The Estée Lauder Companies achieved net sales of US$3.90 billion in the first quarter of fiscal 2020 (ended September 30), up by +12%* (constant currency), with travel retail singled out as performing very well on a global basis.

Growth in the channel was broad-based, with double-digit rises for Estée Lauder, La Mer, Origins, Jo Malone London and Bobbi Brown. Growth also reflected increases in international passenger traffic, improved conversion and strategic investments to support both new and existing products, said Estée Lauder.

The company added: “The decline in travel retail in Hong Kong was offset by an acceleration in other Asian markets due to strong consumer demand for our products.”

Total operating income hit US$779 million, up strongly by +20% (+19% reported). This largely reflected the company’s higher net sales coupled with disciplined cost management across the business even though advertising investment was increased. Initial market reaction was subdued with a dip in the share price this morning to US$183 from US$192 last night.

The Estée Lauder Companies President and CEO Fabrizio Freda said: “We have started fiscal 2020 with terrific results. Our winning strategy based on multiple engines of growth helped us deliver an extraordinary performance, especially in light of the volatile global environment.

“Our sales growth was led by excellent results from international markets, particularly in China and other emerging markets; the skincare category; the travel retail and online channels globally; our Estée Lauder brand and several luxury brands – all of which grew double digits.”

Freda noted that all four of the company’s biggest brands – each with annual sales of “well over US$1 billion” grew globally, with hero franchises continuing to power the Estée Lauder portfolio.

Product segment review

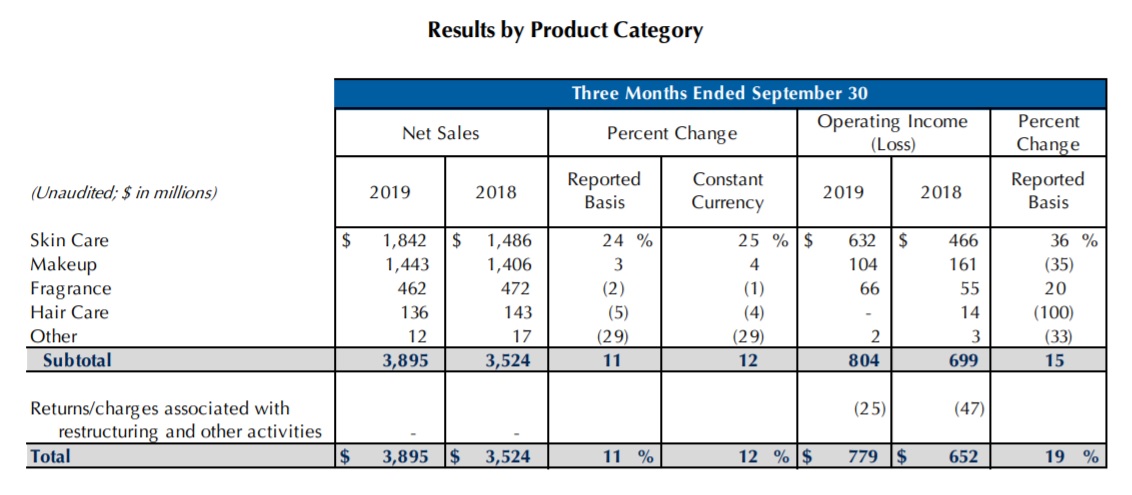

Among the main categories, skincare was the runaway success growing at +25%, while makeup rose by +4% and other segments such as fragrance and haircare contracting (see table below). Skincare– Net sales grew across all regions led by double-digit growth for Estée Lauder and La Mer. Clinique and Origins also expanded globally. The Estée Lauder brand saw strength in core franchises such as Advanced Night Repair, Micro Essence and Revitalizing Supreme and was supported by innovations including Advanced Night Repair Intense Reset Concentrate. La Mer generated net sales increases across every region and major channel helped by existing linessuch as The Treatment Lotion and The Concentrate, as well as The Regenerating Serum relaunch. Clinique’s growth was driven by Moisture Surge, the Dramatically Different Moisturizing franchise and Smart Clinical, which drove growth in North America and travel retail.

Skincare– Net sales grew across all regions led by double-digit growth for Estée Lauder and La Mer. Clinique and Origins also expanded globally. The Estée Lauder brand saw strength in core franchises such as Advanced Night Repair, Micro Essence and Revitalizing Supreme and was supported by innovations including Advanced Night Repair Intense Reset Concentrate. La Mer generated net sales increases across every region and major channel helped by existing linessuch as The Treatment Lotion and The Concentrate, as well as The Regenerating Serum relaunch. Clinique’s growth was driven by Moisture Surge, the Dramatically Different Moisturizing franchise and Smart Clinical, which drove growth in North America and travel retail.

Makeup – Growth was primarily driven by double-digit increases from Estée Lauder, Mac, Tom Ford Beauty and La Mer but partially offset by lower sales from Too Faced, Becca and Clinique. Estée Lauder was helped by the Double Wear line while Mac had big increases in Greater China, Japan, Southeast Asia and Latin America, and also expanded consumer reach that supported strong growth in travel retail and online. Tom Ford Beauty was driven by lip colour, eye shadow and cushion compact products in Asia/Pacific, and a highly successful launch on Tmall this quarter. La Mer saw continued success with The Luminous Lifting Cushion Foundation, as well as better targeted consumer reach.

Fragrance – Sales decreased by -1% as growth at Jo Malone London (helped by the launch of Poppy & Barley) and Tom Ford Beauty (led by certain Private Blend fragrances and the launch of Metallique) was offset by certain designer fragrances. The Estée Lauder brand also had a difficult comparison due to the launch of Beautiful Belle in the prior-year period.

Haircare – The segment declined by -4% reflecting lower net sales from Bumble and bumble, primarily in North American salons and speciality channels, and difficult comparisons at Aveda due to a successful shampoo and conditioner launch in the prior-year period.

Review by geographic region

Asia Pacific was the biggest growth driver at +26% while Europe, the Middle East & Africa had a strong showing with +19%. The Americas saw a contraction of -6%. Americas – A North American decline was driven primarily by soft colour cosmetics sales whereas skincare continued to grow. Sales of hero products increased by double-digits across all categories, and Estée Lauder said that several of its brands gained share in sub-categories including mascara, moisturisers and serums. Fragrance declined, in part, due to lower sales at the Estée Lauder brand related to a difficult comparison with the prior-year period. Online grew across brand.com and retailer.com. In Latin America net sales grew by double-digits led by Mexico and Brazil.

Americas – A North American decline was driven primarily by soft colour cosmetics sales whereas skincare continued to grow. Sales of hero products increased by double-digits across all categories, and Estée Lauder said that several of its brands gained share in sub-categories including mascara, moisturisers and serums. Fragrance declined, in part, due to lower sales at the Estée Lauder brand related to a difficult comparison with the prior-year period. Online grew across brand.com and retailer.com. In Latin America net sales grew by double-digits led by Mexico and Brazil.

Europe, Middle East & Africa– Strong growth of +19% was primarily due to high double-digit gains in travel retail and online though every market in the region contributed to the rise. There were double-digit increases in the Balkans and Switzerland, while, in emerging markets, double-digit gains were seen in Russia and the Middle East.

Asia/Pacific– Very high growth at +26% was broad-based, with nearly every market in the region expanding and more than half expanding by double digits. Greater China, Japan, Korea and emerging markets in Southeast Asia each delivered double-digit sales growth. In Greater China, growth accelerated on the Mainland, while net sales in Hong Kong declined as a result of the recent riots that impacted key shopping areas. Nearly all brands generated double-digit sales growth in the region.

Raised full-year guidance

Estée Lauder sees strong consumer demand for its fiscal year “ahead of the industry” implying it will build global share. Freda was optimistic about the rest of the period and said: “With our strong start and continued confidence in our ability to execute effectively, we are raising our full year net sales and earnings per share guidance in constant currency.”

The company expects global prestige beauty to grow approximately +5-6% during the fiscal year, assuming no additional geopolitical risks materialise. It believes its net sales will increase at+8-9% (at constant currency) which is above the high-end of the company’s long-term growth goal, and an increase from the previous estimate.

Nevertheless, the beauty giant is cautious about the continued softness of brick-and-mortar retail in the US and the UK affecting overall prestige beauty industry growth, especially makeup, as well as other uncertainties such as Brexit and instability in Hong Kong. The company also expects a gradual moderation of sales growth in China and travel retail.

Countering some of these potential negatives are improved data analytics and consumer insights which are fuelling new innovations and digital marketing as well as broadening existing growth engines and activating new ones for the company.

* All percentages shown are on a constant current basis unless stated.