GERMANY/INTERNATIONAL. Retail performed solidly as Fraport Group, operator of Frankfurt Airport and several foreign gateways, delivered a strong performance for the first nine months of 2023.

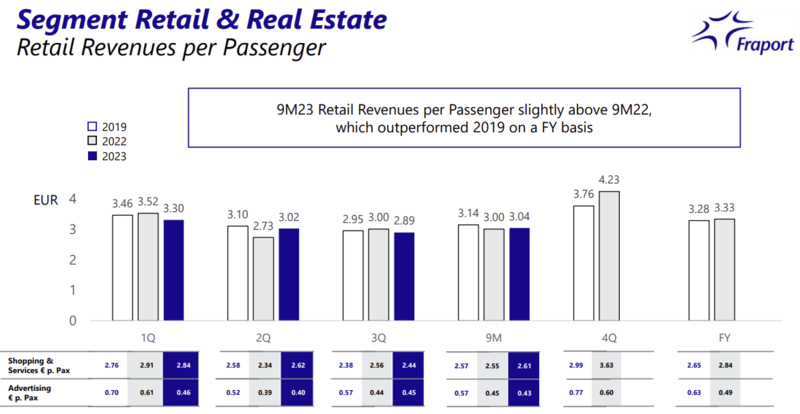

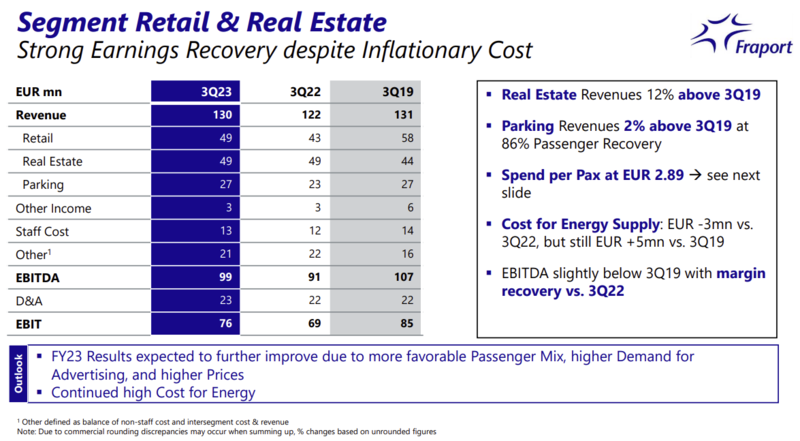

Q3 retail revenues rose +14% year-on-year (see table below) to €49 million, representing 84.5% of pre-pandemic 2019 figures. However, retail revenues per passenger softened in Q3 (see chart below) to €2.89, down sharply on the €3.30 in Q1 and €3.02 in Q2.

Nine-month retail revenues per passenger were slightly above the comparative period last year. In 2022, Q4 and full-year retail revenues per passenger outperformed 2019 so the Q4 2023 result will be closely monitored in light of the Q3 performance.

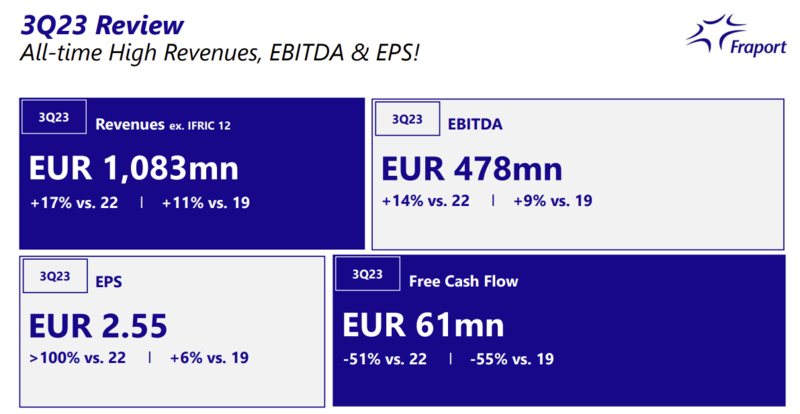

Buoyed by a notably strong Q3, which saw Fraport’s revenue, EBITDA and net profit achieve all-time highs, key operating figures for the nine months to 30 September exceeded 2019 levels.

Q3 parking revenues rose +2% above Q319 at just an 86% passenger recovery ratio.

Groupwide net profit for the nine months period reached €357.0 million, buoyed by traffic growth across the Group’s airports.

In view of the performance, Fraport confirmed its outlook for the full 2023 fiscal year (see sidebar) and expects to reach the upper range of the given forecasts.

| Future positive For the full year 2023, passenger numbers at Frankfurt are expected to reach the middle half of the projected range of between at least 80% and up to 90% of pre-COVID (70.6 million) levels seen in 2019. In view of the positive performance during the first nine months of 2023 and the stable outlook for the fourth quarter, Fraport also confirmed the financial guidance as specified in the first-half interim report. Group EBITDA is projected to reach the upper half of the forecast range of between €1,040 million and approximately €1,200 million. Likewise, the Group result is expected in the upper half of the projected range of between some €300 million and €420 million. |

Fraport CEO Dr. Stefan Schulte said; “We had a strong third quarter. As an important milestone, our actively managed Group airports outside Germany saw combined passenger traffic fully recover to 2019 levels during this period.

“The 14 Greek gateways and Antalya Airport were driving this trend by setting new all-time passenger records. Our home-base Frankfurt Airport also performed well, with passenger volumes in the third quarter of 2023 reaching 86% of 2019 levels.

“Fraport is thus overcoming the crisis faster than other major German airports. Backed by the ongoing traffic recovery, our financial performance also significantly improved. During the third quarter, Fraport’s revenue, EBITDA and net profit achieved new all-time highs. This is an important factor as it will help us continue to gradually reduce the debt incurred during the pandemic.”

Supported by the rebound in passenger traffic during the summer months, Group revenue grew by +17% to €1,083.3 million in Q3 (Note: In each case, the IFRIC 12 adjustment applies for revenues resulting from construction and expansion measures at Fraport’s subsidiaries worldwide).

Q3 Group revenue as per IFRIC 12 exceeded the respective Group revenue from pre-crisis 2019 by +11.4% (Q3/2019: €972.8 million).

Group EBITDA improved to €478.1 million in the third quarter (Q3/2022: €420.3 million; Q3/2019: €436.7 million). The Group result or net profit jumped by €120.8 million to a new record high of €272.0 million (Q3/2022: €151.2 million; Q3/2019: €248.6 million).

In the first nine months of fiscal 2023, Group revenue as per IFRIC 12 rose by €494.5 million to €2,631.9 million (9M/2022: €2,137.4 million; 9M/2019: €2,486.7 million). The nine-month-revenue for the first time includes proceeds from aviation security fees, totalling €167.0 million. These were levied by Fraport after assuming responsibility for passenger security screening at Frankfurt Airport at the start of 2023.

Group EBITDA improved by +15.8% year-on-year to €959.5 million in the first nine months (9M/2022: €828.6 million; 9M/2019: €948.2 million). The Group result (net profit) improved noticeably by €258.9 million to €357.0 million.

Last year’s nine-month Group result of €98.1 million was negatively impacted by a full €163.3 million write-off of loan receivables from Thalita Trading Ltd. in connection with the investment at Pulkovo Airport (LED) in St. Petersburg.

Passenger demand remains high

Passenger demand remains high

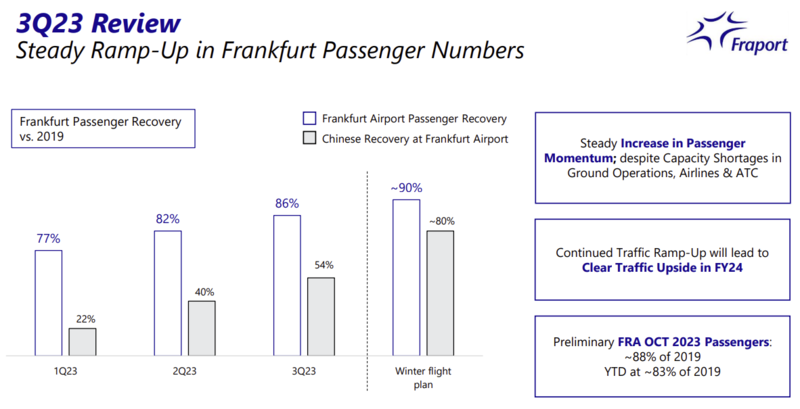

In the first nine months of 2023, passenger traffic at Frankfurt Airport increased by +23.9% year-on-year to around 44.5 million.

Demand was particularly high for traditional holiday destinations within Europe and long-haul flights. High-frequency traffic to/from North America continued to rebound to almost pre-pandemic levels in the first nine months. The number of passengers from China also increased steadily.

Frankfurt’s passenger traffic for the first nine months amounted to about 82% of pre-crisis 2019 levels.

Fraport’s Group airports worldwide also continued to report passenger growth in the first nine months of 2023. The 14 Greek gateways again led the way, with their nine-month traffic rising by +11.6% in 2023 versus pre-pandemic 2019.

In Q3, Antalya Airport on the Turkish Riviera also surpassed the pre-crisis levels from Q3/2019 by around +2%. Combined traffic at Fraport’s actively managed airports around the globe rebounded to pre-COVID levels in Q3 for the first time since the pandemic. ✈