increased confidence that we will improve on the organic operating profit growth we delivered in fiscal 2010,” he added.

REGIONAL PERFORMANCE

North America – Volume growth and mix improvement in US spirits and a solid recovery in Canada

• North America returned to volume growth and delivered mix improvement led by the growth of spirits

• Innovation contributed significantly to net sales growth

• Gross margin expansion was driven by improved product mix and tight control of cost of goods

• Marketing spend increased +12% with further increases in investment behind the strategic spirits brands

• Promotional spend was reduced on US spirits brands in the off trade which cost Diageo one percentage point of share

• Wine declined as promotional support was reduced in a category where growth was driven by increased promotions

• A reduction in overheads also contributed to operating margin improvement

Europe – Continued economic weakness impacted performance in the region despite strong growth in the emerging markets of Russia and Eastern Europe

• The economic pressures in Greece, Iberia and to a lesser extent Ireland led to a -13% net sales decline across these markets

• In Great Britain net sales grew +1%, however negative price/mix in spirits and the strong growth of wine led to margin erosion

• Russia and Eastern Europe grew net sales over +20% as a result of the improving economic situation and strong growth of imported spirits

• In the rest of Europe a mixed performance resulted in net sales decline of -1%

• Import restrictions in Turkey resulted in no trading in the domestic channel in the half

• In line with these trends, marketing spend in Greece and Iberia decreased -21%, spend in Russia and Eastern Europe increased over +50% whilst spend in the rest of Europe increased slightly, focused on strategic brands

• Operating profit decline was principally driven by negative category mix in Great Britain and economic weakness in Greece and Iberia

International – Continued strong performance with double digit net sales growth and positive price/mix in all three hubs

• Increased marketing spend across the region and improved distribution in key markets drove volume growth of +9% and net sales growth of +13%

• In Latin America and the Caribbean, the strong performance of scotch brands delivered double digit volume growth and price/mix improvement

• In Africa the continued strong performance of beer in East Africa, Nigeria and Cameroon and the growth of scotch in South Africa drove net sales growth of +10%

• GTME benefitted from further increases in marketing investment along with innovation in both product and retail offerings which resulted in volume growth of +10% and net sales growth of +15%

• Marketing investment grew ahead of net sales, driving strong top line growth. Nevertheless, operating margins improved again

Asia Pacific – Double digit growth in Scotch; emerging markets in Asia grew net sales +15%

• Top-line improvement was led by the emerging markets of Asia, which grew net sales +15% driven by India, Thailand, Malaysia and Vietnam, together with +9% growth in Korea

• Diageo strengthened its leadership position in Scotch across the region gaining share in all markets

• Johnnie Walker was the key driver of performance, supported by double digit net sales growth on Windsor and The Singleton

• There was a strong performance in Korea with share gains in the Scotch category

• In Australia, Diageo gained share in spirits and ready to drink, but net sales declined due to a more aggressive off trade pricing environment

• Marketing spend grew ahead of net sales, focused on Johnnie Walker in emerging markets

• Operating margin increased as higher marketing spend was more than offset by lower overheads

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

CATEGORY PERFORMANCE

Spirits:

Spirits was the driver of overall net sales growth for Diageo, led by scotch, up +6%, and vodka, up +8%. Within Scotch, the key driver was Johnnie Walker in the emerging markets where net sales grew +23%. This was supported by Windsor and Buchanan’s in the deluxe segment and by Black & White, VAT 69 and White Horse in the standard and value segments.

North America contributed most to the growth of vodka, with continued strong momentum in Cîroc and the launch of RÖKK vodka in the premium segment. Smirnoff net sales declined in its largest markets of the US and UK but grew high double digits in the emerging markets, reflecting the strategy of positioning standard products to emerging middle class consumers.

Marketing spend behind spirits grew +15%. Key campaigns in the period were the global “˜Walk with Giants’ campaign on Johnnie Walker, the Smirnoff “˜Nightlife Exchange Project’, a strong holiday programme entitled “˜Cîroc the New Year’ in North America and an increase in digital marketing and sponsorship supporting the global growth of Captain Morgan.

Beer:

There was double digit net sales growth and positive price/mix in Africa led by Harp in Nigeria, Tusker in East Africa and Windhoek in South Africa. Ireland was the key driver of the 4% net sales decline of beer in Europe, as Guinness declined due to weakness in the on trade, particularly in rural areas.

In Asia Pacific beer net sales grew +6% following a successful “˜Arthur’s Day’ programme on Guinness and increased on trade activity in Malaysia. Two percentage points of positive price/mix on beer was driven by price increases taken across Africa and in Great Britain.

Wine:

North America and the UK together account for over 85% of Diageo’s wine business. Net sales of wine in North America declined -7% as promotional support was reduced. In the US, this resulted in share loss in an overall wine category growing at +5% and driven by increased promotions. In the UK meanwhile, wine net sales grew strongly at +18% led by a strong summer Bordeaux campaign and distribution of the [yellow tail] brand.

Ready to drink:

Although net sales declined -1%, there was an improvement in the half, due to a slowdown in the rate of decline in North America, stabilisation in Australia and growth in emerging markets such as Brazil and Nigeria. In Great Britain, the traditional ready to drink segment remained in decline, although pre-mix cans continued to grow strongly at over +40%. Diageo has a leading position in this segment and grew share.

Likewise in Australia, Diageo is driving the emergence of ready to serve through innovations such as Smirnoff Signature Serves and Smirnoff Cocktails. These new products have created retailer and consumer excitement and now appear as a permanent fixture in off trade outlets, Diageo said.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

STRATEGIC BRANDS PERFORMANCE

Brand performance is now reported using the 14 strategic brands below. This replaces the previous classification of eight global priority brands, which was introduced in 2002 following the Seagram acquisition. The new classification is a natural evolution and better reflects the way in which brands are managed, Diageo explained.

Johnnie Walker: Johnnie Walker contributed over a third of Diageo’s net sales growth in the period, driven by International. The fastest growth came from the super deluxe variants, led by Johnnie Walker Blue Label, while Black Label growth outstripped Red Label as consumers began to trade back up. However, higher promotional spend, particularly in Asia, led to one percentage point of negative price/mix.

Volume was down in North America, but depletions grew in a broadly flat scotch category. In Europe, performance was impacted by sharp declines in Spain and Greece, its largest markets, but this was partially offset by strong growth in Russia and Eastern Europe. Marketing spend increased +19% driven by investment in International and Asia Pacific behind the proven global “˜Walk with Giants’ campaign.

Crown Royal: Crown Royal grew net sales driven by strong growth of Crown Royal Black which sells at a price premium to the base variant and contributed to two percentage points of price/mix improvement. Crown Royal Black remained the number one product in IRI’s new spirits product tracker.

J&B: The majority of the net sales decline stemmed from Spain, the brand’s largest market, where consumer confidence remained low and there was destocking at the wholesale and retail level. J&B continued to lose share as consumers traded down to lower priced Scotch brands. In France, the brand’s second largest market, increased marketing spend and successful new bottle formats drove an +8% increase in net sales.

Windsor: Windsor remained the best selling Scotch brand in Korea, growing share by one percentage point in the period, driven by strong momentum behind the Windsor 12 variant. A price increase contributed to double digit net sales growth.

Buchanan’s: Price increases in Latin America and the success of the newly launched premium Buchanan’s Master variant drove net sales growth. In the US, where Buchanan’s is reportedly the fastest growing brand in the Scotch category, net sales grew +34%, as marketing spend increased awareness amongst multicultural consumers.

Bushmills: Bushmills grew net sales in all regions. Marketing spend behind the “˜Bushmills Brothers’ campaign and the launch of new packaging for Bushmills single malts helped drive global net sales growth.

|

(L-R) Baileys returned to volume and net sales growth led by International; Spirits was the driver of overall net sales growth for Diageo, led by Scotch, which was primarily driven by Johnnie Walker in the emerging markets where net sales grew +23%; In Latin America and India, Smirnoff’s strategy of building the brand by positioning it to the emerging middle class consumer continued to be successful, delivering strong net sales growth |

Smirnoff: Although there was strong growth in International, the vodka category remained intensely competitive in Europe which led to negative price/mix and net sales down -1%. In the US, Smirnoff lost share as the reduction in the level of off trade price promotion increased its relative price. In Europe, net sales declined due to the economic difficulties in Spain and Greece, along with lower volume and negative channel mix in Great Britain.

In Latin America and India, Smirnoff’s strategy of building the brand by positioning it to the emerging middle class consumer continued to be successful, delivering strong net sales growth. Marketing spend increased +16% as the Smirnoff “˜Nightlife Exchange Project’ was launched globally.

Ketel One vodka: In North America net sales were down -1%, reflecting the competitive pressures in the super premium vodka segment. However, volume continued to grow behind the successful “˜Gentlemen, this is vodka’ campaign. The roll out of the brand into other markets led to double digit net sales growth in all regions outside North America.

Cîroc: Cîroc continued its momentum in the US significantly growing volume and net sales, as well as gaining share in the ultra premium vodka segment. The new Coconut and Red Berry flavours drove overall brand growth and comprised over 50% of total brand volume.

Baileys: Baileys returned to volume and net sales growth led by International. In Europe, performance was negatively impacted by the slowdown in Iberia and Southern Europe, where liqueurs suffered disproportionately. A challenging off trade promotional environment in Great Britain and Australia contributed to two percentage points of negative price/mix.

Captain Morgan: Captain Morgan grew net sales in all four regions, notably in Europe. However, in the US, its largest market, the brand lost share due to the introduction of new spiced rums at lower prices or higher proofs. Outside of the US, Captain Morgan grew net sales and share in the key markets of Great Britain, Canada and Mexico, supported by increased marketing spend.

Jose Cuervo: Within an intensely competitive retail environment in the United States, Cuervo continued to sell at a price premium to competitors but ceded share. Especial Silver and new flavour variants helped drive brand performance. Outside of the US, a new distribution agreement in Australia was the key contributor to global net sales growth of +7%.

Tanqueray: Depletions grew in North America but volume and net sales declined primarily as a result of destocking in the period. Tanqueray performed strongly in International and particularly in Europe. Innovative marketing executions in Great Britain, including a sponsorship with the Goodwood Estate, and increased spend in Spain led to strong net sales growth in these markets.

Guinness: Overall performance was negatively impacted by a sharp net sales decline in Ireland, where the economic conditions accelerated the shift to the off trade. In Great Britain, performance also declined, partly due to consumers’ preference for lager during the 2010 Football World Cup. In Africa, the brand continued to sell at a price premium to local lagers, and Cameroon and East Africa drove growth in volume and net sales. Marketing spend was concentrated behind the second global “˜Arthur’s Day’.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |