INTERNATIONAL. The global luxury industry recorded growth of just +2.4% last year, the first time in three years that growth has fallen below double digits. Global accountancy and consulting firm EY has estimated the market’s value at €217 billion.

The company’s Luxury and cosmetics financial factbook – based on publicly available data and brokers’ reports – also reveals that growth was led by US and Chinese consumption.

EY Global Luxury Leader Paul Wood noted that while the growth rate had declined – in 2012 the market grew by +10.4% – profitability had been maintained due to “volume growth, a high retail mix with greater margins and an increased focus on efficiency”.

The cosmetics market also grew last year, by +3.8%, and was valued at €175 billion. The beauty industry is expected to double in the next ten to 15 years with China, the USA, Brazil, India and Japan as leading markets.

|

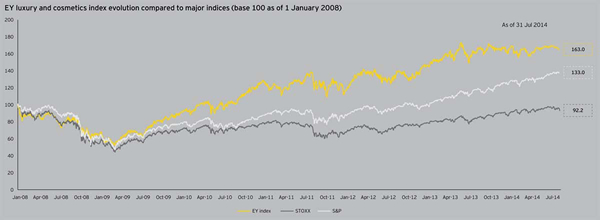

Click on the above to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

Luxury spending from Chinese consumers is under pressure, EY noted. New government regulations, more discerning customers and evolving buying trends have impacted the growth of luxury houses. The market has also changed due to Chinese consumers’ lack of brand loyalty, desire for higher-end products and demand for a digital channel.

Last year Chinese shoppers represented around a third of global luxury spend, and will represent close to 40% of all luxury growth to 2020.

The factbook also notes that while luxury houses have traditionally lagged behind other retailers in their digital presence, an increasingly youthful luxury demographic is driving faster digital development.

The growing emergence of e-tailers – especially in the US fashion market – is starting to challenge the traditional luxury world. While online business still only amounts to 4.5% of the luxury market, sales grew by +30% year on year.

Wood said: “Luxury companies will continue to present high-potential growth with a limited risk profile. This will be driven by longer-term urbanisation, a reducing drag on the wholesale market and an increasing shift toward younger, male customers.”

|

Click here to read more about the EY Luxury and cosmetics factbook 2014 |