SWITZERLAND. International travel retail giant Dufry today posted a +1.9% rise in turnover for 2019 to CHF8,848.6 million (US$9,358.1 million) in results (see full details below) cast in the ominous shadow of the escalating COVID-19 crisis.

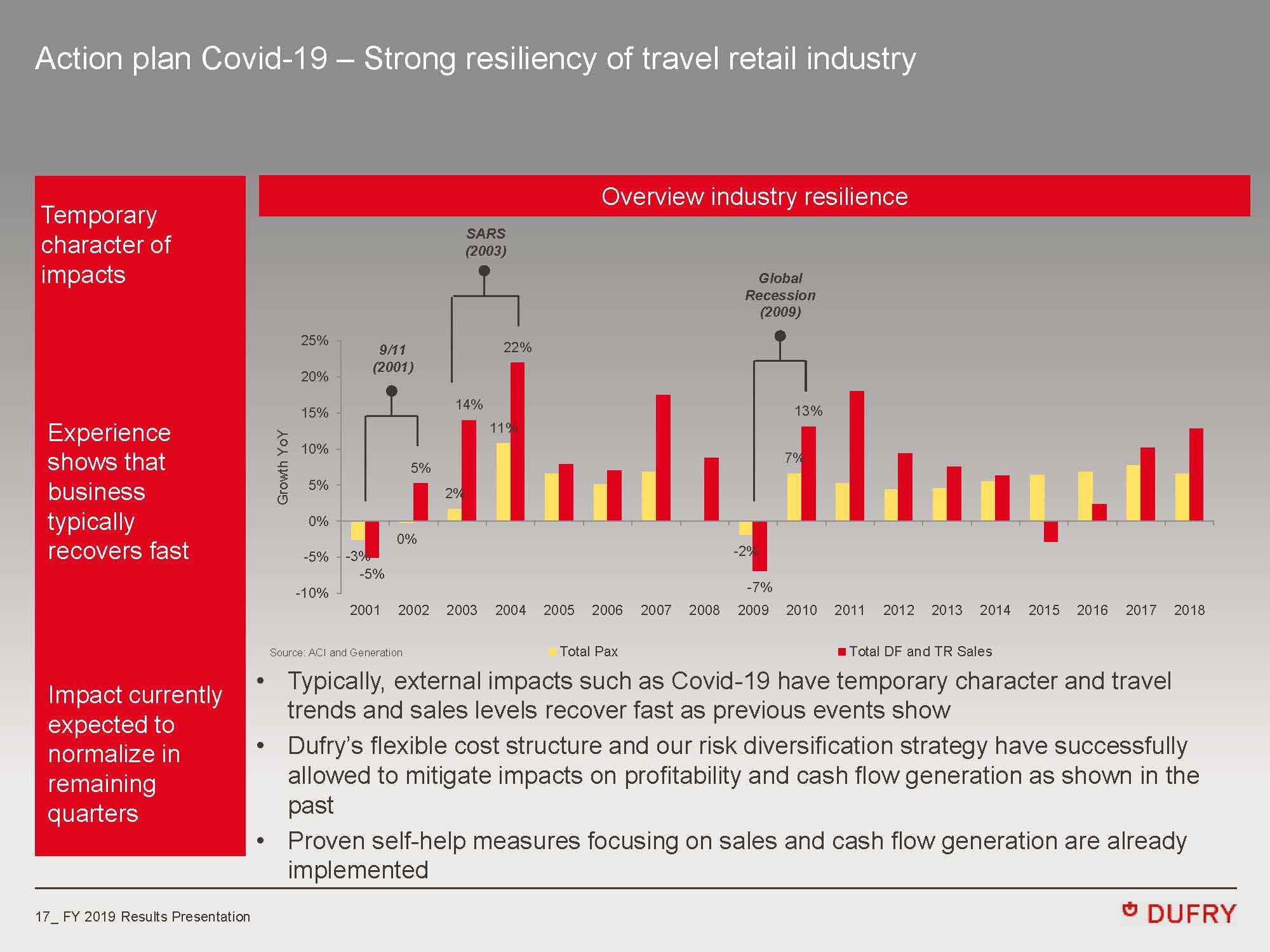

Dufry said that provided the health crisis improves in the second semester – and considering that Q3 is the company’s most important – it expects to reach a negative, single-digit organic growth performance for the full-year 2020, based on current information.

The COVID-19 outbreak has cast a pall over the travel retail sector worldwide, especially after US President Donald Trump’s announcement last night that travel from 26 European countries to the US for the next 30 days would be banned from midnight on Friday (13 March).

Commenting on the impact of the COVID-19 outbreak, Dufry Group CEO Julián Díaz said: “At the beginning of 2020, we saw a further acceleration of the business. Then Covid-19 impacted our operations where we have exposure to Asian customers as well as in locations directly impacted by the phenomena.

“We have immediately implemented several worldwide initiatives to accelerate sales; to secure cash generation through renegotiations of rents and with brands, and to reduce costs through actions at third party cost levels and with employee reorganisations. Currently it’s still challenging to estimate the impact for the full year.”

Outlook uncertain as losses mount

Díaz continued: “The group organic growth performance saw a further acceleration in January 2020. In February [as the COVID-19 outbreak started to spread globally -Ed] performance was negative reaching -7.3%. In February, Europe and Africa performed slightly negatively; Asia Pacific and Middle East reported negative growth at double-digit level; North America was negative at single digit, while Central and South America featured positive growth. Year-to-date until end of February, organic growth was -2.3%; and year-to-date until March 8th organic growth was -3.8%.”

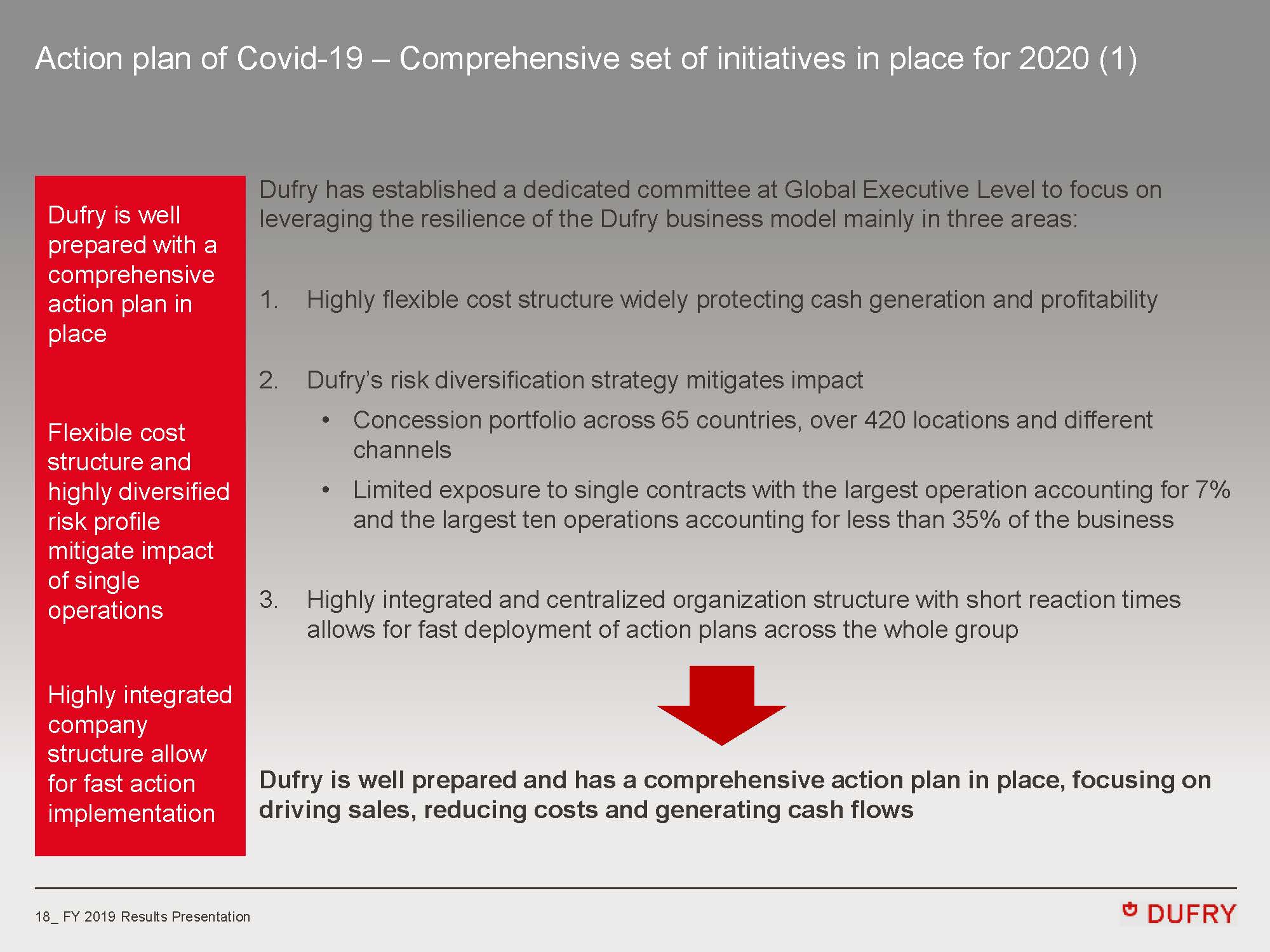

Emergency action plan

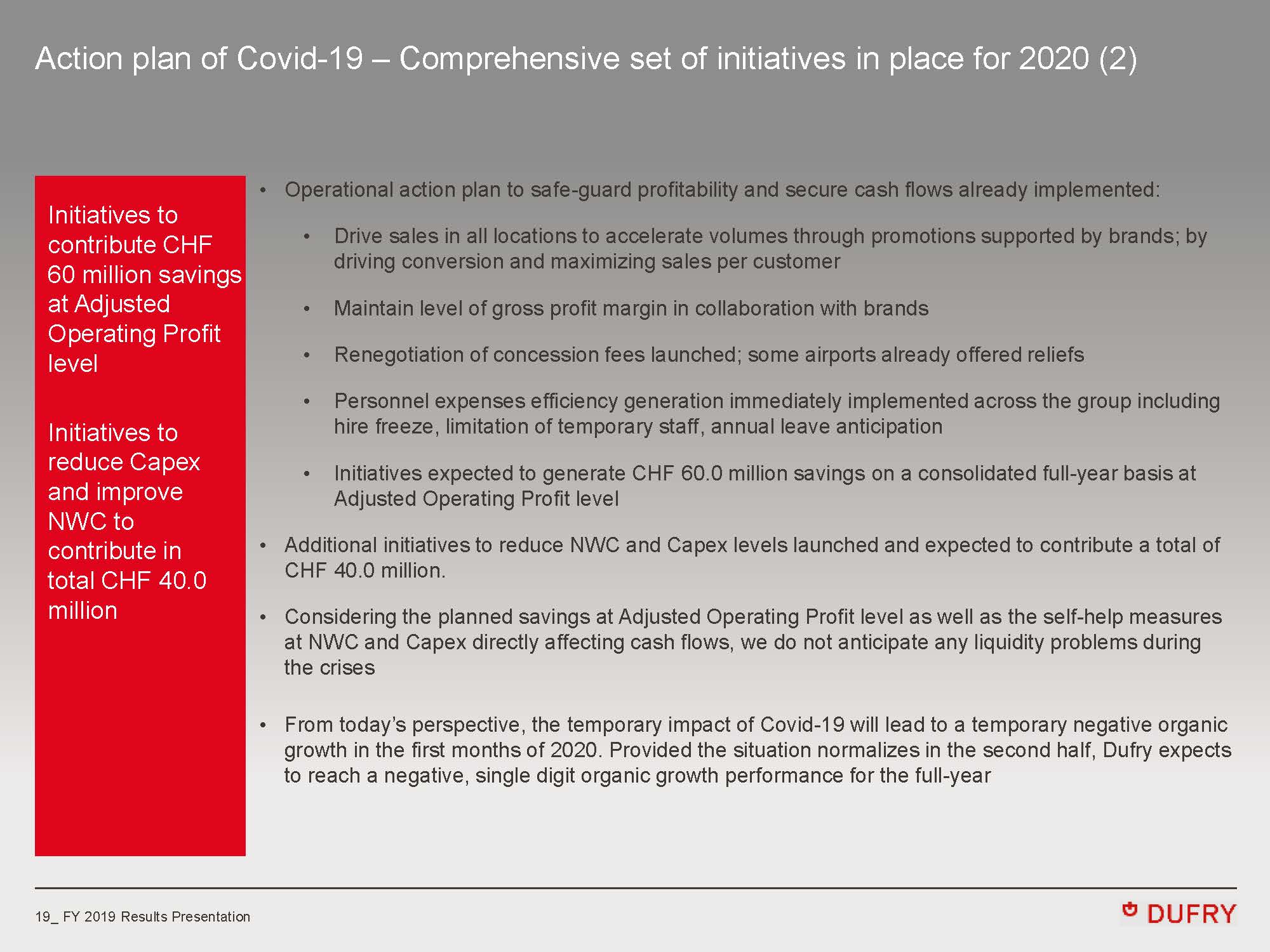

Díaz said that the company has set up a special committee at the Global Executive Committee level and implemented an action plan to secure cash flow generation, drive sales and safeguard profitability.

“The action plan is monitored on a weekly basis and includes initiatives to accelerate sales volumes, maintain gross profit margin levels, reduce personnel and other expenses as well as renegotiate rents,” he noted.

“Provided that the situation improves in the second semester and considering that the third quarter is the most important for the company, Dufry expects to reach a negative, single-digit organic growth performance for the full-year 2020, based on current information”

In total these initiatives are expected to generate savings of CHF60 million (US$63 million) on a consolidated full-year basis at adjusted operating profit level. Additional measures to offset cash flow impacts have been launched at capex and net working capital level, which are expected to generate in total a contribution of CHF40.0 million (US$42 million) in the full-year.

Díaz said: “Considering the planned savings at adjusted operating profit level as well as the self-help measures at NWC and capex levels, we do not anticipate any liquidity problems during the crisis.

“Provided that the situation improves in the second semester and considering that the third quarter is the most important for the company, Dufry expects to reach a negative, single-digit organic growth performance for the full-year 2020, based on current information.”

2019 solid

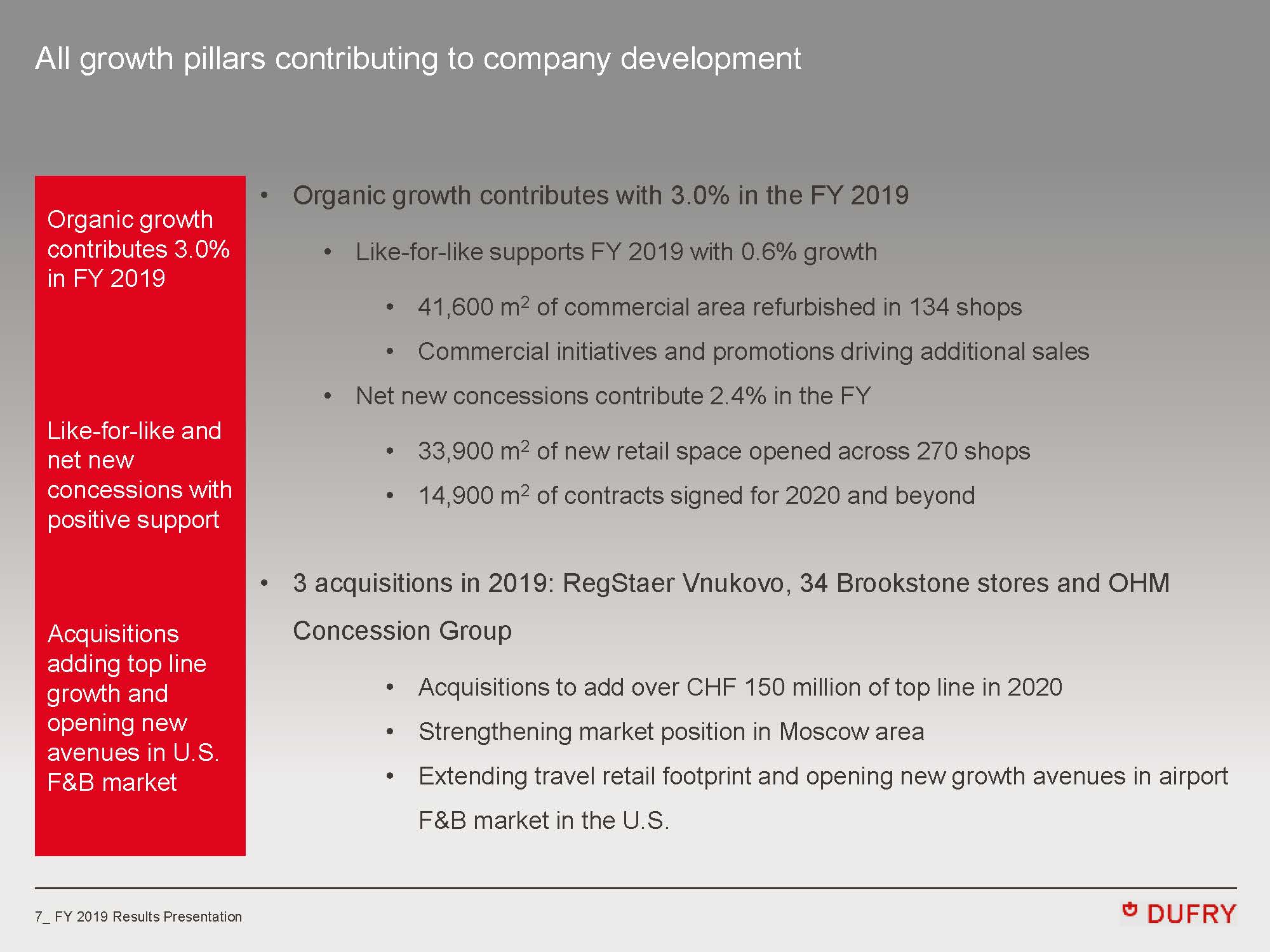

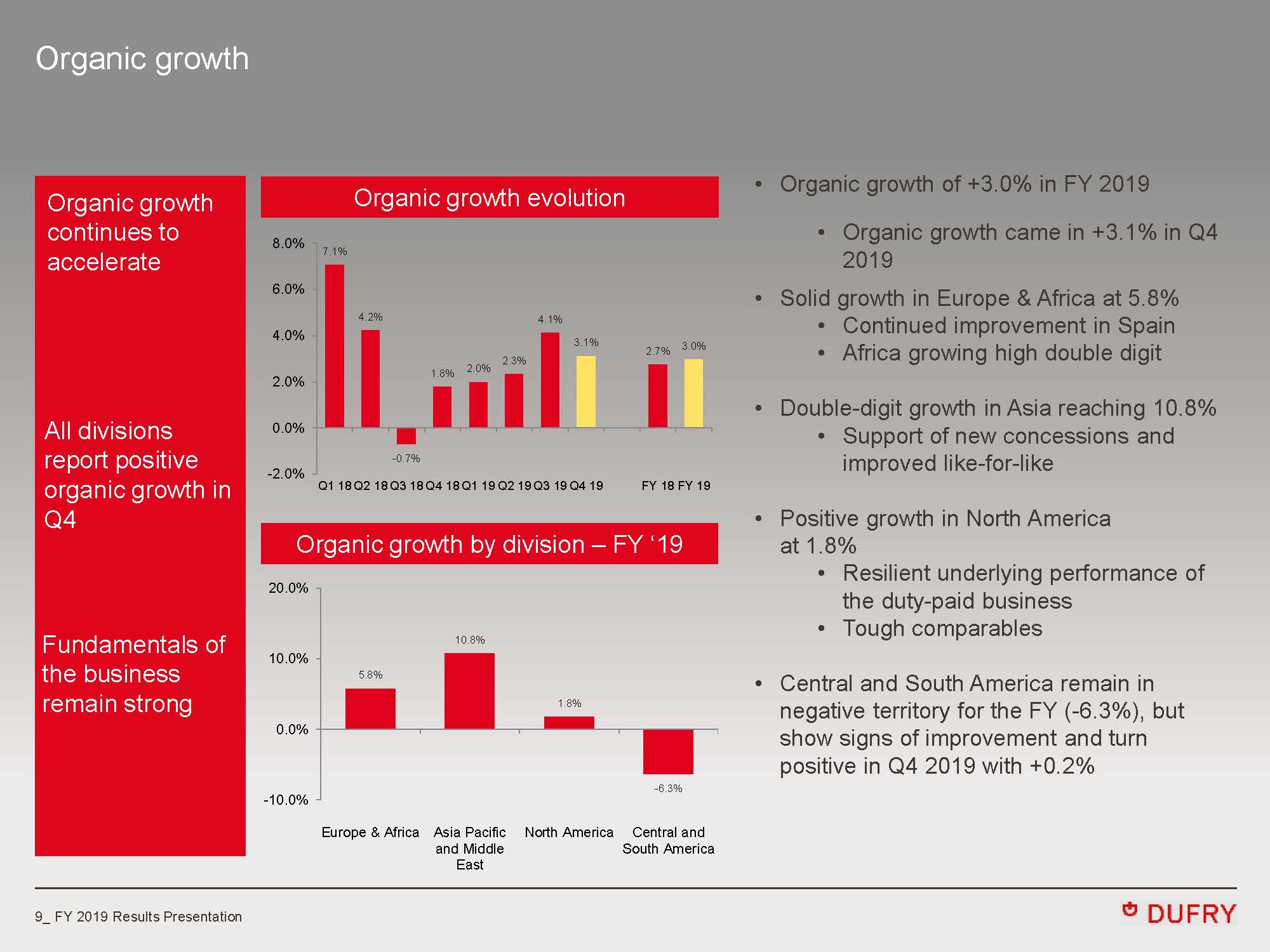

Organic growth accelerated to +3.0% in the 2019 financial year, driven by like-for-like improvement (+0.6%) and new concessions, which contributed 2.4%.

Quarter 4 organic growth reached a healthy +3.1% supported by the positive performance of all divisions. Like-for-like performance also improved considerably in the quarter, rising +2.2%.

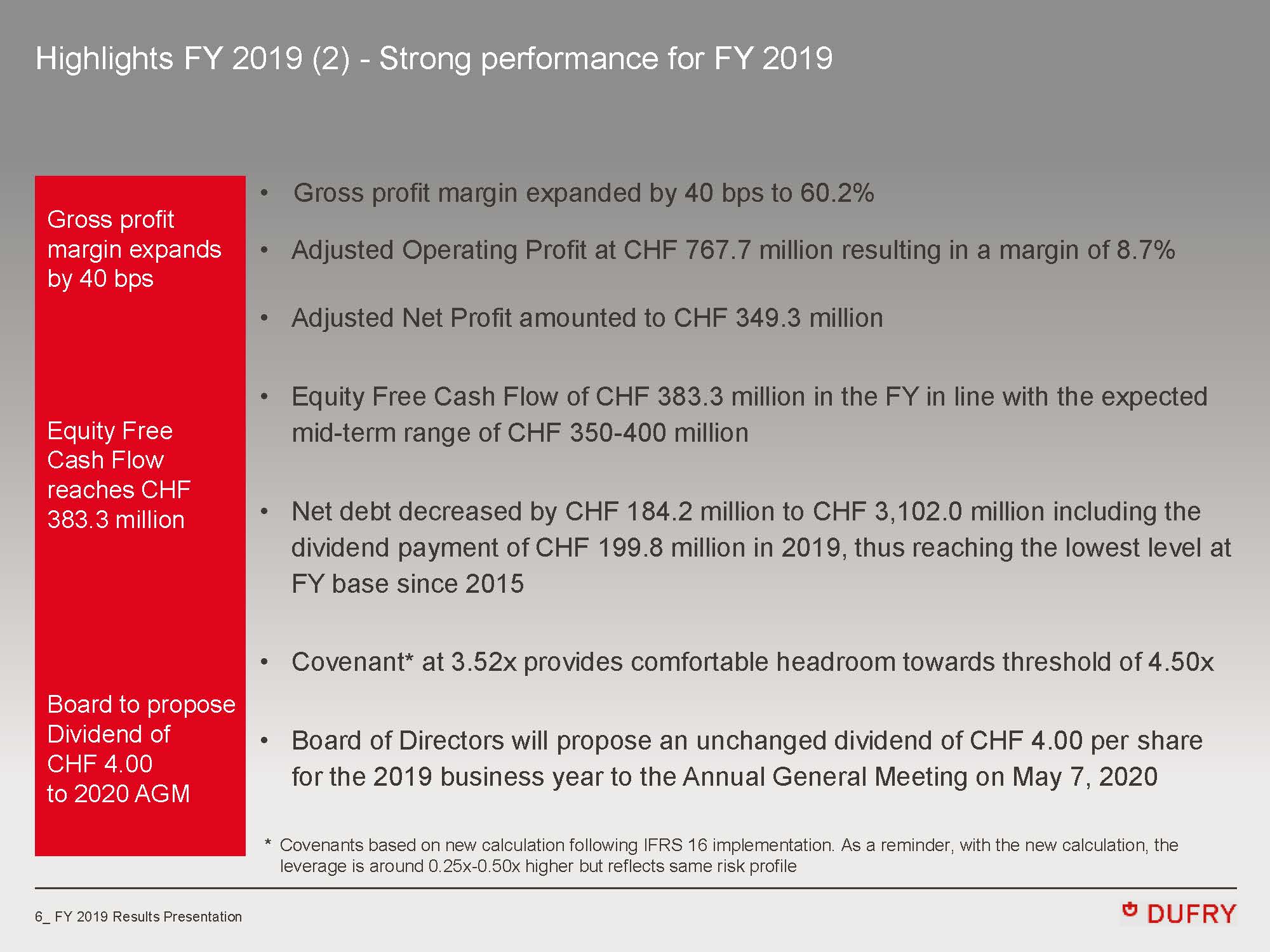

Adjusted operating profit (Adjusted EBIT) reached CHF767.7 million (US$806.9 million), with the respective margin amounting to 8.7% in 2019. As previously reported, Dufry started to report under the new IFRS 16 framework, which mainly changes the accounting treatment of leases (previously leases were accounted as expenses. Now fixed components are capitalised and amortised over the lifetime of the contract, while all variable components of the concessions are classified as lease expenses. For 2019, lease expenses amounted to CHF1,372.9 million).

Adjusted net profit reached CHF349.3 million (US$367 million) in 2019, while the respective adjusted EPS was CHF7.00 (US$7.36). Net Profit to equity holders reached CHF26.5 million (US$27.9 million) in the year under review.

Cash flow is king

Contrary to the income statement, the effects of IFRS 16 on the cash flow are minimal, Dufry noted. Cash flow KPIs will therefore continue to be key for measuring the performance of the business, the company said.

Díaz commented: “2019 was characterised by an ongoing acceleration of organic growth, which supported by our marketing initiatives and new concessions increased to +3.0%, in line with our mid-term average guidance. Organic growth has been benefitting from both solid contributions from new concessions and like-for-like growth, which has turned positive in Q3 reaching +1.3% and increasing to +2.3% in Q4.

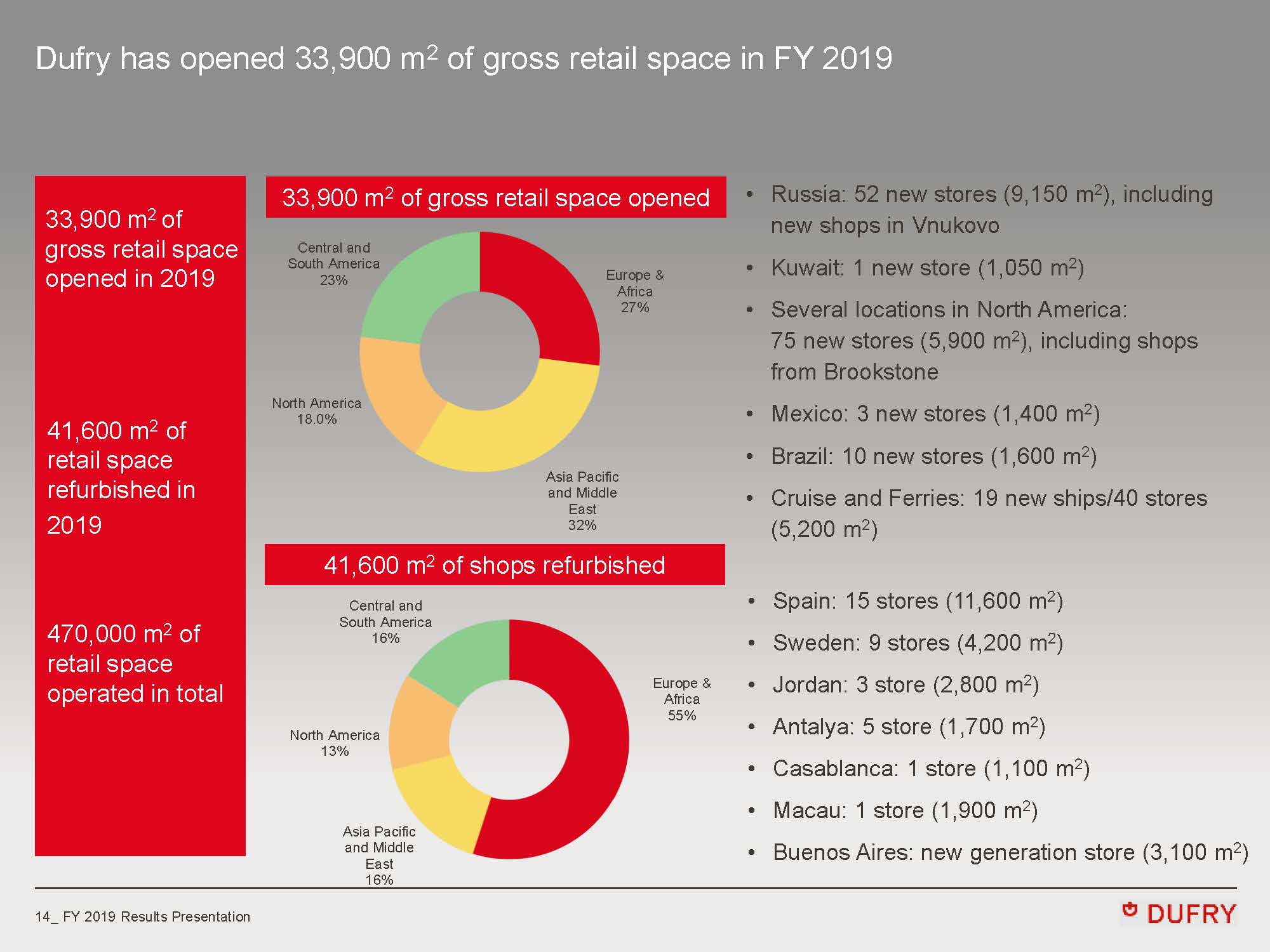

“This performance was driven by several initiatives such as the implementation of the new commercial platforms as well as our ongoing refurbishment program covering 41,600sq m of retail space, mainly in Spain, Sweden, Jordan and Turkey.

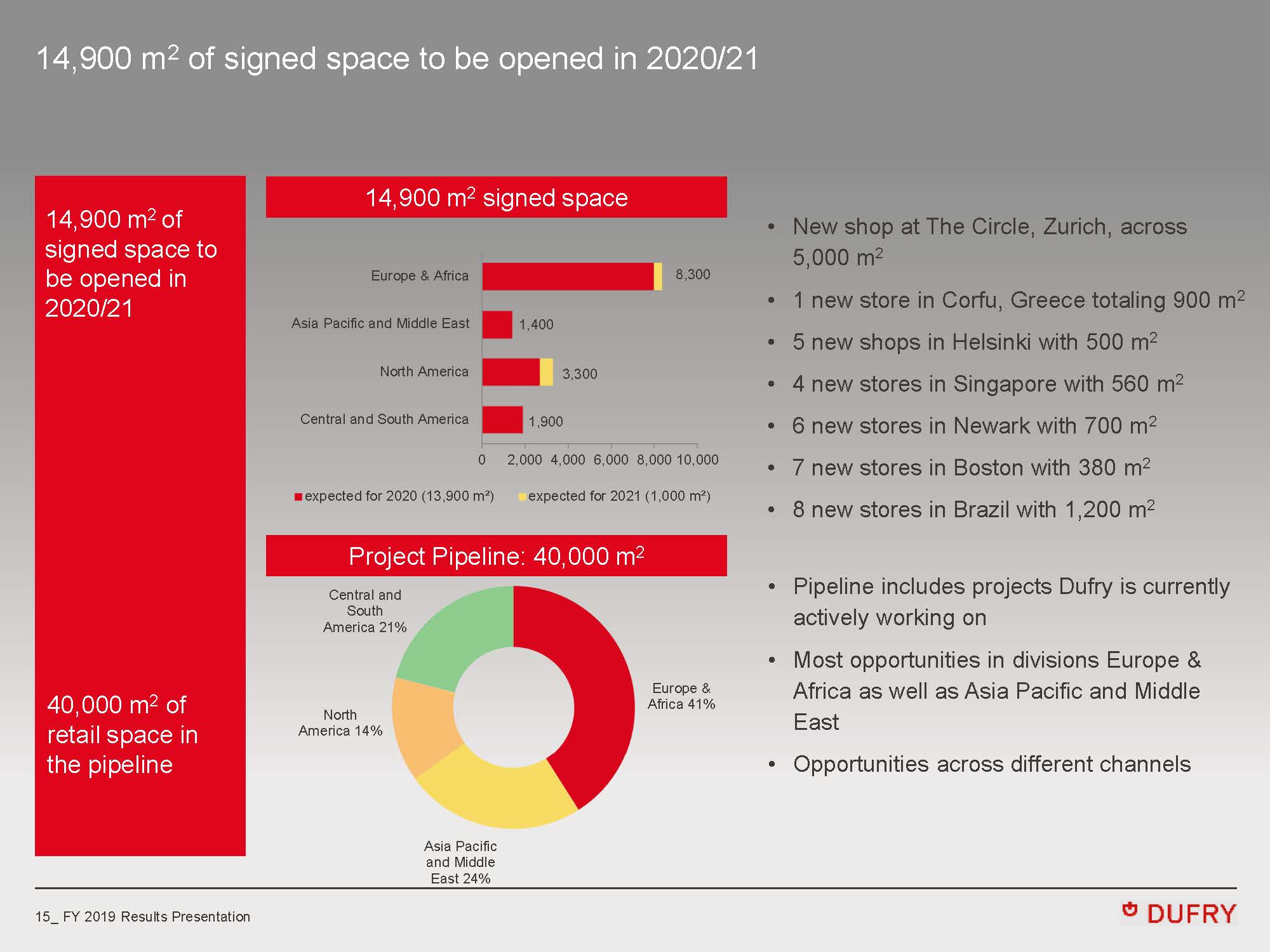

“Regarding business development, we added some 33,900sq m of gross retail space in 2019, including the opening of new shops in Russia, Mexico, Kuwait, Brazil and several ships. We also already signed around 14,900sq m to be opened in 2020 and 2021 in existing and new locations across the globe.

“In the context of further expanding our business going forward, in 2019 we achieved several milestones such as the acquisition we performed in Russia, consolidating our position in the country, and the two acquisitions in the United States through our Hudson subsidiary. Here we created additional growth opportunities allowing us to expand both in duty paid and duty free, while at the same time accelerate the penetration of the important airport F&B market.

“Last but not least, we successfully extended the AENA contract for up to five years covering all the airports in Spain. I am looking forward to rolling out to further locations in Spain; our successful commercial initiatives and best practices already tested across five pilot airports to accelerate performance even more. It’s worth to note that this implementation will not need any significant Capex investment.

“Moving forward, we will see the contribution of our new concessions, which we have added organically and through M&A in 2019. Therefore, we are optimistic about Dufry´s ability to deliver mid- and long-term sustainable growth and solid cash flows with our resilient business model.”

MORE TO FOLLOW