INTERNATIONAL. The Duty Free World Council (DFWC) quarterly KPI Monitor, produced on its behalf by research agency m1nd-set, reveals strong international outbound travel momentum in the July-September period.

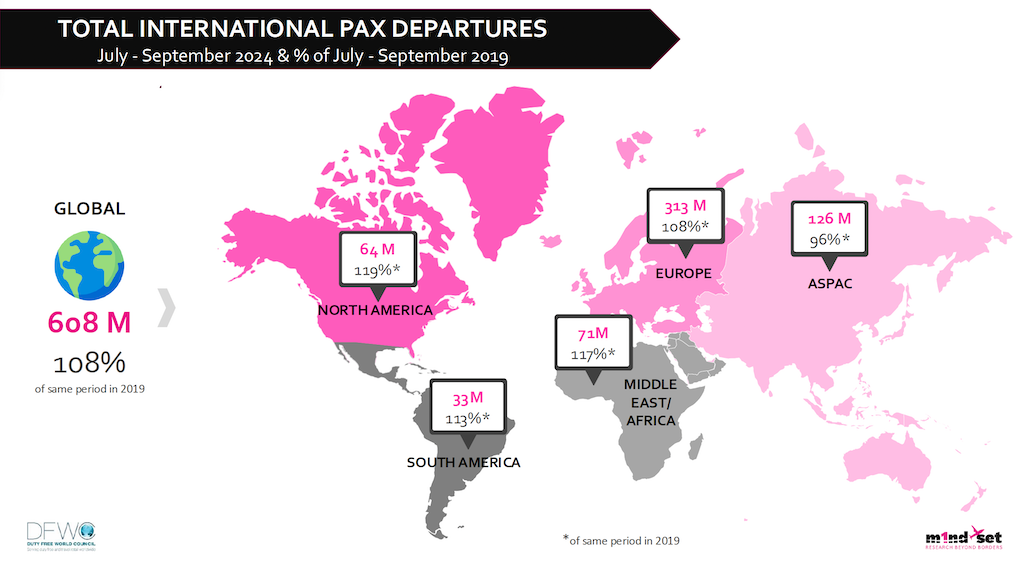

The number of travellers increased by +30% in Q3 compared to Q2, reaching 608 million. Q3 2024 traffic was +12% higher year-on-year.

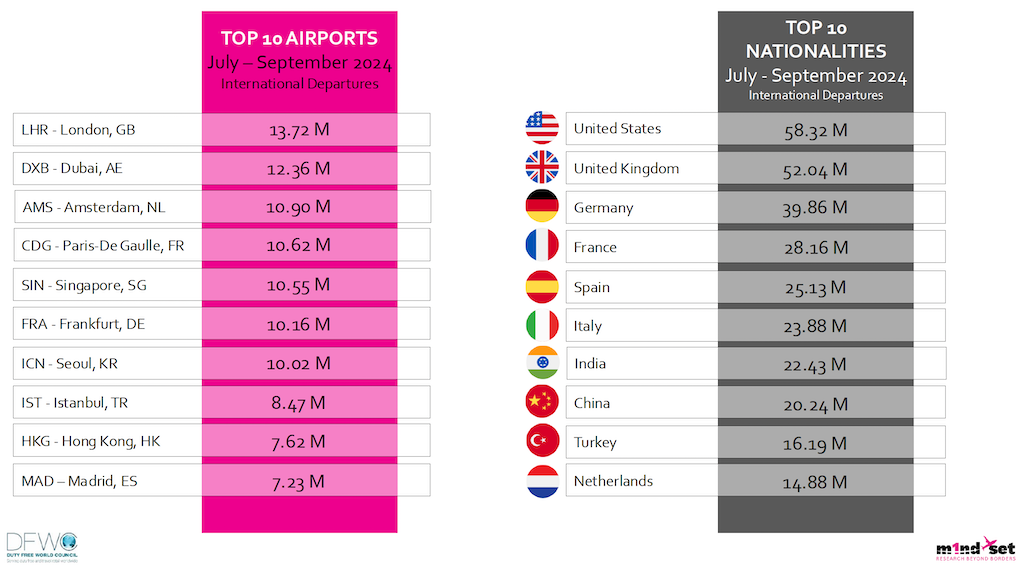

There was no movement among the top four positions in terms of travelling nationalities across the latest quarter, with the US, UK, Germany and France leading the rankings.

The number of US international travellers increased +30% between Q2 and Q3 to just under 60 million while those from the UK rose +46% to 52 million. Meanwhile, Germany posted the highest growth among the top travelling nationalities with a +52% increase in international departures between the two quarters, to just under 40 million passengers.

The number of international Chinese travellers grew by +24% between Q2 and Q3, reaching more than 20 million in Q3. Notably, this represents +68% growth compared to the same period in 2023.

With the exception of Asia Pacific, all world regions are now well above the traffic levels of 2019, the research found. Globally, traffic was +8% higher than the 2019 level in Q3, compared to +2% higher in Q2 this year.

North America, the Middle East & Africa and Latin America show the most robust growth, at +19%, +17% and +13% respectively measured against the same period in 2019. European traffic in Q3 was +8% higher than in Q3 2019 and Asia Pacific approached the 2019 level at 96%.

London Heathrow Airport edged ahead of Dubai International to take the top spot among global airports for international departures. Heathrow saw just under 14 million international departures in Q3, up from 10 million in Q2, while Dubai followed in second place with 12.4 million.

Amsterdam Schiphol, Paris Charles de Gaulle and Singapore Changi complete the top five airports for international departures with between 10.5 and 11 million international departures each in Q3.

Airport shopper trends

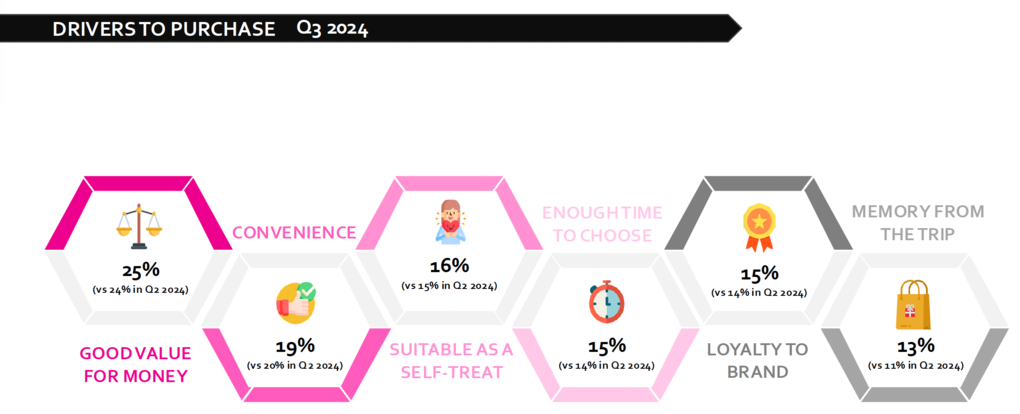

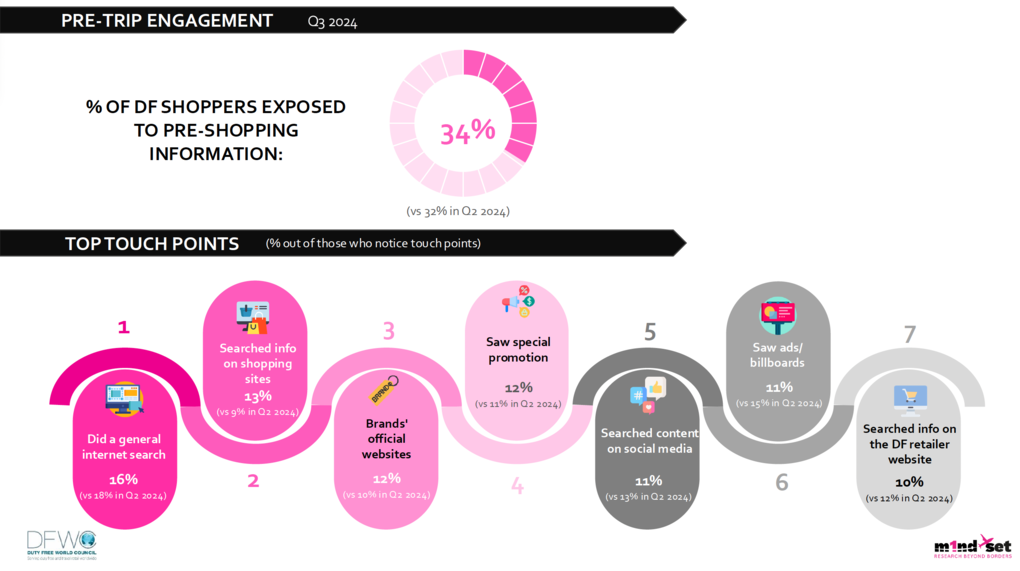

In addition to traffic evolution, the DFWC’s quarterly KPI Monitor also provides an overview of the evolution of key shopper trends. Significant trends from the Q3 monitor include the decline in gifting as a purpose to purchase, a shift in the main motivations to purchase and an increase in impulse purchases.

M1nd-set Owner and CEO Peter Mohn explained: “The Duty Free World Council’s KPI Monitor which follows the global trends picks up on some of these underlying tendencies we have observed through other recent studies across various regions and categories.

“The decline in gifting as a purpose of purchase is one of these long-term evolutions, which is still the case in the short-term, dropping from 27% in Q2 this year to just less than a quarter, 24%, in Q3. Self-consumption remains the number one purchase destination, accounting for just over half of all purchases. Sharing purchases increased moderately by +3% from 14% to 17% while on-request purchases have remained stable.”

The purchase rate in duty free and travel retail has remained stable over recent years, Mohn noted, and the conversion rate has even increased by +6% compared to the pre-COVID era, when looking at shopper behaviour across all categories. This, he observed, implies that the price competitiveness issues which the duty free and travel retail channel is often synonymous with do not necessarily impact the decision to purchase.

Mohn continued: “Shoppers who make the final purchase decisions inside the store, namely undecided shoppers and impulse buyers, account for a vast majority, i.e. more than seven out of ten purchases, with a moderate increase in the percentage of impulse buyers.

“This is consistent with the other major trend we are seeing over recent years as well as in the short-term, namely the decline in the importance of price and value as a purchase driver, as more experiential aspects to the shopping experience take precedence over the financial influencers.

“We have seen a significant decline in the importance of price advantage in particular, with a -19% drop over the past five years, as in-store experiences become the main purchase drivers. The latest DFWC KPI Monitor reveals that 45% of global shoppers are impacted by in-store experiences compared to 41% who cite the price advantage as a key reason to purchase.”

Price nevertheless remains a barrier to purchase for the non-shoppers, which the DFWC KPI Monitor also tracks. 18% of non-shoppers cited higher prices than at home and 14% higher prices than at destination, up from 15% and 12% respectively compared to the previous quarter.

Lack of motivating promotions is another main purchase barrier, cited by 16% of non-shoppers, -1% less than in Q2. Other reasons for not shopping include a desire not to carry additional items (16% compared to 13% in Q2), no intention of purchasing anything (14% vs 16% in Q2) and not being attracted by anything (12%, no change vs Q2).

DFWC President, Sarah Branquinho commented: “One of the key reasons and benefits of the DFWC quarterly KPI Monitor is to provide the industry with the underlying trends that enable stakeholders to enquire further about the ‘why’ and ‘how to adapt’.

“This trend-tracking enables stakeholders to explore global tendencies further, to discern how they compare to their business locally and, most importantly, to understand why and how they can take advantage of the insights to adapt their strategies on a global, regional or local level.” ✈