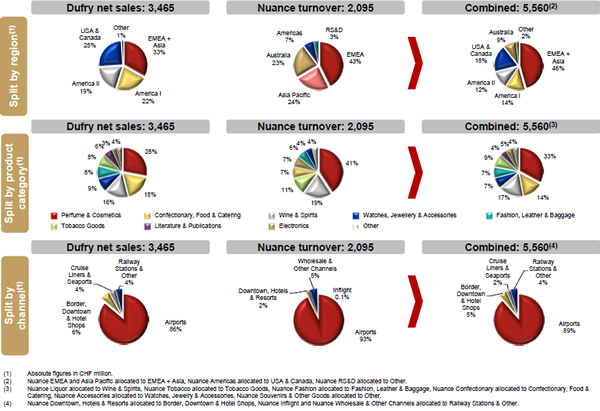

INTERNATIONAL. The new powerhouse travel retailer generated by Dufry’s acquisition of Nuance will account for sales of CHF5.5 billion (US$6.2 billion), based on 2013 figures. That’s according to CEO Julián Díaz, speaking to analysts after this morning’s news (broken by The Moodie Report) of the company’s swoop for its Swiss rival.

Díaz said: “This is an important step for Dufry in the consolidation of the travel retail market. Over the past years we have played a big role in the industry’s consolidation, integrating middle and small sized companies, delivering synergies and generating value. We started out in 2003 with 46% gross profit margin and completed the last quarter with close to 60% gross margin.

“Today we are presenting an acquisition that continues that transformational approach, one that changes the landscape significantly for Dufry as well as the competitive landscape for the travel retail industry.”

|

Click on the above to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

He added: “It also continues our global diversification strategy and it confirms Dufry as the market leader, reaching a level of 14.8% of all worldwide airport retail sales [and 12% of travel retail across all channels, he added -Ed], with more than 150 million customers a year, 1,750 shops, 23,000 employees and operations in 63 countries and in 239 airports.

“It also increases significantly our exposure to the brands, with the added sales volume improving our global negotiations with suppliers.”

For Dufry by region, it will add countries and territories complementary to current ones. The combined group will hold leading positions in Latin America, Central America, North America, Africa and the Mediterranean, and have an attractive concessions mix in Europe and Asia, said Díaz.

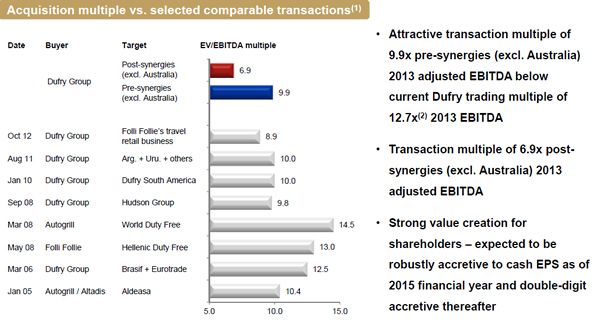

He noted that the CHF70 million in synergies announced this morning will “start impacting the P&L of the company in 2015 and will be fully reflected in 2016. It will generate significant value for our shareholders, being robustly EPS accretive from 2015 and double-digit cash accretive from 2016.”

|

Click on the above to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

On the move to deliver those synergies, Díaz said: “”We already have a plan to integrate the company from the bottom to the top over the next 12-18 months, along with our consultant AT Kearney. Nuance’s operations will be integrated into the existing Dufry business units, and then it will change to work with the same standards and procedures as we work with. We will then undergo a complete reorganisation of the worldwide regions within the company [to reflect the new shape] in three to six months.”

Improved gross profit margin will make a key contribution (around CHF35 million) to the expected CHF70 million in synergies that are targeted. This will come from enhanced purchasing power with suppliers, said Díaz, along with a consolidated logistics platform and an optimised supply chain.

The remaining CHF35 million will be generated by combining global and regional headquarters of the two companies (with global HQ to remain in Basel), plus a lower general and administrative cost base. “We have identified CHF35 million of savings that will be completed within the first 12 months of operations,” he added.

Díaz didn’t shirk the fact that this will be a challenging project. “There is a complexity with this acquisition that does not exist with other middle to small acquisitions we have done, mainly due to the complex integration we face. But we have the know-how and organisation to integrate a company of this size.”

He added: “One of the challenges is that in many of our functions we are centralised while Nuance is more decentralised, especially in terms of its negotiations and agreements with suppliers. [Addressing] this will be [key] in achieving the synergies we mentioned.”

A steering committee from Dufry will lead the integration, he noted, led by Luis Marin (financial control and review of the takeover) José Antonio Gea (standardising global functions such as procurement, logistics and operations), Jordi Martin-Consuegra (restructuring of Nuance and support function standardisation) and Andreas Schneiter (financial integration).

Díaz also said there would be a role for senior management from Nuance in the new group, saying they could offer much know-how and expertise. “Nuance management represents a great asset and could in my view contribute to the new organisation. We have to be clever in combining the best of both organisations,” said Díaz.

Raising the value of key categories

With Nuance included, the new Dufry will see a shift in the balance of the key categories’ contribution to the business.

P&C accounts for 41% of Dufry turnover today but just 28% of Nuance sales; at the new group the figure will become 33%, and it’s an area which Dufry has big ambitions to become even stronger, said Diaz.

Other area of focus will be food & confectionery (14% of combined group sales) and luxury goods, which he said would be one of the “main areas for product development”. Watches, jewellery & accessories will be 7% of the business with fashion & leathergoods a further 7%. That combined 14% compares to a share within Nuance of 17% today, but just 10% for Dufry. Tobacco will be 9%, electronics 5%, news & books 4% and other sectors will make up the balance.

The Australian question

Importantly, Diaz noted the impact of the loss-making Sydney Airport concession on the business, both in his presentation and in the Q&A with investors. Adjusted for Australia, turnover at Nuance turned from CHF2,095 million to CHF1,608 million, while adjusted EBITDA was CHF156 million from CHF131 million.

Excluding Australia, Dufry will contribute 69% of turnover and 77% of EBITDA to the new group, with Nuance accounting for 31% and 23% of these numbers respectively.

Speaking about Sydney Airport’s duty free contract (heavily loss-making for Nuance), Díaz said: “We will participate in the tender and try to do it [renew] but not at the same level as today. It will only be possible to continue if we can reach the level of returns we are targeting for the business and improve the [financial] conditions. The multiples we have worked out are based on the assumption of new terms.”

Asked how he sees the rest of the Nuance network and its prospects, Díaz said: “The concession portfolio is very stable with an average of 6.5 to seven years. We do plan to reorganise some of the concessions if they are not profitable. In these cases we will try to reach the level of profitability that we expect, and if we do, we will keep the concessions. If the concessions do not participate in the levels we expect, we will close them down.”

Diaz concluded: “This is the most attractive acquisition [yet] in terms of value creation for our shareholders. We are confident that we will achieve the synergies in the time period mentioned or in an even shorter period as with previous acquisitions. Creating value is the most important reason for this acquisition and we believe it will be EPS cash accretive in 2015, and double-digit cash accretive in 2016 and after that.

“We are focused on being the leader in this industry, not because we have to be the leader – that is just a tool – but because we are focused on being the most profitable and valuable company in the business. As market leader we can deliver value in terms of competition worldwide – we are one of the few global companies in this business – and also in terms of our relationships with suppliers.”

UPDATE 16.40 GMT

In related news, to help fund the acquisition, Dufry has announced the launch of an offering of up to CHF275 million Mandatory Convertible Notes (MCN), due on 18 June 2015. These are convertible into ordinary registered shares of Dufry to be issued by Dufry Financial Services B.V. and to be guaranteed by Dufry AG.

Dufry said: “The net proceeds of the issue will be used to fund in part the recently announced acquisition of The Nuance Group. In addition, Dufry intends to call an EGM on 26 June 2014 to obtain shareholder approval for an ordinary capital increase to raise approximately CHF725 million with pre-emptive rights.”

The MCN Offering is being made to institutional investors only, outside the USA, Australia, Canada and Japan, in offshore transactions.

The Mandatory Convertible Notes due on June 2015 will be issued at 100% of the principal amount in denominations of CHF200,000 per note. The MCN is expected to pay a coupon in the range of 2.0% and 2.75% per annum.

All day on Wednesday, our Moodie Live rolling news service has featured reaction to today’s huge story. Click here for the full feed.