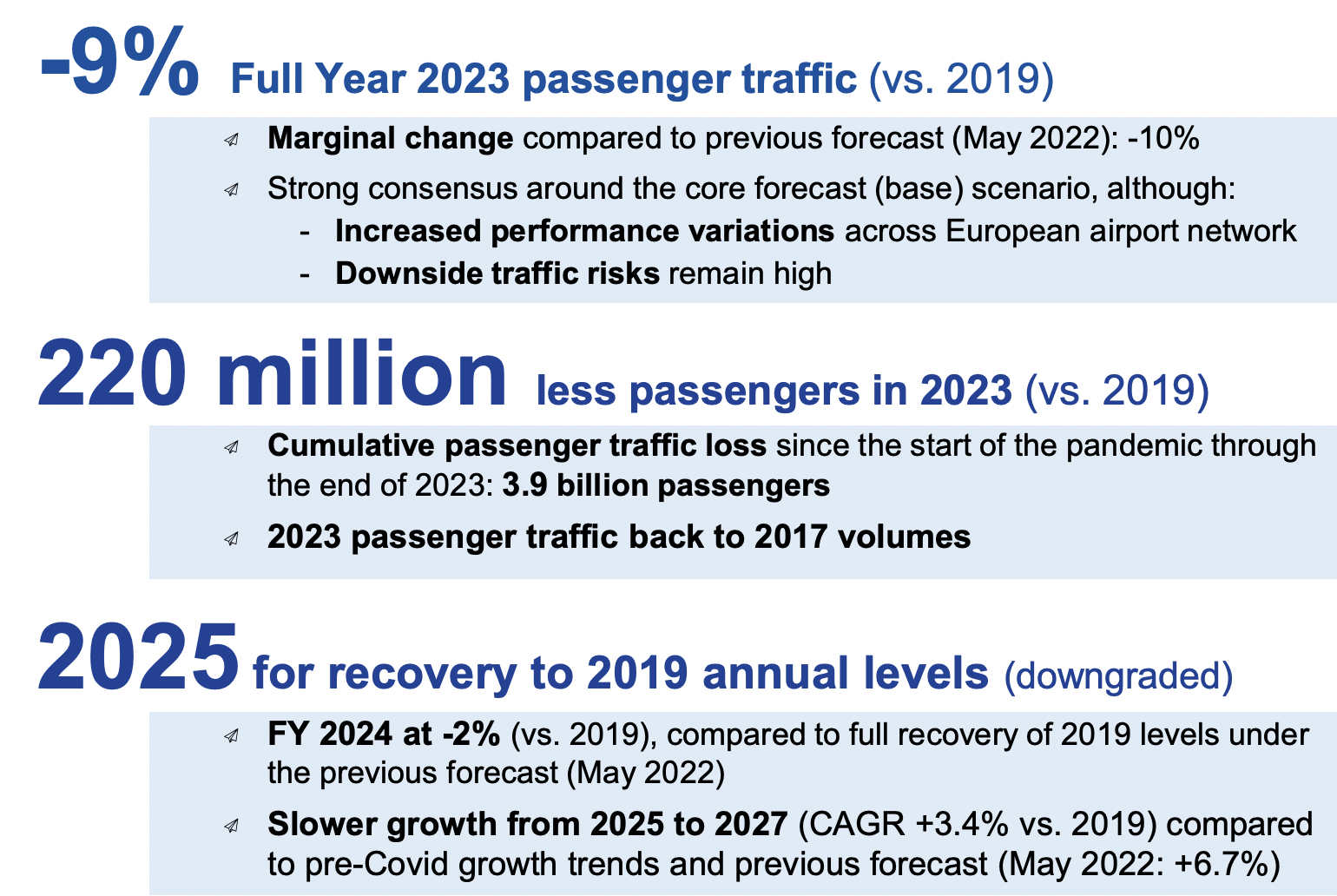

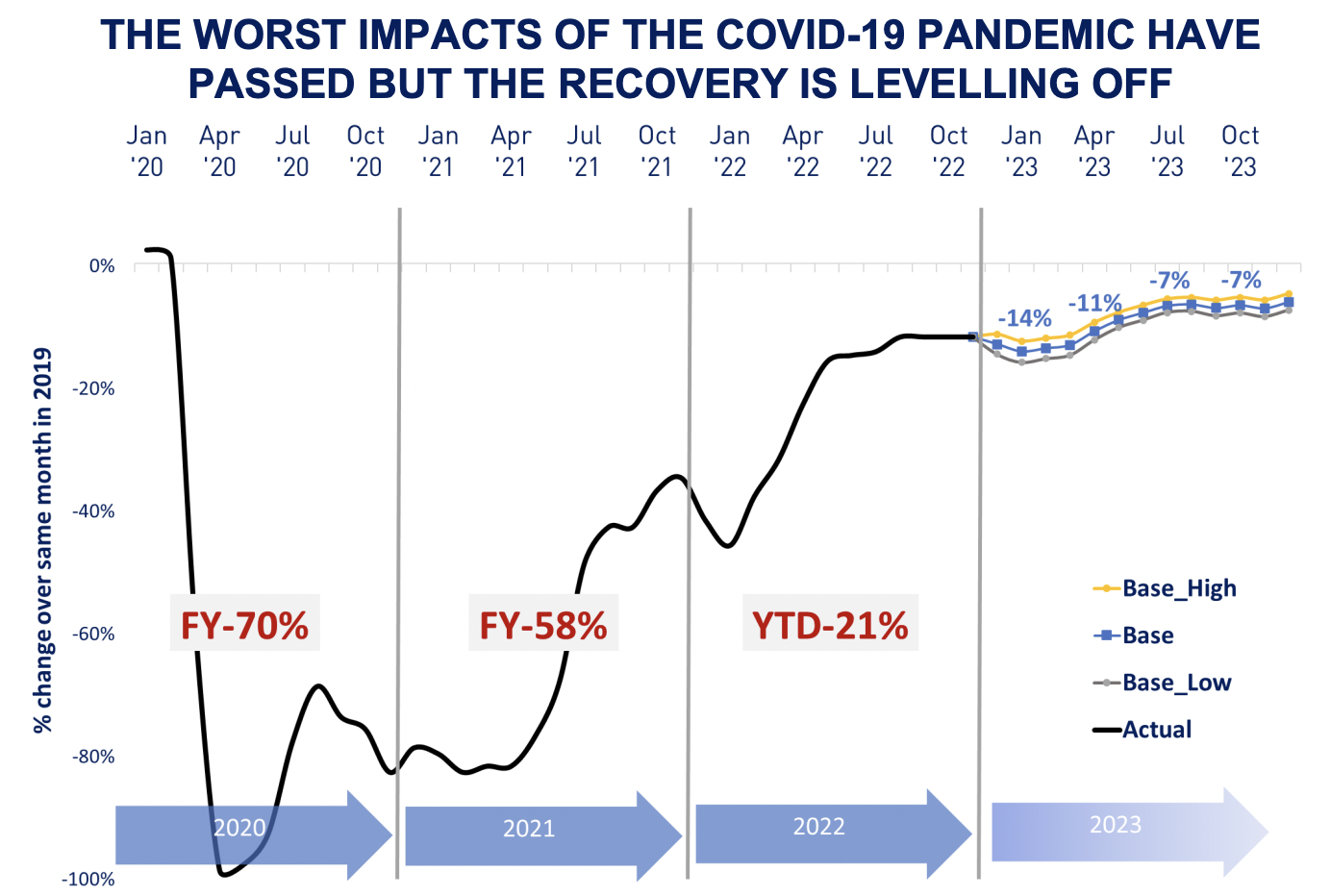

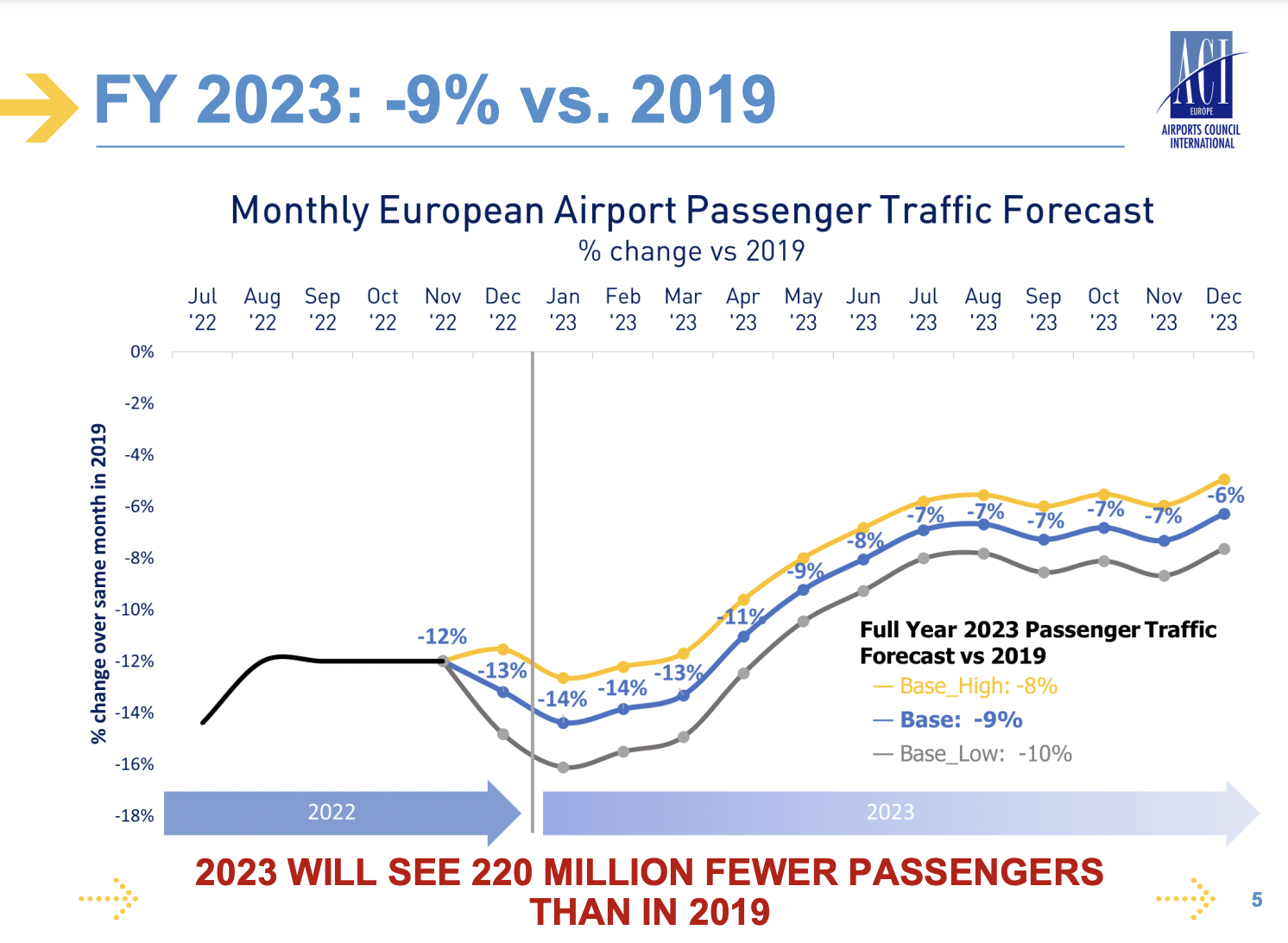

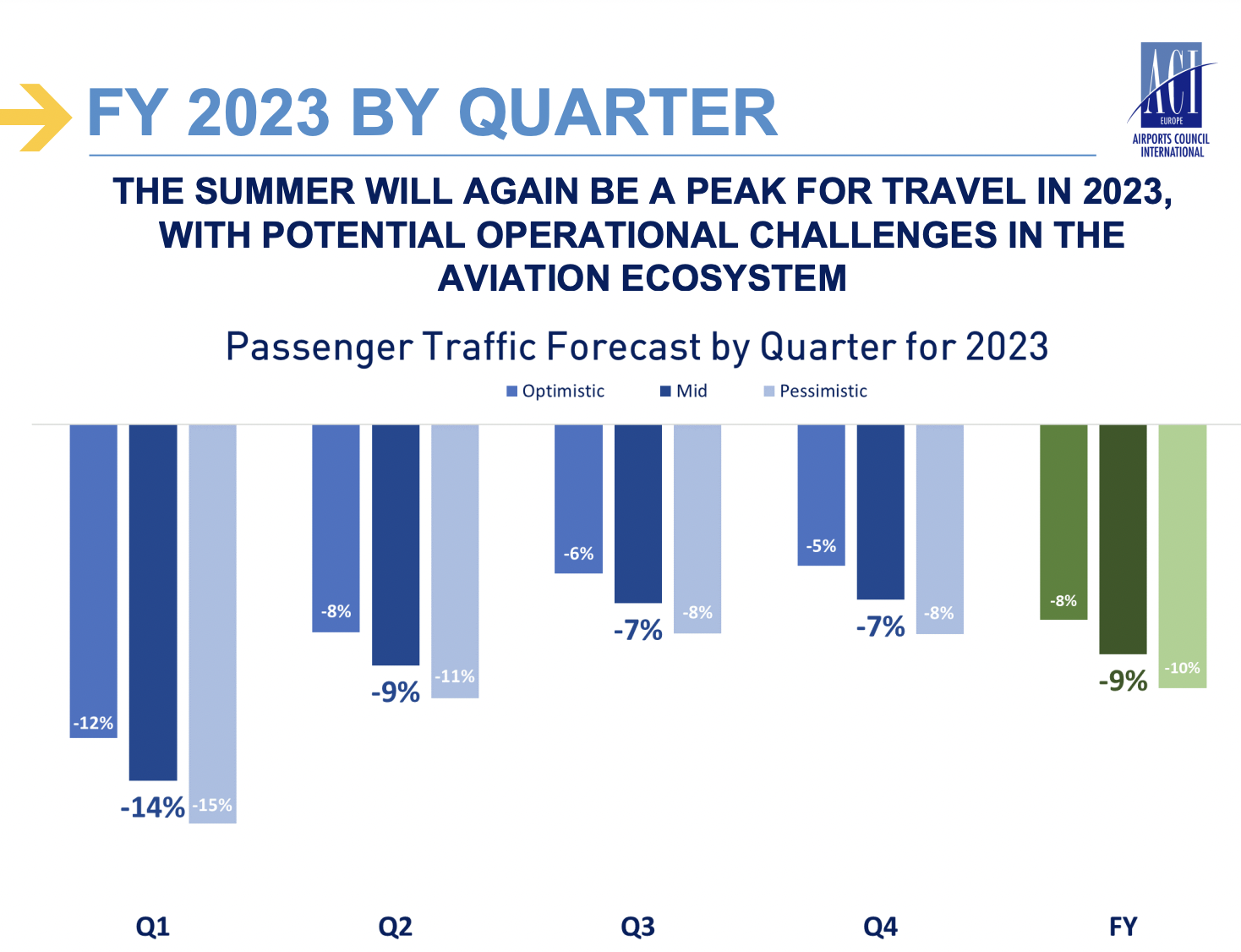

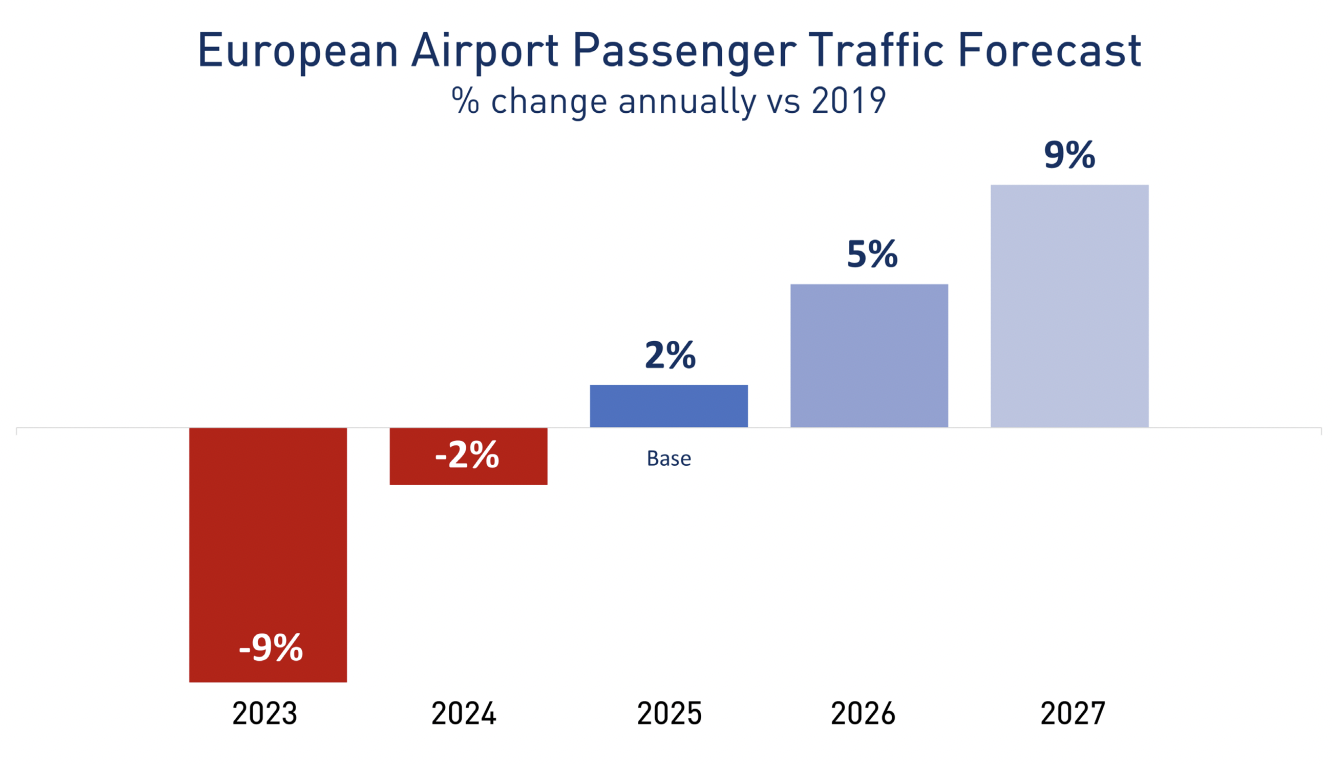

EUROPE. Airports Council International (ACI) Europe has revised its passenger traffic forecasts downward in light of the impact of geopolitical factors and economic headwinds. Passenger volumes in 2023 are set to fall -9% below pre-pandemic levels, and full recovery in the region is only expected in 2025, not 2024 as previously indicated.

ACI Europe Director General Olivier Jankovec said: “Passenger traffic has made a strong comeback since last Spring and has so far been very resilient in the face of increasing geopolitical and economic headwinds.

“However, we now expect the passenger traffic recovery to level off moving forwards, with the timeline pushed to 2025 before Europe’s airports finally get back to where they stood before COVID-19 hit. Next year, we will still miss 220 million passengers, meaning our volumes will only match 2017 levels.

“All this reflects a mix of determinants with more negatives than positives – along with significant downside risks.”

Continued geopolitical tensions and the war in Ukraine will continue to affect several national markets – and dominate downside risks. Deteriorating macro-economics and inflationary pressures are also set to weigh on demand, noted ACI Europe, with air fares having increased sharply throughout Q3 and Q4 2022.

Passenger air travel inflation has been at double digits in the EU for more than a year, with October 2022 data showing that price of passenger air travel had increased by +30.9% compared to the same period last year (CAPA).

Higher regulatory costs will also result in sustained inflationary pressures on air fares, it added. On the supply side, tight capacity management mainly by Full Service Carriers and the continuing travel restrictions to China will also limit further traffic growth, it added.

At the same time, ACI Europe said it expects the impact of these factors on passenger traffic to be partially compensated by a degree of resilience in leisure demand and the continued expansion of Ultra-Low Cost Carriers. The end of the airport slots waiver granted to airlines as of next Summer should also ease supply pressures.

At the same time, ACI Europe said it expects the impact of these factors on passenger traffic to be partially compensated by a degree of resilience in leisure demand and the continued expansion of Ultra-Low Cost Carriers. The end of the airport slots waiver granted to airlines as of next Summer should also ease supply pressures.

This combination of factors will hit airports differently depending on their location, size, market position and business model. This means the increasing gaps in traffic performance across airports are here to stay in the year to come, said the association.

Jankovec commented: “It is becoming an increasingly mixed bag of impacts and outcomes. We expect several airport markets – especially those relying predominantly on tourism – to exceed their pre-pandemic passenger volumes as soon as next year. But many others will not fare so well and take much longer to recover.”

He concluded: “On the longer horizon, once the last impacts Covid-19 have finally departed, European airports will face higher levels of risk than in the past. Our regulators must reflect and fully account for this.”