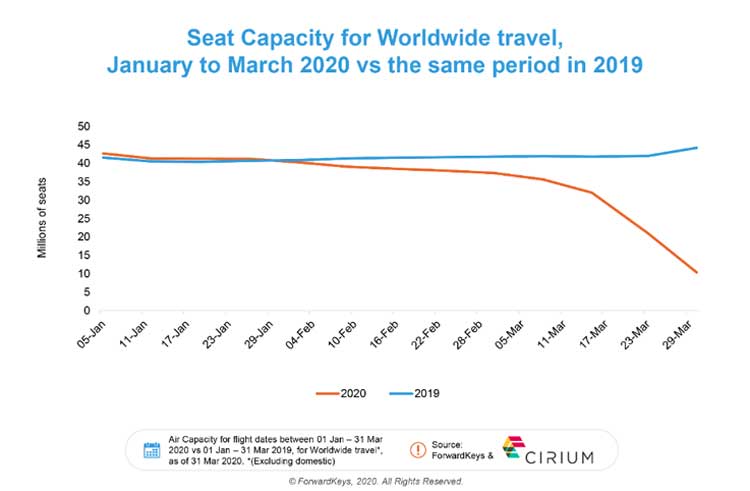

INTERNATIONAL. International airline seat capacity this week (30 March to 5 April) fell to just 23% of the level available in the first week of April last year. That’s according to data from travel analytics company ForwardKeys. Just 10 million seats were still in service worldwide, mainly to facilitate essential travel, compared with 44.2 million a year ago.

In the first quarter of the year, airline seat capacity was -9.4% down compared with Q1 2019 (482 million seats compared with 532 million in Q1 2019).

At the start of January, capacity was slightly up on last year, noted the analyst. However, this started to fall during the last week of January when the Chinese government announced restrictions on outbound travel. From then until the middle of March, air capacity fell substantially and even more sharply to the end of the month.

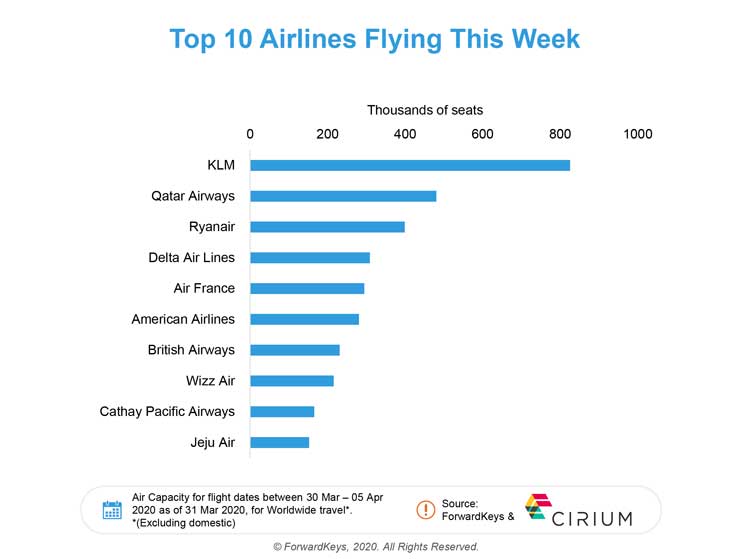

The top ten airlines still operating in the first week of April are: KLM with 800,000 seats still in service; Qatar Airways with nearly 500,000 seats in service and Ryanair with 400,000. They are followed in descending order by Delta, Air France, American, British Airways, Wizz Air, Cathay Pacific and Jeju Air. This picture will change soon after Ryanair recently announced that almost its entire fleet will be grounded.

ForwardKeys VP Insights Olivier Ponti said: “Governments have closed entire countries; and in response, the airline industry has cut services to the bone. It is likely that when we get to the other side of the pandemic, things won’t return to the vibrant market conditions we had at the start of the year, anywhere near as easily as some people imagine. By then, it is possible that a number of airlines will have gone bust; consumers will have lost confidence in flying and uneconomic discounts will be necessary to attract demand back.”