NORTH AMERICA. The Airport Restaurant & Retail Association (ARRA) has underscored its call for financial support for airport concessionaires by issuing a ten-point paper outlining the harsh realities of business today, and the actions needed to aid recovery.

As reported, ARRA and its counterpart organisation the Airport Minority Advisory Council (AMAC) have been urging US airports and Congress to ensure financial relief measures for their members, airport restaurateurs and retailers.

This week ARRA released ‘Facing Facts: The Survival of Airport Shopping and Dining’, which Chairman Pat Murray said should help “stimulate conversation” around the industry’s future. On ARRA’s weekly call with its membership this week, Murray discussed the key points (see below) with airport consultant Steve van Beek and ARRA Executive Director Rob Wigington.

Setting the scene, ARRA noted that airport responses to the crisis facing concessionaires ranges from short- or longer-term waivers of fixed rent (Minimum Annual Guarantees), to varying periods of rent deferral, to simply saying “a contract is a contract.”

The Federal Aviation Administration has urged airports to collaborate with tenants and issued guidance on how airports can grant waivers and deferrals.

The ten ‘facts’ laid out by ARRA are as follows:

#1: Air Traffic Will Not Recover This Year

Since the declaration of the public health emergency four months ago, airline passenger traffic fell more than 95% from 2019 (pre-pandemic) levels, noted ARRA. During May, there was a slight recovery. According to Airlines for America (A4A), the trade association of US airlines, for the week ending 24 May:

- · Air travel (onboard passengers) fell -89%.

- · Flights were down system-wide -74%.

- · Domestic flights fell -68%.

- · International flights were down -95%, and in 2020 are expected to be half of levels in 2019

- · Airlines have idled over 3,000 planes, or 50% of their fleets.

ARRA commentary: “While some airports have started to see small upticks in traffic, they have been sporadic and inconsequential relative to airlines, airports, and airport business partners. By every indication, recovery will be slow, an outlook shared by airlines and industry analysts alike. Traffic projections to the contrary should be justifiably viewed with scepticism, if not disregarded as wholly and unreasonably optimistic.

“Passenger volumes took three years to recover from 9/11 and 7+ years following the 2007-08 global financial crisis. In this environment, where the survival of thousands of concessions businesses is at stake, it is imprudent to use a ‘best case’ scenario as the basis for structuring rent relief proposals.”

Steve van Beek said: “It will be a very different looking industry in future. That means how passengers flow through airports to the type of passengers who are flying. It’s not just about overall traffic: it’s how traffic filters through the concourse, shops and restaurants. It will be a challenging period, requiring all of us to forecast together to assess how the business will work.”

#2: Airport Restaurant and Retail Operators Can’t Pay Minimum Annual Guarantee During Recovery and Survive

As noted previously, ARRA has insisted that there can be no recovery without abatement of fixed rent or Minimum Annual Guarantee (MAG) through December 2020 at a minimum, and discounted percentage rent until traffic returns to at least 80% of the 2019 baseline.

ARRA commentary: “15%-20% of 2020 budgeted sales are dedicated to pay rent (Minimum Annual Guarantees, Percentage Rent, Storage Rent, Common Area Maintenance and other fees) and another 10-12% for debt service. With no sales or little sales, these expenses grow as a percentage of sales.

“Moreover, it’s important to shift the mindset from percentages to actual dollars. If an operator can manage all the other expenses in its P&L well, they would still lose millions. The survival equation becomes one that has nothing to do with being profitable, but only how much cash a business has on hand, and how many months it can survive based on the payments drawn down on that sum.”

Steve van Beek said: “The low volume of traffic means aeronautical revenues are reduced. MAGs are set at a multiple above those volumes so it’s clearly not possible to pay MAGs over a sustained period of time. This is not a 2020 problem, it’s a 2021/2022 problem. To think that we need only a six-month strategy is not going to work. It will need a restructuring of relationships.”

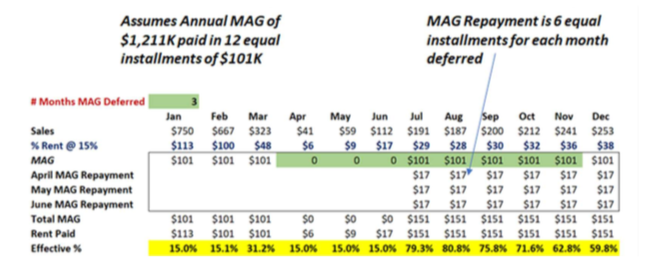

#3: Deferral Is Not Relief

ARRA commentary: “Deferring MAG is not a viable solution. Simply stated, lost sales in April, May, June and later are gone forever and will never be available to support the rent being deferred. If rent is deferred until late 2020, 2021 or even a later date, rent will actually double during the period operators are expected to repay deferrals. But, sales will not double and, once again, MAG will force businesses into a negative cash position.”

Rob Wigington said: “We understand that airports are in a quandary, and we appreciate those that have stepped up. But the temptation to say ‘I’ll just defer and look at it later’ doesn’t get the job done. We must be able to plan to stay in business, which is what we are trying to get across. Whatever sales didn’t get made in March to June are not coming back; you cannot pay rent on the basis that you did [make those sales].”

#4: The COVID-19 Financial Crisis is Devastating All Operators – Large and Small

#5: Interconnectivity of Primes, ACDBEs and Subtenants = Financial

ARRA commentary: “Martin Moodie, Founder of The Moodie Davitt Report, was recently asked about the payment of MAGs in global concession contracts during the pandemic. He noted that there are airports that erroneously believe that operators, particularly ones operating globally, ‘have the money to pay MAG’.

“The perception is that a large company can withstand poor performance in one market by making up for it in others. However, in this case of global impact, the scale of the larger companies works against them as every market in which they operate has been affected. Each market around the world is suffering much the same way, and the problem becomes multiplied by the size and scale of the companies.”

Steve van Beek said: “Facts 4 and 5 are very important. Those who work in airports and who are not connected with RFPs or concession oversight don’t really understand the relationships. There are some global companies that airports may think have deep pockets. You might be geographically dispersed but in this situation, all your business is hit with a 95% reduction. There is no off-set. Whether you are global or local, you face the same challenges.”

On Fact 5, Rob Wigington said: “The primes and ACDBEs each bring things the passengers want; brands local and national, and showcases for the community. By pointing this out we want to dispel some myths that all of these operators work independently. What happens to one affects the other; in fact 80%, or the vast majority, of ACDBEs are in joint ventures.”

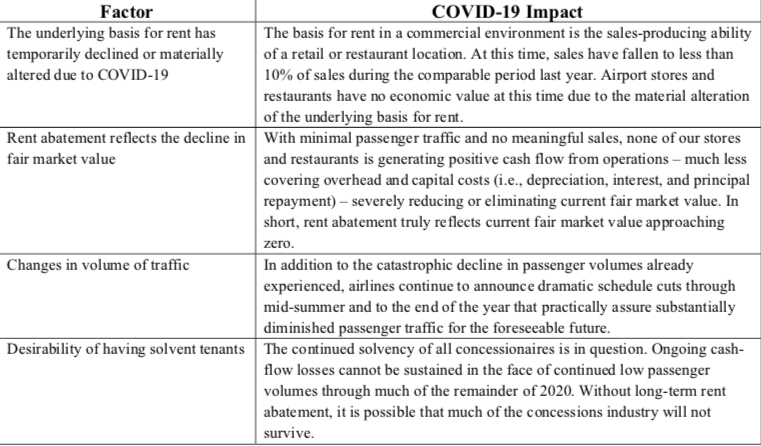

#6: The ‘Meeting of the Minds’ Underlying Concessions Contracts is Gone

ARRA commentary: “COVID-19 is far more than a typical market fluctuation; it is an unforeseeable catastrophic event that has crippled the global travel sector. The result is that the basis of the fundamental agreement between airport and concessionaire –enplanements in exchange for rent – has been materially and adversely affected.

“For an airport to take a position that ‘a contract is a contract’ and continue to expect concessionaires to pay minimum fixed rent when there are few, if any, enplaning passengers, ignores the basic expectation of both parties when signing a lease and concession contract – that there would be passengers at sufficient levels to sustain an airport concessions business.

“Concessionaires never agreed to be an airport’s insurance policy. Eliminating fixed and/or minimum rents until such time as there is sufficient traffic to support functional airport concessions businesses honours the ‘meeting of the minds’ of both parties at the time of contracting. This is good faith. This is fundamentally fair.”

Steve van Beek said: “Many contracts today were written or renewed in a time of growth, in the last ten years and especially over the past six. We got into a virtuous cycle – more capacity, more flights, more travellers, more shops open, more money spent. That created so many opportunities across ACDBE programmes, regional stimulus and so on.

“The problem now is that the virtuous spiral has turned into a vicious spiral. As revenue dries up and passenger numbers drop, we are left with this overhang of too few passengers chasing too much of the capacity that came online in those years.

“Unwinding that and having new administrative, business and legal relationships to underlie the partnership between concessionaires and airports is vital. We cannot expect that contracts designed during the virtuous period will work and survive in this (hopefully short) vicious period.”

#7: CARES Act Grants Replace Lost Revenue

This relates to the use of US$10 billion in Federal grants for airports that could be used for any lawful purpose, though there has been confusion, said ARRA, about its interpretation.

ARRA commentary: “There is more than sufficient justification to apportion a share of CARES Act grants to abating MAGs and renegotiating rent and fees.”

Rob Wigington said: “The confusion has been about how the grants are being administered. The Federal Aviation Administration put money out there fast for airports but the way it is structured means that airports first spend and are then reimbursed. But they cannot reimburse themselves for deferring or waiving rents.

“It was intended to replace lost revenues and help them meet their debt obligations. But they must provide some of that relief to their concessionaires and I would argue it is in their power to do so.”

#8: Airport Financials Are Sound – Opportunity Exists for MAG Relief

ARRA commentary: “According to Moody’s Investors Service, the airport bond rating agency, (Sector Comment, April 29, 2020) despite the impact of COVID-19 airport finances and bond ratings remain stable.

“Airports have ‘cash-on-hand’ and multiple layers of reserve funds specifically established to cover periods of unanticipated events or emergencies and the resulting disruption on operations and revenues. Such reserve funds are a critical component of fiscally sound management.

“When looking at which revenue source ‘makes or breaks’ the airport budget, concession fees are unlikely to move the needle one way or the other. For US airports, aeronautical revenue constitutes about half of total revenues. Of the remainder, terminal concessions produce less rent than automobile parking and rental cars, and therefore, have less impact on total airport revenue.”

Rob Wigington said: “No airport CEO ever feels like they have enough reserves. It’s tenuous for many airports who have to make hard choices. But we just point out that they receive a boost from the CARES Act grants, and there are ways even with bond ordinances to deal with tough situations. It is complex. We are just saying you can work through it together in a way that involves all parties.”

#9: Airport Restaurant and Retailers are Critical to the Local Economy

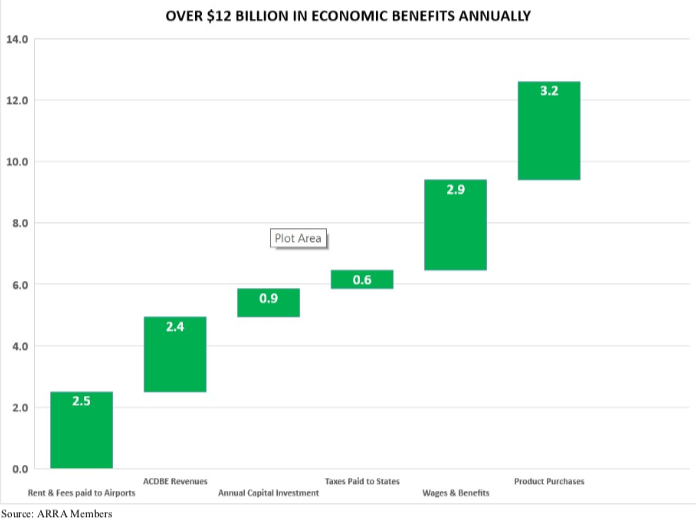

Airport restauranteurs and retailers contribute significantly to local economies, said ARRA, to the tune of around US$12 billion a year (see chart).

Steve van Beek said: “Airports put out their own economic impact studies, which advises on how much good they do [in the community]. A lot of times the individual contribution of the restaurants and retailers are buried under non-aeronautical revenue. It’s not always transparent what your [ARRA] members do here; we need to sensitise policy makers to this. There are different actors, they have their own shareholders, they take care of different people but they are a large part of what airports call their own contribution.”

#10: What Can Airports Do Now?

ARRA commentary: “There are several immediate steps that airports can take to assist concessions operators, enabling them to survive the historic drop in traffic and have a reasonable chance to resume service as traffic returns.” Airports are urged to:

- Take a realistic view of traffic patterns and in formulating rent relief proposals, plan for the worst-case scenario – whether or not it turns out to be the case.

- Grant immediate relief from fixed rent (MAG) through 2020, and initiate variable percentage rent rates until 80% of pre-COVID or 2019 enplanements have returned and stabilised. Honour the intent of the US$10 billion Federal relief package, which was enacted to offset lost revenue, and provide rent abatement to concessionaires.

- Engage all stakeholders in the discussions of rent relief.

- Consider using unrestricted reserve funds to meet other budget requirements .

- Defer capital investment in new concessions development projects.

- Suspend all storage rents, utilities, CAM, Marketing Fund and parking fees.

- Suspend all scheduled mid-term refurbishment.

- Suspend any pending RFPs/RFQs.

- Develop a measured and rational store reopening plan in collaboration with concession operators which considers the recalibration of MAG and percentage rents, to be updated and revised as the situation continues to unfold.

Steve van Beek said: “It’s a good time to take a step back and ask what will we need, how can we make the current collection of retail and F&B work and how can we improve things? It’s no good if we get more passengers coming through and the stores are shuttered. We are part of one eco-system.”

Rob Wigington said: “We must engage and be open about how we work through this together. We hear many examples of airports that are doing this with their concessionaires, who are seeking feedback and comment on how to reopen. And it’s for concessionaires to figure out what they can realistically do under constrained traffic.

“On the other side, as we begin to talk recovery, new measures, processes and so on, it is going to be challenging for the passenger. We have to focus on what it looks like in the terminal. The passenger will in effect have less of an offering.

“We need to ensure these shops and business can remain open and are viable. Otherwise passengers will have nothing to do, nowhere to shop or dine, and that is not a recipe for a great experience. It’s in all our interests to ensure an excellent service for the growing numbers of passengers as business returns. If we cannot make them feel comfortable and safe, they won’t come back.”