Unflattering year-on-year comparisons with the pre-May 2023 crackdown on daigou activity in the key Hainan offshore duty-free market weighed on L’Oréal’s first-half performance but sell-out momentum in the channel has been improving sequentially.

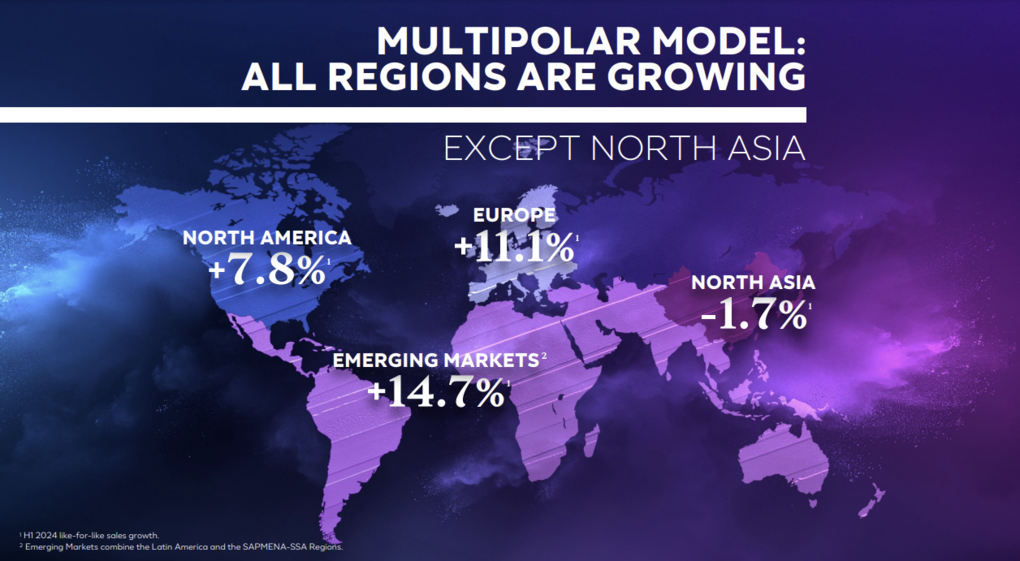

That was among the key takeouts from L’Oréal’s earnings call yesterday following the unveiling of its H1 results the previous evening, which showed heavily travel retail-influenced North Asia as the only major region to show a year-on-year sales decline.

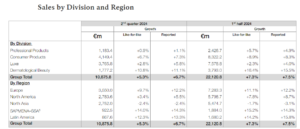

Introducing the call, L’Oréal CFO Christophe Babule said: “L’Oréal delivered another strong performance in the first half in a beauty market that remains dynamic. If I have to summarise the first half in four key figures, I will highlight, first, the continued strong like-for-like growth of +7.3%. Remember that we were lapping pretty tough comparisons of +13.3%.

“The gross margin of 74.8% was up 50 basis points and a first-half record. The operating margin of 20.8% was up ten basis points and also a first-half best. And the net profit of €3.65 billion was an increase of +8.8% versus the first half of last year.”

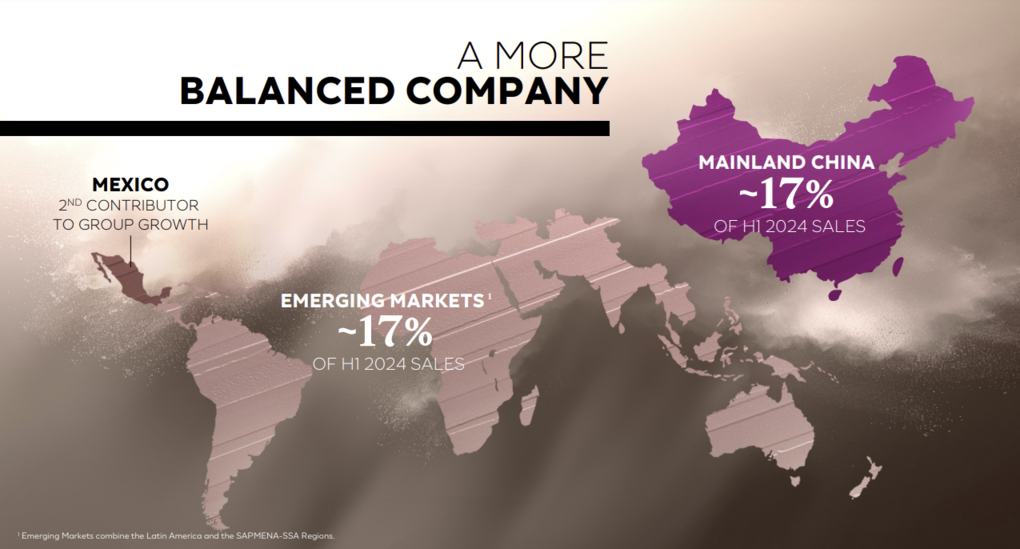

Noting the -1.7% year-on-year sales decline in North Asia, Babule attributed it to renewed weakness in the Mainland Chinese market (though the group gained share in three of its four divisions).

“Travel Retail still weighed on growth in the first half, but momentum has been improving sequentially,” he said.

L’Oréal estimates the global beauty market grew +5-6% in the first half, compared with the group’s +7.3% improvement. “This means that we outperformed once again, and that is after three consecutive years of exceptionally strong share gains,” L’Oréal CEO Nicolas Hieronimus commented.

“One of the things that I’m very pleased with is that our growth is balanced between value and volume, not just in this first half but since the beginning of the inflationary crisis in 2021,” he added.

“When we look at the last 12 quarters, we see, on average, an almost perfect mix of volume at +3.4%, price at +4.1% and mix at +3.3%.”

Commenting further on North Asia’s -1.7% decline, Hieronimus highlighted the impact of Mainland China, which he said accounts for two-thirds of group sales in the region.

After a very slight recovery at the start of the year, market growth turned negative in Q2, he said as the comparison base was very high.

“We are not seeing any pickup in consumer confidence, which is critical to growth in beauty,” Hieronimus observed. “Overall, we estimate that the market was down between -2% and -3% in the first half. Within that, there was a huge divergence in trends. Mass was up slightly, while luxury was down in high single digits.

“In that context, we grew +0.8% and continued to outperform the market. We gained share in three of our divisions, especially Luxe, where we outpaced the market by six points.”

Hainan sell-out down by almost a third

Focusing on Hainan, he said the offshore duty-free sector was down -30% in H1. “We are seeing a steady increase in arrival numbers, but the conversion rates remain soft. We slightly outperformed the market in sell-out and continued to gain share,” Hieronimus added.

Echoing his comments after the group’s Q1 results, Hieronimus noted: “I told you in April that our inventory levels [in Hainan] were broadly at the right level, and as a result, our sell-in is progressively improving quarter after quarter.

“In the rest of North Asia, growth was up in the mid-teens, driven by the dynamic trends in travel retail and robust growth in markets like Japan, which saw a surge in tourism [largely driven by the 34-year low Yen -Ed].”

Looking to the future, Hieronimus said: “We expect the global beauty market to remain dynamic and grow by about +4.5% this year, slightly above the +4% long-term average.

“In North Asia, we don’t see really much change in the second half. We expect growth in Mainland China to remain slightly negative and travel retail sell-in [there] to gradually improve.”

Asked for his comments on Hainan’s performance in June after a poor Q1 [June representing a more flattering comparison given the daigou crackdown on the island was in full swing in the same month last year, and therefore a potential harbinger of what is to follow in H2 -Ed], Hieronimus replied: “As far as travel retail is concerned, you’re right to say that the first quarter was very negative. The second quarter was just a bit negative, and we are going to enter into positive territories in sell-in from Q3 onwards.”

He continued: “The sell-out run rates in Hainan are lower than what everybody would like. So it’s still very good for our sell-in because of the comparative basis. But today in sell-out, we see more traction in Japan or Korea – and Japan, in particular, with the Yen price than in Hainan where consumers travel but shop less.”

Hieronimus was asked if the tougher restrictions on daigou activity in South Korea and Hainan had decreased the availability of such product in China or whether resellers had simply switched their sourcing to other markets such as Japan, driven by the favourable currency impact.

“As far as Asia travel retail and its impact on the Chinese domestic market, I think the best guesstimate… is that the quantities of products available on the local market coming from daigou may have shrunk a little bit, but I don’t think it has had yet a major impact,” he responded.

“First of all, because as you said, the daigous haven’t disappeared. They’ve moved – Hong Kong, Japan, Korea – and we are monitoring this very closely. So in the end, it’s the same story. It will be different by brand and by group [but] it’s all about controlling the pricing activity and discounts between the two territories to avoid creating unnecessary opportunities that can undermine the equity of our brands in the local market.

“And I’m tempted to say that part of the reason why we are constantly gaining share on the Chinese market is that we’ve done, I would say, a decent job – though it’s never perfect – at protecting the local market versus the impact of travel retail daigous. At least that’s what our retail partners in China tell me, and I’m happy to hear it.”

Pressed on the impact of the weak Yen in creating a big price differential with other Asian markets and therefore potentially driving daigou activity in Japan, Hieronimus replied: “It’s true that the Yen is lower, but we don’t have any specific measures to take because there are no big discounts playing in Japan.

“There might be individual daigous and consumers that use the opportunity. But I don’t see this as a huge pocket of gray market opportunity.” ✈

Scan the QR codes via WeChat to visit our platforms. Stories related to the China travel retail sector at home and abroad are featured in this unrivalled dual service. For native content opportunities please contact Zhang Yimei (China) at Yimei@MoodieDavittReport.com or Irene Revilla (international) at Irene@MoodieDavittReport.com. For editorial please reach out to Martin Moodie at Martin@MoodieDavittReport.com