GERMANY. At last week’s annual press conference, Gebr. Heinemann management outlined key details of the company’s 2021 sales, and its ambitions for 2022. Alongside our key takeaways from that event (see The Moodie Davitt eZine at this link), we bring readers further details and commentary. We begin with the Hamburg-based company’s assessment of the drivers of performance last year, and how 2022 is trending to date.

As reported, Gebr. Heinemann has budgeted that it will reach 75% of 2019 turnover in 2022, or around €3.6 billion, alongside “solid profitability”.

Chief Operating Officer Raoul Spanger said: “In Q1 2022 we only reached 67% of 2019 turnover but we are seeing turnover growth going towards the direction of our target. What we have seen in April and over Easter just confirms this.”

He said that the ‘revenge shopping’ phenomenon had driven higher than average spends in the return to travel phase, though this appears unlikely to be maintained beyond next year.

Spanger added: “We are also seeing several locations over-perform against expectations. Istanbul is one example. Also, at Sydney we had not budgeted any business in the first half but this is already back at 30% of 2019 with limited travel so far.

“75% is a tough target, an ambitious target, but we are fighting for it and we feel there’s no reason we cannot reach it despite the external factors we all face.”

Commenting on key gains in 2021, Spanger cited airport contracts in Norway, Bologna and Lviv (the latter currently closed due to the Ukraine-Russia conflict). He commented: “Norway was a real milestone for our company in this crisis, almost like a fast forward button.

“It was not below what we call our red lines for tenders, it was transparent but tough and very important to win. Our extension at Copenhagen through negotiation was also very important.”

On the wider picture, Spanger added: “Our strongest markets [in 2021] were Eastern Europe and South-eastern Europe, especially the airports in Kyiv, Moscow, Istanbul and Tel Aviv. We developed significantly stronger there in 2021 than in Northern and Central Europe. The development from 2020 continues: the lower the complexity of a location, the faster it returns to growth while complex hubs with less direct traffic and many destinations have a hard time.”

Asia Pacific remains difficult, he acknowledged, though Sydney, as noted above, is performing ahead of expectations in the return phase. “Last year Sydney had hardly any turnover, Kuala Lumpur was closed but we had good news too. We extended in klia2 and at Gold Coast in Australia so we have a solid Asia base now alongside our existing operations and our downtown store in Macau. The business will suffer as long as the Chinese don’t travel but we are looking towards a much better year in 2022.”

CEO Max Heinemann added that the group had budgeted for a return of Chinese travellers by the start of Q4, but said it was unclear whether this would happen with lockdown restrictions. “It looks unrealistic right now but we have factored that into our aspiration to reach 75% of 2019 sales.”

Any investment in the US will remain restricted to cruise for the next couple of years, said the company, with some new ship launches imminent.

A true global player

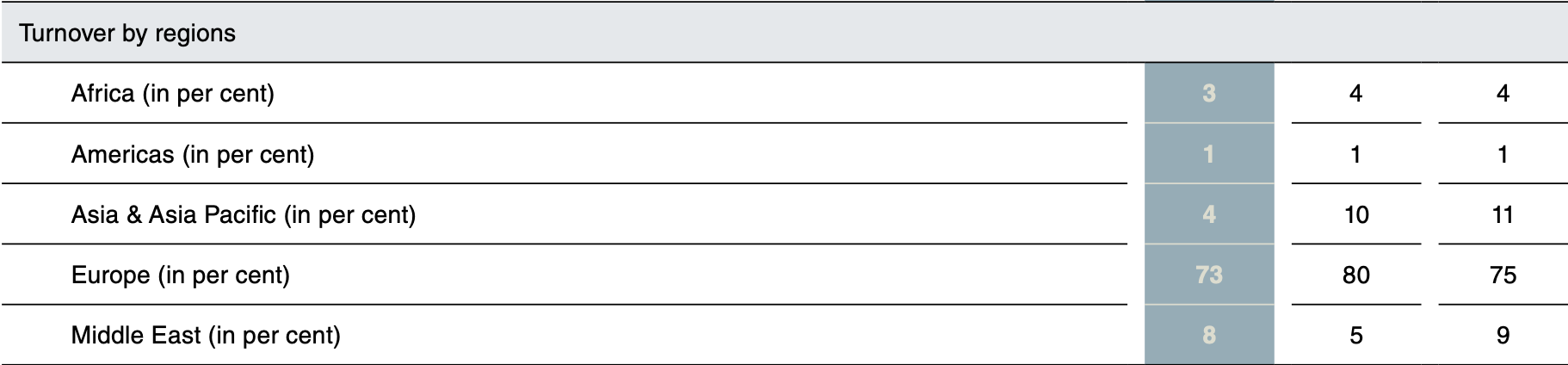

Management underlined the ambition for Heinemann to become a fully global company, though currently its turnover is weighted heavily towards Europe (80% including Germany).

Spanger said: “We will invest further in Europe and in Asia. We won’t make strategic investments in America in the next two years and are focused on those markets that we believe in. That includes Americas which is a US$100 million business if the cruise business remains OK. The Miami base will be kept for sure, and maybe in two years’ time we will change our policy again.”

Max Heinemann added: “What the crisis has taught us is that we need a global focus. Pre-crisis we were going everywhere at the same speed; now we set a timeframe for reaching certain goals. But our vision is based on being a global travel retail company, not just a travel retail company.”

On the importance of operating in retail plus distribution, Spanger said: “Our strong multichannel approach was very supportive throughout the year. 2021 also confirmed again how important it is to stand on two strategic pillars – this way we remain stable and independent of single markets.”

Assessing how the industry has evolved over the past two years, Raoul Spanger said: “Travel retail is on a sound footing. The enthusiasm to buy is unbroken and many travellers are even spending significantly more money than before the crisis.

“What has definitely changed for us is that we need contracts with more flexibility. Especially with the airports, we had long and sometimes difficult discussions about conditions and new contract models. In the end, we reached good compromises in a spirit of partnership. However, large marketplaces will continue to be highly competitive in the future and we must be prepared for complex requirements and evaluation systems such as those in the Norway tender to become the norm.”

On future channels for the business, Max Heinemann commented on the urban air mobility business, noting the unveiling in the UK of Air-One, the infrastructure enabling a fully-operational hub for electric vertical take-off and landing (eVTOL) vehicles.

He said: “This is what I mean by pushing the borders to widen the potential of the entire industry. This is one of these elements and technologies that is super exciting because it will means new rules will have to be written. And we want to be there when these rules are being written.”

Max Heinemann also commented on the future for the wider industry.

“We understood early that we need to remain positive no matter the challenge. We switched into future mode quickly along the way. We are definitely hit. It has made us humble and sharpened our instincts. The industry now has a more volatile business model. People thought it would be a time of consolidation but no players have disappeared. We see more progressive partnership, more transparency.

“It has opened our eyes to the vast potential that is there. We were comfortable before as an industry, surfing a good wave. Now we have seen the fragility of the business and confirmed the business model and our ability to survive the greatest crisis we have had.

“We aim to be the best at what we know and become great at what we might not yet know. It has shown us what we are good at and what we are not yet quite that good at yet. It has shown us that we can build bridges to make the industry a brighter place.

“We can confirm that we will play a leading role and seek to create needed change to unlock the potential of the sixth continent.”

“The traveller journey is the main focus,” he concluded. “We want to make their lives easier, more exciting, give them back the idea of being excited about travel.

“I am convinced that the partnerships we built are even stronger now, and that the next years will be decided by how good these partnerships are, and by how we actually really collaborate in our industry. That will be a differentiating factor.”

*More highlights from the Gebr. Heinemann press conference will follow.