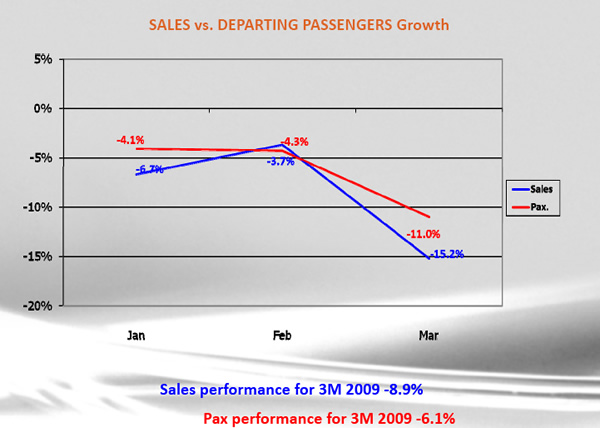

GREECE. Hellenic Duty Free Shops S.A. today announced a -8.9% fall in duty free and travel retail sales for the first quarter of 2009 to €35.8 million. That outstripped a passenger decline of -6.1% for the quarter.

EBITDA for the group’s duty free operations fell by -12.0% to €6.6 million.

For HDFS, duty free revenues dipped by -8.5% to €14.6 million and duty paid sales slipped -9.1% to €21.2 million.

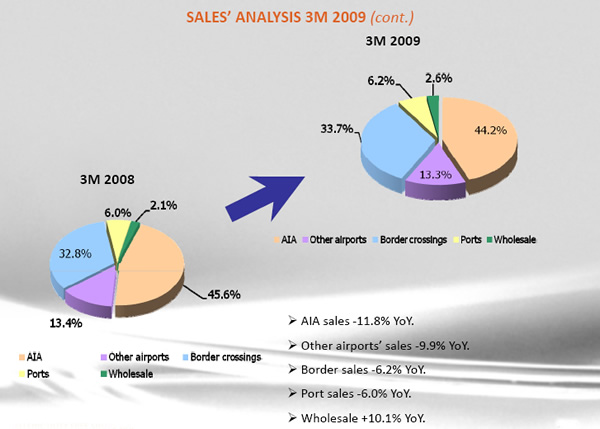

Sales at flagship location Athens International Airport fell by -11.8% in the first quarter, while other airports posted a combined fall of -9.9%.

|

|

Tobacco was the best-performing category, slipping by just -3.0% year-on-year to €7.7 million. Luxury goods and other products fell by -4.8% to €6.7 million and confectionery/fine food was the next best result with a fall of -7.9% to €3.7 million.

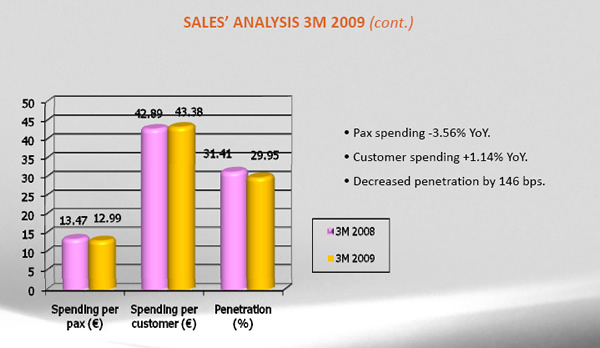

Spend per passenger fell by -3.56% though spend per customer rose +1.14% (see charts) and penetration fell from 31.41% to 29.95%.

For the whole group, including Hellenic Distributions, Links and Elmec, sales rose +6.5% in the quarter to €120.8 million but EBITDA slipped by -3.7% to €15.1 million.

|

|

HDFS General Director George Velentzas said: “I feel satisfied with the performance of all the companies of the HDFS Group since, despite the adverse conditions and the negative implications from the global financial turmoil affecting consumer confidence as well as retail consumption, the financials of all the companies can be characterized as quite solid – especially when compared to the performances of the companies in the sector.

“It is also worth mentioning that the financials of the parent company HDFS [i.e. the duty free retail operation -Ed] are the best among the companies in the travel retail sector.”

MORE STORIES ON HELLENIC DUTY FREE SHOPS

Hellenic Duty Free posts +2.1% 2008 revenue gain but final months prove tough – 30/03/09

Hellenic appoints The Design Solution to develop new Athens International duty free store – 30/01/09

Hellenic Duty Free posts solid +3.8% revenue gain despite “˜international turmoil’ – 27/11/08

[comments]