|

INTERNATIONAL. In huge breaking news, Dufry Group has struck a deal to acquire 50.1% of World Duty Free Group (WDFG), held by the Benetton family through its Edizione and Schematrentaquattro S.p.A. (Schema34) holdings.

[Look out for our ongoing analysis and comment over the next 48 hours via the acclaimed, constantly updated Moodie Live real-time Blogging service on our home page].

The sale price for the stake is €1.3 billion, valuing WDFG at €10.25 per share. The price per share represents a premium of around +22% on the volume-weighted average share market price of WDFG shares in the last six months to date.

The Moodie Report reliably understands that Dufry beat off strong but conditional approaches from Lotte Duty Free of South Korea and Sunrise Duty Free controlling shareholder, Hong Kong-based Boyu Capital.

|

“It’s a great opportunity for us and especially for our management“ |

Julián Díaz CEO Dufry |

The binding agreement covers the entire interest held by Schema34 in World Duty Free S.p.A. (50.1% of its share capital).

In a press statement tonight, Dufry said: “The transaction values WDF at €3.6 billion and will trigger a mandatory takeover offer for the remaining shares. Dufry will finance the acquisition through a mix of debt and equity, raised through a rights issue which is underwritten by a group of banks and well-known cornerstone investors.”

Edizione said in a statement released earlier on Saturday evening: “Following a competitive process, Edizione and Schema34 selected Dufry as acquirer of the stake in WDF to ensure the business’ successful positioning in the long term. The integration with Dufry presents a strong strategic rationale, creating the world’s leader in the travel retail sector.”

Dufry CEO Julián Díaz told The Moodie Report: “It’s a great opportunity for us and especially for our management.” He said it was too early to discuss the integration process that lies ahead (layered on top of Dufry bedding in its 2014 acquisition of Nuance), simply commenting: “We have a complete plan.”

On the price paid, he declined to comment other than to say: “The price is what we consider to be the right price for the asset.”

Explaining the choice of Dufry, WDFG Chairman (and Autogrill CEO) Gianmario Tondato told The Moodie Report: “We had higher prices and different offers”¦ from the Far East for example. Everyone showed up. The problem was that they were all conditional. The conditions were important for us. We wanted certainty.”

The closing of the sale of the stake is subject to the approval by Dufry’s shareholders’ meeting of a capital increase aimed at partially financing the transaction and to the approval by antitrust authorities.

|

“We had higher prices and different offers”¦ from the Far East for example. Everyone showed up. The problem was that they were all conditional. The conditions were important for us. We wanted certainty.“ |

Gianmario Tondato Chairman WDFG |

A group of shareholders representing around 30% of Dufry’s voting share capital provided Edizione and Schema34 with irrevocable undertakings to vote in favour of the capital increase at the shareholders’ meeting. It is expected that the closing of the sale will occur in the third quarter of 2015.

Following the completion of the acquisition, Dufry will launch a mandatory public tender offer on the remaining WDFG shares, in compliance with Italian law.

Talk of a divestment has circulated since last September when WDFG announced that it was intent on “pursuing business combinations with other operators”.

Since then, the retailer’s share price has surged amid strong investor interest and intense market speculation of a deal. The shares closed on Friday night at €10.96, having exceeded €11 per share earlier in the week. This was up by over +70% since the stock hit a 52-week low €6.33 on 16 October, following revelations about the cost of retaining the group’s Spanish airport duty free concessions.

Edizione and Schema34 have been assisted by Bonelli, Erede, Pappalardo as legal counsel and by BofA Merrill Lynch as financial advisor. Deutsche Bank was financial advisor to WDFG.

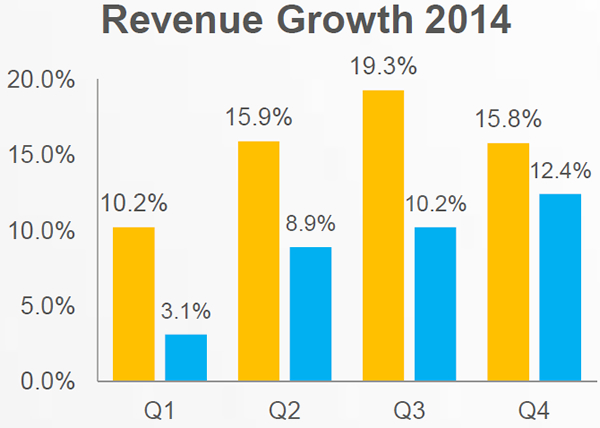

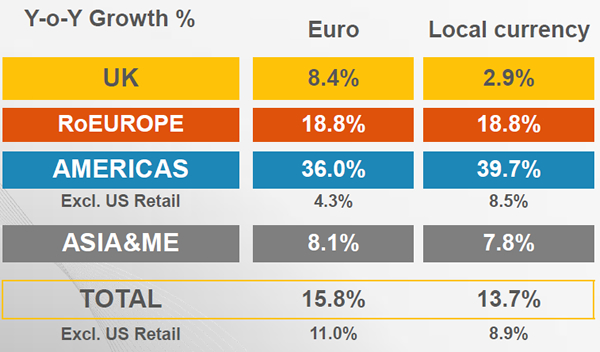

As reported, WDFG revenues climbed by +15.8% year-on-year to hit €2,406.6 million in 2014. Adjusted Ebitda was €289.7 million, improving +5.2% from a year earlier, with net profit at €41.5 million, down by €69.3 million compared to €110.8 million recorded in 2013.

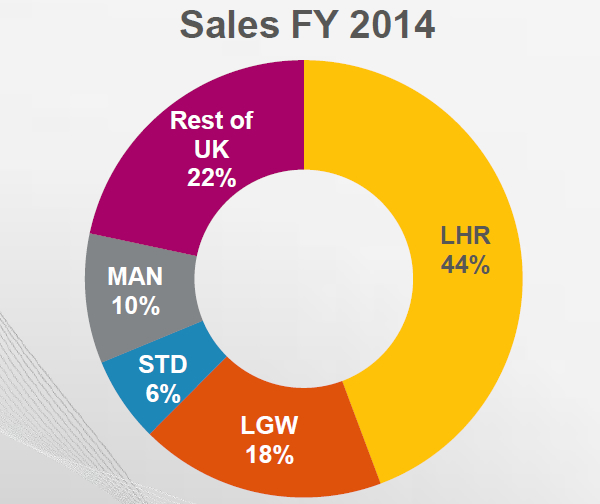

In 2014, WDFG extended its concession portfolio with a number of key deals. It added a six-year-and six-month extension to its London Heathrow duty free concession – which accounted for 44.3% of the group´s total revenue in the UK in 2014 and 19.5% of total global sales. Other contract extensions over the period include a five-year contract extension to operate in Kuwait City Airport and a number of other small retail contracts. With these, the average portfolio length at WDFG is nearly nine years, which it said is “one of the longest in the travel industry”.

The group also secured three new operations recently. These include a six-store retail package at Los Angeles International Airport Terminal 6; a new beauty store at San Francisco Airport T3; and a 13-year agreement to operate the Eurotunnel Charles Dickens Terminal store from Q1 2015 (on the French side of the Channel Tunnel). The group also completed the acquisition of Finnair’s travel retail operations at Helsinki Airport.

The Moodie Report will bring you more comment on this big breaking news story soon, with further reaction from WDFG Chairman Gianmario Tondato and Dufry CEO Julián Díaz.

|

Travel retail transformed: Dufry will have consolidated the sector’s second, sixth and seventh largest players into an industry tour de force with combined turnover of €6,697 million (based on 2013 numbers), some +65% more than DFS Group |

|

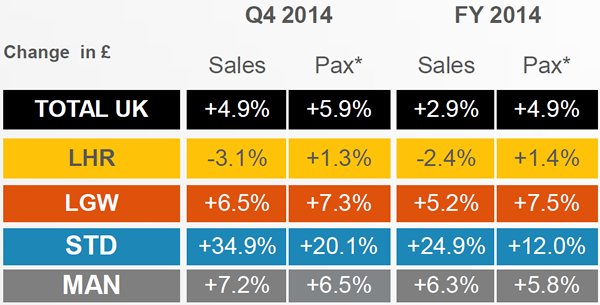

World Duty Free Group’s UK operations continue to drive growth, though the strong Pound Sterling and lower spends among Chinese and Russians have brought challenges at Heathrow |

|

|

|

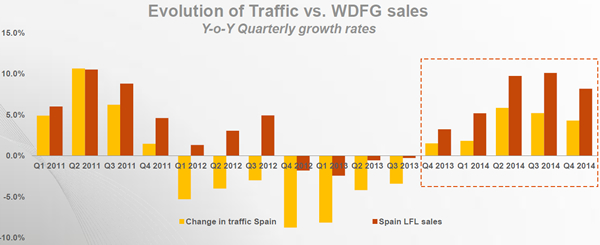

WDFG’s quarter by quarter revenue performance in 2014 |

|

|

UK performance by airport by airport in 2014 |

|

|

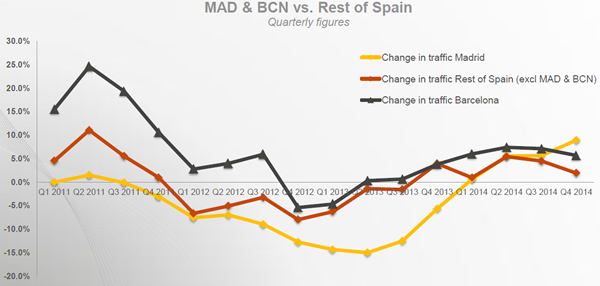

Spain has recovered but Madrid and Barcelona continued to struggle in 2014, not least due to the downturn in Russian arrivals and spend |

|