UK. London Heathrow Airport is forecasting a +7.2% rise in retail revenues year-on-year in 2023 alongside a +9% increase in passenger traffic to 67.1 million. The details were revealed in Heathrow’s latest Investor Report, released this month.

The forecast is based on a continuation of the recovery seen in the second half of 2022 but with some softening due to the weaker economic climate. 2023 is expected to see a return to a “more typical pre-Covid travel profile” across the year.

In 2023, total revenue is forecast to increase to £3,187 million as traffic continues to recover, driven by the +7.2% increase in retail revenues noted above and a -4% decrease in non-retail revenues, as well as a +14.5% increase in aeronautical revenues.

The 2023 forecast is for Adjusted EBITDA to increase by +4.1% to £1,747 million, aided by further passenger growth.

In 2023, operating costs are forecast to increase +18.3% to £1,440 million to support the increase in passengers, the full year effect of re-opened terminal facilities and higher utilities costs.

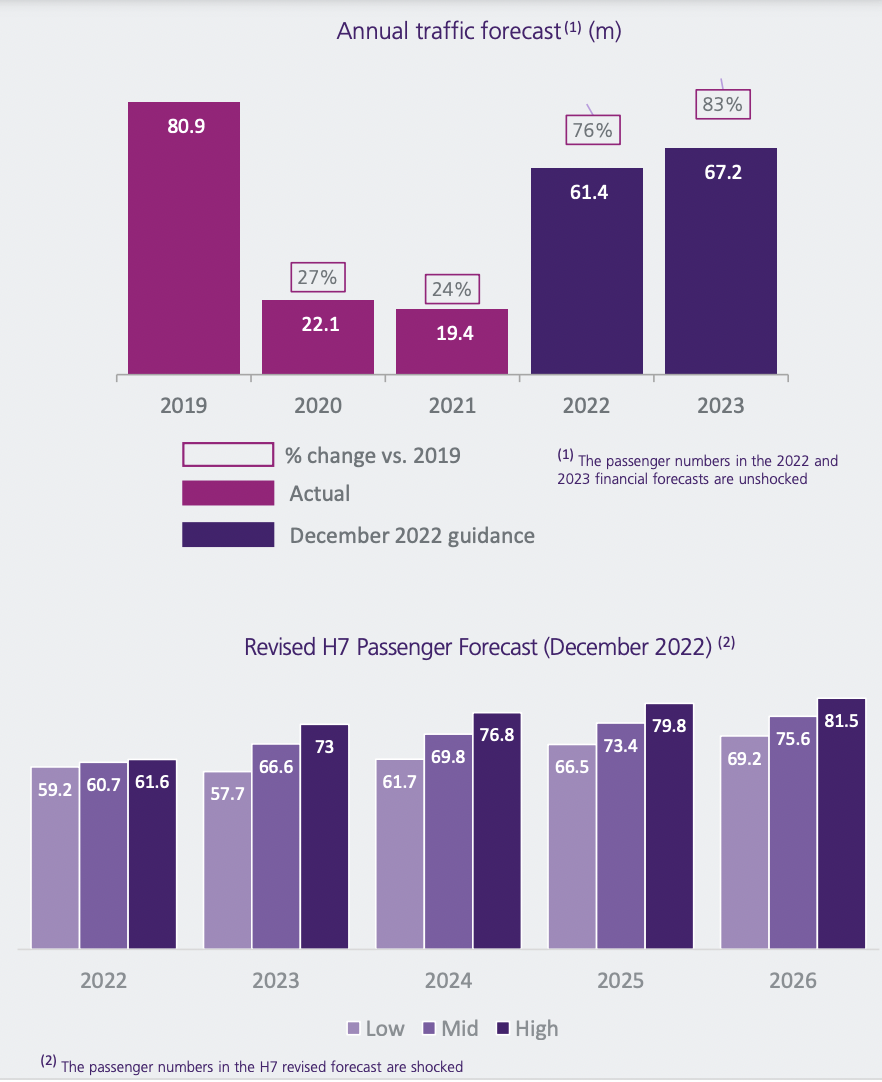

For 2022, traffic is expected to increase +216% year-on-year to 61.4 million passengers. This is at the upper end of the guidance released with Heathrow Q3 results and is an increase from the forecast published in June 2022. The 2023 estimate of 67.1 million would represent 83% of 2019 traffic levels.

For 2023, the airport has assumed high and low traffic scenarios. In the more positive scenario, it foresees all Covid restrictions lifted by early 2023; the economic outlook aligned with a slower tightening of policy; faster easing of restrictions in East Asia and Russian airspace; and an improved recovery of business travel.

In the low scenario, the main differences in assumptions to the base case are that: existing Covid restrictions remain in place for longer; the pessimistic economic outlook is more pronounced and prolonged; the East Asia markets remain effectively closed throughout 2023; Russian airspace remains closed and business travel is slower to recover.

Revenue in 2022 is forecast to increase by +138.5% to £2,895 million. Retail income is expected to increase +152.4% this year to £548 million, particularly as a result of a strong car parking performance.

However, said the company, the removal of tax free shopping has resulted in a decline in spending per passenger to £8.93 (from £11.19 in 2021). Other revenue is expected to increase by +6.2% to £470 million.

Adjusted EBITDA in 2022 is forecast to increase +337% to £1,678 million. This is driven by higher passenger numbers, with total revenue increasing by +138.5% to £2,895 million. Operating costs have increased by +46.5% to £1,217 million, reflecting the reopening of operations.

Adjusted operating costs in 2022 are forecast to increase to £1,217 million (2021: £830 million) because of the increased operation ramp-up costs in the year and the implementation of Heathrow’s ‘build back capacity’ plan. Operating costs on a per passenger basis are expected to fall by -51.4% to £20.81.

Heathrow CEO John Holland-Kaye said: “The UK aviation sector was hit hardest of any major market by border controls and lack of government support, and it is a testament to the forward planning and the hard work of colleagues in keeping Britain’s hub airport running, growing faster and serving more passengers than any other airport in Europe.

“This year we have welcomed around 61 million passengers, about -25% fewer passengers than before the pandemic. There are strong headwinds facing the economy, and UK aviation will probably not have recovered full capacity until the end of 2023. Our priorities remain working closely with our airline partners to provide excellent passenger experience and to safely get back to full capacity as quickly as possible.” ✈