INTERNATIONAL/CHINA. In major breaking news, Dufry announced early this morning that it had been notified by HNA Group* that the Hainan-based Chinese group has exceeded a key threshold of 15% due to an agreement with third parties** to purchase 16.79% of the Swiss travel retail giant’s shares.

The closing of the transaction is subject to certain conditions.

Notifications regarding shareholding position can be found at the website of the SIX Swiss Exchange. Dufry stock closed last night at CHF159.20. That puts this morning’s investment at a market value of CHF1.44 billion (circa US$1.5 billion). However, the purchase price was determined based on market conditions, “including a low double-digit premium and subject to increase in case of certain events”.

We will update this story throughout the day with further analysis and reaction. See below for full background on this deal and HNA’s recent investment trail. The HNA investment in Dufry has been made through Hongkong Huihaisheng Investment Co. Limited, Hong Kong.

That entity is in turn indirectly fully owned by HNA Group, Haikou, Hainan Province, People’s Republic of China, which in turn is indirectly controlled by Hainan Province Cihang Foundation.

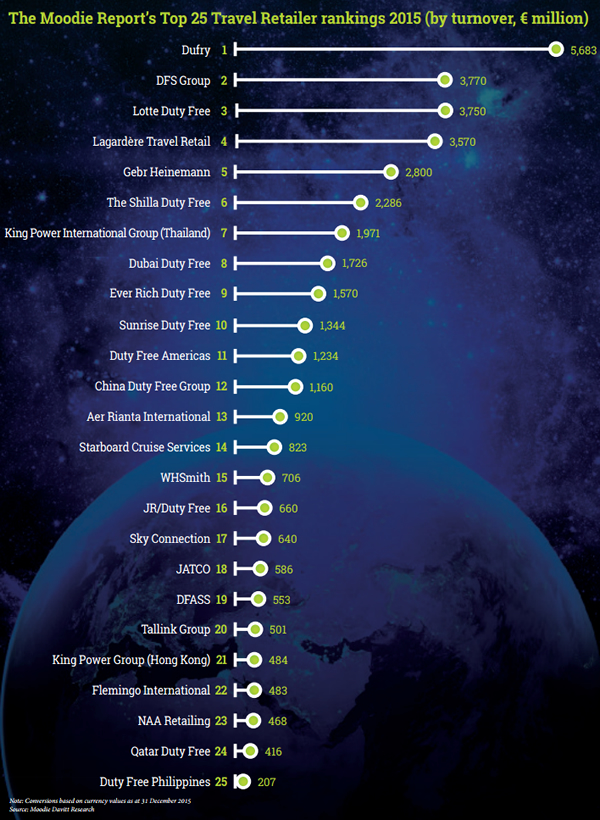

Click on image to enlarge

**BACKGROUND

As reported, Chinese aviation-to-leisure giant HNA Group approached Dufry’s sovereign wealth fund shareholder GIC and fellow Singaporean fund Temasek in March regarding an investment in the world’s biggest travel retail company.

Reliable sources in the investment community confirmed that approach to the Moodie Davitt Report. The Wall Street Journal reported news of the approach earlier that week.

The two Singaporean funds collectively held over 16% of Dufry stock.

As reported, HNA Group had to make a public disclosure once it reached a 3% holding.

However, the Swiss take-over code means that a mandatory offer for the whole company is not triggered unless a stake larger than 33.33% changes hands.

Until now Dufry had received no communication from HNA, causing uncertainly in the investment community about the Chinese group’s intentions. A hostile takeover would be extremely difficult to achieve given the structure of Dufry’s shareholding and Chinese limitations on foreign investments, and seems unlikely anyway given HNA’s deal-making history.

Sources believed originally that a likelier scenario was that HNA is seeking to extend its presence in the travel services chain with a position of significant influence in the world’s largest travel retail company. Such a position would have the additional benefit of making it ultra-difficult for any other outside party to gain control of Dufry in future. That spectre has now emerged with today’s big breaking news.

Piecing together a jigsaw puzzle When it reported HNA Group’s US$6.5 billion bid for a 25% stake in the Hilton hotel chain last October, the Financial Times (FT) said the deal “cemented its reputation as one of China’s most acquisitive groups”. In under two years the privately controlled company had announced foreign and domestic transactions worth over US$33 billion (see acquisition trail below), the FT noted — half spent offshore, according to data provider Dealogic — as it forged a global empire with interests spanning aviation, logistics and tourism. The FT commented: “Begun in 1989 as a private airline on the tropical island of Hainan, HNA’s buying spree shows no sign of slowing. Founder Chen Feng, a former employee of China’s state civil aviation administration, has transformed Hainan Airlines, the group’s flagship company, from a two-jet operation into the country’s fourth-largest airline and has built a sprawling conglomerate. “While Mr Chen has largely ceded control of the group’s day-to-day operations to his co-chairman, Wang Jian, and chief executive Adam Tan, the Hilton acquisition is a key piece of his plan to profit from Chinese tourists as they travel around the world.” The FI cited a source close to HNA saying, “The vision is to be a vertically integrated aviation and tourist group. They are buying different pieces and putting it together like a jigsaw puzzle.” Not only is HNA acquiring a large piece of Dufry but also, it appearsa, another key piece of that puzzle. |

From The Moodie Davitt Report May Print Edition, out in coming days I’m not normally one for predictions but I’ll make one here. The acquisitive, Hainan-based conglomerate HNA Group has pulled off a flurry of major acquisitions in recent times and I believe travel retail will be among its next power plays. The Moodie Davitt Report has confirmed that HNA has indeed been in communication (as originally touted by the Wall Street Journal) with Dufry’s two Singaporean wealth funds GIC and Temasek. As we went to press, Dufry had not been contacted by the Chinese group, causing uncertainly in the investment community about HNA’s intentions. A hostile takeover would be extremely difficult given the structure of Dufry’s shareholding and seems unlikely anyway given HNA’s deal-making history. Informed sources believe a likelier scenario is that HNA is seeking to extend its presence in the travel services-to-hospitality chain (it already owns gategroup; Carlson Hotels; a 25% stake in Hilton Worldwide Holdings; CIT Group’s aircraft leasing business; 13% of Virgin Australia; 23.7% of Azul Brazilian Airlines; and airport luggage handler Swissport International). By taking a position of significant influence in the world’s largest travel retailer it would be strongly placed to shape the company and the sector in the future – as well as making it very difficult for any other outside party to gain control of Dufry. Don’t forget either that at its 28 October 2016 board meeting, CDFG parent China International Travel Service voted to create a joint venture with Hainan Duty Free. And Hainan Duty Free (full name HNDF Haikou Meilan Airport Duty Free Shop) is a provincial government and private partnership between Hainan Provincial Duty Free Company Limited and none other than HNA Group. Just think of the possible permutations among that network of relationships. |

*HNA’S ACQUISITION TRAIL

Dufry operates around 2,200 duty free and duty paid shops in airports, cruise lines, seaports, railway stations and downtown tourist areas.

The Swiss retailer employs close to 29,000 people. The company, headquartered in Basel, Switzerland, operates in 64 countries in all five continents.

Chinese conglomerate HNA Group has been very active in recent times in making acquisitions across its fields of interest with aviation and aviation-related services central to the expansion. Here is a selected timeline of some of its main deals:

- December 2016: As reported, HNA completes acquisition of gategroup, the Swiss inflight services provider, in a transaction valued at CHF1.4 billion (US$1.47 billion).

- December 2016: Completes acquisition of IT products and services company Ingram Micro through subsidiary Tianjin Tianhai Investment Company. The all-cash transaction is for US$38.90 per share with an equity value of approximately US$6 billion.

- December 2016: Closes deal to acquire Carlson Hotels through subsidiary HNA Tourism Group. Also acquires Carlson’s 51.3% stake in Brussels-based Rezidor Hotel Group.

- October 2016: China Duty Free Group parent company China International Travel Service votes at its board meeting on 28 October to create a joint venturewith Hainan Duty Free.

- October 2016: Announces intention to purchase a quarter of Hilton Worldwide Holdings Inc. for US$6.5 billion.

- October 2016: Buys CIT Group’s aircraft leasing business for US$10 billion.

- May 2016: Agrees to purchase 13% of Virgin Australia for US$114 million, with plans to raise that stake to about 20%.

- March 2016: Increases stake in Deutsche Bank from 3.04% to 4.76%.

- March 2016: Acquires Manhattan’s 245 Park Avenue skyscraper for US$2.21 billion.

- November 2015: Agrees to buy 23.7% stake in Azul Brazilian Airlines for US$450 million through subsidiary Hainan Airlines.

- July 2015: Agrees to buy airport luggage handler Swissport International from PAI Partners for US$2.81 billion.