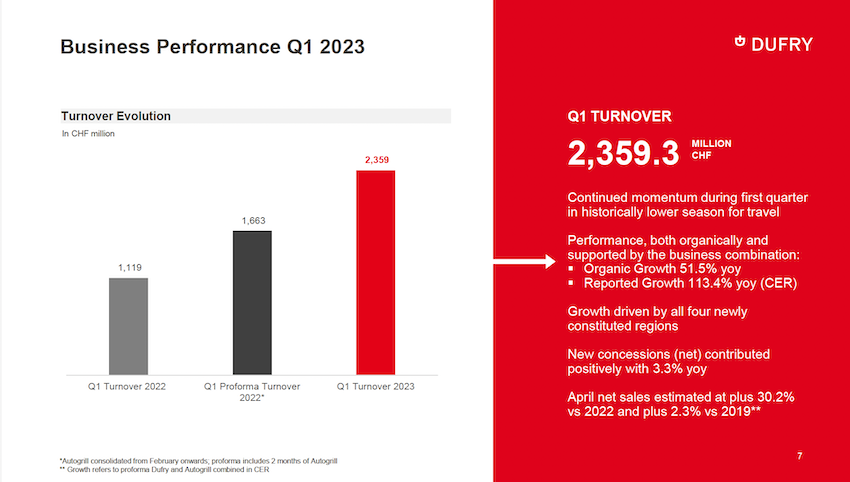

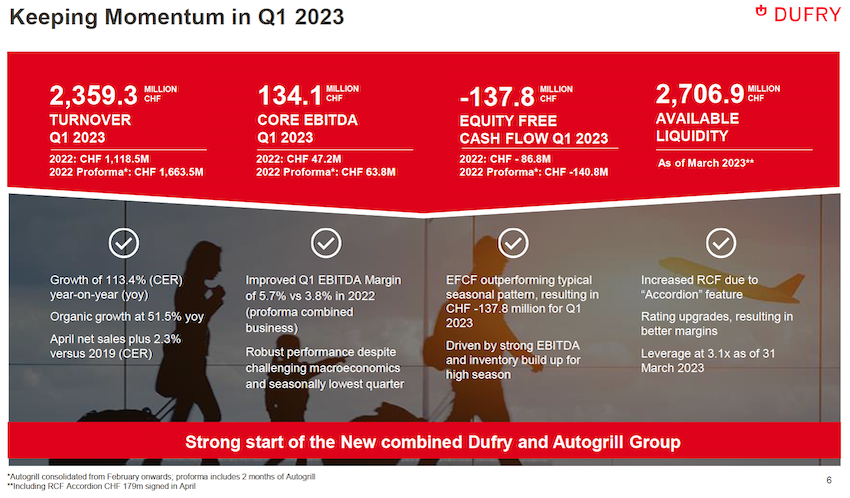

INTERNATIONAL. Dufry – recently combined with Autogrill – has reported continued positive momentum and resilient demand in Q1 2023 with consolidated turnover reaching CHF2,359.3 million (US$2,653 million). This represents turnover growth of +113.4%, with +51.5% organic growth against Q1 2022, which was still impacted by COVID-related restrictions on travel.

New concessions (net) contributed positively with +3.3%. Currency effects on turnover stood at -2.5% for the quarter, mainly related to the performance of the Euro and UK Pound.

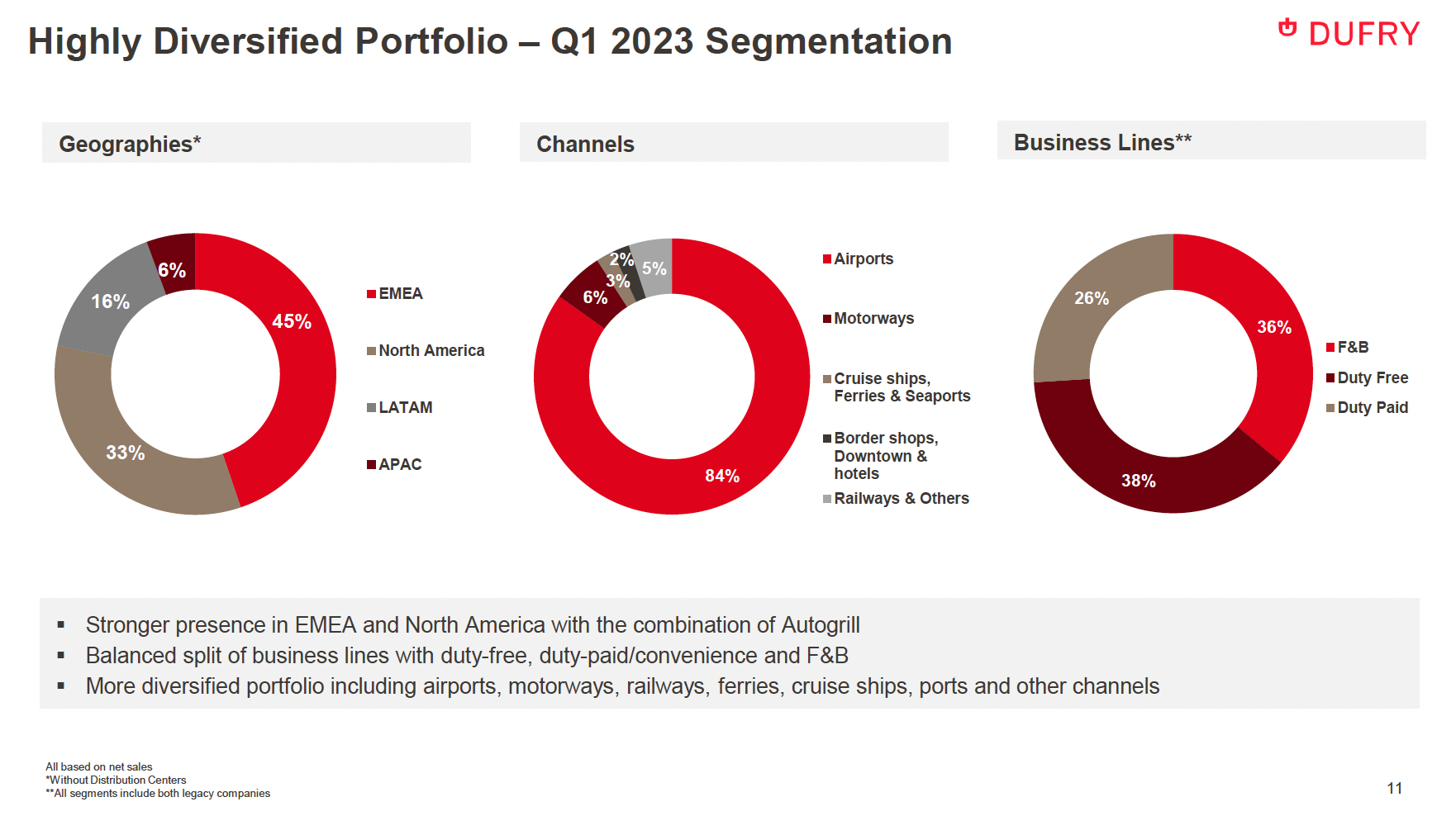

The combined Group continued to benefit from a balanced split of business lines in Q1. Duty free accounted for 38% of turnover, duty paid/convenience for 26% and food & beverage for 36%. The airport channel contributed 84% in a more diversified portfolio including motorways, railways, ferries, cruise ships, ports and other channels.

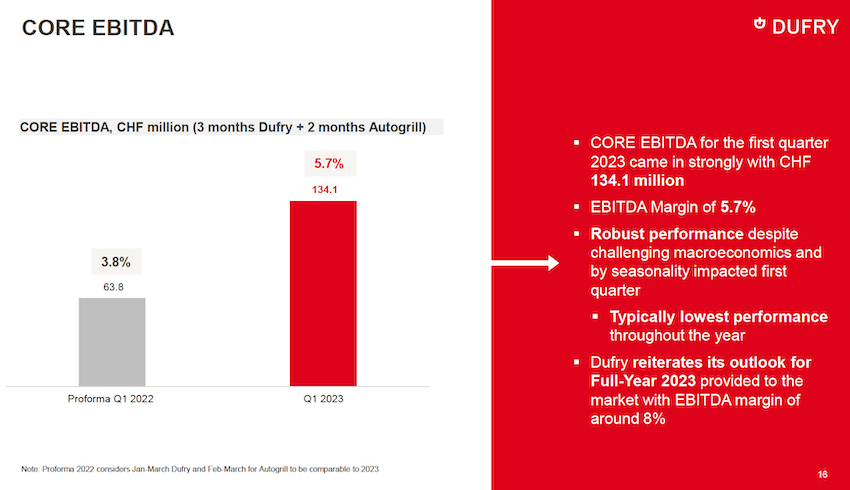

Core EBITDA for the first quarter 2023 came in strongly with CHF134.1 million (US$150.8 million), above the prior year’s levels.

Dufry said the solid performance was driven by strong EBITDA and working capital movements, typical for the first quarter, including inventory build-up in preparation of increased demand across the high season throughout Q2 and Q3. Based on current visibility, Dufry has reiterated its outlook for full-year 2023 provided to the market.

The combined Group’s net debt stood at CHF3,029 million as of end March 2023. Available liquidity amounted to CHF 2,528.4 million, including CHF 1,164.5 million in cash and cash equivalents and CHF 1,363.9 million undrawn debt under the existing Revolving Credit Facility (RCF) at the end of March 2023.

As reported, in April, Dufry employed the RCF’s ‘Accordion’ feature for increased flexibility and to onboard some of Autogrill’s lending banks alongside Dufry’s existing providers.

Dufry Group CEO Xavier Rossinyol commented: “Today is momentous for Dufry, for our people and our investors. This is our first report as a combined Group; Dufry and Autogrill are now one united company, creating value for all stakeholders together.

“In our first quarter as a combined business, working together towards our Destination 2027 strategy, we have capitalised on the continued momentum of the travel sector to deliver CHF2,359.3 million turnover versus CHF1,118.5 million last year.

“This was a solid performance, organically and supported by the business combination. Moreover, April net sales stood at +30.2% versus 2022 for the combined Group and were – at constant exchange rates – tracking ahead of 2019 levels over the past two months.

“We are well positioned for quarter two while we maintain our discipline, both in new business development and in cost and cash management. On an external level, our teams closely monitor any potential geo-political, macro-economic, inflation, operational and airport capacity changes, as well as changes in consumer sentiment, adjusting our course to mitigate risk and take advantage of opportunities.

“With leadership representative of both companies, our teams are on track to generate synergies and new commercial concepts, with initial benefits as early as this year. We are committed to realising our business integration while continuing to deliver outstanding service experiences for our customers.

“This traveller-centric approach benefits more than just our customers, flowing on to our concession, brand and business partners alike.

“Thanks to all members of our Board of Directors for their guidance and steering of the integration process, and in particular to Dufry’s Chairman Juan Carlos Torres Carretero for his vision and tireless support.

“The new combined group has a stronger financial position, lower leverage and more financial flexibility. At the same time, the new shareholder structure benefits our integrated company with a strong core of stable shareholders with strategic and industrial focus, in particular those represented in our Board of Directors, Advent and our largest shareholder Edizione who bring in long-term planning and vision.

“Our thanks go to the Benetton family and our Honorary Chairman Alessandro Benetton for their support, direction and ongoing strategic commitment to our combined Group’s shared future.

“Above all, I want to thank our employees for their extraordinary motivation and hard work. We remain convinced that by revolutionising the travel experience globally, we will continue our growth trajectory and track record of delivery.”

Recent developments

Dufry has continued to see strong demand for travel retail and travel F&B into Q2, which the company said affirms the Group’s confidence in its near-term outlook. The company estimates April net sales performance of +30.2% versus 2022 and of +2.3% versus 2019.

The company said it expects continued positive developments throughout 2023 based on current trading and visibility on consumer behaviour.

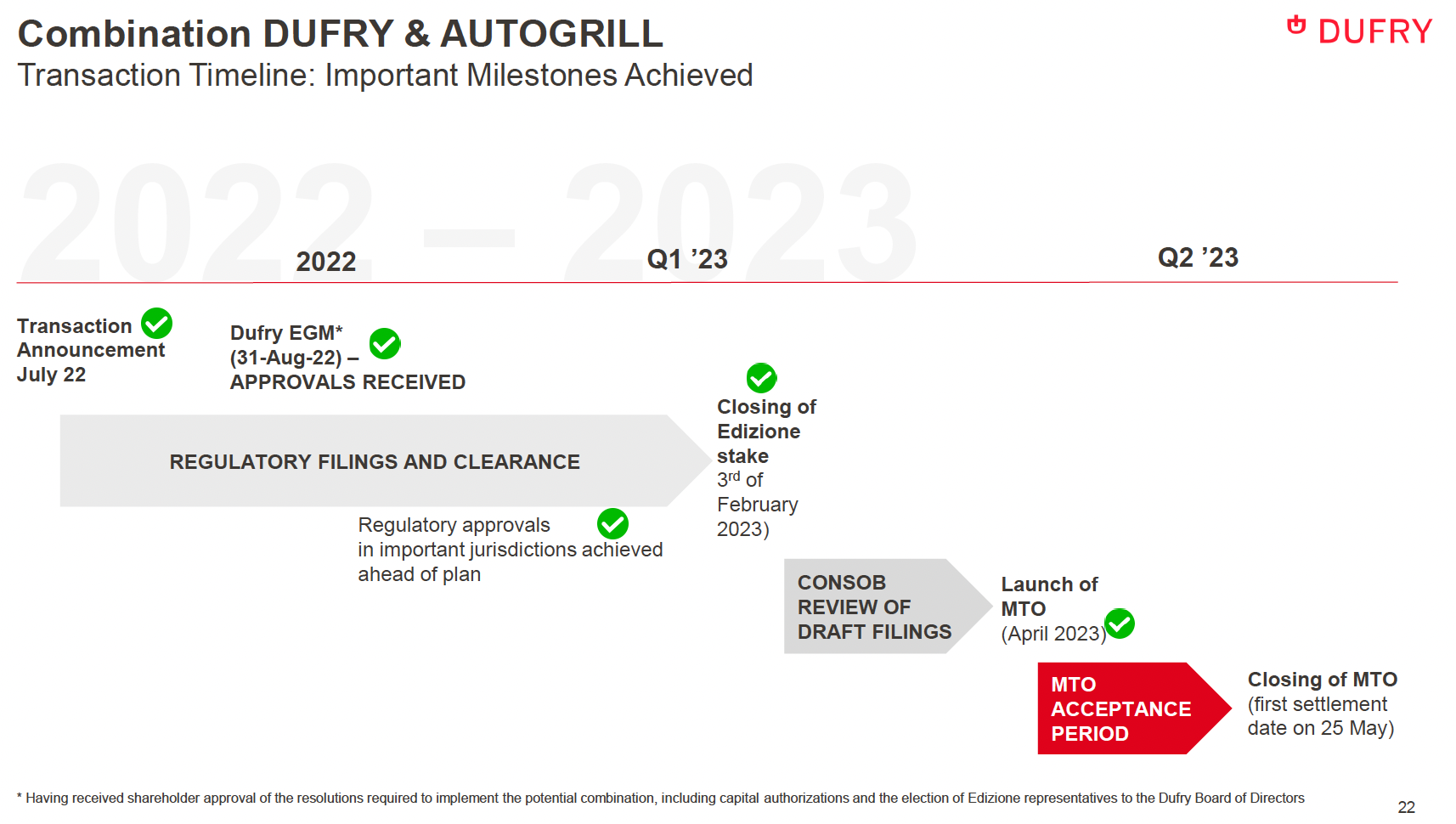

Dufry closed the business combination with Autogrill by transferring the 50.3% stake in Autogrill, formerly held by Edizione, and began fully consolidating the business as of February 2023.

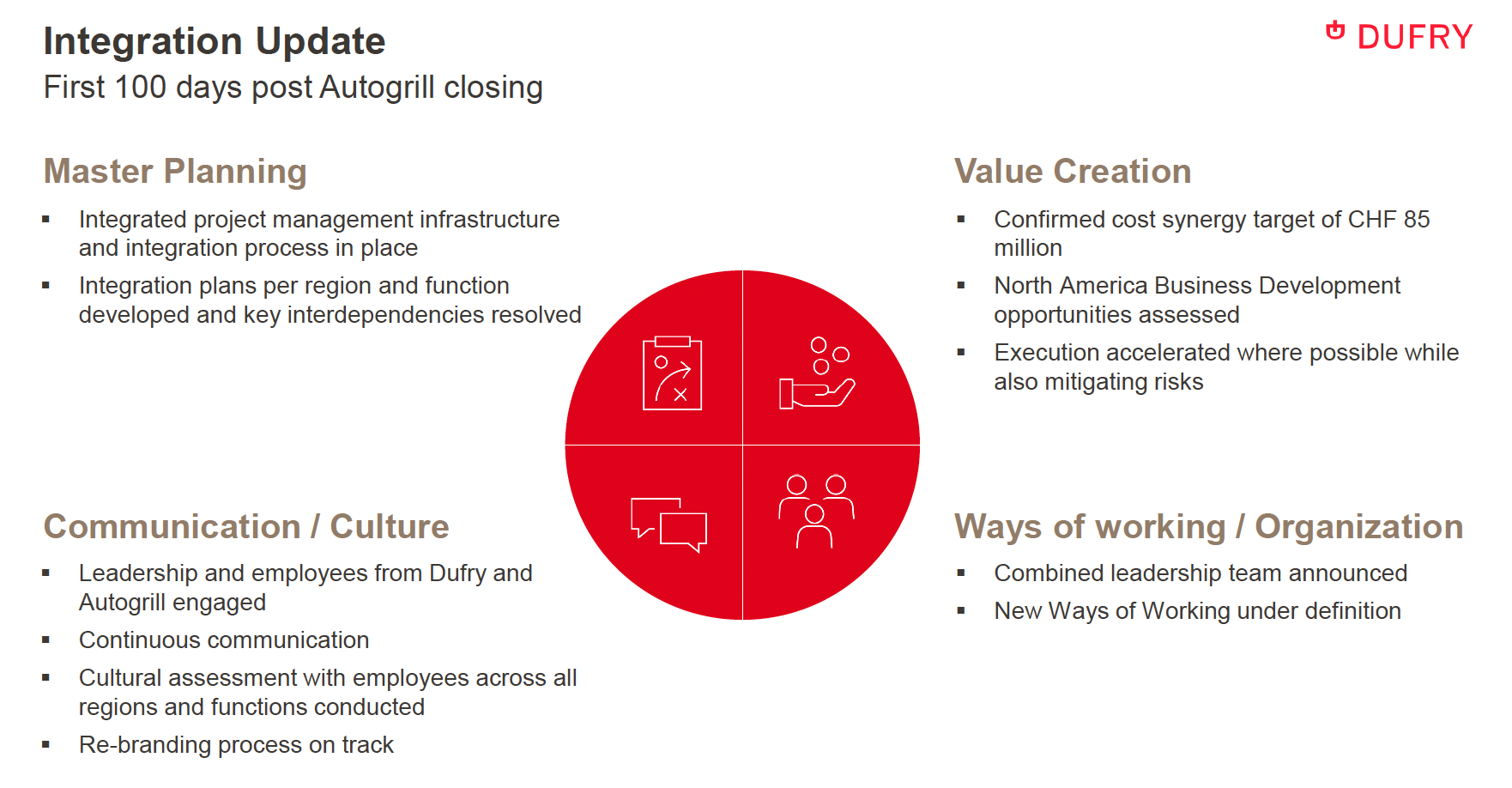

The integration process began immediately with all pre-requisites met to deliver the previously identified expected run-rate cost synergies of CHF85 million. Independently from the fast-progressing integration and pursuant to Italian law, Dufry launched an MTO on the remaining Autogrill shares, with closing expected towards the end of Q2 2023.

The transformative combination is part of Dufry’s new strategy ‘Destination 2027’ to revolutionise the travel experience. In line with its strategy, Dufry formed a new Global Executive Committee, which includes representatives and expertise from both companies.

At Dufry’s Ordinary General Meeting 2023, Dufry’s shareholders voted in favour of Alessandro Benetton (Chairman of Edizione and former Board member of Autogrill), Enrico Laghi (CEO of Edizione) and Sami Kahale to represent Edizione on Dufry’s Board of Directors, supporting the integration and long-term strategy of the combined Group with their knowledge and experience.

As a core pillar of its long-term strategy, Dufry said it continues to focus on strengthening its sustainability engagement. Progress achieved in the period includes advances in its Community Engagement Strategy and related initiatives, diversity & inclusion training and awareness campaigns as well as the roll-out of internal communication channels across the combined Group to engage employees globally.

Regional performance

With the consolidation of Autogrill as of February 2023, Dufry amended its segment reporting to four regions in line with its leadership and management structure: Europe, Middle East and Africa (EMEA), North America (NA), Latin America (LATAM) and Asia Pacific (APAC).

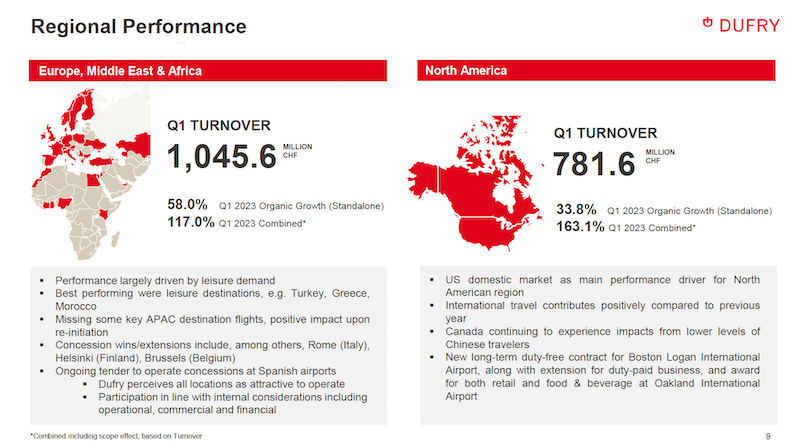

Turnover in EMEA amounted to CHF1,045.6 million in Q1 2023 from CHF505.8 million one year ago. Organic growth versus 2022 was +58%. The EMEA region’s continued healthy performance was largely driven by leisure demand.

Best performing locations for the company included leisure destinations such as Turkey, Greece and Morocco. During Q1 2023, Dufry succeeded in winning or extending retail and F&B concessions at airports such as Helsinki (Finland), and had openings at, among others, locations including Brussels (Belgium), East Midlands Airport and Stansted (UK), Düsseldorf (Germany) as well as across The Netherlands.

North America’s turnover stood at CHF781.6 million in Q1 2023 versus 298.1 million in Q1 2022. Organic growth versus 2022 was 33.8%. Dufry noted that the main performance driver was the strong domestic market in the US, while Canada continued to be impacted by the lower levels of Chinese travellers.

In retail, a new Hudson Nonstop, powered by Amazon’s Just Walk Out technology, opened in Charleston International Airport, bringing the total number of Hudson Nonstop stores to eight, and five stores were opened in the brand new Newark Liberty International Airport Terminal A.

In F&B, openings included LaGuardia Airport and Jacksonville International Airport. Additionally, Dufry was awarded a new long-term duty free contract for Boston Logan International Airport, along with an extension for its duty paid business there. It was also awarded long-term contracts for both retail and food & beverage at Oakland International Airport.

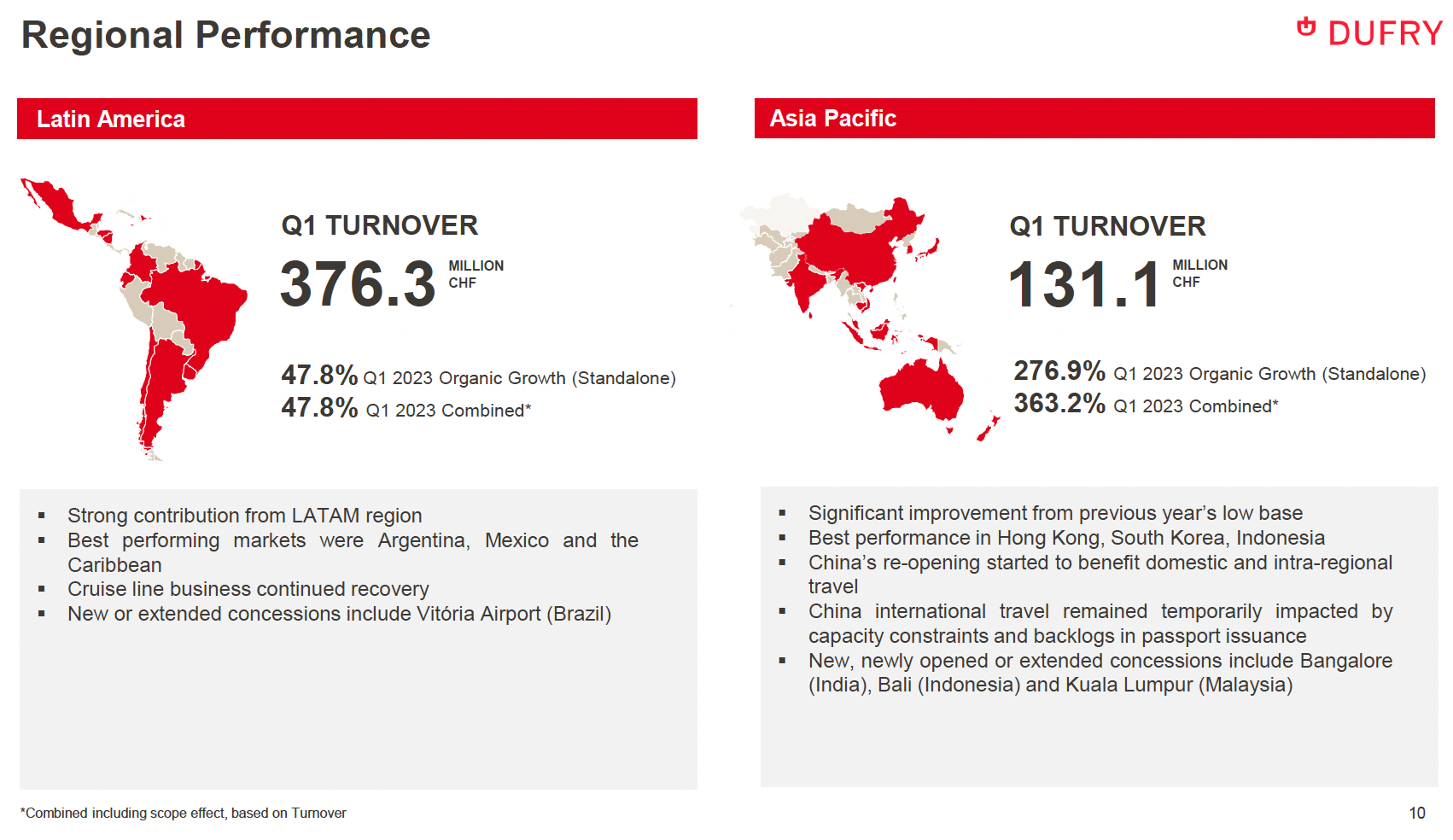

Latin America turnover stood at CHF376.3 million in Q1 2023 versus CHF254.3 million in Q1 2022. Organic growth versus 2022 was 47.8%. Best performing markets were Argentina, Mexico and the Caribbean. Dufry noted that its cruise line business continued to recover. New or extended concessions in Latin America included Vitória Airport in Brazil.

Following the easing of restrictions in China at the beginning of the year, Dufry said Asia Pacific saw a significant improvement from its previous year’s low base. China’s reopening started to benefit from domestic and intra-regional travel, with international travel remaining temporarily impacted by capacity constraints and backlogs in passport issuance.

Asia Pacific turnover reached CHF131.1 million in Q1 2023 from CHF31.6 million in Q1 2022. Organic growth versus 2022 was +276.9% (CER). New, newly opened or extended concessions include Bangalore (India), Bali (Indonesia) and Kuala Lumpur (Malaysia).