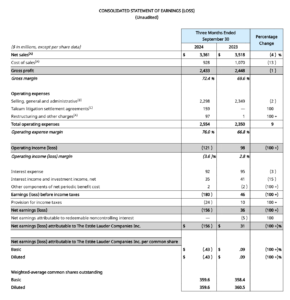

The Estée Lauder Companies (ELC) has reported a -4% drop in net sales to US$3.36 billion for the first quarter of fiscal 2025, ended 30 September. Organic net sales decreased -5% driven by weakened consumer sentiment and the softening of prestige beauty in China, low conversion rates and inventory pressures in Asia travel retail.

ELC attributed these challenges to shifting consumer preferences, with travellers increasingly prioritising experiences over retail purchases, particularly in beauty categories.

The growth in several markets, including Japan and other Priority Emerging Markets such as Brazil, Mexico, India, the Middle East, Türkiye, South Africa, Thailand, Malaysia, Vietnam, Indonesia and The Philippines partially offset the decline.

ELC Chief Executive Officer Fabrizio Freda commented: “Our first-quarter results are largely aligned with our outlook on an adjusted basis, even though the expected headwinds in China and Asia travel retail were greater than anticipated. Our Profit Recovery and Growth Plan drove gross margin expansion, which was partially offset by operating deleverage. Other pillars of our strategic reset also delivered promising initial results.

“As we reignite skincare, our night-time innovations proved highly sought after, driving strong organic sales growth for the category in the markets of EMEA as well as strong share gains for the second consecutive quarter in prestige skincare in China, led by La Mer.

“We advanced our ambitions to capitalise on the multiple growth drivers of fragrance. We expanded consumer reach of our luxury and artisanal portfolio and launched Balmain Beauty, as we aim to strengthen our strategic leadership in luxury fragrance, demonstrated in the quarter by having become the top-ranked company in Japan in the category driven by Le Labo and Jo Malone London.

“Moreover, we set the stage to reaccelerate our growth in the prestige tier of fragrance. We also made great strides in our pursuit of moving faster to leverage winning channels, most notably in the USA having delivered a sequential acceleration of retail sales growth in the first quarter. And just last week we further demonstrated our execution of this pillar, as our Estée Lauder flagship brand debuted in the US Amazon Premium Beauty store.

“While we believe the new economic stimulus measures in China present medium- to long-term potential for stabilisation and ultimately growth in prestige beauty, we anticipate still-strong declines near-term for the industry in China and Asia travel retail.

“In the rest of our business, we continue to expect the ongoing normalisation of growth in prestige beauty, most notably in North America. With this complex industry landscape, including the difficulty in forecasting the timing of market stabilisation and recovery in China and Asia travel retail, and in the context of leadership changes, we are solely issuing an outlook for the second quarter and withdrawing our fiscal 2025 outlook.

“Additionally, we are reducing our dividend to a more appropriate payout ratio, which will also create more financial flexibility for our incoming leadership team to reaccelerate our profitable growth trajectory.”

Despite the revenue decrease, ELC’s Profit Recovery and Growth Plan (PRGP) is beginning to yield positive effects. Initiatives under the PRGP have led to an improved gross margin through lower cost of sales, although operating deleverage due to the decline in net sales has dampened overall performance.

Reported operating losses for the quarter hit US$121 million, a drop from last year’s operating income of US$98 million, though adjusted operating income rose +23% in constant currency to US$133 million.

As reported, ELC recently announced that William Lauder will step down from his current role as Executive Chairman. It also announced the appointment of Stéphane de La Faverie as President and Chief Executive Officer, and member of the Board of Directors, effective 1 January 2025.

Freda added: “Having worked alongside Stéphane for many years, I am thrilled to welcome him as our next President and CEO and look forward to supporting a seamless transition for the next several months. In an industry as dynamic as prestige beauty, Stéphane’s deep knowledge, exceptional strength as a leader and ability to combine inspiration, authenticity and strategic insights to drive profitable growth will enable him to move us forward with speed and agility.”

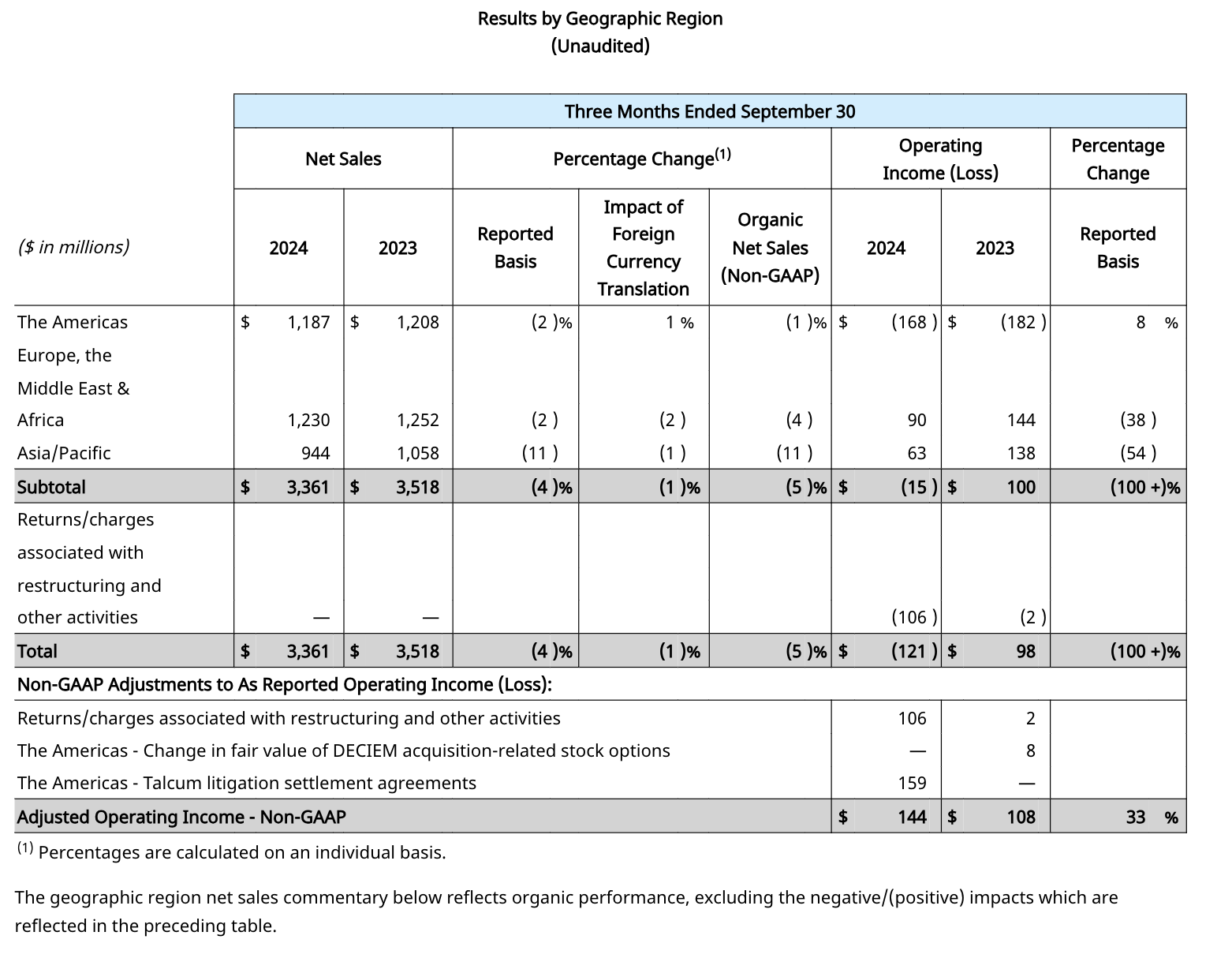

Regional performance

Asia Pacific

Q1 net sales in Asia Pacific decreased -11%, primarily due to declines in Mainland China and Hong Kong. Mainland China’s prestige beauty segment has been impacted by declining consumer sentiment, while in Hong Kong low replenishment orders and low conversion rates among travellers have further strained the market.

However, Japan emerged as a bright spot, with double-digit growth across all categories, led by fragrance. Operating income decreased, primarily driven by the decline in net sales, partially offset by disciplined expense management.

Europe, Middle East and Africa (EMEA)

EMEA net sales dropped -4%, driven by a double-digit decline the company’s global travel retail business. Net sales grew in low single digits collectively in EMEA markets, fuelled by online sales and innovations in skincare. Operating income decreased partially due to strategic investments aimed at driving growth, including new product innovation and expanding consumer reach.

Americas

Net sales in the Americas recorded a -1% decline in the first quarter, primarily due to sluggish demand from brands such as MAC, Aveda, Tom Ford and Too Faced in North America. However, strong online performance through Amazon’s US Premium Beauty store launch provided a boost which helped its retail sales grow by low single digits in the USA. This was also partially offset by growth in Latin America and especially with makeup in Brazil.

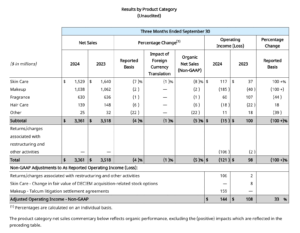

Category breakdown

Skincare

Skincare net sales dropped -8% in Q1, largely influenced by weakened consumer sentiment in China and lower conversion rates in Asia travel retail.

Additionally, lower replenishment orders in Asia travel retail – particularly given heightened inventory pressures due to slowing retail markets – impacted organic net sales. These challenges contributed to double-digit declines for La Mer and Estée Lauder.

However, partially offsetting the drop for the Estée Lauder brand’s sales within Mainland China and Hong Kong SAR was a growth in net sales across EMEA and the Americas. This increase was driven by innovation in the Advanced Night Repair and Revitalizing Supreme+ product lines, with a strategic emphasis on night-time skincare.

In the Americas, net sales growth reflected shipments for Estée Lauder’s October 2024 launch in Amazon’s US Premium Beauty store. Overall, skincare operating income improved due to lower cost of sales and careful expense management, though it was somewhat offset by declining net sales.

Makeup

Makeup net sales for the first quarter saw a -2% decrease, primarily impacted by MAC and Too Faced, although Clinique offered a slight offset in gains. MAC experienced a high-single-digit decline in net sales, reflecting weaker retail sales in North America that subsequently led to reduced replenishment orders. Ongoing business disruptions in the Middle East also weighed on MAC’s net sales. Too Faced similarly saw a reduction in net sales, especially within North America.

Conversely, Clinique experienced a double-digit global increase in net sales, driven by growth across all regions. This stemmed from continued strength in the lip subcategory, led by the Clinique Pop and Almost Lipstick franchises, bolstered by new product innovation. It was also supported by its fiscal 2024 third-quarter launch in Amazon’s US Premium Beauty store.

Fragrance

Fragrance net sales fell -1%, mainly due to challenges in global travel retail, though this was partially offset by growth in Asia Pacific and in markets across EMEA collectively.

Reported and organic net sales for the company’s luxury brands, excluding global travel retail, grew mid single digits compared to the previous year, reflecting strategic investments in direct-to-consumer expansion, particularly in freestanding stores.

Tom Ford’s net sales declined by high single digits, reflecting retail softness in North America, which led to lower replenishment orders, as well as the ongoing travel retail challenges. Similarly, ELC’s prestige brands posted a double-digit decline, largely driven by travel retail issues.

Jo Malone London’s net sales remained flat as challenges in global travel retail were offset by broader business growth due to new products such as Orange Marmalade and Hinoki & Cedarwood, as well as established products such as Cypress & Grapevine, which benefitted from a strategic focus on men’s products.

Le Labo, however, saw double-digit growth in net sales, largely due to the continued success of the Classic Collection and the annual City Exclusive event. This growth was further supported by expanded direct-to-consumer reach globally.

Despite these gains, Fragrance operating income decreased due to strategic investments aimed at expanding global consumer reach and supporting the growth of its luxury brands, including promotional activities for the fiscal 2025 launch of Balmain Beauty.

Haircare

Haircare net sales declined -6% in Q1, primarily driven by Aveda, which was affected by the timing of shipments and continued softness within the company’s North America salon channel. However, the category’s operating losses improved, reflecting a reduction in cost of sales and disciplined expense management, though partially offset by the dip in net sales.

Q2 outlook

ELC retracted its full-year outlook due to market volatility and has tempered its outlook for Q2 FY2025, anticipating continued difficulties in Asia travel retail.

ELC forecasts that organic net sales will decrease between -8% and -6% in the second quarter. It is maintaining investments in the second quarter to drive growth in key business areas, particularly through innovation and preparations for holidays and other high-traffic shopping periods.

Looking ahead, ELC remains cautiously optimistic about potential benefits from China’s recent economic stimulus, though it does not anticipate immediate improvements in Q2. In the rest of its business, it continues to expect the ongoing normalisation of growth in the prestige beauty industry, most notably in North America. ✈