INTERNATIONAL. On Tuesday 7 March, global travel retail powerhouse Dufry announced a +76.1% organic growth rate in turnover to CHF6,878.4 million (US$7,396.5 million) based on constant exchange rates for 2022, as reported.

The company said it had delivered its financial targets, including core profit of CHf106 million (US$112.6 million) from a CHF236.2 million loss a year earlier.

The results, in line with expectations, were driven by robust demand for travel following the lifting of restrictions across most geographies, Dufry said.

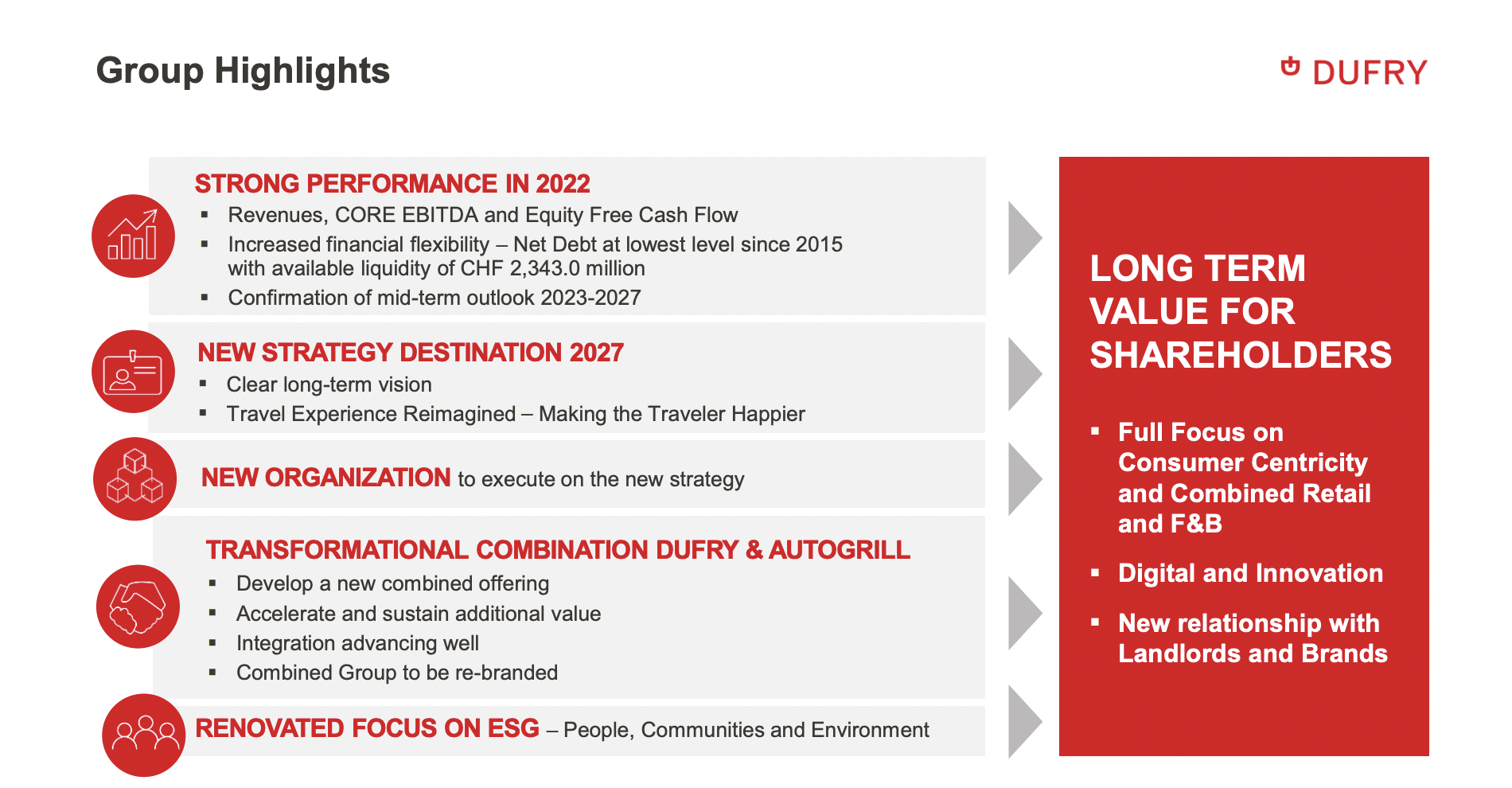

On an investors call that followed the results announcement, Dufry Group CEO Xavier Rossinyol began by expressing five core messages based on performance in 2022, Dufry’s updated strategy and the market environment.

“Number one, we were ahead of our own expectations in turnover in core EBITDA and equity free cash flow. We also have had a very successful refinancing a few months ago, which gives us a strong financial position with the lowest net debt level in absolute terms since 2015, and are already ahead of our financial covenants for 2023.

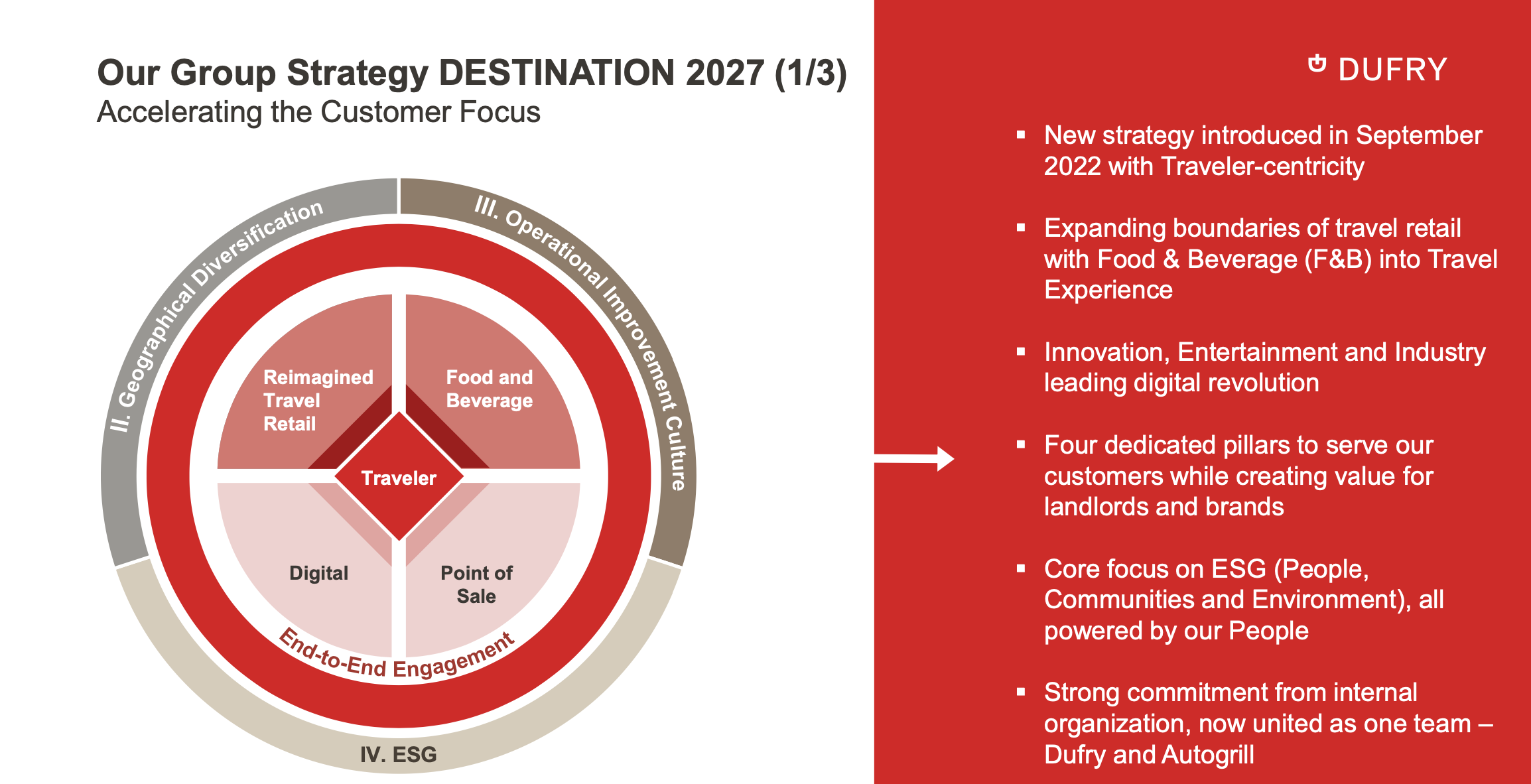

“Second, we have a clear long term vision. We presented our ‘Destination 2027’ strategy in September, and we are already implementing it to create a full ‘Travel Experience Revolution’.

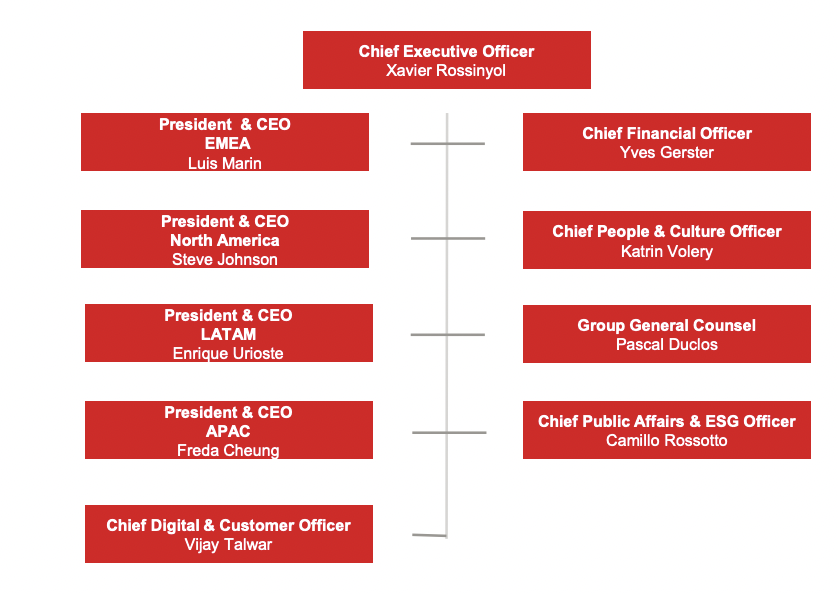

“Third, we have announced our new organisation with new senior management in line with the new strategy.

“Fourth, we are also advancing slightly ahead of plan in the transformational combination between Dufry and Autogrill. The whole purpose is to accelerate our value generation through this combination. We confirm all the targets we announced and that the new group will be renamed and rebranded to reflect the scope of business we have, after the Summer.

“Fifth, we renovate our commitment to ESG and all that means for our people, environment and our communities.

“We do all that to generate long-term value for our shareholders thanks to this consumer-centricity, thanks to this digital and innovation focus and through establishing a new type of relationship with landlords and brands, [focused] on creating more value and not necessarily only talking about how we share the existing value.”

Early 2023 performance

Dufry turnover year-to-date (through February) in 2023 is just -3% behind the same period in 2019, said Rossinyol. Organic growth is up +71.3% year-on-year compared to 2022.

“We have seen demand driven by leisure travel but corporate travel is also coming back,” he added, commenting on the drivers of performance in 2022 and continuing for 2023. The average level of store opening in 2022 was 80-84%, with close to 100% expected across the board for 2023.

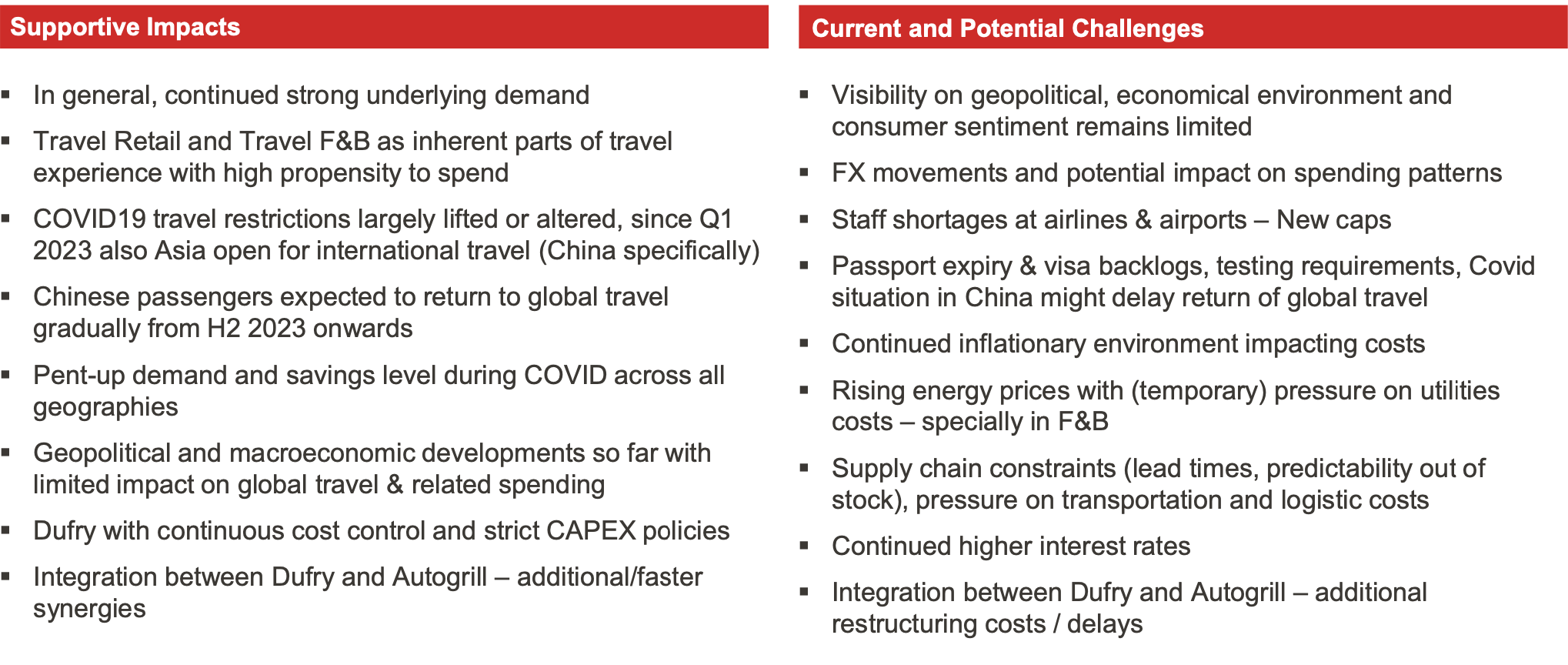

On the big picture, he said: “In general, we see continued strong underlying demand, and that travel retail and travel F&B are seen as inherent parts of the travel experience with a high propensity to spend.

“The lifting of the restrictions in Asia Pacific and in particular in China are definitely good news. It will take some time, because now Chinese travellers need to get visas and passports renovated. So it will take some time and not come overnight. But for the last half of the year we believe this will have a very strong supportive effect not only in Asia Pacific but also in some key locations in Europe and North America.”

On the major challenges, Rossinyol highlighted those linked to “geopolitical and macroeconomic situations”. He also noted the impact of inflation, staff shortages, visa and passport backlogs, energy prices, supply chain constraints and higher interest rates as potential issues affecting the business.

‘Traveller-centricity’

Rossinyol also commented on the integration with Autogrill and offered an update on the vision behind the new combined business.

“We need to make sure we focus more on the needs and the desires of the traveller, to increase our expenditure per passenger, which will have not only a positive effect for us as a company, but also in our relationship with the airport. We need to build a company which clearly differentiates from the competition and we believe that the combination of travel retail and F&B is instrumental here.”

He added that the new management group represents “the best of the two teams”. Importantly, he pointed to the strong accountability placed on each region to manage its P&L and business development.

“EMEA, North America, Latin America, Asia Pacific: it’s the first time some of the regions are part of the group Executive Committee and report directly to the CEO, showing the importance we give to those areas. And each of those responsible has relevant background to those geographies.

“We also have a new Chief Digital Customer Officer (Vijay Talwar) with relevant experience on transforming brick and mortar organisations into digital organisations. Our strong global functions will allow the regions to focus on the day to day of the business and at the same time to guarantee that we can generate synergies.”

On how the ‘Destination 2027’ strategy is taking shape, Rossinyol said the group had introduced 70 brands in the past six months to address new customer profiles it identified as relevant under the new strategy.

Piloting new stores though data

He also that six new pilot concept stores were being introduced from this month using data “to define how the store is organised, the assortment, the pricing and even where the salespeople will be in the store.”

He added: “We will do the cost benefit analysis on these and then decide how we roll them out.”

With technology improvements such as self-checkout, the company target is to reach 750 shops in North America alone in 2023 to deliver added consumer convenience, boost spend and lower the cost base.

On people and culture across the combined group, there is now one global HR portal, designed as an internal communication tool and learning platform. An ‘Internal First’ initiative allows candidates from within the group to view new roles first.

Innovation is also top of mind, said Rossinyol. “We are working on a travel retail innovation lab and we will leverage the innovation labs that Autogrill has in F&B.”

The combined group is already serving 2.3 billion passengers a year across travel channels, representing an opportunity for a “totally different engagement with travellers”.

Opportunities exist, added Rossinyol, in cross-selling, mixed formats between F&B and retail, more touchpoints with the consumer and further opportunity for business development.

He added: “We also have overlap in certain geographies, but in other geographies, one of the two companies [Dufry and Autogrill] has experience or know-how that can be used to bring the other company into those markets. And something even more important, in some cases, one of the two business segments is too small, but the combined business has an opportunity to enter markets that in the past were not addressed.”

Reducing risk through diversification

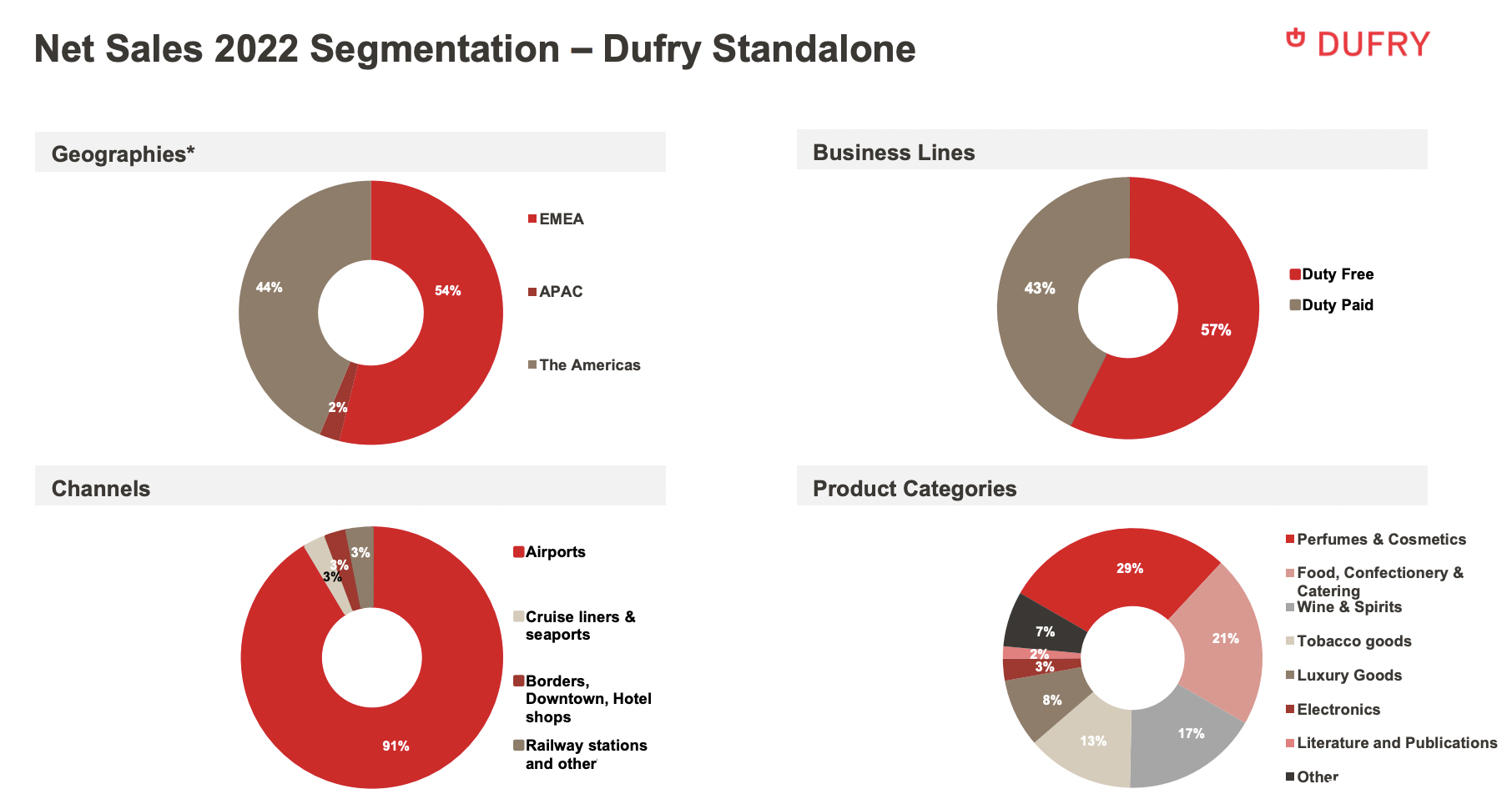

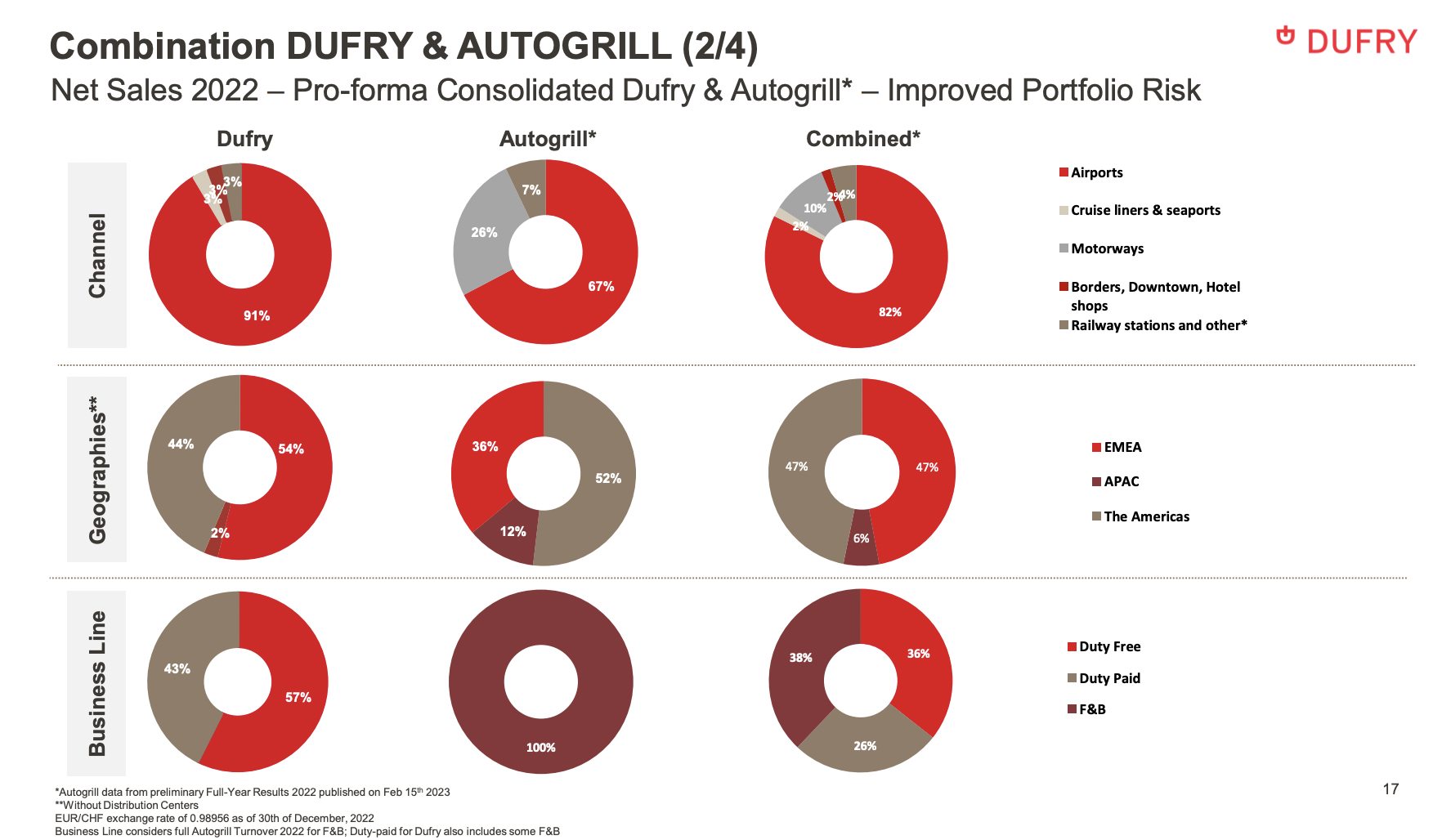

Crucially, said Rossinyol, the combined company carries “reduced portfolio risk” as it operates over 1,000 contracts worldwide. Airports represent over 80% of the business but the other 20% is split across rail, motorways, cruise and seaports plus other channels.

Importantly too, the business is now split almost equally between duty free, duty paid and food & beverage. “This is a diversified portfolio also against potential regulatory change.” Also each region in future will manage all aspects of the business (retail and F&B) in that region.

China recovery

Addressing the question of recovery of Chinese outbound travel, and whether domestic spend might be displaced to international markets, Rossinyol said: “It is not easy to answer. Common sense says that if Chinese travellers have options outside China when they could basically only travel to Hainan, then there should be some movement of the sales between domestic China – and Hainan in particular – and the rest of the world.

“As a foreign company, we cannot operate duty free stores in China and we only have a management and supply agreement [in Hainan]. So we believe part of the flow will go outside. Hainan will remain an important destination, but maybe less so in the future than it was for the last three years.”

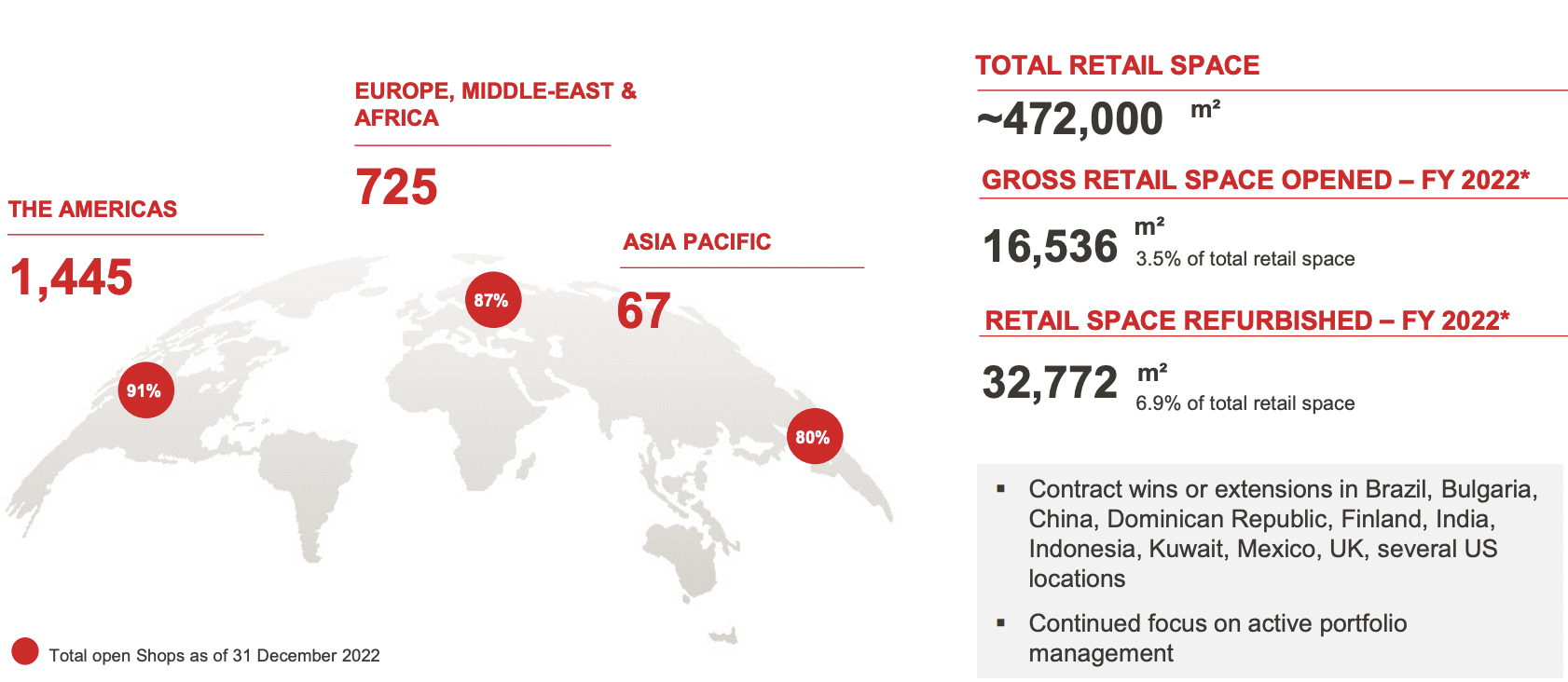

Asked about the group’s plans to expand in Asia Pacific, Rossinyol said: “We have a big commitment to APAC and a new CEO [Freda Cheung] who will take over in the next months after a transition.

“Expansion in Asia will be via organic growth on existing locations, it will be leveraging on some of the partnerships we have like the partnership with Alibaba, it will be new tenders, new joint ventures, and maybe M&A. There are no specific targets on the table right now. We always said that M&A is part of our long-term strategy and Asia is not an exception to that. But right now, we are focusing on the other priorities.”

Digital advances

Addressing digital initiatives, Rossinyol said that the “real breakthrough is going to be when we can launch a digital engagement programme including Dufry and Autogrill, which hopefully will be done later in the year.

“For now what we are doing is to build the technology first. Second, we are adding some external partners. We have seen that in order for any loyalty or engagement programme with consumers to make a difference, it cannot only be giving a discount on our product, but it needs to be something that we offer different from the competition.

“Third, we now finally see some positive effects of the collaboration with Alibaba. And some of the key platforms they have particularly addressing Chinese travellers will be also embedded in our digital platform recruiting.”

New industry landscape

Asked about airport reaction to the combined Dufry-Autogrill offer across retail and F&B, Rossinyol said: “There are a few airports and a few landlords that are neutral. And then there are some that are already extremely enthusiastic about the possibilities to offer something innovative and different to their passengers.

“We are convinced that we will see some hybrid concepts enter into new markets of one of the two businesses over the next few months. So we will make the integration tangible in the short term. We always said this integration would take years, not months. But the first reaction of some airports is very positive and we are working on some opportunities.”

Concessions and profitability

On the plan to improve the profitability of its concessions base, a key element in Dufry’s updated strategy, Rossinyol referred to the group plan of “active portfolio management”.

“We are in the business of making money. We see airports or other landlords as partners. And therefore we believe both parties have to make the necessary amount of money. We believe that discipline on tendering is of the essence today and going forward. I still believe we can increase our market share in several markets, but only under the premise that it will be a proper return on investment on those concessions.”

More generally on the bidding environment, Rossinyol said: “This remains a competitive market. But there have started to be signs that not everybody is going to go to bid for anything at any price. A few days ago one player [Gebr. Heinemann -Ed] announced that they will not enter the Spanish tender (see below). It’s encouraging in the sense that not everybody believes they can go anywhere at any price.”

The Spanish airports tender

“Aena is a big piece of our business,” said Rossinyol of the tender for duty free space at 27 Spanish airport conducted by the airports group. “But it’s not an exception to our approach of cost discipline. Therefore we are looking into it, we will make an offer for those parts of the business we believe are reasonable and in which we can get return on investment.

“We will not sacrifice the profitability of the group because one place has always been with us or is traditional or we have some type of sentimental attachment to it.

“This is business and this is about making money in the long term. It is a complex tender with six packages with a lot of things to be analysed and it’s too early to see the level of our interest. But we will commit to a disciplined approach to those financials. Our contract runs until October this year and the tender will be set up between May and June. And by then we will know which part of the business we will retain or we don’t retain.”

Long-term trends

Premiumisation and convenience are among the big picture trends that are dictating the future of the industry, said Rossinyol, when asked about lasting structural trends.

“We think our business will be based on one side on more premium items; in duty free, there is a clear premiumisation across all our key suppliers. Also we believe convenience is going to be more and more about fast transactional time, and that self-checkout and avoiding queues is key for that segment.

“In F&B it is a bit of both. There are sub-segments in F&B that could bring additional value. And we think also transactional time, for example being able to order on your device versus having to call the waiter is also something that can bring additional value.

“As a retailer you need to adapt. And that is what we are doing with this combination. F&B is a very important segment, and luxury sales are important too.

“Some of the highest expenditures on luxury are from Chinese and they are coming back to travel so we should see an uplift there.

“But again, if the trend is luxury, we will offer more luxury, and we see that premiumisation in beauty, in wines & spirits as a mega trend and that is good for our business. But likewise, we need to offer F&B or convenience often to the same passenger. The name of the game is to adapt our offering to whatever are the needs of the passenger. With the Chinese definitely that means more luxury when they come back.”

The outlook for 2023

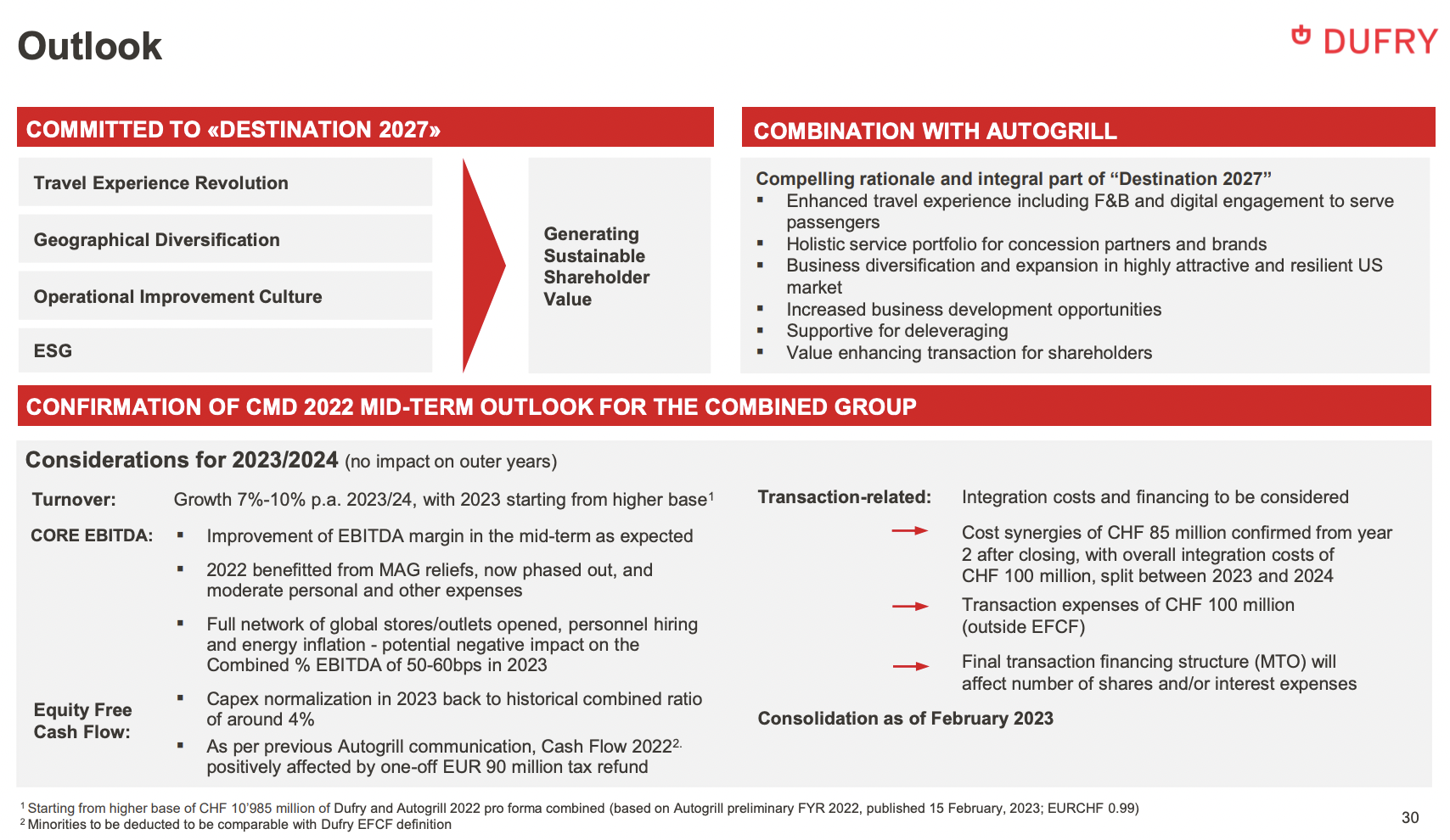

On the period ahead, CFO Yves Gerster commented on the projection of a 7-10% rise in turnover in 2023/24, based on the pro forma combined sales number of CHF10,985 million in 2022.

The group also aims to maintain “robust” profitability levels. Gerster said: “We have already achieved the 75 to 100 basis points margin improvement that we have initially expected only for 2023. So we even went beyond that with our reported 8.8% EBITDA level.

“On the cashflow side we will return to historical levels of 4% capex for the combined group.”

Rossinyol later added: “The year has started strongly and all we see so far is encouraging. The comparables will be more difficult in the second half for obvious reasons. And we should remember that for travel retail, 2022 was the longest Summer with a lot of leisure demand moving from September even to late October.

“We see positive trends, such as the opening of China, which is good news for us from London to our operations in Canada. On the other side, we don’t know if the Summer will stretch as long as it did last year.”

Asked whether Dufry would remain based in Switzerland post-merger, Rossinyol said: “We are a Swiss company and we remain committed to Switzerland. I do believe that what we need is to focus on delivering the Travel Experience Revolution. Like any modern company we have expertise in different areas across the world, and we need a structure that reflects our global complexity.

“On the new logo and brand, we have hired an expert and they are doing their research. We will see in due time [how that looks].