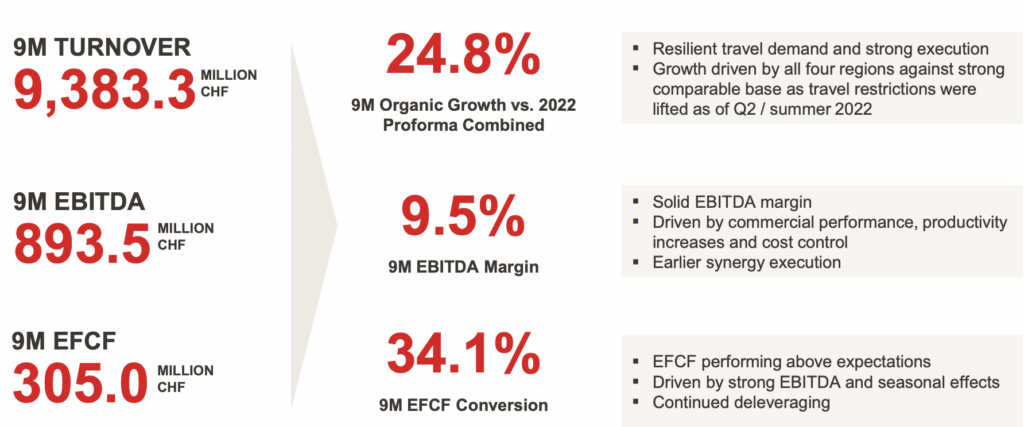

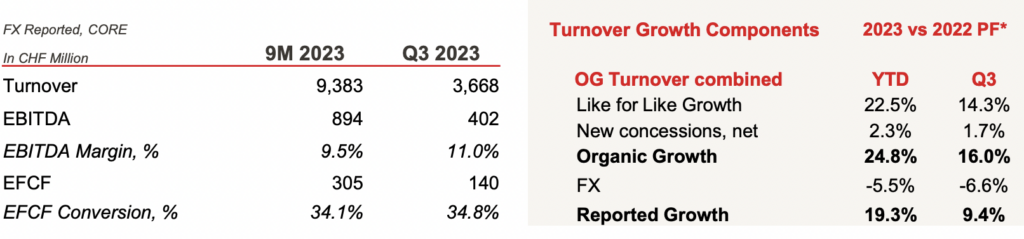

INTERNATIONAL. Dufry (about to become Avolta) today reported its latest interim results, with core* nine-month turnover (combining Dufry and Autogrill performance) reaching CHF9,383.3 million (US$10,378 million) up +24.8% in organic terms. Q3 turnover hit CHF3,668.1 million (US$4,057 million), up by +16% year-on-year.

Core EBITDA in the nine months reached CHF893.5 million (US$988.2 million) with a 9.5% margin. In Q3 the figure was CHF401.7 million (US$444.4 million), resulting in an 11% margin. Equity Free Cash Flow (EFCF) reached CHF305 million (US$337.4 million) in the first nine months.

The company said the integration of Autogrill was “advancing successfully, with full run-rate synergies of CHF85 million as of 2024 and in-year synergies of CHF30 million already in 2023”.

Dufry Group CEO Xavier Rossinyol commented: “Our Q3 2023 Trading Update will be the final set of results shared under the name Dufry Group – pending the approval of our shareholders at tomorrow’s EGM, the Dufry-Autogrill business combination will take the next step forward and become a visibly unified company under our new name Avolta, more than the sum of its parts.

“The delivery of Q3 and nine-month 2023 figures driven by robust demand, strong execution and the broadest portfolio in the industry, paired with continued cost management and earlier synergy implementation, openly demonstrates the resilience of our combined company. We have successfully advanced on the integration, with our rebranding to Avolta as the final step, generating full run-rate synergies of CHF85 million already as of 2024, one year ahead of plan.

“Should our current performance continue through the last quarter, we project a full year 2023 organic growth of around +20% versus the previous year turnover for the proforma combined business of CHF10,805 million. Having a translational effect on our growth, the devaluation of relevant currencies against our reporting currency, Swiss Francs, is expected to impact growth by around -5% to -7%.

“Based on this, FY 2023 reported growth is expected to be around +15% versus the previous year for the proforma combined business. As a translational effect, this does not impact on EBITDA margin or cash conversion. We further expect to report an improved Core EBITDA margin of 8.5% to 8.7% and an improved EFCF of CHF270 million to CHF290 million.”

He added: “Set in line with our Destination 2027 strategy, our capital allocation policy aims to realise profitable growth, stable cash flow and value creation for our shareholders. As we seek to strike a balance across deleveraging, growth and returns to our shareholders, we will use two-thirds of EFCF for deleveraging, relevant business development and small bolt-on M&A.

“Deleveraging remains a focus point and we are targeting a leverage of 1.5-2.0x net debt/Core EBITDA, with a maximum of 2.5x after relevant business development or small bolt-on M&A, with the aim to return to target. Further on this, one-third of the group’s EFCF will be allocated to dividends.”

The company also reported a strong start to Q4. It said: “With a footprint spanning 75 countries, Dufry has continued to see strong demand for travel retail, essentials and travel F&B despite recent geopolitical tensions and challenges described by other discretionary spending categories, not comparable to Dufry’s business.

“The company estimates October core turnover performance of +14.6% versus 2022 and of +7.9% versus 2019 (both in constant FX, proforma combined).

Q3 regional performance

Reported turnover in Europe, Middle East and Africa (EMEA) amounted to CHF2,089.4 million,with core turnover reaching CHF2,002.1 million in Q3 2023, resulting in proforma combined organic growth of +12.3% year-on-year.

The EMEA region’s performance was largely driven by leisure demand, benefiting holiday traffic destinations in Southern Europe, Middle East and Africa in both travel retail and F&B.

Best-performing locations included leisure destinations in the Mediterranean. In addition, the UK, Nordics and Central Europe benefitted from increasing international inbound travel – including returning travellers from Asia Pacific.

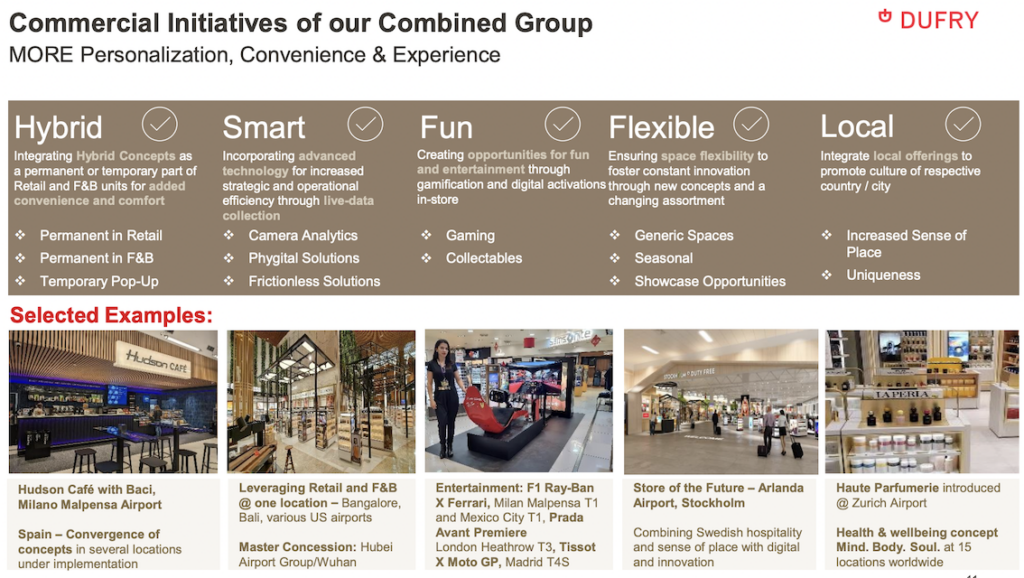

The company noted: “During Q3 2023, Dufry had new openings or significant upgrades in several relevant locations, including for example its innovative Haute Perfumery concept, opened in Zurich or the opening of the new Debonair Food Hall in Palermo Airport. Significant refurbishments include the grand opening of the Next Generation store at Stockholm Arlanda combining Swedish hospitality and sense of place with digital and innovation. Among one of the first new hybrid concepts, Hudson Cafè with Baci was opened at Milan Malpensa Airport.”

North America turnover stood at CHF1,081.3 million in Q3 2023, with organic growth versus 2022 proforma of +11.1%. In the US, both F&B and travel retail businesses continued with robust growth “supported by traffic trends and solid demand from domestic and international”.

Canada benefitted from some early return of Asian travellers during this period. In retail, a number of stores were opened at Las Vegas Harry Reid International Airport in connection with Dufry’s contract extension through 2038.

In the modernised international Terminal E at Boston Logan International Airport, store openings included several duty free shops as part of Dufry’s recently awarded 12-year duty free contract. New specialty retail stores also opened at New York JFK International Airport.

Additionally, the Group was awarded a 15-year travel convenience contract for Fresno Yosemite International Airport in California.

In F&B, US openings included dining venues at Jacksonville International, Fort Lauderdale-Hollywood International, Birmingham-Shuttlesworth International, Charlotte Douglas International, Hartsfield-Jackson Atlanta International, Salt Lake City International, San José Mineta International, Orlando International, Chicago O’Hare International and Las Vegas Harry Reid International airports.

Latin America turnover came in at CHF421.9 million in Q3 with organic growth year-on-year proforma of +27.8%. Best-performing markets were Argentina, positively impacted by local currency developments, as well as Mexico and the Caribbean, benefiting from leisure demand.

Brazil continued to improve as more international traffic returned. The cruise line business progressed further. New or extended concessions in this region included Vitória Airport where Dufry opened its new duty paid store, after signing a ten-year contract, and new openings in Argentina and Jamaica. In addition, Dufry signed a 20-year contract to operate a duty free store at the General San Martin international bridge, the main crossing point between Argentina and Uruguay.

Asia Pacific saw a significant improvement from the previous year’s low base, driven by domestic, intra-regional and gradually returning inbound and outbound international travel.

The region reported turnover of CHF134.8 million in Q3 2023 with organic growth proforma up by +44.8%.

The company said: “While Chinese outbound travel continued to be impacted by air capacity constraints, demand from other nationalities to travel within the region as well as internationally became increasingly evident, in addition to strong domestic demand.”

New, newly opened or extended concessions within the region included the seven-year extension at Kuala Lumpur International Airport for F&B, the grand opening of retail and F&B operations at Bali Airport and the announcement that Dufry has formed a joint venture with Hubei Airport Group to operate Wuhan Tianhe Airport’s Terminal 2 as master concessionaire for retail and F&B.

Dufry opened new retail stores at Bangalore International Airport, India where the company has a joint venture for 15 years to operate duty free shops, while also operating F&B outlets.

*Core turnover excludes net sales from the motorway fuel business and income from fuel sales included in core other operating income. ✈