In the third in a series about the future of European airport concessions compiled by Blueprint with data from ACI, Blueprint Partner Thomas Kaneko Henningsen discusses the importance of embracing digital in the right ways to boost passenger spend and engagement. Click here for part one in the series, and here for part two.

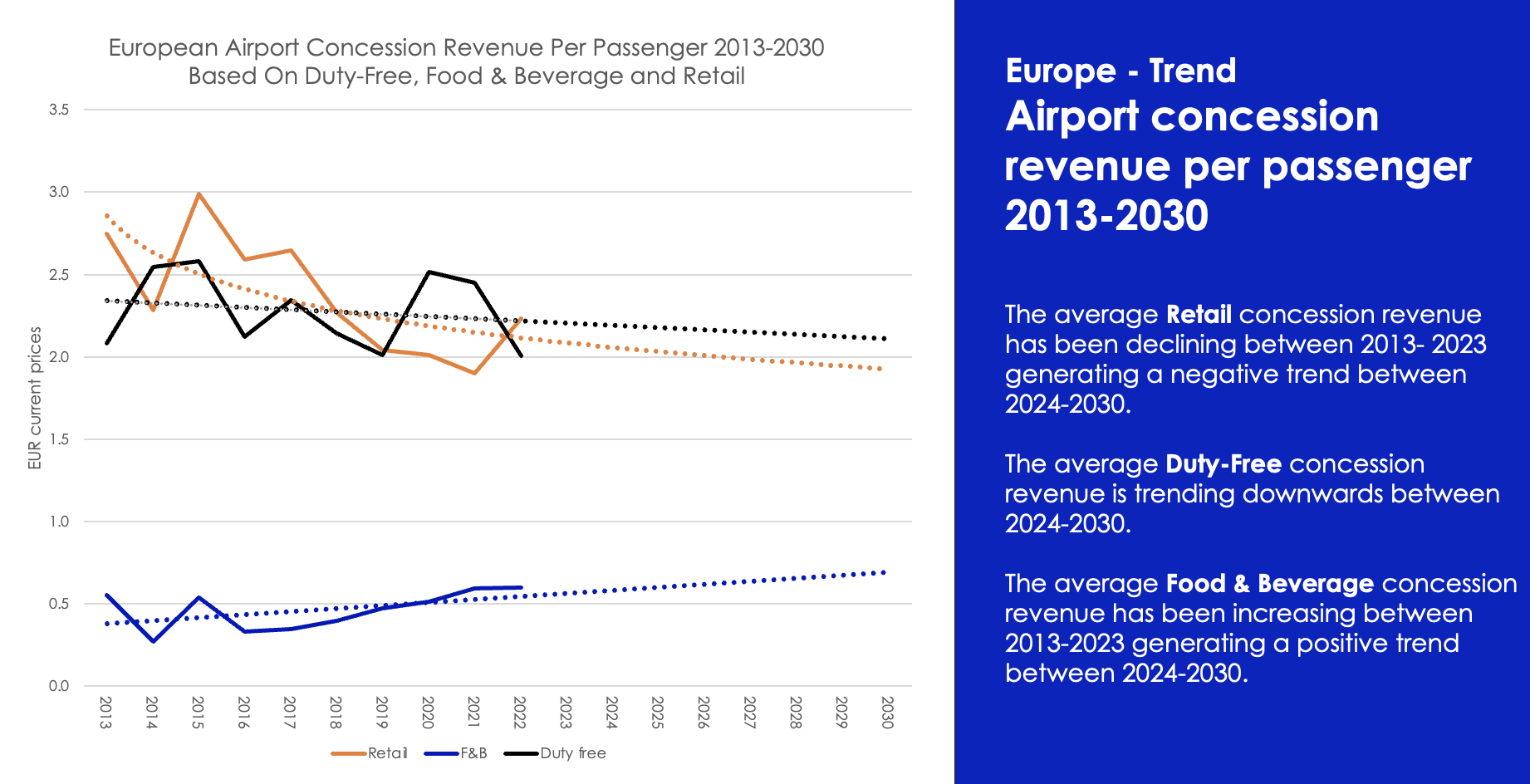

European airport retail concession revenue per passenger has been steadily declining since 2013, and worryingly, this negative trend is forecasted to continue over the next five years. That is based on airport association Airports Council International (ACI) World’s historical data and compiled by Blueprint Associate Thomas Thessen – previously a Chief Economist with Copenhagen Airport, a former ACI member and currently SAS Chief Analyst.

In our previous columns (linked above), we detailed our forecasts for airport concession revenue from 2023 to 2030. It showed that total global retail, F&B and duty-free concession revenue would grow +5.1% (CAGR) over the period with Europe trending below this at +3.6%.

What is usually agreed upon today is that the passenger experience and satisfaction are directly linked to spend. Therefore, airport retail should not be a simple transactional prospect for travellers, especially when it comes to those alluring high-end items that inevitably need guidance and interaction with in-store sales staff.

ACI has raised concerns that the airport commercial channel is not engaging sufficiently with digital. At last November’s Trinity Forum, the association unveiled a report called ‘Airport Commercial Digital Transformation Best Practices 2024’. It is designed to guide airports in their commercial transition.

In the report, the global airports association said: “Airports have made considerable investments in digital transformation to drive operational excellence, but they are far behind in adopting commercial digital technologies compared with industries such as retail and hospitality.”

ACI World Director General Justin Erbacci added, “Airports rely on non-aeronautical revenues to support infrastructure upgrades, enhance the passenger experience, and ensure economic sustainability. They account for approximately 40% of total airport revenues globally. By leveraging digital technology, airports can unlock new partnerships and revenue models.”

Leveraging digital and even artificial intelligence in the airport channel is fraught with challenges, not least of which is the potential to remove the crucial in-store experiential component and replace it with more transactional online services.

Online has its superior advantages: anyone, anywhere, anytime can access it, pricing is more transparent than ever, and the shopper can use the 24/7 service at their own convenience. Eventually, AI will mass-customise online shopping, making purchase suggestions based on shoppers’ past behaviour, budget and product availability.

Therefore, airport retail will automatically end up competing to a much larger degree with ultra-high-performing and massive-volume ecommerce retailers such as Amazon and Alibaba, where the exact same product is likely to be cheaper.

Unless airport retail evolves in the direction of memorable, immersive and unique product experiences, it will remain transactional and therefore less nuanced and less relevant.

A digital conundrum

But how digital is leveraged must be carefully considered in relation to physical retail experiences. For airport shops, digital and AI are becoming an intrinsic part of the conversation. Particularly AI has the potential to transform airport retail, but this must not be at the expense of the much needed in-store interaction between sales staff and shoppers.

There are key questions to address as well. Should airports invest heavily into creating a single online shopping platform for multiple retailers to better engage travellers? This has been tried by one or two large hubs with limited success. Or is it best to leave it to retailers to develop their own tailored platforms for pre-order, click-and-collect services, and the like?

For example, Singapore Changi Airport has a dedicated website called iShopChangi for travellers and non-travellers alike, with delivery anywhere in Singapore.

Frankfurt Airport has an online site that allows click-and-collect airside, landside collection for certain brands like Steiff stuffed toys and electronics sold by PAX Airport Shopping for non-travellers, and delivery to any Germany address.

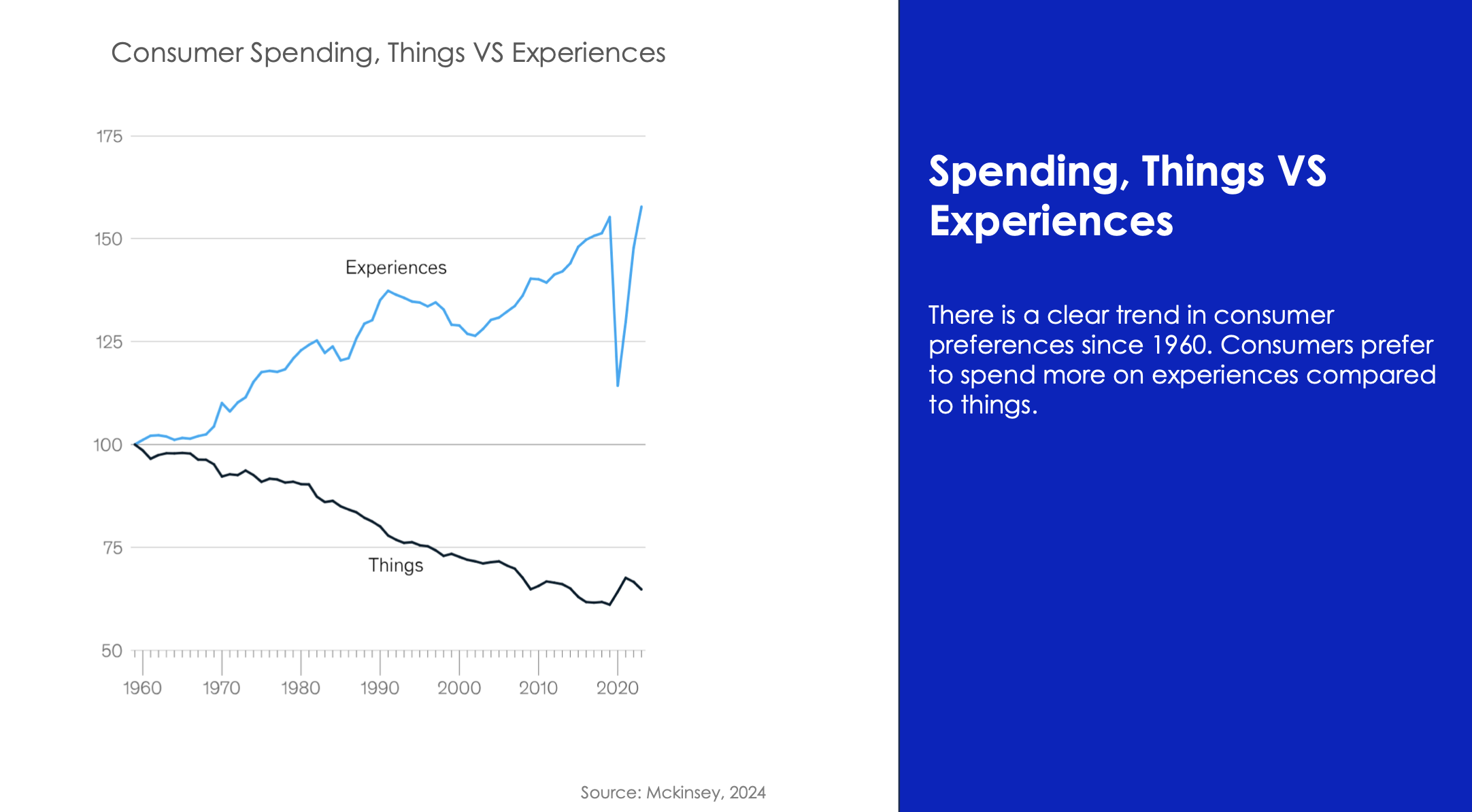

The spending data in domestic markets is very clear when it comes to experiential retail. A 2024 McKinsey study tracked spending going all the way back to 1960, using it as the index year. It showed a clear trend in consumer preferences: shoppers can’t get enough of experiences versus regular items, which went downwards. The only time that the contrasting trends saw a blip was during COVID when the ability for domestic retail to offer up experiences was almost non-existent (see chart above).

Travel retail is, in essence, a luxury-oriented market and it has been selling high-end products to high-spending shoppers for decades. Airports such as Incheon, Sydney, Dubai and Heathrow have extensive luxury offers, and in Qatar Duty Free’s case several of these are driven by premium services and unique experiences such as the Dior Spa or the Fendi Caffe.

Instagrammable moments are now becoming a standard in airport retail categories and many of the bigger brands have built their high-profile promotions around these. Last year’s Benefit Benemart pop-up at Sydney Airport, Netflix’s Emily in Paris Charmère RTD cocktails in Heathrow Airport Terminal 5, and the Pokémon event at Tokyo Haneda Airport in January were refreshing examples of how to engage Gen Z and Millennial travellers in a playful and fun way while driving social engagement.

Memorable experience is everything

All luxury sales should be about the experience, yet there appears to be a disconnect between the domestic market and travel retail. KPMG last year projected growth for luxury, despite some of the lead groups like LVMH and Kering seeing downturns. This was because other brands, such as Hermès and Moncler, are soaring thanks to their unerring focus on delivering customer experiences.

The consultancy is projecting that luxury overall, will continue to see an upwards trend with sales exceeding US$311 billion in 2028, a growth rate of +3.2% CAGR from 2023 (see chart above).

Sadly the prospects for travel retail are nowhere near as good. According to Bain, from 2025 to 2030 not only will spending per passenger decrease, it will do so at an alarming rate. With 2019 indexed at 100, per-head spending will drop to 94 in 2025, and then 83 in 2030 (see chart below).

A key factor is omnichannel sales. They will become more prominent in travel retail, accounting for more than 10% of total sales in 2025 and over 20% by 2030. Although the data come from a 2022 Bain report, the study makes the point loud and clear that a reason for the stagnation in overall sales is that travelling shoppers will have easier access to omni-channel shopping.

ACI Europe Director of Economics Michael Stanton-Geddes warned that this down-turn in retail concession revenue spend decline comes at an acutely bad moment. “Over the decade before COVID-19, many European airports financed investment from non-aeronautical profits, as aeronautical revenues remained low.

“The risk that retail revenues stagnate will put more pressure on airport management just when they need to be investing. So working to optimise the retail concession channel is critical.”

Travel retail stakeholders must be careful what they wish for. Although digital and AI are crucial to airport retail’s future, both have to be implemented in ways that enhance the overall shopping experience and substantially add to it.

Taking the digital ecommerce route carelessly will turn airport retail into a commoditised market, a battle likely to be lost to ecommerce. Instead, the battle to be won is standardising memorable, immersive and mass-customised airport retail experiences that we know travelling shoppers crave. ✈