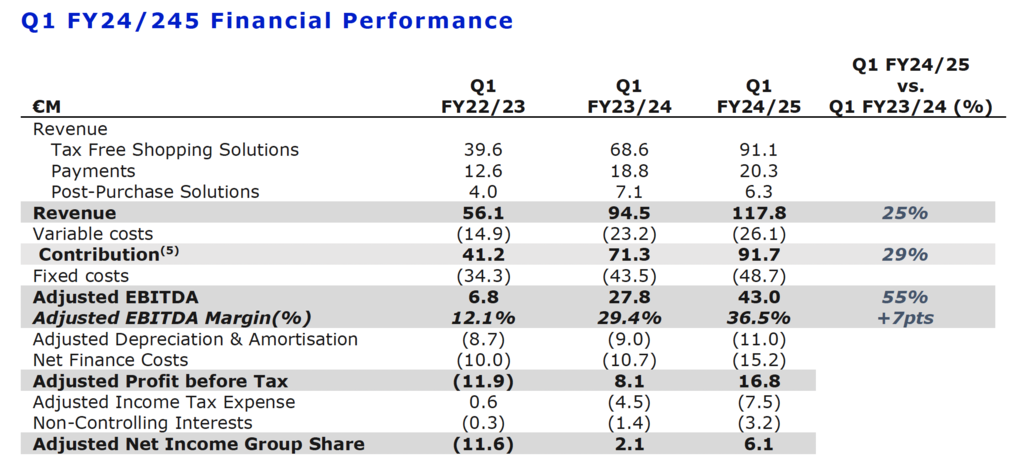

INTERNATIONAL. Global Blue Holding Group, owner of tourism shopping tax refund company Global Blue, today posted a +25% rise in first quarter revenues (ended 30 June 2024) to €118 million.

The financial results showed significant improvement across all key quarter metrics, including a +55% year-on-year increase in adjusted EBITDA to €43 million.

The Group delivered adjusted profit before tax of €16.8 million in the quarter (+107% year-on-year).

Global Blue noted the positive results are reflective of strong positive trends in global tax-free shopping revenues which, as reported, rose +25% in July and +41% in the second quarter (April-June 2024).

Given these encouraging market results and Global Blue’s strong start to the year, the company has reiterated its financial guidance and long-term targets, with projected FY24/25 adjusted EBITDA of more than €200 million.

Revenue in detail

Global Blue’s Tax-Free Shopping Solutions business delivered Q1 revenue of €91.1 million, a +33% year-on-year increase. Revenue in Continental Europe reached €74.4 million (+26%), while the Asia Pacific total reached €16.8 million (+78%).

In Continental Europe, Global Blue reported a significant year-on-year progression across all nationalities, including GCC (+43%), Mainland China (+31%) and USA (+17%).

The company also observed the strong year-on-year performance in Asia Pacific, with Mainland China (+224%), North East Asia (+146%) and Hong Kong and Taiwan (+69%) all reflecting a solid acceleration in the recovery.

Payments delivered revenue of €20.3 million, a +8% year-on-year increase, ahead of the +5% Sales-in-Store, mainly due to the increased margin on both treasury gains and acquirers, Global Blue noted.

Global Blue revenue from FX Solutions business reached €10.4 million (+6% year-on-year), while revenue in the Acquiring & Gateway business reached €10 million (+13%).

Post-Purchase Solutions delivered revenue of €6.3 million, a -11% year-on-year decline. The company noted this figure was impacted by management’s decision to move away from certain low-contribution ZigZag carriage contracts and the contribution growth of the segment (after carrier costs) was strong at +14%.

Reaction

Global Blue CEO Jacques Stern said: “We are pleased to report a strong start to our financial year with +25% year-on-year growth in Q1 FY24/25 revenue, somewhat contrasting with the overall mixed performance reported during the same period by luxury companies.

“The year-on-year growth in adjusted EBITDA reached 55% in Q1 and the adjusted EBITDA margin improved by seven points to 37%, reflecting the high operating leverage profile together with the ongoing focus on the cost base.

“This has led to a solid acceleration in annualised adjusted EBITDA to €205 million compared to €164 million in the previous quarter.

“In light of continued robust operational improvement and free cash-flow generation not reflected in the share price, we are announcing a US$10 million share repurchase programme.” ✈