FRANCE/INTERNATIONAL. Travel retail and food & beverage company Lagardère Travel Retail was the key driver behind parent company Lagardère SA’s strong H1 performance delivered earlier this week, a performance underlined by newly appointed Lagardère Group Deputy Chief Executive Officer in charge of Finance Grégoire Castaing on a post-results earnings call.

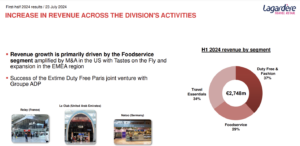

In turn the division’s triple axis of Travel Essentials, Duty Free & Fashion and Foodservice, with the last-named performing particularly well, positions Lagardère Travel Retail well for growth, the group noted.

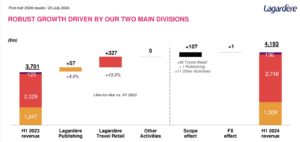

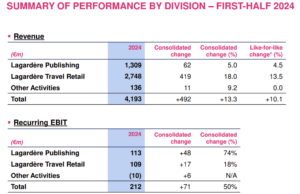

As reported, Lagardère Travel Retail posted a +13.5% year-on-year rise (like-for-like/+18.0% reported) in first-half revenues to €2,748 million – representing 65.5% of group turnover. Lagardère SA’s reported revenues rose +4.5% to €4,193 million.

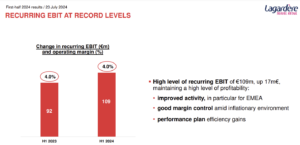

Lagardère Travel Retail’s recurring EBIT reached a record €109 million – 51.4% of the group total – driven by solid performances across the EMEA region (with standout performances in Romania, Italy and the UK) and North America, which offset a Mainland China-driven decline in North Asia.

The difference between reported and like-for-like data was attributable to a €95 million positive scope effect, mainly reflecting the food & beverage sector acquisitions of Tastes on the Fly (€79 million), Marché International (€9 million) and Costa Coffee in Poland (€7 million).

Commenting on group results at the start of the call, Lagardère SA Chairman and Chief Executive Officer Arnaud Lagardère said: “The Board and myself are extremely proud of all colleagues from all divisions in the Lagardère group for their achievement and the record numbers.

“We continue our growth and profitability semester after semester, year after year. And hopefully, we will do the budget for this year, and we will do better, I hope, than last year.”

Introducing Castaing who joined the company on 3 June from Canal+, Arnaud Lagardère said: “One of the top missions Gregoire will carry out is to lower the net debt amount and bring more focus to the overall company on cash management… this is going to be very, very helpful.”

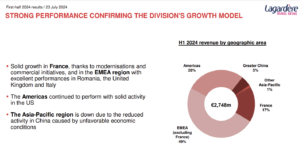

Referring to Lagardère Travel Retail’s global performance, Castaing said: “The EMEA area, excluding France, is still our main market with a very strong dynamic recording a growth of +22% in H1 driven by increase of traffic from international tourists especially in Italy, Romania and the UK.

“France is still a core market, also with a positive trend and a growth of +18%. The growth in the Americas region is slightly lower than during ’23, but still very robust with roughly +7% during this semester. And as with many players, our activity in North Asia wasn’t very good recently, which is largely attributable to the unfavourable economic climate in China.”

However, Castaing said it was important to underline that despite the situation in Asia, the company’s performance had remained positive there, with revenue reaching €2.7 billion.

Breaking Lagardère Travel Retail’s performance down to its three main segments – Travel Essentials (34% of revenue), Duty Free & Fashion (37%) and Foodservice (29%), Castaing noted: “The activity was mainly driven by foodservice growth, which saw a significant boost since our acquisitions in this segment.”

He added: “I think it’s also important to notice that we have now a well-balanced portfolio of activities with three main business lines of roughly equal weight.”

Noting the divison’s €109 million recurring EBIT, Castaing said: “The profitability remained high at 4%. This level is stable compared to last year, but significantly higher than the pre-COVID level, which was more between 2% and 3%.

“It’s a good thing to stay at this high level of margin even with significant growth in terms of revenue. This is obtained thanks to improved activity in the EMEA, good margin control by the team and, of course, efficiency on the cost and game plans.”

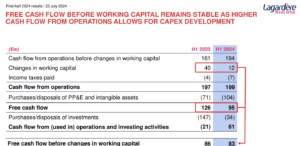

Turning to cash flow, Castaing underlined the heavy €104 million capex in this semester, up significantly year-on-year. “I would like to underline this because even if we are focused on cash generation, we also still invest significantly in this fast-growing and profitable business,” he commented.

“However, it’s also good to note that despite this increase of capex, free cash flow before change in working capital is almost stable at €83 million, thanks to higher cash from operations.”

Concluding on an upbeat note, Castaing said of group prospects: “Despite the uncertain economic environment, we remain confident in our ability to maintain high level of results, thanks to the dynamism and responsiveness of the teams.

“Lagardère Publishing to remain relatively similar performance to last year despite the pressure on costs and Lagardère Travel Retail has potential for value and profitability growth – of course, in an environment which stays normalised and buoyant.” ✈