INTERNATIONAL. Dufry this morning revealed an improved set of first-half results showing double-digit revenue and profits growth.

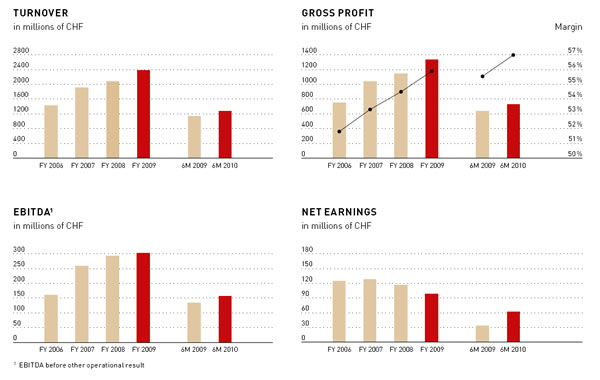

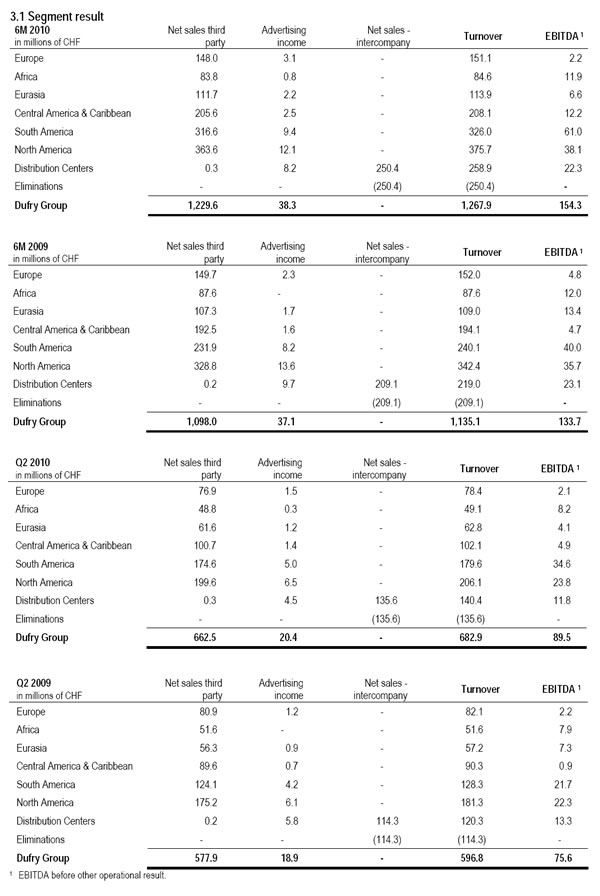

For the period to 30 June the Group’s turnover increased by +15.8% year-on-year at constant foreign exchange rates, of which organic growth accounted for 10.2 percentage points. EBITDA grew by +20.3% at constant rates and reported net earnings almost doubled to CHF60.7 million (US$57.4 million).

Turnover measured in Swiss Francs grew by +11.7% to CHF1,267.9 million (US$1,198.2 million) during the period.

|

“Dufry outpaced the passenger growth significantly, and achieved double-digit growth on spend-per-passenger and average ticket across the Group “ |

Julián Diaz Chief Executive Officer Dufry Group |

Dufry Group CEO Julián Díaz commented: ”During the first six months of 2010 Dufry has improved its performance and achieved solid organic growth despite the economic environment not having fully recovered yet and specific events, such as the volcano ash cloud, impacting our industry.

“Dufry outpaced the passenger growth significantly, and achieved double-digit growth on spend-per-passenger and average ticket across the Group thanks to the further development of our execution capabilities, which we have enhanced through the “˜Dufry plus One’ and “˜One Dufry’ initiatives.

“At the same time we were able to further expand our gross margin as part of our consistent improvements in the past, as well as the new initiatives started since the beginning of the year.

“We intend to continue with our profitable growth strategy and on top of the new operations added during the first half, we will enrich our concession portfolio with new retail space to be opened during the second half of 2010.

“Nevertheless we are alert in respect to the uncertainties related to the global economic development but we remain optimistic because the travel retail industry has showed its resilience again. During the first half of 2010, we have seen good passenger growth and an increase in spend.”

Apart from double-digit organic growth, new projects contributed 5.6% while the foreign exchange impact of translating into Swiss Franc was a negative 4.1%.

Gross margin further improved by 1.4 percentage points to 57.0% in the first half of 2010 from 55.6% in first half of 2009.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

In absolute terms, gross profit reached CHF 723.3 million (US$683.5 million) for the first half of 2010 compared to CHF631.5 million for the same period 2009.

Dufry said that the improvement was due to continuous growth of the Group, including several new locations, implementation of global negotiation with suppliers, and the further development of new initiatives started in 2010 as part of the “˜Dufry plus One’ project.

EBITDA[1] for the first half of 2010 increased by +20.3% to CHF160.9 million (US$152.1 million) at constant FX rates. When translated into Swiss Francs, EBITDA grew by +15.4% to CHF154.3 million. EBITDA margin was 12.2% compared to 11.8% for the relevant period in 2009.

As a percentage of turnover, selling expenses reached 22.1%. During the first six months of 2010, the renewal and the start-up of a number of new concessions resulted in an increase in selling expenses. Also, the development of the local currencies had an effect in certain countries and in the first quarter of 2009, Dufry benefited from temporary rebates on concession fees.

Personnel expenses and general expenses remained stable compared to last year when measured as percentage of turnover. Personnel expenses were 15.8% for half year 2010 compared to 15.9% in the respective period of 2009 and general expenses were unchanged at 6.9%.

Depreciation and amortization amounted to CHF64.4 million (US$60.9 million) for the first half of 2010 compared to CHF 62.2 million in the corresponding period of 2009. Other operational result was minus CHF5.7 million (US$5.4 million) for the first half of 2010 and mainly includes restructuring costs and new projects.

EBIT in the first half of 2010 increased by +28.2% to CHF84.2 million (US$79.6 million).

|

Financial expenses decreased by CHF9.1 million to CHF14.8 million (US$14.0 million) in the first half of 2010 versus CHF 23.9 million in the respective period of 2009. The improvement was mainly due to lower interest expenses resulting from lower debt during the first quarter of 2010, improved cash management and a favorable interest rate environment.

Net earnings for the Group (before minorities) almost doubled and stood at CHF60.7 million in the first half of 2010 versus CHF33.4 million in the respective period of 2009. Net earnings to equity holders reached CHF40.4 million for half year 2010 compared to CHF10.4 million during the same period in 2009.

Following the completion of the merger with Dufry South America Ltd (“˜DSA’) at the end of March, minority interests decreased substantially. Assuming that the merger had taken place at December 31, 2009, pro forma net earnings to equity holders are CHF51.9 million.

|

|

DEVELOPMENT OF TURNOVER BY REGION

EUROPE

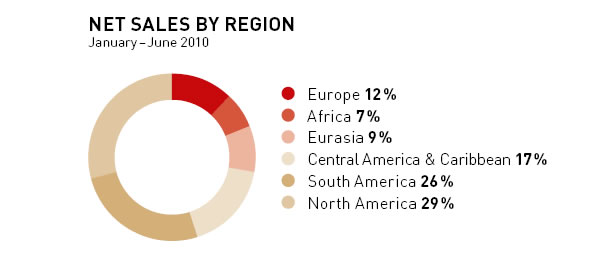

Turnover of Region Europe grew by +3.4% when measured in local currencies.

Translated into Swiss Francs, however, it decreased by -0.6% to CHF151.1 million (US$142.8 million at today’s rates). The performance in the second quarter was impacted by the volcano ash cloud in April 2010, which led to a loss of turnover for approximately one week.

However overall trends continued to improve at a moderate pace including Italy, which saw positive momentum. Dufry also expanded its business in this region, for example with new shops at various Italian railway stations.

AFRICA

Region Africa posted a stable turnover when measured in local currencies; when measured in Swiss Francs, turnover decreased by -3.4% to CHF84.6 million (US$79.95 million at today’s rates) in the first half of 2010 compared to CHF 87.6 million in the same period in 2009.

Region Africa was also impacted by the volcano ash cloud as most flights departing to/from Europe were cancelled during the close-down of the European air space. The region also had temporary effects in Algeria and Egypt, where Dufry’s shops in Sharm-el-Sheikh were closed due to flooding.

The Group’s main operations in Tunisia and Morocco had a solid performance and especially the Moroccan business performed very well.

EURASIA

Region Eurasia’s turnover grew by +4.5% and stood at CHF 113.9 million (US$107.6 million) in the first half of 2010. Performance in most operations was positive, and Cambodia and certain Russian operations experienced double-digit growth.

Furthermore the new [duty paid] operations in Shanghai started to contribute, which was partially compensated by the closing of some shops in Singapore and Hong Kong.

[NOTE: In February 2009 the group founded Dufry (Shanghai) Commercial Co Ltd. Thereafter Dufry signed a seven-year contract with Shanghai Hongqiao International Airport to operate 20 duty paid stores, covering an area of 1,500sq m in the new West Terminal. The West Terminal became operational at the end of March 2010, just ahead of the opening of the Shanghai 2010 World Expo.

In related news, on 19 May Dufry acquired the remaining 49% of the voting shares of Global Service Retail Group (GSRL) for a price of CHF2.8 million (US$2.7 million) from the minority shareholder.]

CENTRAL AMERICA & CARIBBEAN

Turnover of Region Central America & Caribbean increased by +7.2% and stood at CHF208.1 million (US$196.7 million) in the first six months. The English-speaking Caribbean has started to gradually improve its performance, Dufry said, and most other operations posted positive organic growth for the period. The acquisition of assets in Mexico in the fourth quarter of 2009 and the subsequent restructuring have also contributed to turnover growth.

SOUTH AMERICA

Region South America increased its turnover by +35.8% to CHF326.0 million (US$308.1 million) in the first half. Brazil continued its strong performance following several initiatives aimed to increase spend-per-passenger, including innovative promotions and sales incentives programs.

NORTH AMERICA

In Region North America turnover increased by +9.7% to CHF 375.7 million (US$355 million). The Hudson Group business continued with positive organic growth trend as did Dufry’s other operations in the US.

This was further supported by an active development of the concession portfolio in the USA, the company said.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

MAINTAINING THE MOMENTUM

Summing up its results Dufry said that during the first half of the year the positive passenger trends, which began towards the end of 2009, carried through the period.

|

“We are alert in respect to the uncertainties related to the global economic development but we remain optimistic because the travel retail industry has showed its resilience again“ |

Julián Diaz Chief Executive Officer Dufry Group |

It noted: “Emerging markets experienced a more dynamic growth compared to developed markets, but in all regions the trend was positive overall.

“The volcanic ash cloud in April caused a temporary contraction in the passenger flows due to the closing of much of the European air space and the cancellation of almost all flights to and from European destinations. On the other hand, all other months had solid international passenger growth rates.”

Since the last quarter of 2009, Dufry said, it has based its operations on the following elements:

• Maintaining the efficiencies achieved in 2009 in relation to the operating cost, net working capital management and capital expenditure.

• Strengthening the Group’s execution capabilities through the introduction of the “˜Dufry plus One’ and “˜One Dufry’ initiatives, which comprise a wide range of specific projects across the Group.

The company said: “As a consequence Dufry has managed to accelerate its growth and profitability over and beyond market growth. Although the global economy still has not fully recovered, Dufry has posted double-digit growth in all respects including turnover, gross profit, EBITDA and net earnings.

“Both the organic growth of 10.2% and the gross margin improvement by 1.4 percentage points are a result of the improved spend per passenger and the focused development of its operations.”

Dufry said it has worked “intensely” in the past quarters to grow its business through expansion projects, and will continue to do so in the coming quarters. “Together with organic growth, maintaining this momentum will lay the ground for Dufry’s profitable growth in the coming quarters and years,” it said.

It said that the successful completion of Dufry’s merger with DSA, combined with the listing of the Dufry AG Brazilian Depositary Receipts programme in April 2010, has strengthened the Group’s position considerably and has added value to Dufry investors.

“The transaction has broadened Dufry’s shareholder base, and the improved free float, liquidity and size should allow targeting new investor segments,” the company pointed out in an important aside.

“Since the beginning of the year our market cap has increased to CHF2,300 million from CHF 1,350 million, and the value of our free float more than doubled to CHF1,430 million from CHF630 million.”

Advertisement |