The positive result was driven by dynamic traffic growth at many of the Group’s airports worldwide and the addition of new concessions in the USA.

This includes Fraport USA assuming responsibility for the centre management at Washington Dulles and Ronald Reagan Washington National airports at the start of this year.

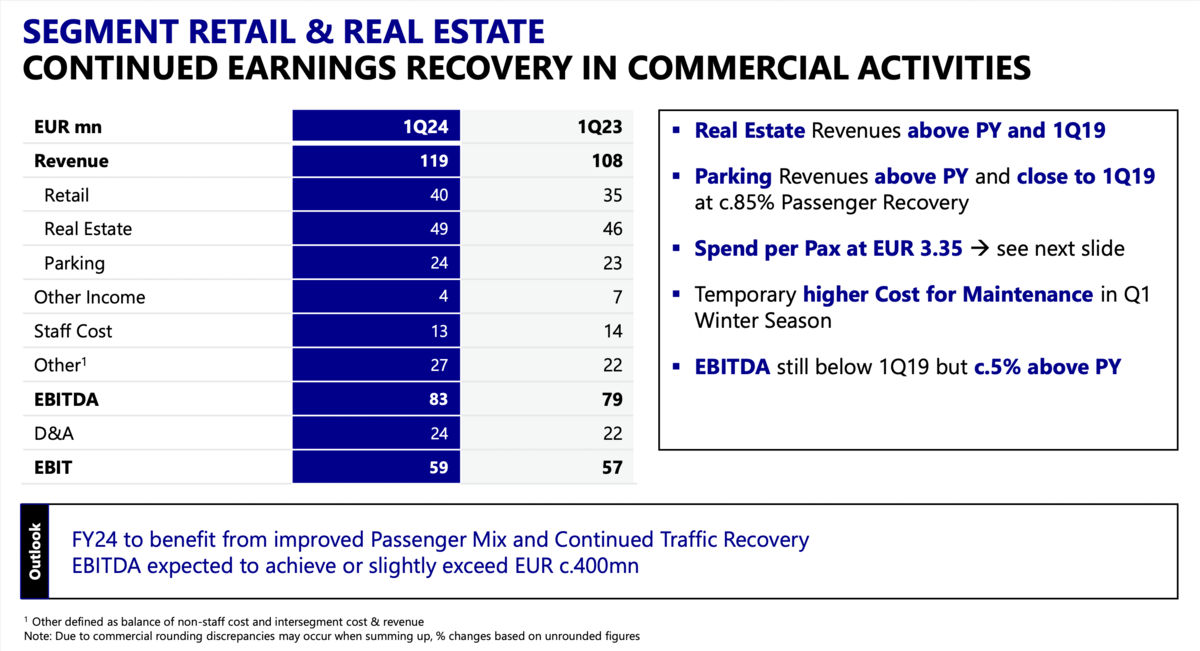

Retail revenues at Frankfurt Airport rose by +14.3% to €40 million in the reporting period, significantly outstripping passenger growth (+10.4% to 12.5 million passengers – c. 85% of Q1 2019).

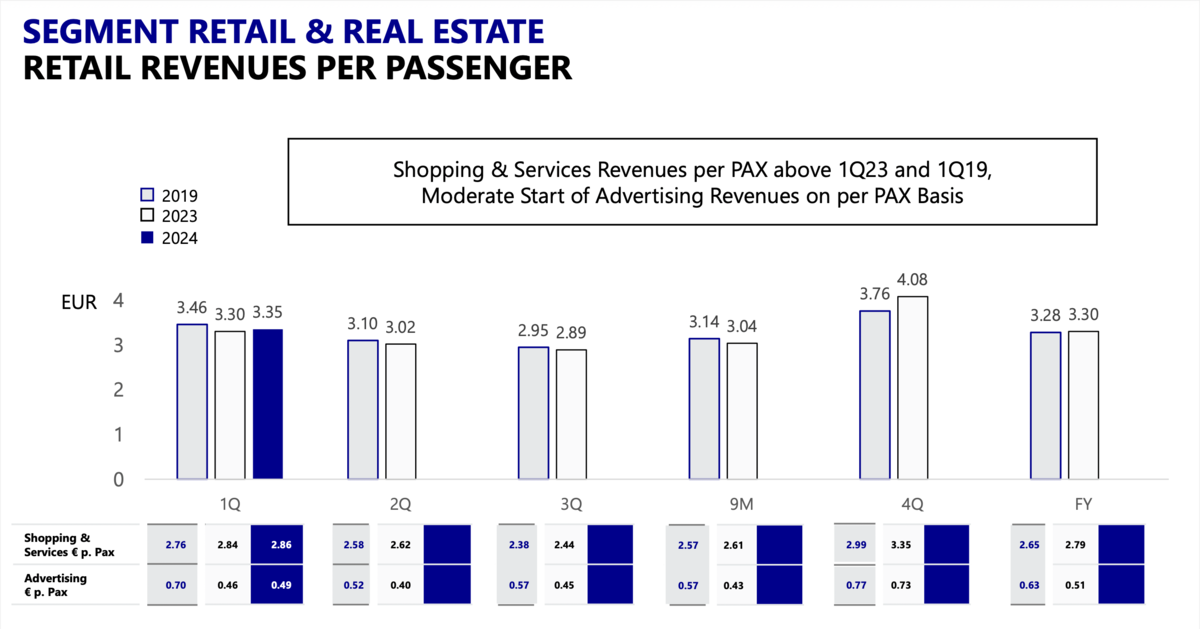

Retail spend per passenger, a key indicator, increased marginally by +1.5% year-on-year to €3.35, though the number still lags against the €3.46 reported in Q1 2019 (-3.2%).

Meanwhile, the Fraport Group operating result or EBITDA (earnings before interest, taxes, depreciation and amortisation) saw a +34.3% boost to €212.6 million. In what is typically the quarter with the lowest business volume, the Group’s net profit also rose to €12.7 million in Q1 2024 (from a €32.6 million loss in the same period of 2023).

Despite the negative effects from several strikes, demand for leisure travel remained high in Q1 2024, Fraport noted. Business travel volumes also increased in comparison with the same period of 2023.

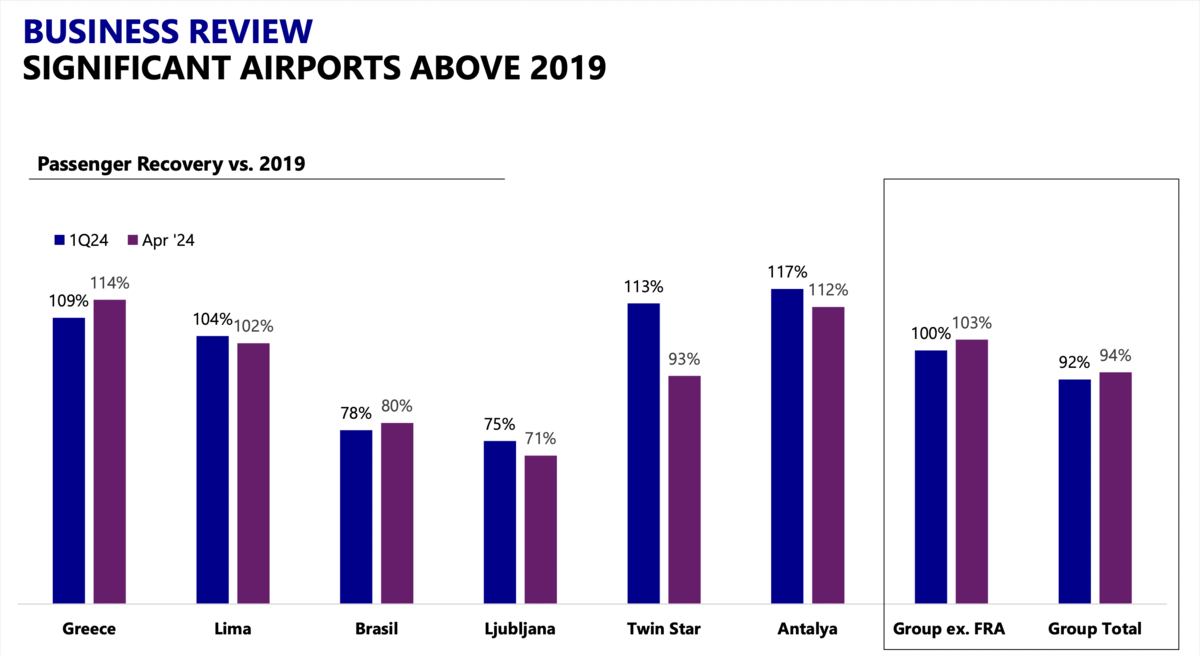

Among Fraport’s global gateways, the standout performer was Antalya Airport on the Turkish Riviera (117% of the 2019 level in Q1), while the 14 Greek airports and Lima Airport in Peru were significantly above pre-crisis passenger levels seen in 2019.

Fraport Group CEO Dr Stefan Schulte said: “Frankfurt Airport was impacted by strikes on several days in the first three months of 2024. Some 600,000 passengers were affected by the strikes in addition to weather-related cancellations. In spite of these adverse effects, the new business year got off to a good start.

“This was, in particular, attributable to growth at our Group airports outside Germany, with many of them exceeding pre-crisis levels again. For the full year, we expect to continue this positive business trend, in line with our guidance.” ✈