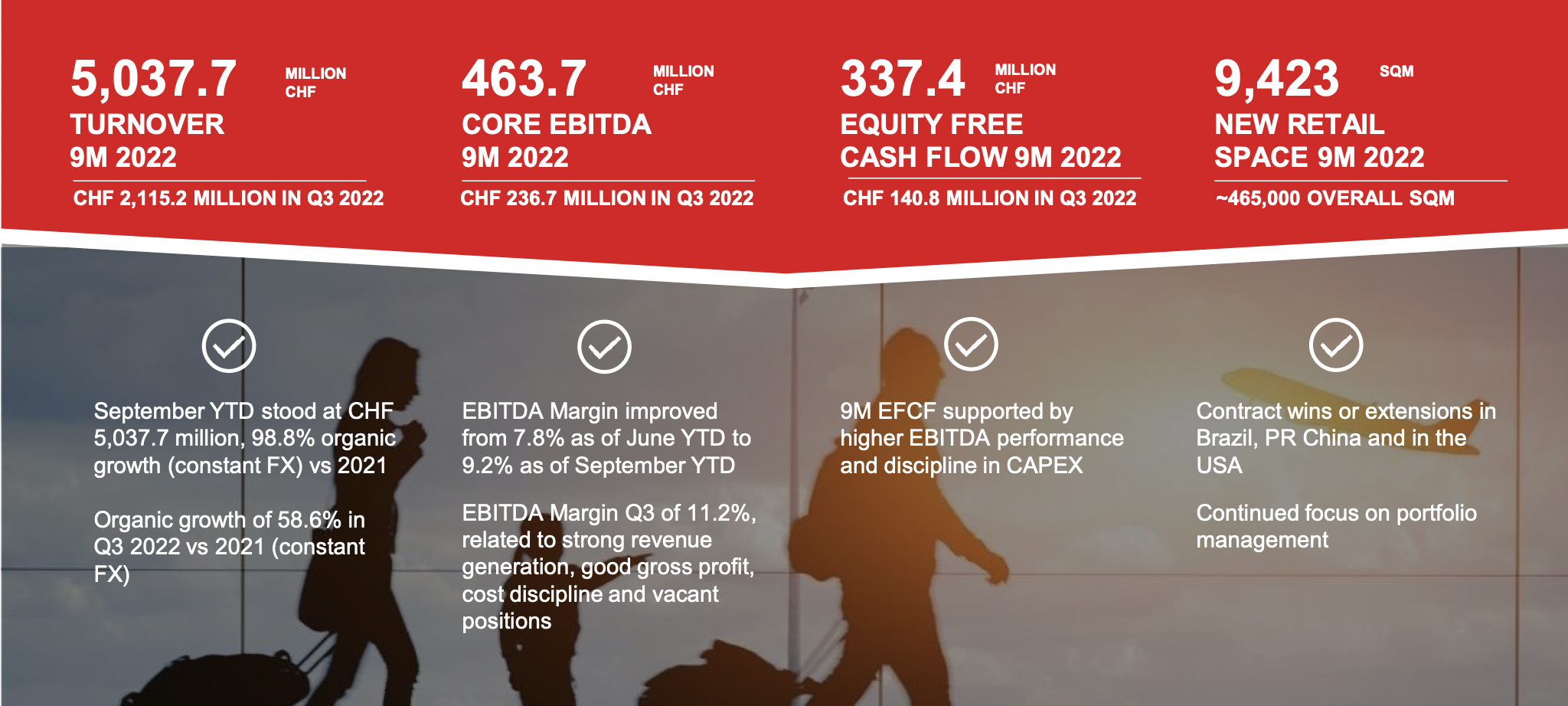

INTERNATIONAL. Leading travel retailer Dufry today reported strong third quarter results, placing the company ahead of its financial projections for the first nine months of 2022.

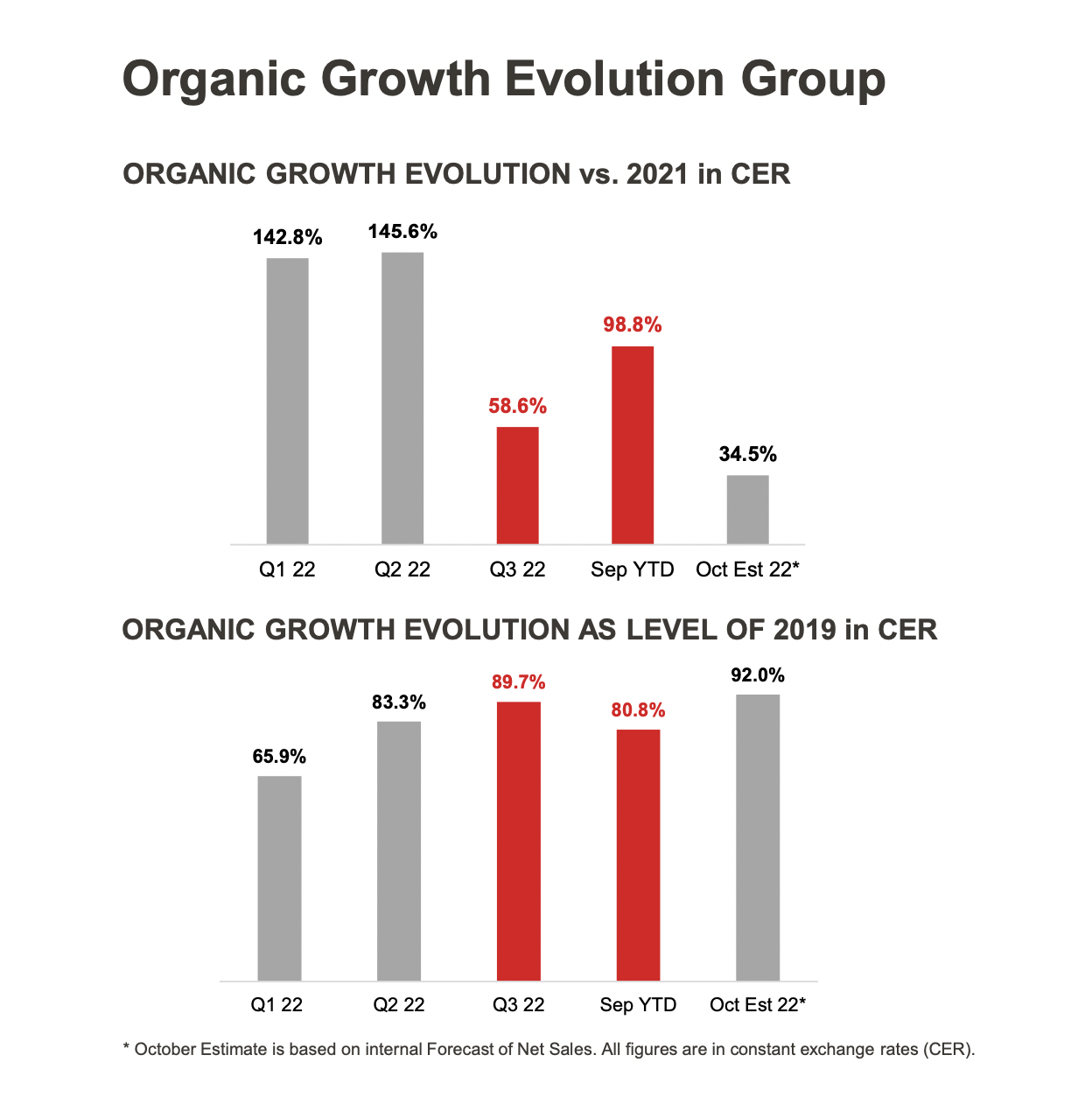

January-September turnover almost doubled compared to last year, reaching CHF 5,037.7 million (US$5,028.5 million). This was up +98.8% on the same period in 2021, and just -24% down on pre-pandemic 2019.

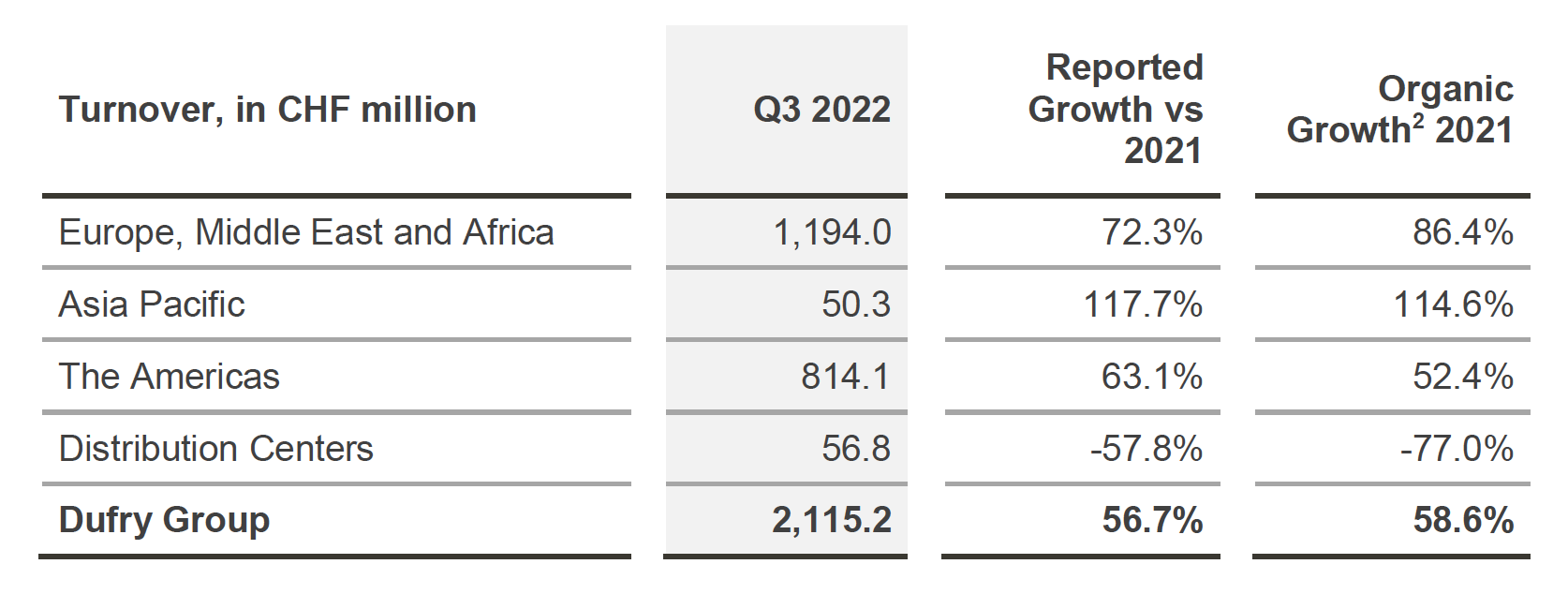

For the third quarter, turnover stood at CHF2,115.2 million (US$2,111.34 million), representing year-on-year organic growth of +58.6% at constant exchange rates (-16% against the same period of 2019).

The positive Q3 momentum has continued into the fourth quarter with October net sales running at +34.5% versus the same month in 2021 at constant currency exchange rates.

Core EBITDA reached CHF463.7 million (US$462.8 million) for the first nine months, with EBITDA margin of 9.2% despite an increasingly challenging macroeconomic situation.

Dufry said it is well positioned to reach full-year turnover of around CHF6.6-6.7 billion (US$5.6-6.7 billion), with projected core EBITDA of CHF560-580 million (US$559-579 million.

Reflecting on the Q3 results, Dufry CEO Xavier Rossinyol said: “We continue to see strong demand during the third quarter 2022 at attractive margins. In particular holiday destinations in the Mediterranean region, Southern Europe, Middle East, Central America and the Caribbean were driving our performance.

“The USA remained strong, and South American countries have traded upwards. Even in the APAC region, we saw an increase in activity, specifically in Australia and parts of Southeast Asia.

“We achieved this strong performance despite travel disruptions and capacity caps at airports over the summer months, rising inflation and energy prices, FX moves and geopolitical uncertainties. We are confident to achieve a strong full year 2022 result despite the ongoing macroeconomic, geopolitical and health-related developments. We continue to see strong demand into the fourth quarter.”

He added: “As a team, we have determinedly worked on our long-term strategy Destination 2027. We remain convinced about the long-term opportunities ahead of us, further enhanced by the planned combination with Autogrill.”

During an earnings call Rossinyol noted that the Autogrill transaction is advancing as planned, with regulatory approvals achieved ahead of plan in important jurisdictions. Subject to the receipt of all outstanding regulatory approvals, the expected closing of the first stage – the transfer of Edizione’s 50.3% stake in Autogrill to Dufry – will happen by the end of Q1 2023.

“Everything so far is going to plan,” Rossinyol said. “We do not expect at this stage any surprises and we will be completing as expected.”

Asked for more details on expected financial performance in 2023, Rossinyol noted that predictions are currently difficult due to several key factors.

He said: “We will start 2023 with a much stronger base than we anticipated. To expect full recovery of [2019] sales next year will depend on geopolitical effects and the speed of Asia opening up, particularly with regards to the China [travel] restrictions, so I don’t think it is realistic next year to be at the levels of 2019.”

Rossinyol added: “We will stop talking about 2019 [as a comparison] soon, with the changing passenger profiles we are seeing. Going forward we will look [at results] year-on-year.”

Trading update

In the first nine months, duty free accounted for 56.1% of net sales versus 43.9% duty paid, reflecting the uptake in cross-border and international flights during the recent months. Concurrently, the airport channel contributed with 92.1% to total turnover. Per category, the main contributors continued to be perfumes & cosmetics with a 29.3% share and food & confectionery with 21.7%, while luxury also saw an increase compared to last year.

Recent developments

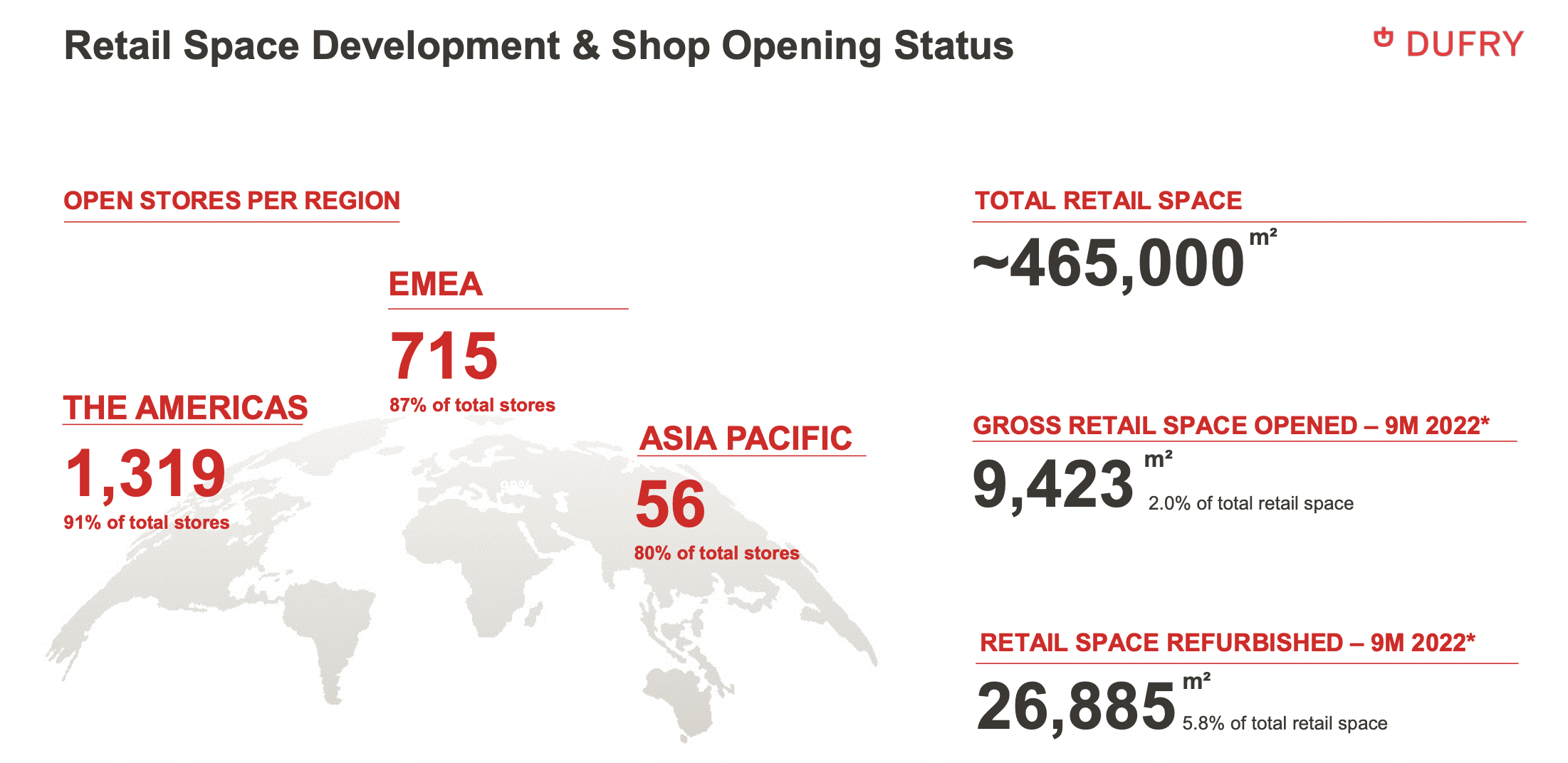

As per the end of September, more than 2,090 shops globally were open, representing 83% of total pre-pandemic levels. Dufry said it has seen strong demand over recent months despite airport disruptions and passenger caps, an accelerating inflationary environment and worsening consumer sentiment.

Embedded in its long-term strategy, Dufry said it continues to focus on strengthening its sustainability engagement. In the third quarter, the company has officially submitted its emission reduction targets to SBTi (Science Based Targets Initiative) for approval and has launched the Supplier Code of Conduct recertification process across North America.

Business development

During Q3 2022, Dufry won several new concessions and extended contracts covering a combined 13,404sq m of space. Among others, Dufry won the tender for a five-year duty paid contract at Chongqing International Airport, China.

In North America, Dufry secured new concessions at Colorado Springs Airport and contract extensions at Birmingham-Shuttlesworth and Harry Reid International airports. Ushering in what it describes as “an entirely new era of retail and dining convenience for travellers”, Dufry opened an integrated ‘Decanted’ wine bar and Hudson Nonstop concept at Dallas Fort Worth International Airport.

Total gross retail space opened during Q3 2022 amounted to 2,745sq m and refurbishments to 10,139sq m.

Regional performance

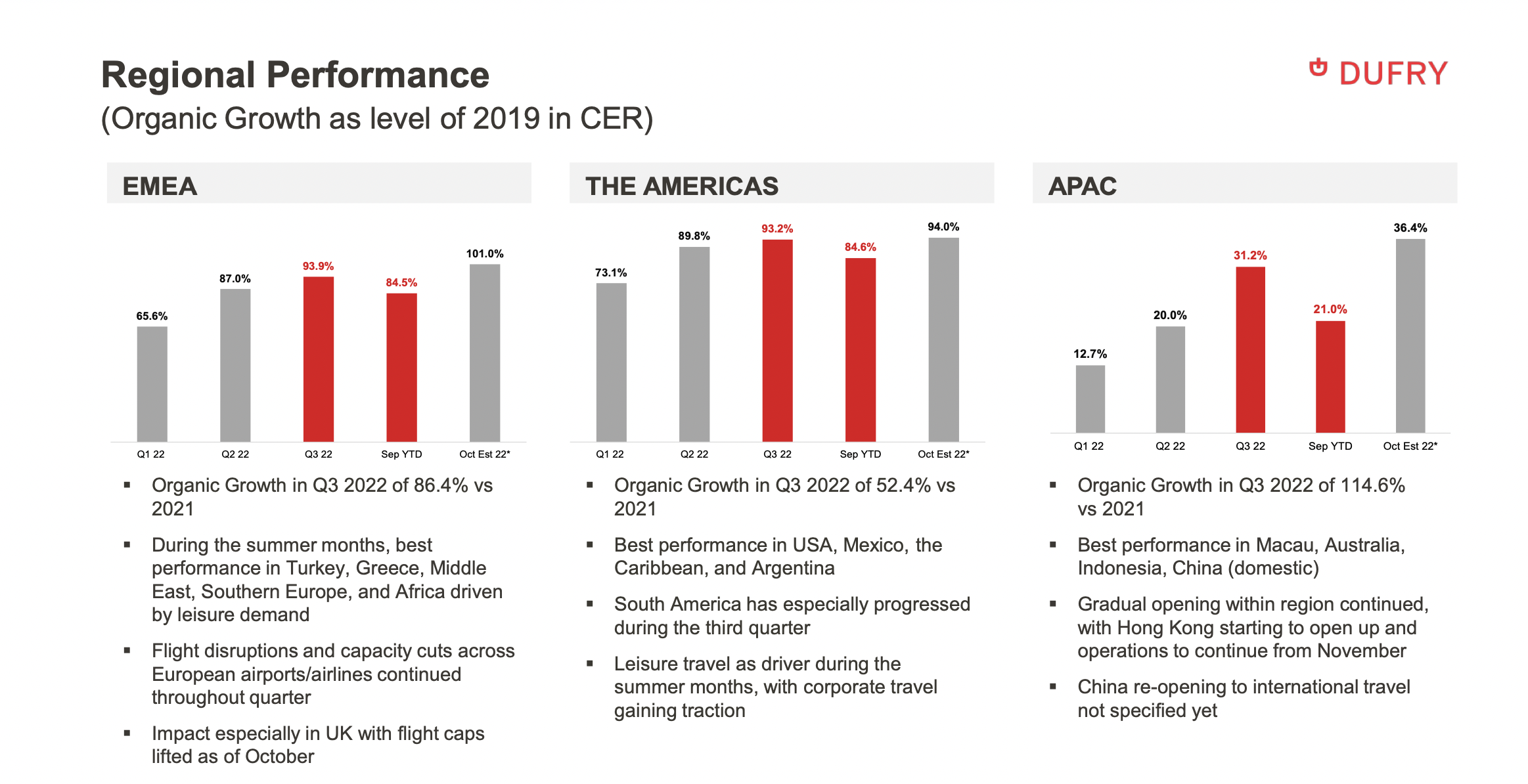

Turnover in Europe, Middle East and Africa amounted to CHF1,194 million (US$1,192.8 million) in Q3 2022 with organic growth versus 2021 up+86.4% in constant FX. During the summer months, the best performing were Dufry’s operations in Turkey, Greece, Middle East, Southern Europe and Africa, driven by strong leisure demand.

The strong EMEA performance occurred despite flight disruptions and capacity cuts across European airports and by airlines throughout the quarter. Asia Pacific continues to improve from very low levels despite still being affected by the lack of passengers due to travel restrictions. Turnover reached CHF50.3 million (US$50.2 million) in Q3 2022.

Asia Pacific organic growth versus 2021 was +114.6% in constant FX. The region saw a steep increase compared to last year, driven by locations in Macau, Australia, Indonesia and China (domestic).

Dufry noted that China is still adhering to COVID restrictive measures, affecting overall travel in the region and internationally.

Americas turnover stood at CHF 814.1 million (US$812.61 million) in Q3 2022 with organic growth up +52.4% year-on-year in constant FX. Best-performing regions were the US, Mexico, Dominican Republic and Argentina.

The company noted that South American locations have progressed during the third quarter, while the US had already seen a rapid rebound.