SWITZERLAND/ITALY. Dufry and Autogrill (the latter through the Benetton family-controlled company Edizione) announced late tonight (10 July UK time/early morning 11 July CET) that they had signed an agreement to join forces and create a new travel retail group that would “redefine travel experience globally”.

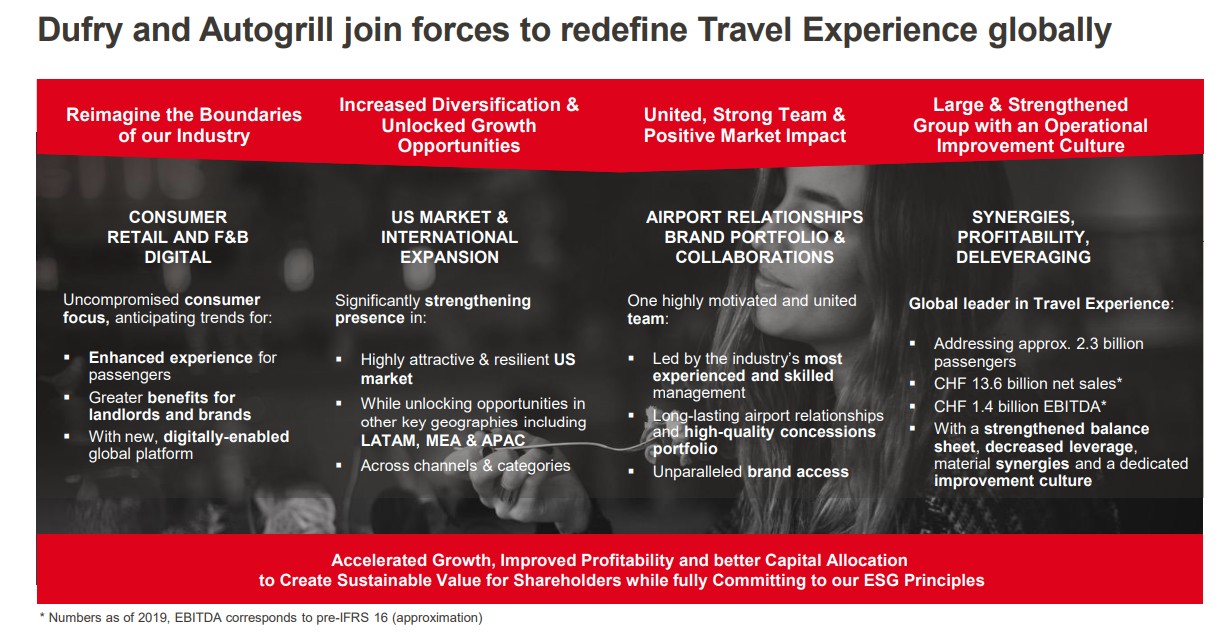

Dufry said that the two parties would be “setting a new industry standard and anticipating consumer trends through an enhanced experience for passengers and greater benefits for landlords and brands, with a new global platform generating immediate value for consumers and shareholders”.

Dufry, one of the most powerful players in travel retail, and Edizione, the owner of Autogrill, the global leader in travel-related food & beverage (F&B), said that they are combining to create a new integrated global travel experience player.

“The union between Autogrill and Dufry will allow the creation of the world champion in the sector, with a leadership position in different geographies and on different services, also favoured by important synergies within the new Group” – Edizione Chairman Alessandro Benetton

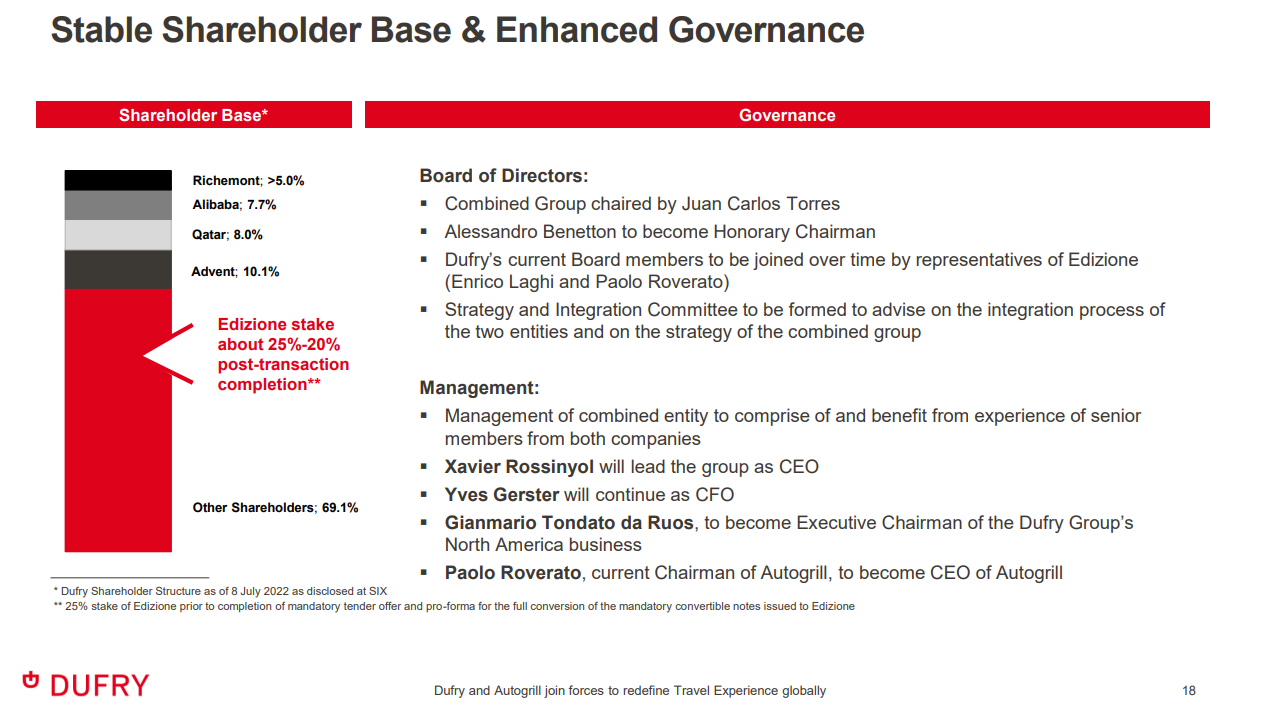

Edizione, which currently owns a 50.3% stake in Autogrill, will become the largest shareholder of the new Group. It will hold a stake of 20-25% at the end of the transaction, depending on the level of subscription to the mandatory tender exchange on offer.

Edizione, which currently owns a 50.3% stake in Autogrill, will become the largest shareholder of the new Group. It will hold a stake of 20-25% at the end of the transaction, depending on the level of subscription to the mandatory tender exchange on offer.

As a result of the transaction, Dufry is expected to launch at closing a mandatory tender exchange offer to the market to exchange Autogrill shares for Dufry shares or alternatively for cash (see details below).

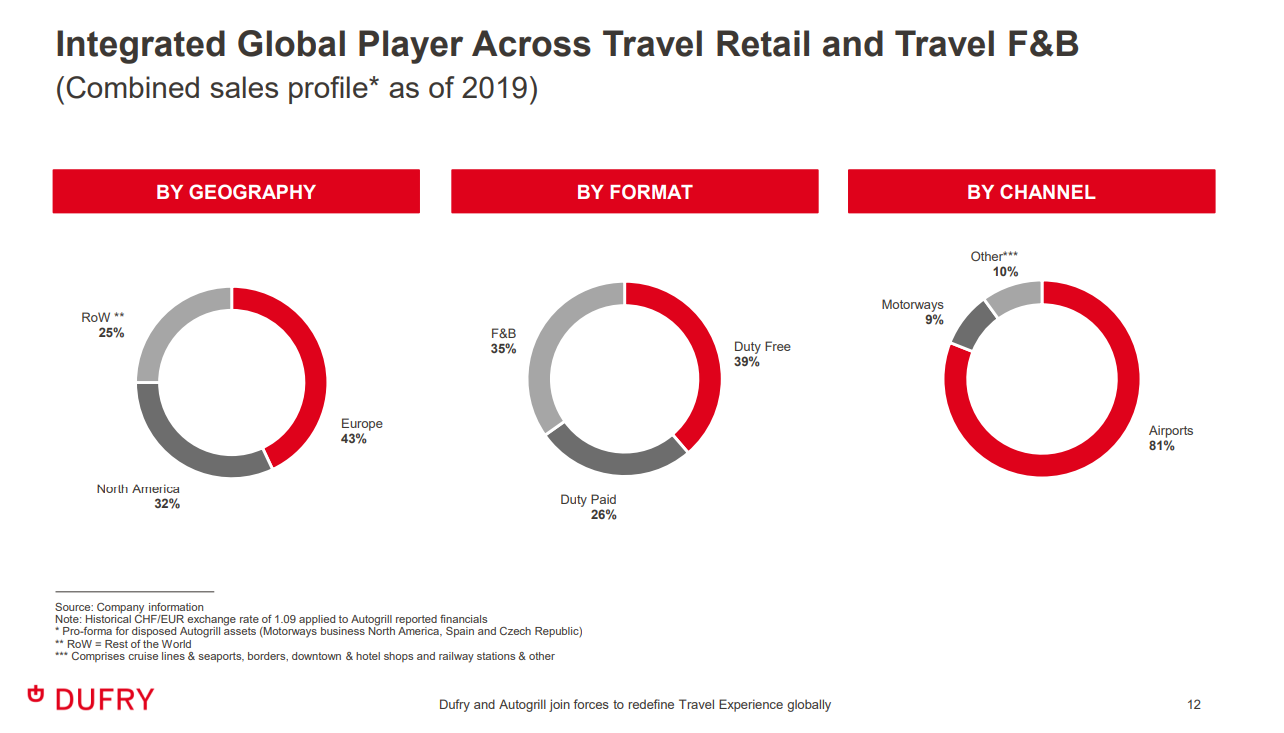

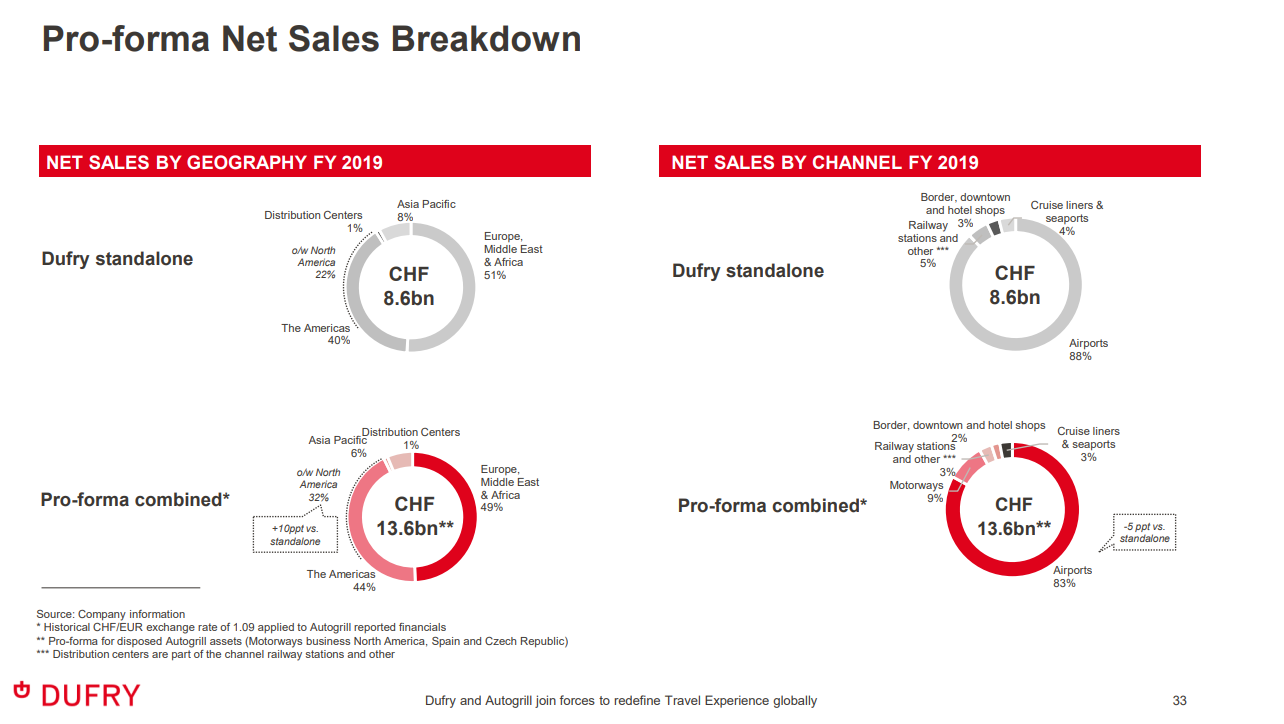

The combined entity will address 2.3 billion passengers in over 75 countries in around 5,500 outlets. These embrace some 1,200 airport and other locations with CHF13.6 billion revenue (2019 pro-forma) and CHF1.4 billion EBITDA (2019 pro-forma, pre-IFRS 16).

Alessandro Benetton will join the new Group Board of Directors as Honorary Chairman with the task of promoting and coordinating institutional relations with the Group’s main shareholders

Gianmario Tondato da Ruos will be appointed Executive Chairman of all the North American activities of the new Group; Enrico Laghi and Paolo Roverato (CEO of Edizione and Chairman of Autogrill respectively) will both join

the Board of Directors of the new Group with the position of Vice Chairman.

Juan Carlos Torres and Xavier Rossinyol will be respectively Executive Chairman and CEO of the new Group.

Edizione said: “This transaction will create a widely diversified global platform with a strong presence in the United States and Europe and a significant base in high-potential Asian markets: this platform will benefit from relevant growth opportunities and cost synergies.

“The Group will operate in an addressable space worth about €105 billion, more than four times larger than the food & beverage segment alone (approximately €25 billion). In short, a global player and an ideal platform to seize new growth opportunities not only in the sectors already covered today but also in new business sectors.”

Upon completion of the transaction, the Group will adopt a new name in order to reinforce the identity created by the combination of the two industry leaders.

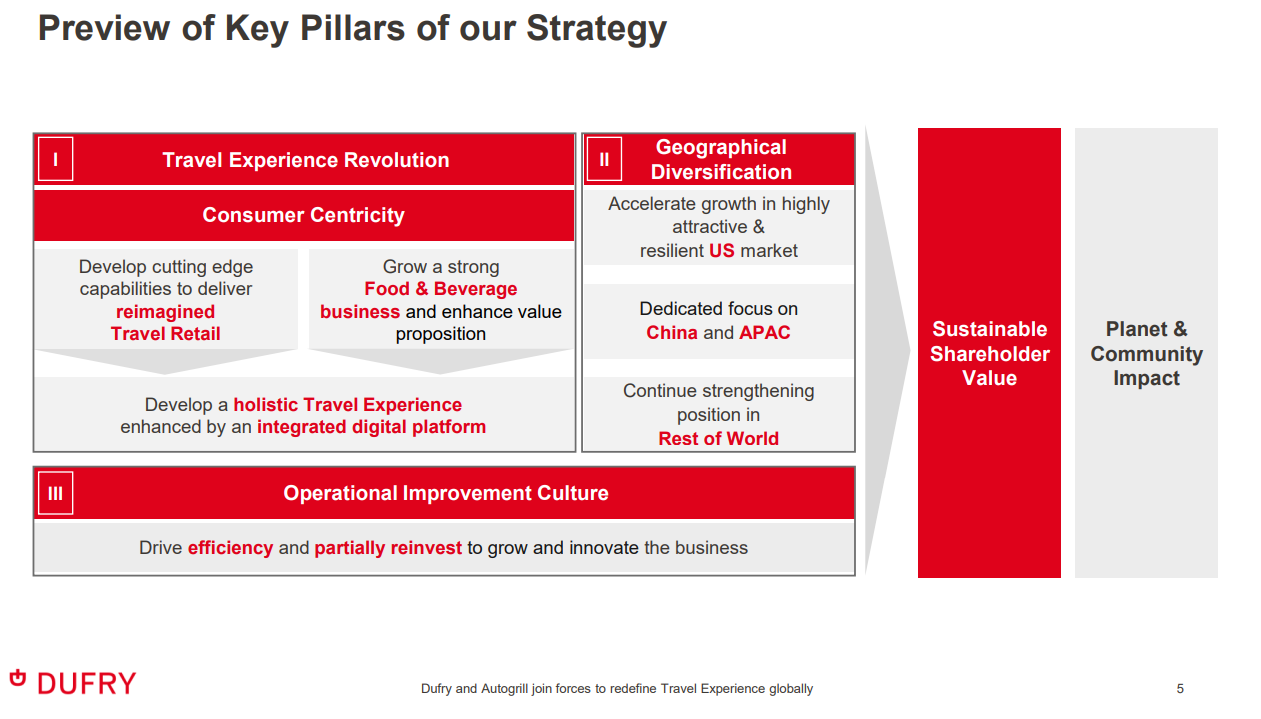

Dufry CEO Xavier Rossinyol commented: “I am very happy to lead this transformative combination, which I am sure will reinforce the new Group strategy and will create sustainable long-term value for our customers and shareholders.

“We are transforming our industry and redefining its boundaries, and we will create a new corporate identity to reflect this fundamental move. By executing on this unique opportunity, we will accelerate growth by fully focusing on consumers and the digital revolution, by offering additional value to landlords and airport partners with an expanded service portfolio, while further diversifying the Group and increasing our resilience.

“With a culture of prioritising serving customers while relentlessly driving operational efficiencies and actively managing our portfolio of concessions, we will be able to drive growth and innovation as well as profitability.

“We remain committed to our ESG principles and contributing to the communities and environments we work in.

“I am impressed by the know-how, skills and – above all – the passion of the teams, both at Dufry and Autogrill. I am sure that together we will build the next generation of travel experience.

“I want to express my admiration for what Gianmario Tondato da Ruos has achieved over the last two decades at Autogrill and his passion for the business. I thank him for continuing to support the company and me going forward.

“I thank Edizione and its Chairman Alessandro Benetton for their trust, full alignment on the strategy and long-term commitment to the new combined company, with great vision and precise execution.”

Autogrill CEO Gianmario Tondato da Ruos said: “A new cycle opens that will allow us to unleash a whole array of options centered around the needs of travellers worldwide. The business combination will enable a flurry of innovations in its offerings, which will translate into more enjoyable travel experiences across various geographies and channels. It represents an outstanding value creation opportunity for our stakeholders.”

Edizione Chairman Alessandro Benetton commented: “This agreement allows the continuation of Autogrill’s growth and development path, an asset that will remain strategic for Edizione.

“The union between Autogrill and Dufry will allow the creation of the world champion in the sector, with a leadership position in different geographies and on different services, also favoured by important synergies within the new Group.

“In this new reality, Autogrill will play a leading role, bringing with it its values and corporate culture, particularly in the areas of sustainable development and innovation. In Dufry and in its current management, we immediately recognised a common vision and values, combined with a managerial culture and skills of the highest level recognised throughout the industry”.

Dufry Executive Chairman Juan Carlos Torres added: “As a leader of travel retail, Dufry has strived to be at the forefront of services and products offered to travellers, airports and brands for years. Now, Dufry pledges to define the travel experience in a manner that creates value for all stakeholders.

“The combination of the two groups will create a new leader in travel experience and allow us to significantly increase our presence in core markets, such as the US, and in the sector of travel F&B. In addition, this transaction will strengthen our balance sheet, reduce our leverage and create meaningful synergies.

“On behalf of the board and myself, I would like to thank the Autogrill, Dufry, and Edizione management teams for their hard work and effort to make this strategic combination happen.”

Details of the deal

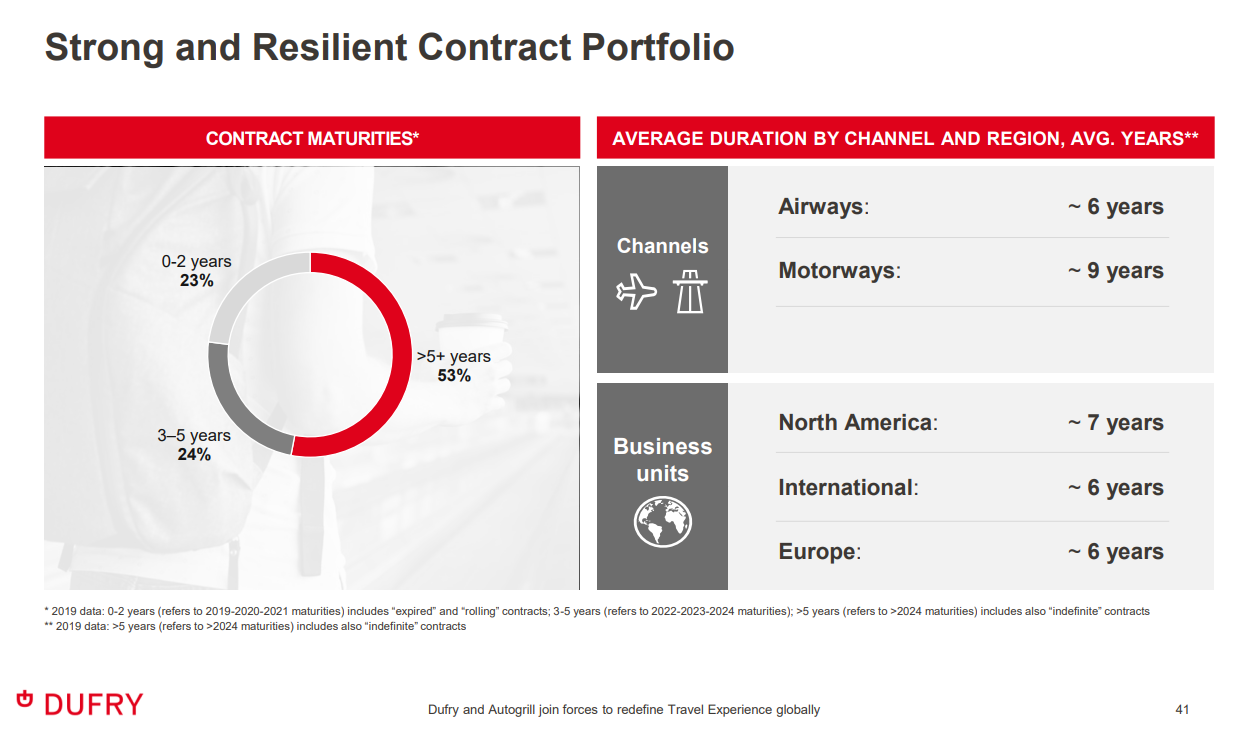

The “transformational combination” represents a complementary strategic fit and will support Dufry’s new long-term strategy, Dufry said in a statement. It added that:

• The enlarged group redefines the boundaries of the industry and will focus on enriching the passenger journey based on experience and innovation

• More integrated and digitalised offerings across travel retail & F&B provide landlords, airport partners and brands with an enhanced service portfolio

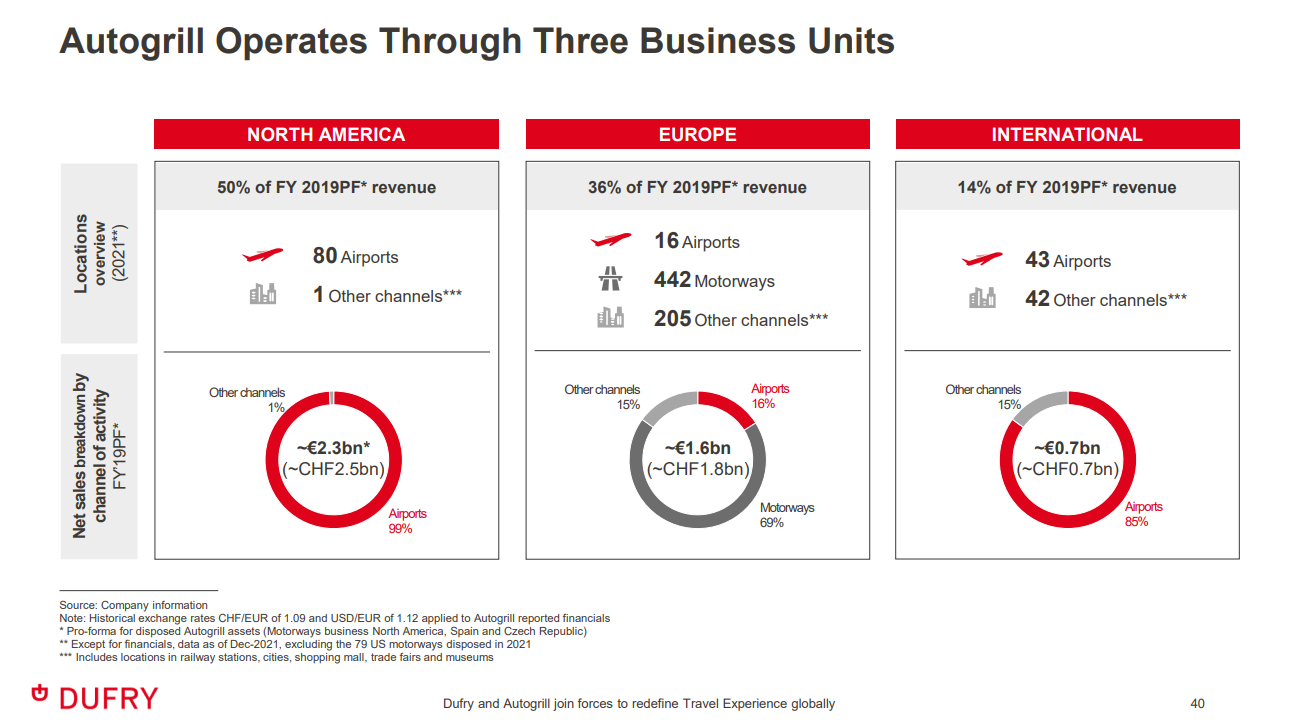

• Dufry significantly strengthens its presence in the highly attractive and resilient US market, while adding opportunities in other key geographies including APAC, Latin America, the Middle East and Africa

• The combination brings together two groups of highly experienced and strongly engaged professionals with complementary skill-sets, led by Xavier Rossinyol as CEO of the combined Group

• Dufry shareholders will benefit from EFCF per share accretion in the first year post-closing based on cost synergies with annual run-rate of approx. CHF85 million

• The enlarged entity will have a strengthened balance sheet with lower financial leverage compared to Dufry on a standalone basis, targeting a below 3x leverage level

• Edizione, through a wholly owned subsidiary, will transfer its entire stake of 50.3% in Autogrill to Dufry at an exchange ratio of 0.158 new Dufry shares for each Autogrill share (referenced to the 3-month VWAP4 of Autogrill and Dufry shares prior to April 14, 2022) (the “Transfer”)

• Following the closing of the Transfer, Dufry will launch a mandatory tender offer for the remaining Autogrill shares, offering Autogrill shareholders the ability to participate in the future of the combined entity by receiving 0.158 new Dufry shares for each Autogrill share (same exchange ratio as offered to Edizione). Alternatively, Autogrill shareholders are offered a cash alternative equivalent to of EUR6.33 per Autogrill share

• At closing, Edizione will become the major shareholder in the combined entity

• The closing of the transaction is subject to regulatory approvals, the approval by Dufry’s shareholders at the Extraordinary General Meeting, as well as other conditions

A new travel retail superforcce: The combined group in figures

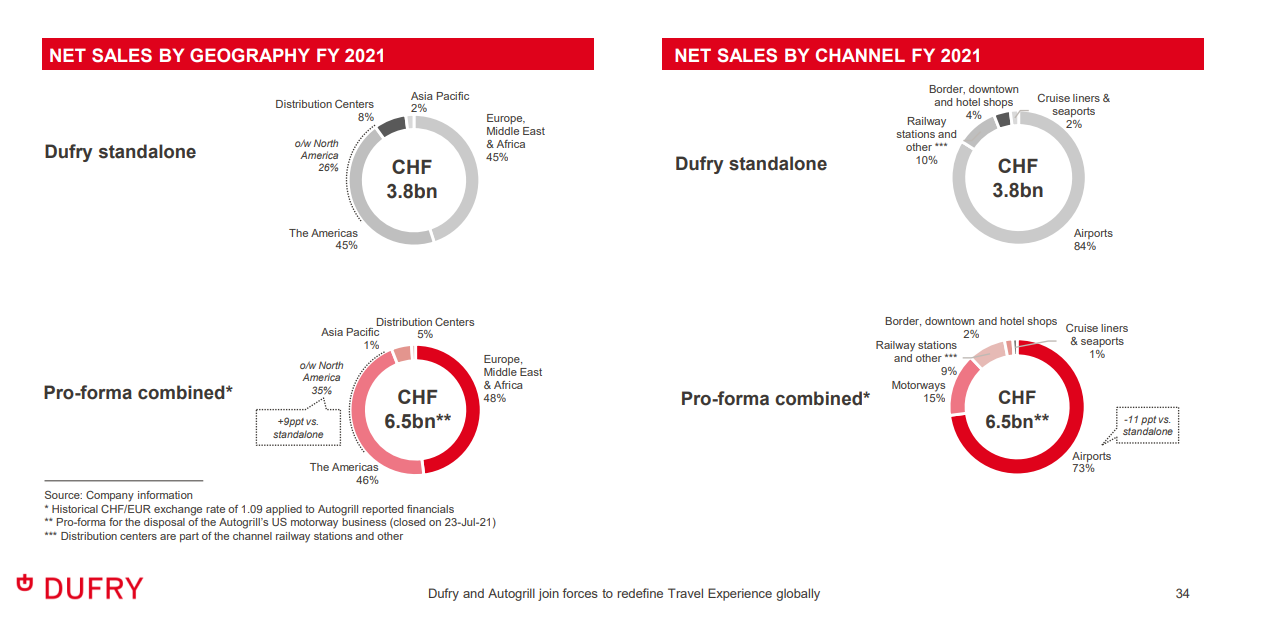

The combined Group will be able to serve over 2.3 billion passengers across all continents in around 5,500 outlets at around 1,200 airport and other locations generating CHF 13.6 billion revenues (2019 pro-forma) and CHF 1.4 billion of EBITDA (2019 pro-forma, pre-IFRS 16).

The Group’s global footprint and presence in more than 75 countries will provide an exceptional experience and knowledge within the industry and enable strong, mutual value-creating relationships with landlords, airport partners and suppliers. The Group will employ around 60,000 people from over 150 nationalities globally, united as one team.

Dufry said that the combined entity is well positioned to provide travellers with a redefined, holistic travel experience that reflects evolving consumer trends.

“Complementing Dufry’s portfolio with F&B broadens our offering and gives us more contact points with travellers, In addition, the integrated Group will have greater resource to grow its digital capabilities, focused on delivering tailored passenger experiences. Dufry’s strategy has always been to serve the traveler along its journey, adapting our offers and concepts to accommodate its changing needs,” Dufry said.

Edizione explains the agreement in more detail

The agreement signed by Edizione and Dufry defines the structure and mechanisms of the transaction, which consists of a transfer to Dufry of the majority stake held in Autogrill by Edizione through its subsidiary Schema Beta S.p.A., equal to 50.3% of the share capital in exchange of newly issued Dufry shares.

This will cause Edizione to hold 30,663,329 newly issued Dufry shares, equal to 25.248% of Dufry’s share capital, corresponding to an exchange ratio of 0.158(3) Dufry shares for each Autogrill share.

The completion of the transaction is subject to the fulfillment of certain conditions consisting of:

- (i) authorisation by the antitrust and golden power competent authorities;

- (ii) adoption by Dufry shareholders of the relevant implementing resolutions;

- (iii) granting by the banks of the bridge financing related to the mandatory tender

exchange offer; - (iv) the non-occurrence of material adverse events. Following this transfer of the controlling stake, Dufry will launch a mandatory tender exchange offer on the remaining Autogrill shares, offering shareholders the possibility of exchanging Autogrill shares for Dufry shares (listed in Switzerland t SIX Swiss Market) at the same exchange ratio as the majority shareholder or alternatively, of receiving an equivalent countervalue in cash (cash alternative) defined equal to € 6.33 per share.