EUROPE. Airports Council International (ACI) Europe and the European Travel Retail Confederation (ETRC) today reinforced their call for the European Union to review legislation to allow travellers from third countries to buy duty and tax free on arrival at EU airports.

The campaign, which began in the Summer, has been backed by an independent report commissioned by ETRC from York Aviation, launched today. It outlines the potential economic benefit achievable through the introduction of arrivals duty free shopping in the region. The study and context was introduced by York Aviation Partner James Brass today, on a call with ETRC President Nigel Keal and ACI Europe Deputy Director General Morgan Foulkes.

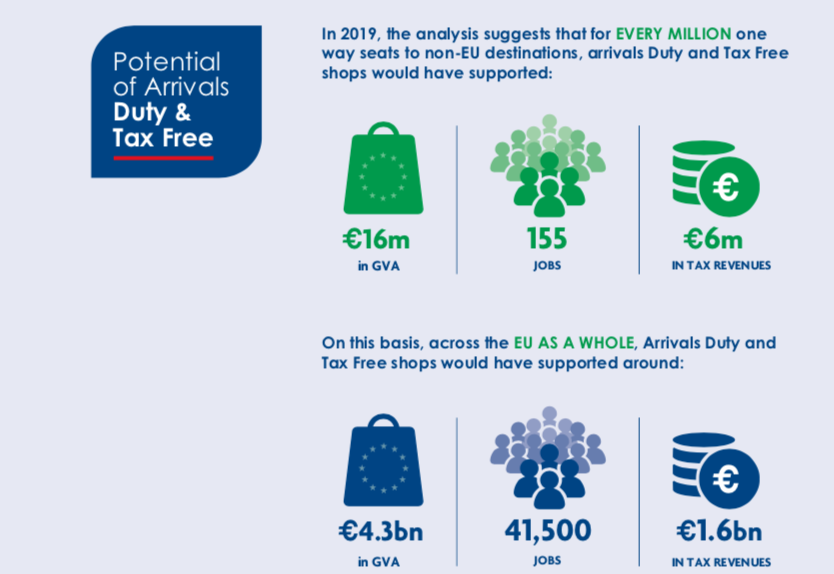

Based on 2019 traffic figures, the analysis found that duty and tax free arrival shops would have generated around €4.3 billion in Gross Value Added (GVA), supported 41,500 jobs and generated €1.6 billion in tax revenues.

The report estimates that arrivals duty and tax free sales could make up an estimated 20% (perhaps rising to 30%) of total travel retail sales at EU airports.

In addition, as the UK is scheduled to leave the EU on 1 January, the numbers of non-EU passengers will increase substantially, and many smaller, regoinal airports would see the benefits from arrivals duty free. Recognising the impact of COVID-19 on air traffic, the report draws the conclusion of an initial impact per million passenger of around €1.3 billion in GVA, 12,100 jobs and €475 million in tax revenues, rising to €3.5 billion in GVA, 33,700 jobs and €1.3 billion in tax revenues.

Crucially, the report noted that:

- It is unlikely that duty and tax free arrivals shops will result in a significant increase in overall travel retail sales globally. Instead they will shift sales from outside the EU to inside the EU;

- The system of allowances will remain and hence it is unlikely that domestic markets will be affected or that there will a cost to the public finances from lost excise duty or sales taxes;

- The change will have a positive impact on government revenues as economic activity within the EU is boosted.

Arrivals duty and tax free shops are commonplace in many airports, including all EEA countries (Norway, Iceland & Switzerland) where it is popular with arriving passengers, mainly resident nationals. But under current EU legislation, duty and tax free sales are only allowed to passengers ‘leaving’ the European Union.

ACI Europe and ETRC noted that allowing duty and tax free shopping on arrival for passengers travelling from third countries to the EU “will restore competition for EU airports versus their international counterparts, by creating much-needed revenue and supporting employment at EU airports at this crucial time.”

ETRC President Nigel Keal said: “The introduction of EU arrivals duty and tax free shopping presents us with a great opportunity to renew the outdated approach to arrivals shopping in the EU.

“As allowances will remain the same, this proposal will simply give passengers another opportunity to avail of their duty & tax free allowance and to choose to support their local airport rather than buy abroad. Our members will be driving the biggest ever industry recovery effort in the coming years – allowing arrivals duty and tax free will greatly facilitate this.”

ACI Europe Director General Olivier Jankovec said: “EU airports are currently facing the most difficult trading conditions in modern history and are urgently in need of government support. Given the unique role that airports play as economic gateways, it is imperative that all steps are taken to keep them open through these difficult times.

“EU airports are currently losing hundreds of millions of Euros of potential commercial income to their non-EU counterparts each year. Arrivals duty and tax free will allow retail sales to be displaced from third countries back to the EU airport of arrival.”

As reported, the campaign has the support of leading travel retailers ARI, Dufry, Gebr Heinemann and Lagardère Travel Retail, with strong engagement with the EU Commission (at the crucial level of DG Taxes) and at national level to support a vote in favour of the new channel.

It is expected that any new legislation would cover the maritime channel as well as airports, just as departures legislation does, said the ETRC.

Keal added that the crisis represented “an opportunity to rethink the EU approach to airport economics, and find ways to rebuild the industry better and stronger”, notably through measures such that don’t cost national governments any money.

“The travel retail sector can help achieve that goal while allowing arrivals duty free to non-EU travellers,” he said. “This is not a new concept and is available in many jurisdictions. It’s a proven business model and can deliver consistent and reliable revenue streams. But EU legislation restricts sales to departing passengers. So we need that legislation to change and have been working on this for seven to eight months now.

“It is primarily about levelling up the market and will ultimately benefit travellers, airport retailers and governments. We are aligned on this as an industry: airports, retailers and our vendors.”

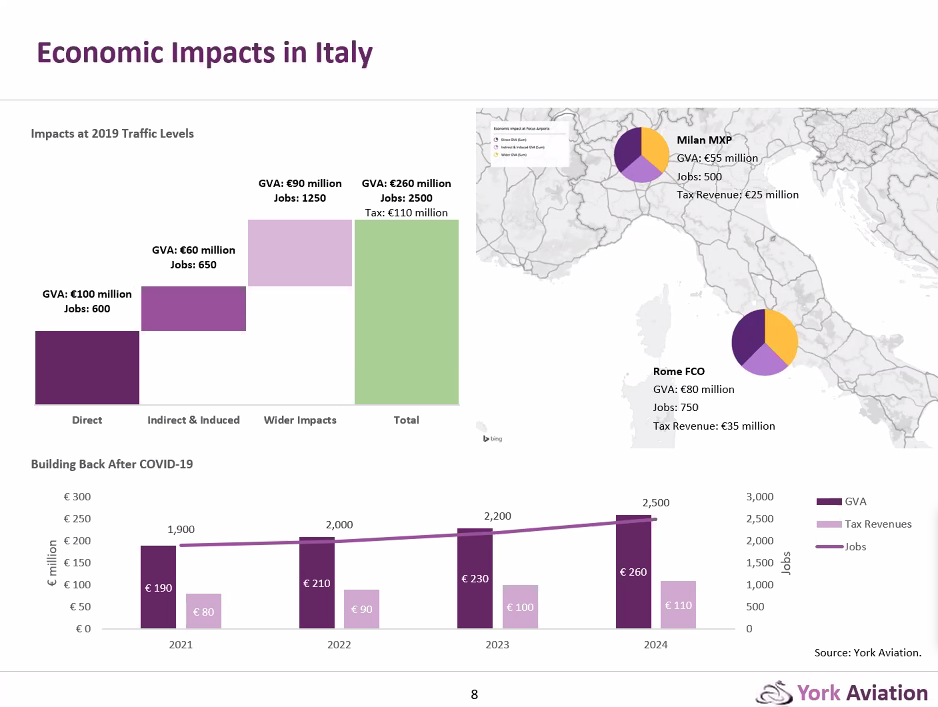

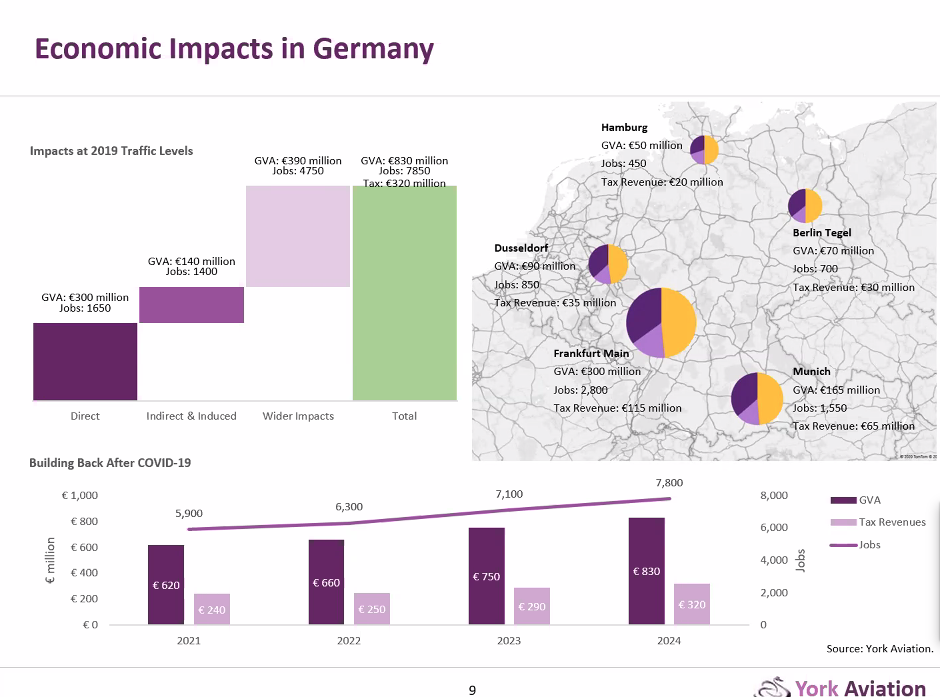

The report leaned heavily on data from Spain, Italy and Germany, and outlined the potential direct, indirect, induced and wider impacts on each market (see charts below).

In its conclusions, ETRC said: “Ultimately, the primary impact of the change would be to ‘level up’ competition in the travel retail market between EU and non-EU airports. Currently, airports in the EU can only sell duty and tax free goods to passengers departing the EU. However, competing airports outside the EU can sell to passengers either on arrival or departure. This stifling of competition is bad for consumers and denies opportunities to generate revenues for EU based retailers and airports, which ultimately support more jobs and GVA.”