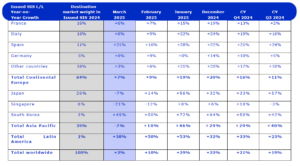

INTERNATIONAL. Global in-store tax-free shopping revenues fell to growth rates of +2% in March compared to +10% in February, according to new data from tourism shopping tax refund company Global Blue.

In Europe, the issued sales in-store growth rate grew +7% in March compared to +9% the previous month. This performance, noted Global Blue, was driven by a +9% rise in the number of shoppers while the increase in average spend-per-shopper softened to +2% linked to a less favourable US$/€ exchange rate.

For origin markets, US tax-free spend grew a solid +16% year-on-year compared to +31% over the last three months, also influenced by a less favourable US$/€ exchange rate.

Mainland Chinese tax-free spend recorded a slight rebound at +6% growth versus last year, compared to -4% over the last three months.

Gulf Cooperation Council shopper spend softened to -12% compared to +21% in February, reflecting the ten-day shift of the start of Ramadan compared to 2024. This shift negatively impacted March figures, however Global Blue expects April figures will see an uplift.

When examining destination markets Global Blue revealed March saw a mixed performance with Spain recording a rise of +21%, France and Italy +6%, and Germany remaining flat.

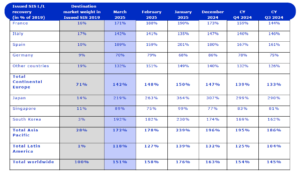

In Asia Pacific, the issued sales in-store growth rate softened to -7% in March compared to February’s +10%. Global Blue noted this softening was influenced by a less favourable Yen exchange rate and a high basis of comparison. Performance was shaped by a +7% increase in the number of shoppers, offset by a -13% decline in the average spend-per-shopper.

For Asia Pacific origin markets, the issued sales in-store growth softened across most nationalities, impacted by a stronger Yen in Japan.

Mainland Chinese tax-free spend fell to -1% compared to +19% in February. Hong Kong and Taiwan shoppers’ Tax Free Spend recorded a decline of -17% versus -11% in February, while North East Asia shoppers’ tax-free spend decreased -42% versus -34% the previous month.

Among destination markets, March showed a strong performance in South Korea at +45%. In contrast, Japan recorded a softening of -7% impacted by less favourable exchange rates, while Singapore eased to -21%, impacted by a high basis of comparison note Global Blue. ✈