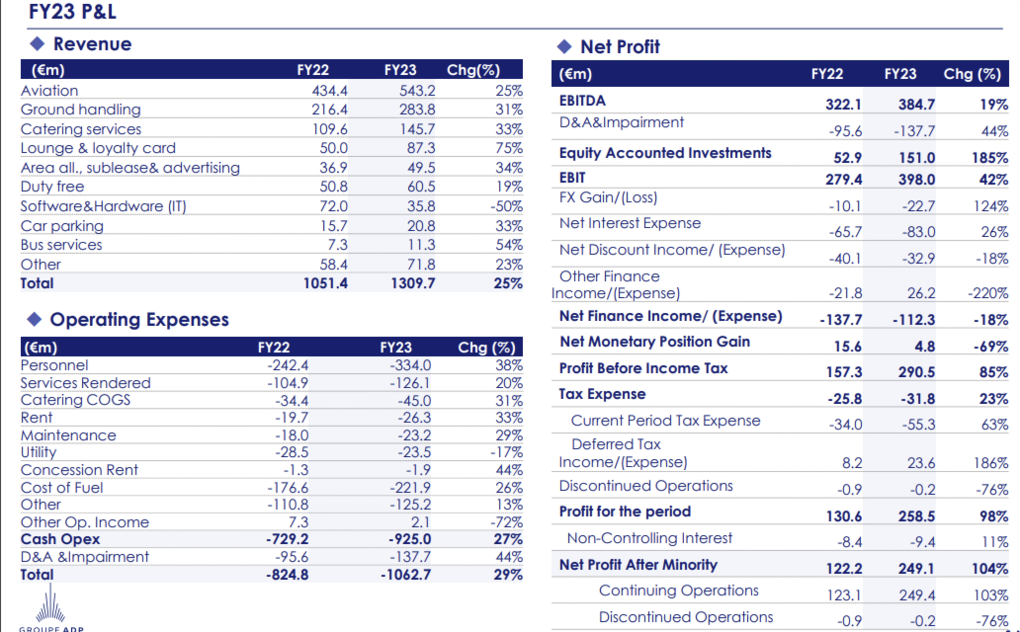

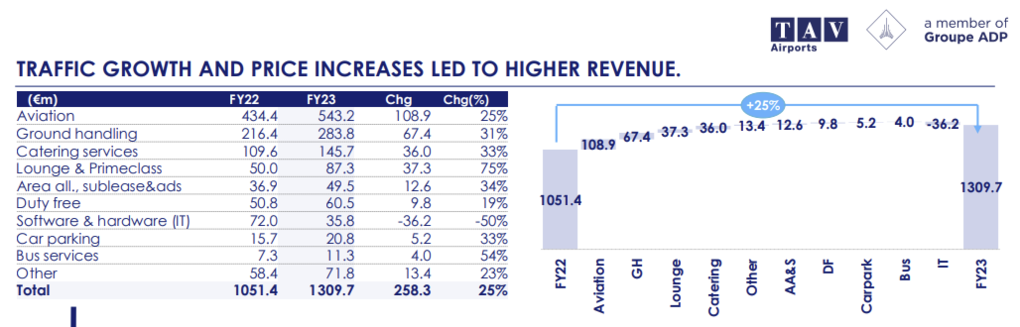

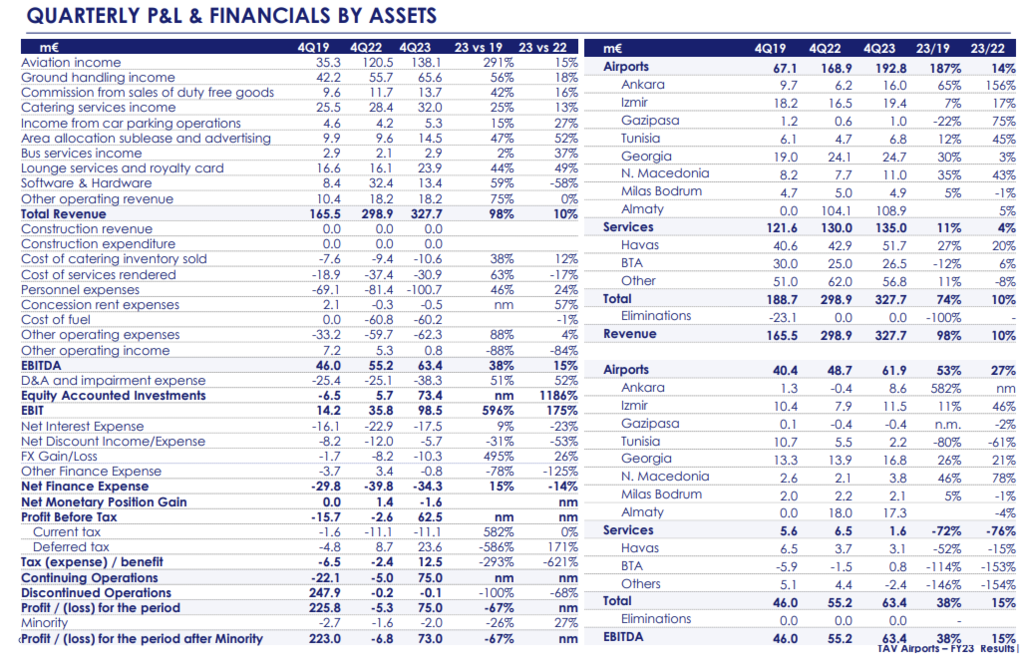

TÜRKİYE/INTERNATIONAL. TAV Airports, a member of Groupe ADP, generated a +25% increase in revenues year-on-year for 2023 to €1.3 billion with commercial sectors – duty free, food & beverage and lounge services – all to the fore.

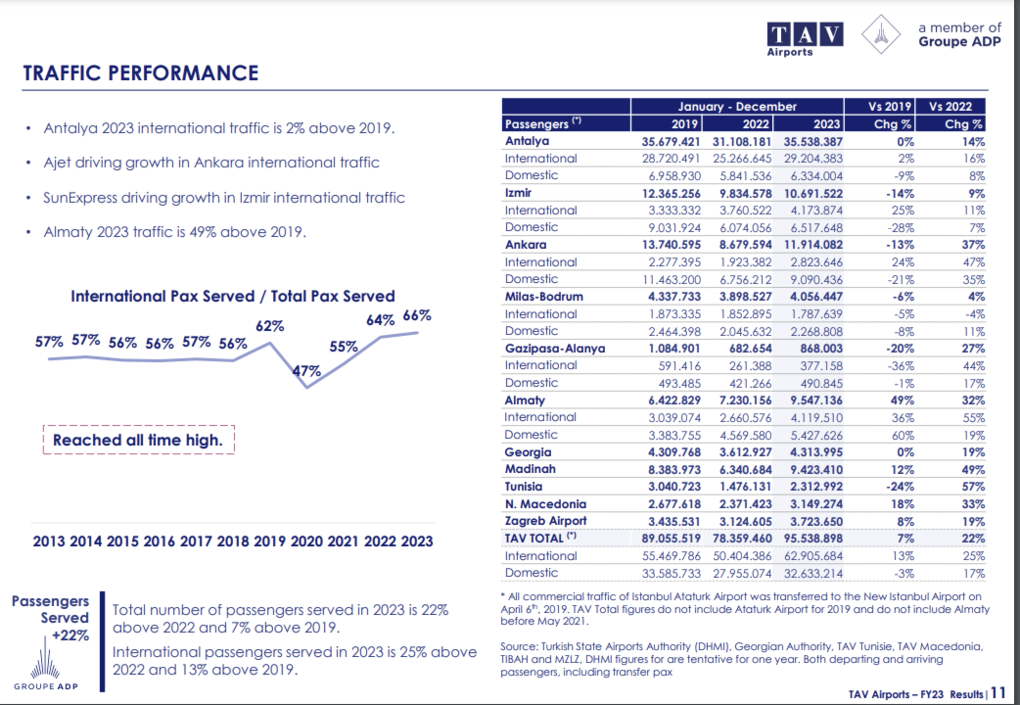

The robust performance was driven by a +22% increase in passenger numbers across the network to 96 million.

EBITDA grew +19% to €385 million. For 2024, TAV Airports expects total passenger traffic between 100 and 110 million, revenue between €1.50 billion and €1.57 billion and EBITDA between €430 million and €490 million.

Revenue growth is expected to be above the passenger increase, mostly due to significant expansion across lounge and hospitality, IT and ground handling services.

As a result of the impressive 2023 performance, TAV Airports is upgrading its 2022 to 2025 compound growth expectations for revenue (between +14% and +18%) and EBITDA (+14% and +20%).

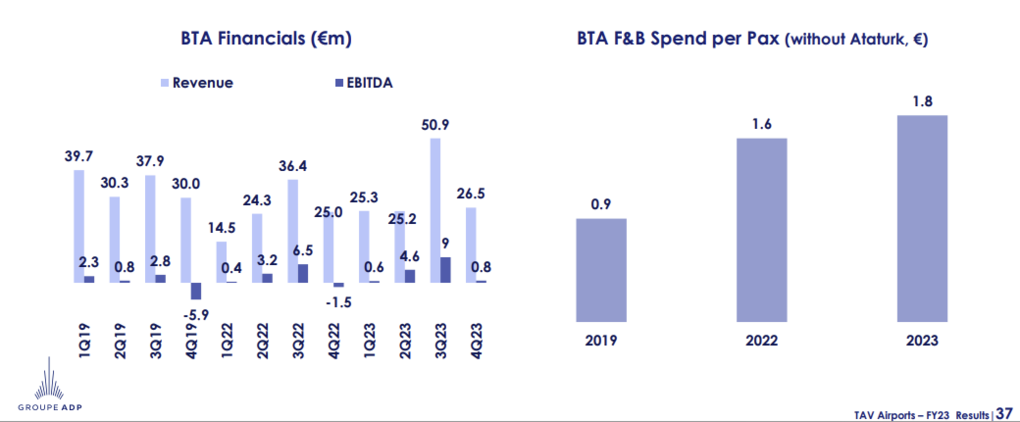

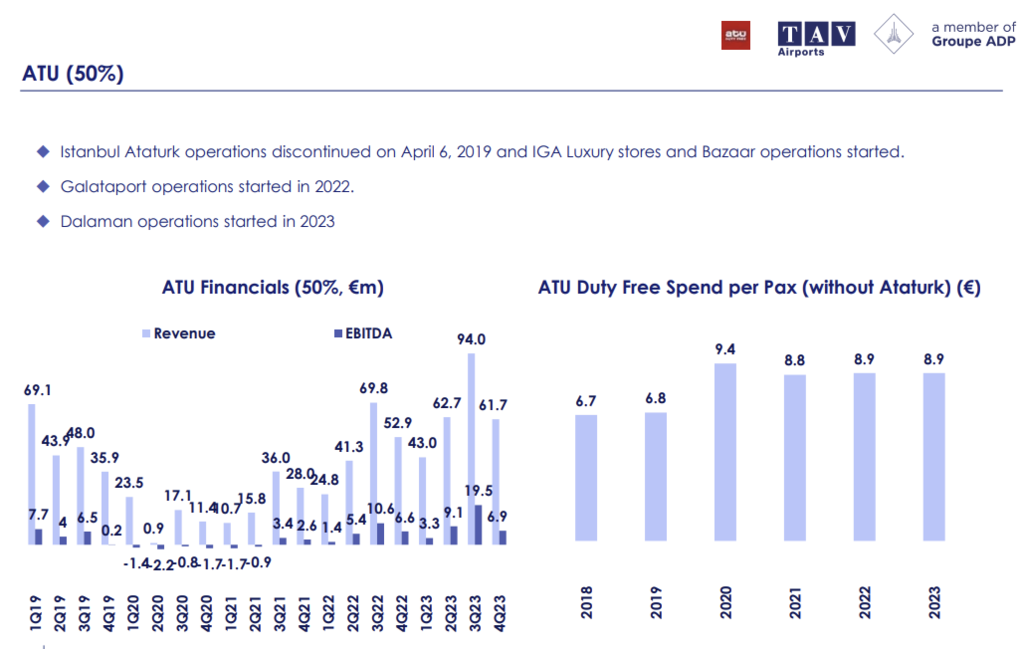

Revenue (income) from duty free concessions rose +19% year-on-year to €60.5 million on the back of higher traffic. Catering services saw a +33% increase to €145.7 million (see tables below), driven by passenger growth, better marketing and Euro inflation better reflected with Euro-based pricing.

TAV Airports CEO Serkan Kaptan stated: “In 2023 we served 96 million guests which was +22% above 2022 and +7% above [pre-pandemic] 2019. Aided by a relatively warmer winter season, we continued to witness healthy traffic growth in the fourth quarter of 2023 and in 2024 to date.

“When we break down the growth into its components, we can see that international passenger traffic was even stronger with +13% growth versus 2019. Moreover, except for Russia and Ukraine, we have witnessed very high growth in most major source markets.

“Germany, which is our top source market, is +24% above 2019. UK traffic is up +58%, Poland +78% and UAE +65% above 2019. Outbound traffic from our non-Turkish airports to Türkiye is also +75% above 2019.

“With the lift of the Russian travel ban in May 2023, we started to see a gradually increasing recovery in Georgia. We are also very happy to welcome 1.1 million Kazakh travellers into our Turkish and Georgian airports with a growth of +116% versus 2019.

{Click on the YouTube icon to discover more about TAV Airports}

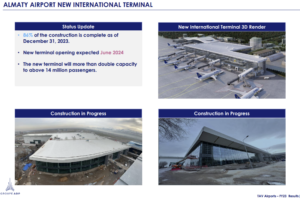

“The historical ties between Türkiye and Kazakhstan are very deep and we are working to make them even stronger through our investment in Almaty Airport [Kazakhstan’s largest international airport –Ed]. With the opening of the new terminal expected in June 2024, travellers will be able to enjoy a world-class assortment of services and facilities.

“Our investment in Almaty will bolster tourism, business and cargo traffic while supporting the overall development of the country.”

Kaptan described Kazakhstan as an up-and-coming market for outbound tourism with a 2023 GDP per capita of US$13,000. “In response to the high demand for travel, the country expects to grow total aircraft fleet size +45% by 2025,” he observed. “We are very proud to contribute to such a historical juncture in Kazakhstan’s economic development.”

Big expansion in Antalya Airport retail space

Elsewhere the company has completed 70% of its investment programme in Antalya Airport and plans to open the new terminal in the first quarter of 2025. This will increase the airport’s passenger capacity from 35 million to 65 million per year.

“We will nearly triple the retail areas in the airport,” said Kaptan. “Furthermore, with a wider and newer retail offering we will enhance passenger experience significantly and improve commercial performance.”

Additionally, the new Antalya Airport concession was awarded to an SPV of which TAV Airports is a 51% shareholder and Fraport holds 49%. Under the agreement, the SPV has the rights to operate TAV’s flagship asset for a further 25 years from January 2027 to December 2051.

TAV Airports noted the “very high” retail revenue (duty free, services, and advertising) potential due to a doubling of terminal areas and an approximate tripling of retail areas. The company said it also had the potential to increase the turnover-related components within the retail contracts .

Additionally, the company’s airside investments in Ankara Esenboğa Airport are 34% complete and are expected to be finalised by the end of 2025. TAV Airports has the rights to operate the airport from May 2025 to May 2050.

Kaptan continued: “We embarked upon a massive investment programme in 2021 to build the future of TAV Airports and we will complete €1.2 billion of committed infrastructure development in our new projects by 2025.

“The total sum of our investment programme between 2021 and 2025, including the acquisition price and upfront rents paid for Almaty, Antalya and Ankara and other investments we are making elsewhere in our assets adds up to around €2.5 billion.

“This massive programme shows our commitment to and confidence in the future of aviation in our core geography and especially in Türkiye. Growth of the global middle class, urbanisation and ecommerce are trends that will continue to support aviation for the foreseeable future.” ✈