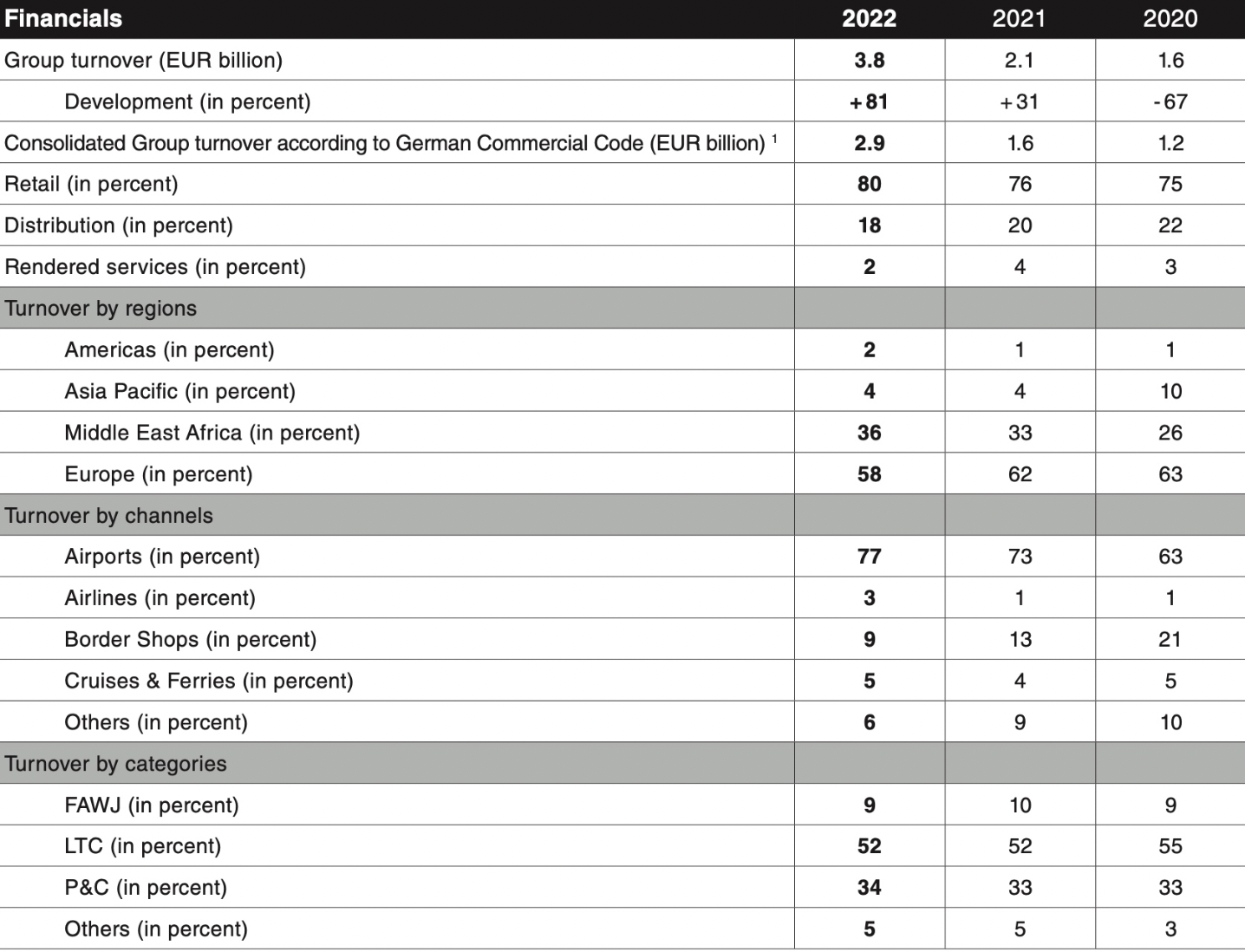

GERMANY. Leading travel retailer and distributor Gebr. Heinemann has revealed a strong set of annual results for 2022, with turnover reaching €3.8 billion, up by +81% year-on-year.

The 2022 figure, achieved despite the impact of war in Ukraine and continuing travel restrictions in some markets, represented 79% of 2019 turnover. Crucially, the group also returned to pre-pandemic levels of profitability last year after breaking even in 2021. The company is also forecasting a +30% rise in sales this year as travel roars back.

The results were announced at the annual Gebr. Heinemann press conference in Hamburg, led by Co-CEOs Max Heinemann, Chief Financial Officer Dr. Kai Deneke and Director Corporate Communications & External Affairs Nina Semprecht. The event was attended by The Moodie Davitt Report and other media.

Retail (up +91% year-on-year) accounted for 80% of the business in 2022, with distribution (up by +59%) around 18% of the total.

Max Heinemann said: “Our 2022 results confirm that we have taken the right steps over the past three years to move strongly into the future. In 2021, we carried out an important strategic relaunch with our mission statement. Now we have succeeded in translating our value proposition into practice.”

He said later: “We are very proud of how we and the industry have recovered. We came back in 2022 as a player in this industry, and participated in better times and better moments in this industry. Our business model proved resilient. In fact now, we are challenged in terms of the speed of recovery. We come from a very painful period to being able to speak about growing pains, which in itself is a luxury.

“The resilience of this industry is based on the traveller itself, which also makes it one of the most beautiful industries probably to be in, because that’s what safeguards us into the future – the willingness and freedom of people to travel and to exchange across different cultures, from business to leisure.

“We repeat our continuing commitment as a family company to travel retail, led by our people. We stick to our values, our purpose and our culture. We created our updated vision and mission and set a new agenda for ourselves as a global trading house.”

As reported, in 2022 Gebr. Heinemann presented a new mission statement – to “turn travel time into valuable time as the most human-centric company in global travel retail”.

Elaborating on how this is coming to life, Max Heinemann noted that it informs all projects and activities as well as the “thinking and fundamental attitude” at Gebr. Heinemann. The group has drawn up a series of pledges to be fulfilled for customers and travellers – standing for “spectacular product assortments, unforgettable experiences and activating price advantages, while being a valuable travel companion with impressive employees and delivering a sustainable impact”.

Heinemann said: “The promises set out our priorities for the coming years. Everything we did last year and will do this year is aimed at implementing them. The task now is to transfer the promises into our shops and make them visible and tangible for our customers and travellers. In 2022, we started this process very successfully and in 2023, we will consistently continue along this path.”

Key financials

On the 2022 performance, Kai Deneke said: “This is a very impressive success, especially considering that we had to absorb the loss of business in Ukraine and Russia – two of our core markets. At the same time, it has been reconfirmed that our strong business mix with a global approach and across different sales channels makes us more resilient to crises. In particular, the border shops and our diversified wholesale business with niche segments such as the diplomatic business helped us a lot during the period of low air traffic.”

He added: “The return to profitability is really worth mentioning, because it came without any special effects or conditions, from government supports to agreements with the airports. This was really about our own efforts, careful management and cost discipline.

“From a CFO perspective, another great result was that we reached compliance with our group financing covenants (based on a syndicated loan agreed in early 2020) two quarters ahead of plan.”

In November, the company extended its syndicated loan agreement with banking partners until January 2026 – which Deneke described as “a strong sign of our banks’ great trust in us as well as in the travel market. Our financing is secured and we have sufficient funds available for the projects and investments that we have prioritised in our group strategy.”

Separately, he added: “One thing to note is that we never stopped working on our processes and organisation during the crisis, we never stopped investing in new IT systems and in developing new capabilities, or on our value proposition. And this has ultimately paid off.”

Last year, at the Hamburg headquarters, Heinemann spent over €12 million in the development of processes and systems, and in 2023 it will almost double that amount.

At 77%, airports contributed the largest share of sales by channel in the year, rising from the figure of 73% a year earlier. This was followed by the border shop business with 9% of total turnover, cruise ships and ferries with a 5% share and airlines with 3%. A further 6% came from other channels such as diplomatic business, free trade zones or military bases.

By region, Europe took the largest share at 58%, followed by the Middle East & Africa at 36% percent, Asia Pacific at 4%, and the Americas at 2%.

The company noted: “By far the strongest growth driver last year was Istanbul Airport, which has performed exceptionally well since its opening in 2019.” This has been driven by strong Middle East and Russian spend over the past year. Istanbul and Tel Aviv (the latter a partnership with JR/Duty Free) are among the major locations trading ahead of pre-pandemic levels, said the company.

By category, liquor, tobacco and confectionery combined accounted for 52% of turnover, followed by perfumes & cosmetics at 34% and fashion, accessories & watches and jewellery at 9%.

Deneke also said that Q1 performance in 2023 was “ahead of plan and budget”. Turnover is up by +51% year-on-year in the period, with the expectation that the full year will deliver sales +30% up on last year, as noted above.

“Uncertainties remain,” he said. “We must carefully manage our costs and cash flow. We don’t know how quickly the Chinese customers will return. There remains the Ukraine-Russia conflict and supply chain, though improved, remains an issue.”

The company also confirmed that it is selling its shares in its Russian retail joint ventures to its local partners, but will remain involved in the wholesale business, “in line with the sanctions regime”. Deneke said Heinemann is “constantly reevaluating the situation and the impact on our remaining wholesale business”.

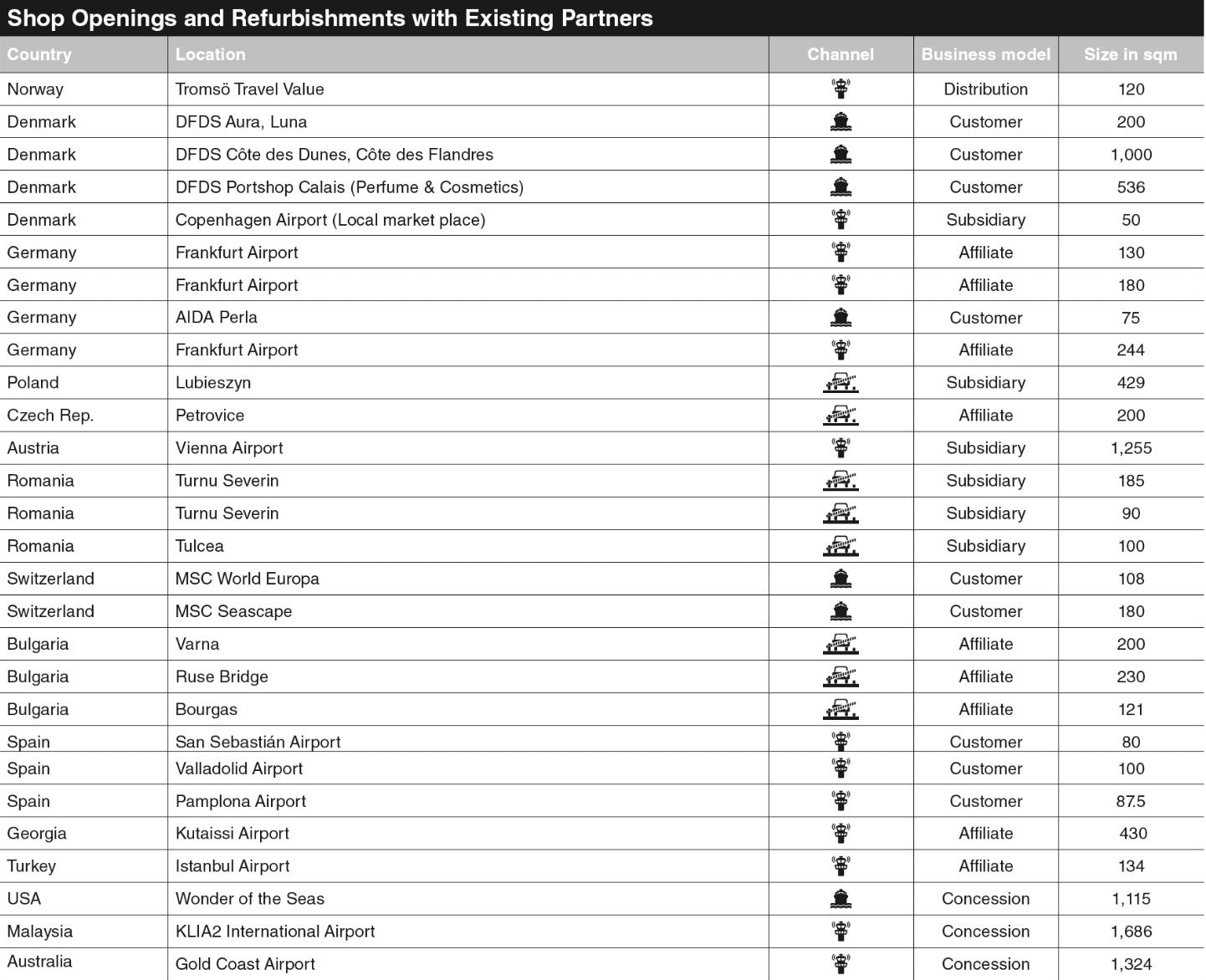

In Ukraine, while business has been hit hard, ten out of 13 border stores continue to operate, noted Deneke. Border shops in Romania and Bulgaria are trading strongly, he added.

On the market recovery, Raoul Spanger said: “After a difficult start, the global travel retail market recovered during the year. We have seen once again that when people are allowed to travel, they travel. China’s strict travel restrictions have led to a further absence of Asian shoppers. At the same time, more people have flown on other continents and in many places we are still seeing above-average spending per passenger. Asian travellers will also return in greater numbers during the second half of 2023, according to our estimates.”

Global focus, regional gains

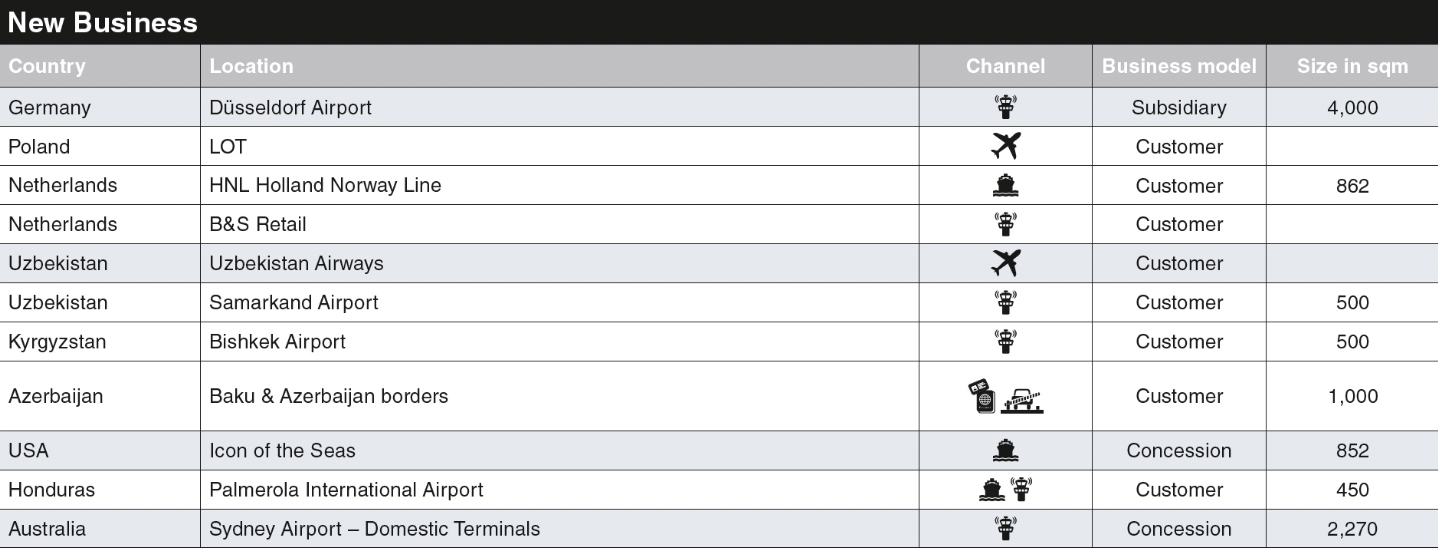

Addressing the key regions, Spanger said that for the next three years, the Americas would remain a cruise and distribution market, and not one where Heinemann will chase airport concessions.

On Asia Pacific, he noted: “This market is around 15 months delayed, and the Chinese, though they are returning, are doing do slowly, but we expect good growth in the second half. That is key for us as Sydney and Kuala Lumpur also rely on their spending. We have invested in both recently, including our biggest store worldwide in Sydney as well as opening under the Heinemann brand in KL.” Last year, Asia Pacific sales were just 33% of pre-pandemic levels, but the company said it expected to make up much ground in 2023.

As reported, Sydney Airport and Heinemann are to open an Australian first in August, with a department store concept for the airport’s domestic terminals (T2 and T3).

Click above for our on location walk-through of the new-look Heinemann Australia environment at Sydney Airport, filmed by Martin Moodie in February

In other developments, Heinemann will reopen its food & confectionery stores at Hong Kong International Airport in May.

Among other key developments, Gebr. Heinemann renewed a number of key concessions and generated new business in 2022. It opened or renovated 27 shops at airports, border crossings and on cruiseships and ferries.

In June, the company won the tender for four duty free and travel value shops at Düsseldorf Airport, marking a return to Germany’s fourth-largest airport after a ten-year absence. After refurbishments are complete, an official opening of the shops is planned for later in the year.

During the year the company also opened seven stores onboard Royal Caribbean International’s Wonder of the Seas, the largest cruiseship in the world. Gebr. Heinemann was also awarded the concession for another new-build by Royal Caribbean, the Icon of the Seas, which is scheduled to launch in 2024, becoming the largest cruiseship in the world.

Gebr. Heinemann also opened or remodelled several border stores and in the airline arena, won tenders for LOT Polish Airlines and Uzbekistan Airways.

Risk and investment

Spanger said: “Over the next two years, around 15 airport tenders with a sales value of €2 billion will come to the market and we plan to take part in many of them, where it makes sense.

“But we also intend to manage our risk as we never know when the next pandemic or similar event will come along. We don’t accept certain elements of risk – our ‘red lines’ – and will be selective. We have to keep risk at a level where, if issues arise, the future of our company is not at risk. But beyond that we are open to many formulas with our partners, from concession to JV, as we have been through our history.”

Spanger expressed some concern that certain airports are deferring investment in infrastructure when they should be taking advantage of the new commercial opportunities now that travel is ramping up. “We see what happened with Istanbul, a new airport. They were ready. Others airports are investing too but we see that others are waiting. Those are the ones that will fall back. Now is the time to invest.”

On supply chain, Spanger said that things had improved steadily in the past year. From a fulfilment rate of around 65% in June last year, it climbed to 77% in January and 87% by March.

On the consumer, Spanger noted a strengthening of spend per head, notably in core European markets as travel has resumed. “We need to eliminate the price comparison with supermarkets and the way to do that is with an exclusive assortment at fair prices.”

Also on consumer spending trends, Deneke said: “From last Summer, with the strong leisure demand, spends per passenger were relatively high, above pre-crisis levels. We see that now levelling out as the passenger mix is normalising. But we do see still positive effects at the SPP level. For 2023, we are carefully optimistic that the capacity issues at airports and border controls are improving so that we will see further increases this coming summer.”

Advances in CSR agenda

Gebr. Heinemann also highlighted the strides it has taken in the area of Corporate Social Responsibility (CSR) with a number of major goals from now to 2023 under key pillars: Energy & Emissions, Waste & Packaging, Product Portfolio and People.

Having already switched to green electricity in 2021, Gebr. Heinemann used 94% renewable energy in 2022. In addition, the company opened its Norway HUB, the first regional warehouse near Oslo, in November 2022. The new warehouse will save around 300,000 transport kilometres per year between Germany and Norway – equivalent to around 570 tons of carbon dioxide.

In 2021, Gebr. Heinemann pioneered a sustainable category concept to travellers. Last year, its ‘Future Friendly’ concept was expanded to locations outside Germany, including Vienna and Budapest (plus Sydney more recently), with an extended range.

Gebr. Heinemann has replaced 25% of consumables in its Hamburg headquarters and logistics centres with sustainable alternatives. In terms of diversity, the company has increased the proportion of women in top management positions year-on-year from 14% to 21%, and cited the proportion of women in leadership posts overall as 39%.

While the company has had to cut jobs in recent years due to the crisis, it currently employs 7,344 staff (up from 6,700 in 2021) from 56 countries.

The media day also included visits to knowledge and innovation hub GHARAGE and to the company’s logistics headquarters in Allermöhe near Hamburg.

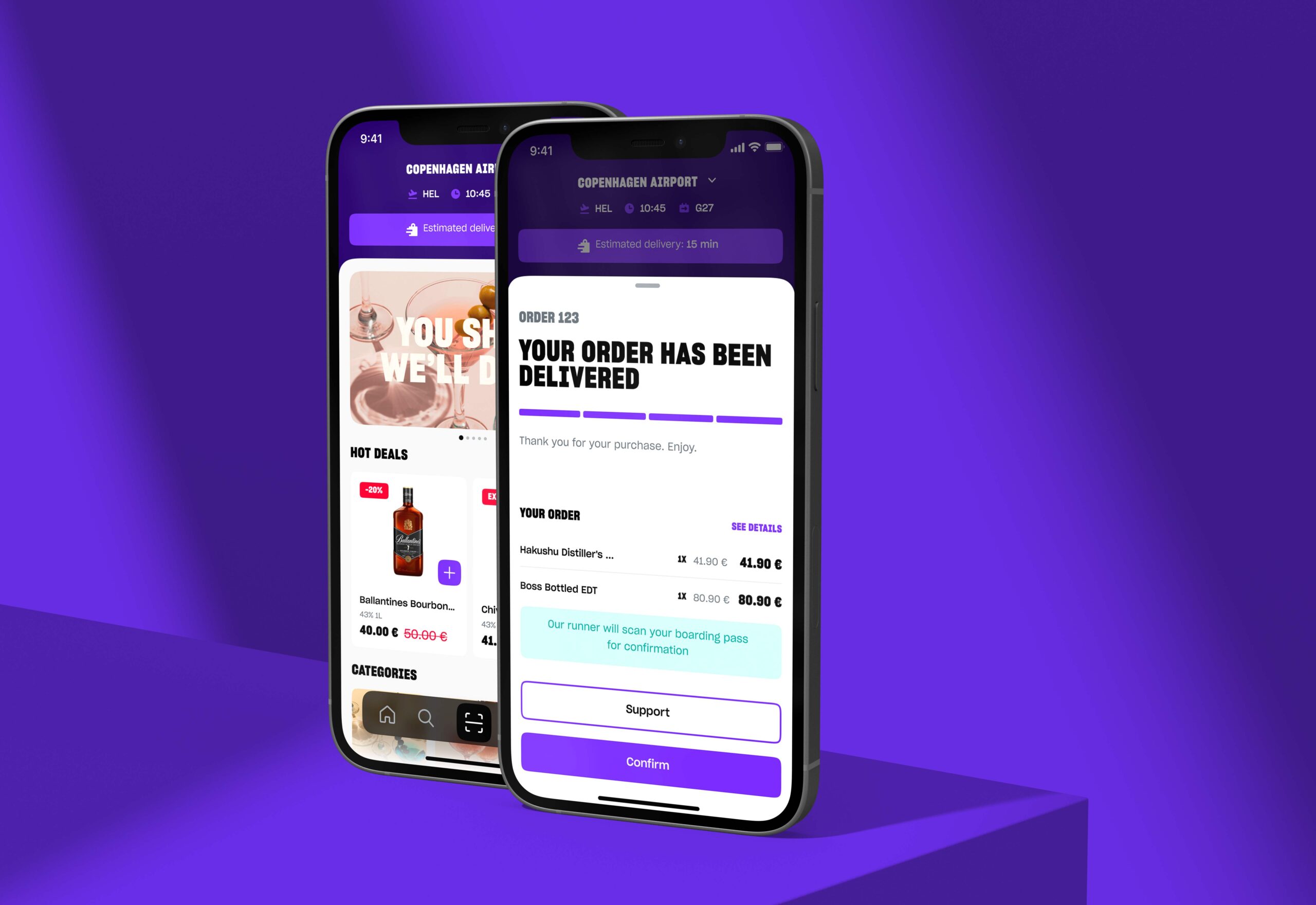

Of the vision hub, Max Heinemann said: “GHARAGE is an innovation driver and has built up a diverse portfolio of ventures. What is common to all of them is the aim to open up new target groups and use new technologies for the travellers’ benefit.”

In April 2022, GATEZERO premiered in Copenhagen as a destination for new Gen Z luxury consumers. In-store analysis has shown that an average of 70% of shoppers are under the age of 30.

Gebr. Heineman underscored its belief that technologies like web3 and blockchain will also have an impact on travel retail, with its venture Amber Island already making use of these technologies.

The company noted: “The web3 community offers its members access to rare and limited collectable whiskeys through NFTs (non-fungible tokens). The feedback from the community and from distilleries who want to collaborate is very positive. Furthermore, the Duffle app, a quick delivery platform for airport retail, went live in January 2023. The app targets the younger, more digitally driven shoppers. Gebr. Heinemann, via GHARAGE, invested and actively supported the venture.”

“It is great to see how these ventures came to life in 2022 and made it possible for us to create real change in the industry,” said Max Heinemann.

*More will follow on the Gebr. Heinemann press conference and our visit to Hamburg shortly. ✈