GERMANY. Frankfurt Airport owner Fraport today reported a -4.4% slide in revenue from its Retail & Real Estate segment to €218.7 million in H1 2014. Within this, retail revenues alone fell by -3.3%, with the key figure of net retail revenue per passenger fell from €3.56 to €3.42 (-3.9%) in the period.

The retail performance was blamed on the lower number of passengers on key intercontinental routes. As Fraport noted, “these passengers show above average purchasing patterns compared to passengers on continental connections”. The company also said there had been an impact from foreign exchange fluctuations, as well as from China’s anti-corruption laws and crackdown on gift-giving (though Chinese passenger numbers climbed by +9.4% in the period).

|

|

Highlighting the impact of lower travel numbers among key nationalities, Fraport said that Brazilian passenger numbers had dipped by -3.5% in the half (versus H1 2013), Russians by -3.8%, Japanese by -15.6% and South Korean numbers had grown by just +0.6%.

EBITDA from the Retail & Real Estate division remained stable at €172 million in the half.

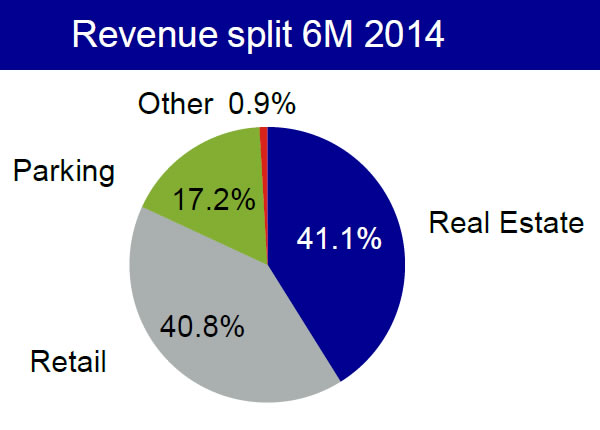

For the first six months of 2014, Fraport reported a +1% gain in adjusted revenue to €1.12 billion. It achieved double-digit gains in both group EBITDA (up by +10% to €354.2 million) and net result (up by +11.7% to €91.7 million).

Frankfurt Airport passenger numbers grew by +2.4% year-on-year in the half to 27.8 million. This was a new record despite a number of strike days that affected the airport from February to April 2014.

|

|

|

Fraport AG Executive Board Chairman Dr. Stefan Schulte said: “Fraport’s good financial performance in the first half of 2014 can be attributed to ongoing passenger growth both in Frankfurt and at our international airports – and also because of lower capital expenditures. The ongoing growth in demand for air traffic worldwide opens up development opportunities for Fraport domestically and internationally – whereby the timely creation of the required capacities at each airport is vital.”

The company also revealed further details of its acquisition of Airmall USA, announced this week.

Citing the benefits to Fraport, it said the move would give it access to the world’s largest aviation market, would deliver “visible and continuous contribution to EBITDA” and offer “a stable cash flow guarantee with the start of the payback period immediately after takeover”. It would also help unlock Fraport’s expertise in a new market, the company added.

|

|

The company also revealed details of its contract lengths at the four US airports where Airmall is present, ranging from 2017 (at Boston) to 2029 (Pittsburgh). It also provided a breakdown of sales from that business, with food & beverage accounting for the largest share (55%; see chart).

We’ll bring you more on this story, including further comment from Fraport and Airmall, in The Moodie Report e-Zine, out later today.