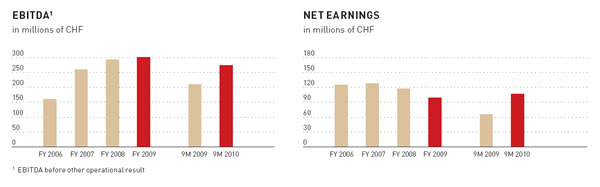

INTERNATIONAL. Dufry Group today reported a strong set of results for the first nine months, with turnover increased by +16.1% at constant exchange rates, of which organic growth accounted for 10.7 percentage points of the increase. EBITDA grew by +20.5% at constant rates and net earnings increased by +65.5% reaching CHF107.9 million (US$109.4 million) in the period.

Turnover measured in Swiss Francs grew by +11.7% to CHF1,966.2 million (US$1,995 million) during the period. As well as the contribution of double-digit organic growth, new projects added 5.4% while the foreign exchange impact of translating into Swiss Francs was negative by 4.4%.

|

“The rebound of passenger numbers this year as well as the continuous improvements in our retail operations were the main drivers for an excellent performance“ |

Julián Diaz Chief Executive Officer Dufry Group |

Gross margin continued to improve by 1.4 percentage points to 57.2% in the first nine months of 2010 from 55.8% one year ago. In absolute terms, gross profit reached CHF1,124.5 million (US$1,141 million) for the first nine months of 2010 compared to CHF982.1 million for the same period in 2009.

Dufry said: “The implementation of the global negotiation with suppliers, alongside the continuous growth and the further development of initiatives started in 2010 as part of the “˜Dufry plus One’ project all contributed to the increase in the gross margin.

In Swiss Franc terms, EBITDA grew by +15.3% to CHF253.4 million (US$257 million) compared to CHF219.7 million for the respective period in 2009. EBITDA margin improved by 0.4 percentage points to 12.9% compared to 12.5% for the relevant period in 2009.

Dufry Group CEO Julián Diaz said: “For the third consecutive quarter, Dufry was able to deliver double digit organic growth and a set of strong results. The rebound of passenger numbers this year as well as the continuous improvements in our retail operations were the main drivers for an excellent performance.

“In terms of implementing our strategy of profitable growth, productivity gains and operational improvements remain important elements and our initiatives “˜Dufry plus One’ and “˜One Dufry are on track and have started to contribute. These are ongoing projects and we want to implement a lot more in the coming 18-24 months to further add value to our business.

“Going forward, passenger growth is expected to remain solidly positive with independent industry research forecasting growth rates of 4%-5% in the coming years. Overall, emerging markets are expected to show a more dynamic growth and we will continue with our strategy to develop this part of the business, in which we already generate 60% of our turnover.”

Selling expenses reached CHF441.1 million (US$447 million) or 22.4% of turnover in the period ended September 30, 2010. The level of concession fees continued to be in line with the previous quarters of 2010, and selling expenses for the half year period 2010 were 22.1%. Compared to last year, the increase in selling expenses was mainly due to the start-up of a number of new concessions, and the impact of certain locations.

Personnel expenses and general expenses were stable compared to last year when measured as percentage of turnover. Personnel expenses remained unchanged at 15.2% while general expenses nudged down to 6.6% of turnover versus 6.7% in the first nine months of 2009.

Depreciation and amortization amounted to CHF94.0 million (US$95 million) for the first nine months of 2010 compared to CHF91.9 million in the corresponding period of 2009.

EBIT in the first nine months of 2010 increased by +24.6% to CHF149.5 million (US$151 million) compared to CHF120.0 million in the respective period of 2009.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

As noted, net earnings (before minorities) increased by +65.5% to CHF107.9 million in the first nine months of 2010 versus CHF65.2 million in the respective period of 2009. Net earnings to equity holders almost tripled to CHF83.5 million (US$84.7 million) in the first nine months of 2010 compared to CHF28.3 million in the same period of last year, bringing the core earnings per share to CHF4.68 in the current nine month period versus CHF2.65 last year.

Dufry’s strong cash generation continued in the nine month period to September 30, 2010. Net cash flow from operating activities reached CHF227.3 million (US$230.6 million). Excluding the investment in net working capital, which was driven by Dufry’s top-line growth, operating cash flow before net working capital changes was CHF259.2 million compared to CHF237.1 million in the same period of last year.

Capex for the period stood at CHF66.2 million (US$67.1 million), compared to the CHF50.1 million registered in the first nine months of 2009. Net debt came to CHF650 million (US$659 million) as of September 30, 2010, CHF67 million lower than the CHF717 million recorded at June 30, 2010.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

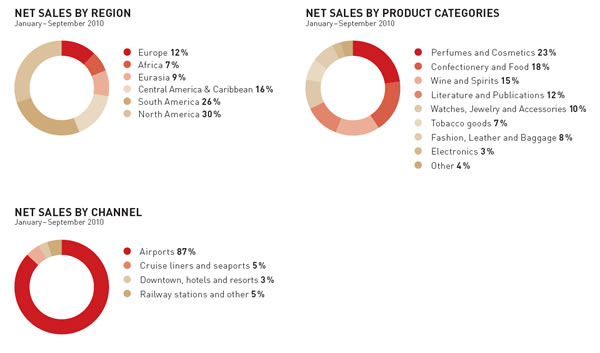

Development of Turnover by Region

Region Europe’s turnover at constant exchange rates grew by +7.0% in the first nine months of 2010 compared to the same period in 2009. Translated to Swiss Francs, turnover was CHF240.8 million (US$244 million) versus CHF241.6 million one year ago. Performance in the third quarter improved due to the Italian operations that saw double digit growth. Turnover growth was driven by the operations at Milan Malpensa airport and by the roll out of the Hudson News concept in various railway stations in the country.

Region Africa registered +3.8% growth at constant rates. In absolute terms, turnover was CHF139.3 million (US$141.3 million) in the first nine months of 2010 compared to CHF144.7 million for the same period in 2009. The Tunisian operations had a solid performance and especially the Moroccan business performed very well. Egypt has also seen a dynamic development in recent months.

In Region Eurasia, turnover grew by +4.2% at constant FX rates. In Swiss Franc terms, turnover reached CHF173.7 million (US$176.2 million) in the first nine months of 2010 compared to CHF172.7 million in the same period last year. The development of the duty paid operations in Shanghai, which Dufry opened in March this year, is on track. On the other hand, Dufry’s repositioning at Singapore airport, with the closing down of certain shops and the focus being on duty paid convenience stores under the Hudson News brand, have led to a decrease in turnover in that location.

Turnover of Region Central America & Caribbean registered an increase of +11.1% at constant FX rates. Translated in Swiss Francs, turnover for the period was CHF301.3 million (US$305.7 million) in comparison to CHF282.1 million in the first nine months of 2009. The English-speaking Caribbean continued to show certain performance improvements and the remaining Caribbean business performed well in general. The positive development in Mexico up to August 2010 saw a setback in September due to the bankruptcy of Mexicana, one of the two incumbent airlines.

Region South America achieved turnover growth at constant FX rates of +44.0%. In absolute terms, turnover increased to CHF519.9 million (US$527.6 million) in the first nine months of 2010 from CHF372.9 million in the same period last year. On top of a very strong development of passenger numbers, Dufry’s Brazilian operations continued to benefit from several initiatives that were implemented earlier this year, such as new ways of payments, aimed to increase spend per passenger including innovative promotions and sales incentives programmes.

Turnover of Region North America at constant FX rates grew by +12.1%. Measured in Swiss Franc, turnover amounted to CHF578.0 million (US$586 million) for the first nine months in 2010 compared to CHF530.7 million in the first nine months of 2009. The Hudson News business continued its positive organic growth trend as did the other operations in the US. This was further supported by an active development of the concession portfolio in the country.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

Growth momentum

The company said: “During the first nine months of the year, Dufry has taken advantage of the positive trends in the travel retail industry: growth in passenger numbers and a recovery of consumer confidence. Despite the growth rates expected to moderate from the last quarter 2010 onwards due to the comparables being stronger, expectations by industry experts remain positive. Global passenger growth in the short- and medium-term is forecasted to be in the 4-5% range, and long term prospects for the travel retail industry are forecasted to grow by +130% until 2020, which represents a compounded annual growth rate of almost +9%. Dufry is determined to capture these growth opportunities.

“From a more macro point of view, the other development that has become very apparent in the last quarters is a shift of the global economic development towards emerging markets. Although in the travel retail industry developed markets have performed positively, emerging markets have shown substantially stronger growth dynamics.

“These trends are likely to be structural and Dufry’s strategy since 2004 focusing on tourist destinations and emerging markets has captured exactly this trend. With more than 60% of its turnover stemming from emerging markets, Dufry has today a significant exposure to these fast growing regions and also has the expertise and capacity to grow this further.

“In addition to accelerating top-line growth, Dufry will work hard to further improve the efficiency of its operations to drive overall profitability. The initiatives “˜Dufry Plus One’ and “˜One Dufry, which Dufry launched earlier this year, are starting to show first results and should increasingly contribute to profitability in 2011 and 2012.

“The merger of Dufry AG and Dufry South America, completed in the second quarter of 2010 has had a very positive impact on Dufry’s investment case. Thanks to the higher free float, simplified corporate structure and the significantly increased liquidity in Dufry’s shares, Dufry has been able to put itself on the radar screen of a new segment of investors focusing on emerging market or global corporates.”