INTERNATIONAL. Gift purchasing in travel retail continues on an upward curve according to new research released by the Duty Free World Council (DFWC).

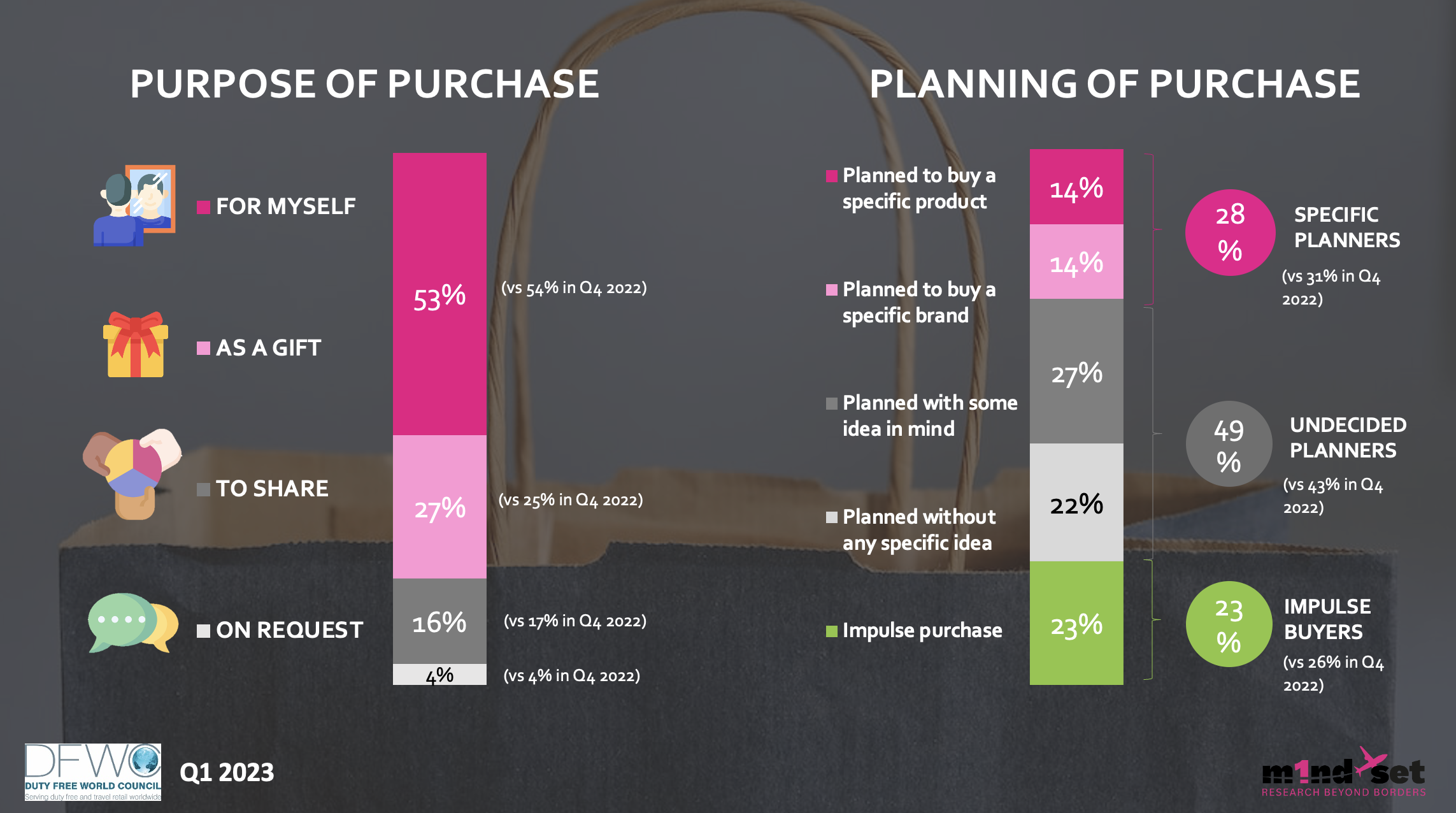

The DFWC Q1 2023 KPI Monitor – compiled by travel retail research agency m1nd-set – finds that gifting is the only purchasing behaviour that is on the rise between Q4 2022 (25%) and the first quarter of this year (27%). The number, however, is still well down on pre-pandemic levels according to the research company.

Giving her thoughts on the research findings, DFWC President Sarah Branquinho said: “One of the key benefits of the DFWC KPI Monitor is its ability to track trends across various shopper behavioural aspects over time.

“This enables industry stakeholders to maintain their finger on the pulse in terms of where the industry is performing well, as well as where improvements can be made.

“The fluctuations in the purchase drivers monitored, such as value for money, convenience, and brand loyalty, as well as the barriers to purchase, such as the lack of motivating promotions, reveal where we need to constantly review the offer, and focus on improving communication of the benefits of purchasing in the duty- and tax-free channel to travellers.”

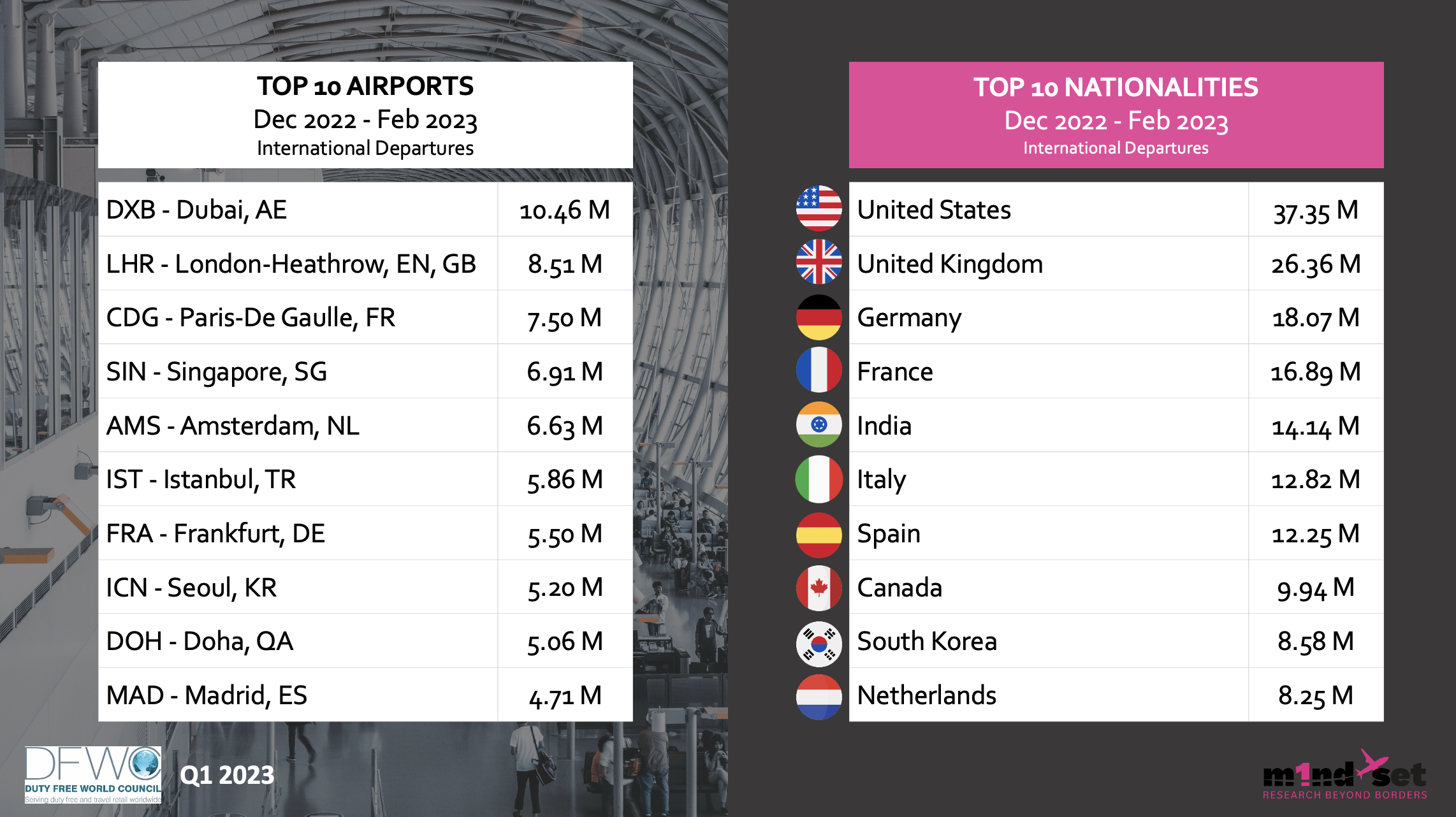

Meanwhile, traffic evolution data – from m1nd-set’s Business 1ntelligence Service (B1S) and sourced from the International Air Transport Association (IATA) – shows that during Q1 this year, global passenger numbers continue to recover and are now only -16% below pre-pandemic levels.

m1nd-set CEO and Owner Peter Mohn said: “Air traffic in both North America and the Middle East between December 2022 and February 2023 has now overtaken the traffic between December 2018 and February 2019.

“North America’s traffic was at 111% of the pre-pandemic level at 42 million in the last quarter, while in the Middle East, international departures were just over pre-pandemic levels at 103%, with 54 million international departures from the region during Q1 this year.

“Only Asia Pacific traffic shows a slower revival due to the staggered reopening across the region, particularly China.”

Mohn continued: “Asia Pacific traffic in Q1 2023 is only just over half the level it was at between December 2018 and February 2019 at 53 million international departures. In Europe and South America on the other hand, air traffic is just below the pre-pandemic level at 95% and 96% respectively.”