GERMANY. Despite comprehensive cost-saving measures, the Fraport Group registered a net loss of €537.2 million in the first nine months of 2020 as the COVID-19 pandemic drove a -70.2% fall year-on-year in passenger traffic. The figure includes €280 million earmarked for measures aimed at lowering personnel costs.

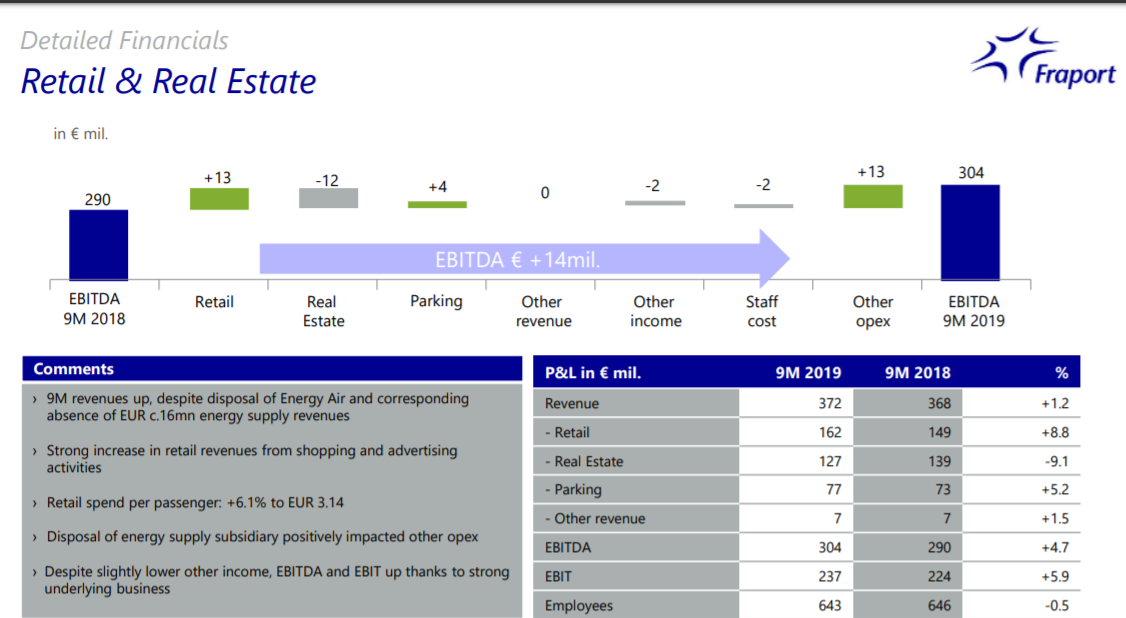

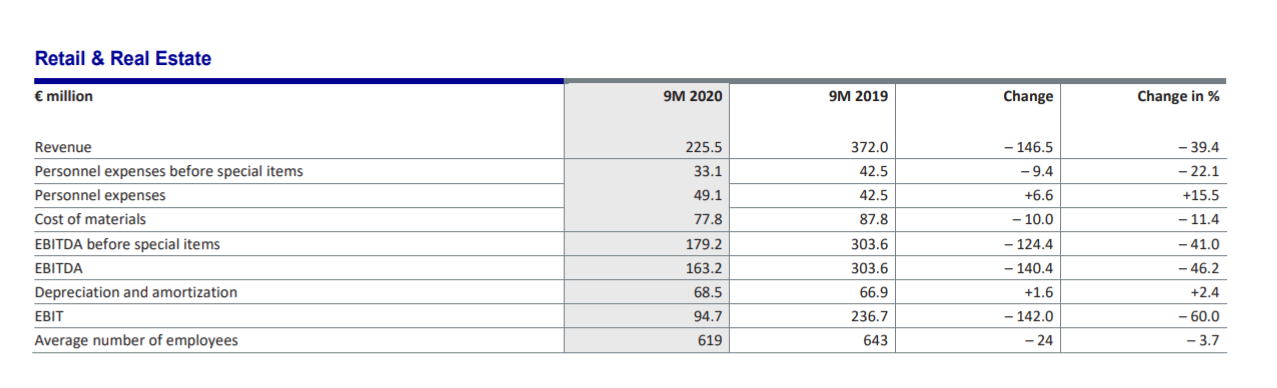

Revenue in the retail and real estate segment fell by -39.4% to €225.5 million. The main reason for the decline was a sharp drop in retail and parking revenues (-€98.5 million and €40.9 million respectively), due to the big decline in passenger numbers at Frankfurt Airport.

Despite that fall, the net retail revenue per passenger increased in terms of calculated value to €4.40 in the reporting period, up from €3.14 in the same period last year.

Revenue from real estate declined only -4.2% to €121.2 million.

Overall segment EBITDA before special items decreased -41% to €179.2 million segment EBIT da was 46.2% down to €163.2 million segment EBIT was 60% down to €94.7 million

Fraport AG Executive Board Chairman Dr. Stefan Schulte said: “Our industry continues to navigate through a very difficult situation. With infection rates rising again across Europe in the past few weeks, governments have largely reintroduced or widened travel restrictions.

“Airlines are downsizing their flight schedules even more. Currently, we do not expect a recovery until at least the summer season of 2021. In response, we are continuing to realign our company to become significantly leaner and more agile – to achieve a sustainable reduction of our cost base.

“We are well on track to achieving this target. Measures implemented at our Frankfurt home base will help us reduce personnel and material costs in the medium term by up to €400 million per year. This corresponds to about 25 percent of our total operating expenses recorded at the Frankfurt location during the 2019 business year.”

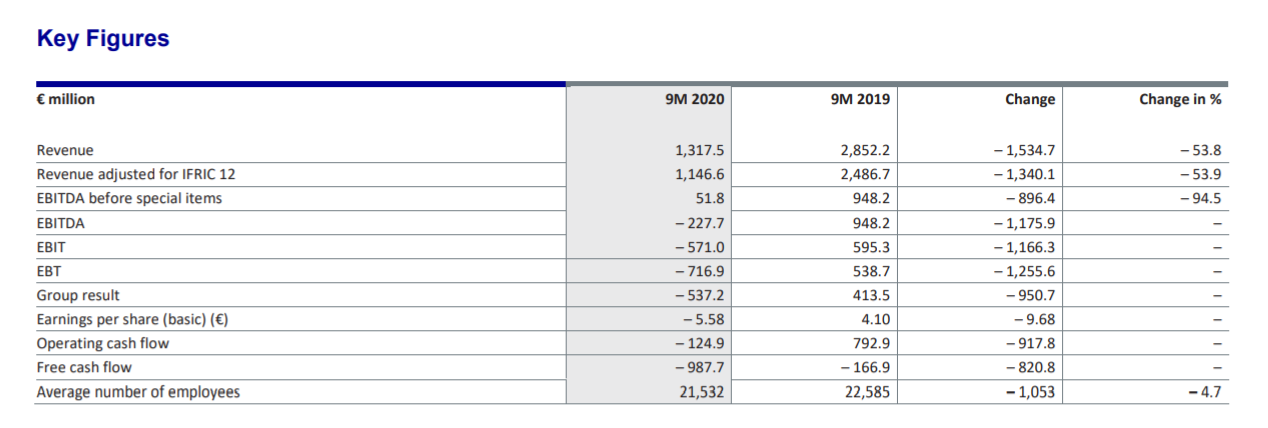

In the first nine months, Group revenue decreased by -53.8% year-on-year to €1.32 billion. Adjusting for revenue from construction relating to capacitive capital expenditure at Fraport’s subsidiaries worldwide, Group revenue was down -53.9% to €1.15 billion.

The company reduced operating expenses (comprising cost of materials, personnel expenses and other operating expenses) by a third in the reporting period, after adjusting for expenses for personnel-reduction measures. Nevertheless, the operating result or Group EBITDA (before special items) collapsed by -94.5% to €51.8 million. Group EBITDA was also impacted by expenses for personnel-reduction measures totaling €280 million.

Taking these additional personnel expenses into account, Group EBITDA for the first nine months of 2020 declined to minus €227.7 million (9M 2019: €948.2 million), while Group EBIT fell to minus €571.0 million (9M 2019: €595.3 million). The Group result (net profit) declined to minus €537.2 million (9M 2019: €413.5 million).

Cost cuts proving effective

The third quarter (July-to-September 2020 period) figures clearly indicate that the cost-reduction measures already taken have proven effective, Fraport said.

While Group EBITDA was still negative in the second quarter (minus €107 million), a positive Group EBITDA of €29.2 million (before special items) was achieved in Q3. The interim recovery of passenger volumes also contributed to this development.

Taking expenses earmarked for measures aimed at lowering personnel costs into account, Fraport posted a Group result (or net profit) of minus €305.8 million in the third quarter of 2020.

Investments and non-staff costs reduced noticeably

By cancelling or deferring investments not essential for operations, Fraport will be able to reduce the related capital expenditure by €1 billion over the medium and long term. Specifically, this refers to investments for the existing terminal buildings and apron area at Frankfurt Airport. Regarding construction of the new Terminal 3, the current demand situation also provides an opportunity for extending the time frame required for specific building measures or the awarding of construction contracts.

Fraport currently plans to open Terminal 3 – comprising the main terminal building with Piers H and J, as well as Pier G – for the 2025 summer schedule. However, the actual date of completion and inauguration for the new terminal will ultimately depend on how demand develops.

Workforce reduction programme well underway

By cutting up to 4,000 jobs largely until the end of 2021, Fraport’s personnel costs at the Frankfurt location will be reduced by €250 million annually.

Simultaneously, Fraport will continue to operate a short-time working scheme. Since the second quarter of 2020, up to 18,000 of the approximately 22,000 people employed at all Group companies in Frankfurt have been working on a short-time basis, involving an average 50-percent reduction in working time, depending on demand. The short-time quota declined during the summer travel period, but the quota is rising again in line with the drop in traffic demand.

Outlook – Frankfurt Airport’s passenger traffic in 2021 to reach only 35-45% of 2019 levels

For the current business year, the Fraport executive board expects passenger traffic at Frankfurt Airport to fall by over 70% year-on-year to approximately 18 to 19 million. Group revenue (adjusted for IFRIC 12) is expected to drop by up to -60%. Group EBITDA (before special items) is forecast to decline sharply – but still remain slightly positive, backed by the already implemented or planned cost-saving measures.

Taking into account expenses earmarked for measures aimed at lowering personnel costs, Group EBITDA will clearly reach negative figures for full-year 2020, Fraport said. Likewise, the executive board expects both the Group EBIT and Group result (net profit) to be significantly negative.

Schulte said: “We currently expect Frankfurt Airport’s passenger traffic in 2021 to reach only 35 to 45 percent of the 2019 level, in particular due to the anticipated very weak first quarter 2021.

“Even in 2023/24, passenger figures will probably still only reach 80 to 90 percent of pre-crisis levels. This means we have a very long journey ahead of us. However, we are confident that the recently launched countermeasures will enable Fraport to be successfully realigned on its long term path of sustainable growth, once again.”